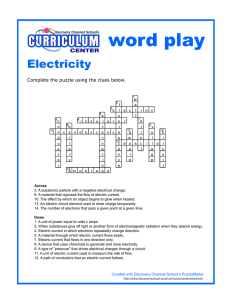

Planning our electric future

advertisement