1262.15.10 - Technology Upgrade Release Notice – October 2015

advertisement

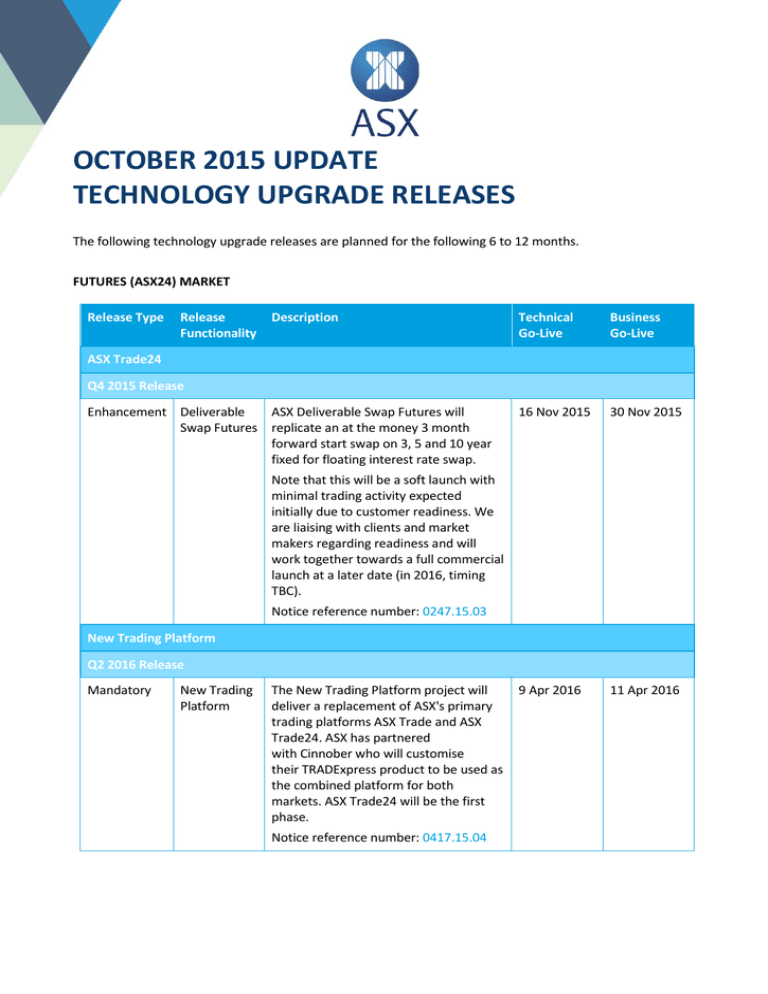

OCTOBER 2015 UPDATE TECHNOLOGY UPGRADE RELEASES The following technology upgrade releases are planned for the following 6 to 12 months. FUTURES (ASX24) MARKET Release Type Release Functionality Description Technical Go-Live Business Go-Live 16 Nov 2015 30 Nov 2015 9 Apr 2016 11 Apr 2016 ASX Trade24 Q4 2015 Release Enhancement Deliverable ASX Deliverable Swap Futures will Swap Futures replicate an at the money 3 month forward start swap on 3, 5 and 10 year fixed for floating interest rate swap. Note that this will be a soft launch with minimal trading activity expected initially due to customer readiness. We are liaising with clients and market makers regarding readiness and will work together towards a full commercial launch at a later date (in 2016, timing TBC). Notice reference number: 0247.15.03 New Trading Platform Q2 2016 Release Mandatory New Trading Platform The New Trading Platform project will deliver a replacement of ASX's primary trading platforms ASX Trade and ASX Trade24. ASX has partnered with Cinnober who will customise their TRADExpress product to be used as the combined platform for both markets. ASX Trade24 will be the first phase. Notice reference number: 0417.15.04 EQUITIES (ASX) MARKET Release Type Release Functionality Description Technical Go-Live Business Go-Live The New Trading Platform project will deliver a replacement of ASX's primary trading platforms ASX Trade and ASX Trade24. ASX has partnered with Cinnober who will customise their TRADExpress product to be used as the combined platform for both markets. 27 Sep 2016 29 Sep 2016 Description Technical Go-Live Business Go-Live The T+2 project will reduce the settlement cycle for Australian cash equities from T+3 to T+2, including an extension to the batch settlement cut off time to 11:30am (from 10:30am). 7 Mar 2016 7 Mar 2016 May 2016 May 2016 (under review) (under review) New Trading Platform Q4 2016 Release Mandatory New Trading Platform Notice reference number: 0417.15.04 CLEARING AND SETTLEMENT SERVICES Release Type Release Functionality CHESS Q1 2016 Release Mandatory T+2 Notice reference number: 1367.14.11 For more information please refer to the following link: www.asx.com.au/T2 Q2 2016 Release Mandatory FATCA Regulation Enable the flow of relevant FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard) information through CHESS. Notice reference number: 0852.15.07 2/6 Enhancement mFund Settlement Service The enhancement release includes: The introduction of CHESS messages for mFund unit transfers May 2016 (under review) May 2016 (under review) Q2 2016 (TBC) Q2 2016 (TBC) 30 Nov 2015 30 Nov 2015 New CHESS messages for the annual tax statement A change to the structure of the current CHESS distribution statement message. Allow distribution preferences to be updated through Sponsoring Participant. Allow Regular Payment Plans to be maintained through Sponsoring Participant. A change to the recipient type for the CHESS 716 message. Notice reference number: 0852.15.07 Enhancement ASX Collateral CHESS Extension of ASX’s existing centralised collateral management service to mobilise equities held in CHESS. This release will involve the introduction of a small number of new CHESS message notifications to enable integration with ASX Collateral. Derivatives Clearing System (DCS) Q4 2015 Release Optional MCM1.4.4e TORESS Options Introduction of Total Return Single Stock options for both exchange listed and Equity Flex Clear. Options will be cash settled and provide cash payments/transfers for ordinary dividends. Enhanced Client Protection Support for FSS Enhanced Protection Regulation. Non-functional enhancements Support for SQL 2012. Reduction of permissions required to run SOD. Notice reference number: 0692.15.06 3/6 Q2 2016 Release Mandatory 1.4.5 Part 2 MCM/DCS OI 1.4.5 – General Service Release. TBC TBC 09 Nov 2015 09 Nov 2015 For more information on this release see: ASX Derivatives Clearing System DCS and MCM 1.4.5 Technical Description Overview. Notice reference number: 0519.14.05 Note: The original go-live of April 2015 was deferred due to the need to meet FSS Enhanced Protection regulations. The key non-functional elements of this release including support SQL 2012 and reduction of required permissions to run SOD are included in MCM1.4.4e. The ASX is now reviewing whether to proceed with the remainder of this release at all given that the majority of the demand was for the aforementioned non-functional elements. Austraclear Q4 2015 Release Mandatory ASX Austraclear System Insourcing Release 5 Release aligned with ongoing ASX Austraclear System support being transferred to ASX from NASDAQ OMX. User interface enhancements and backend infrastructure upgrades. Notice reference number: 0851.15.07 4/6 DIGITAL SERVICES Release Type Release Functionality Description Technical Go-Live Business Go-Live This release will replace the existing Participants section of ASX Online. Q1 2016 Q1 2016 ASXOnline Q1 2016 Release Enhancement ASXOnline Participants Notice reference number: 0792.15.07 5/6 ASX Mandatory Release Periods ASX mandatory releases require all users and vendors to amend their applications that directly connect to the relevant ASX service. ASX may require accreditation of each application either in entirety or to capture the scope of the mandatory change. ASX generally plans to implement no more than two Mandatory Releases [per service] per calendar year. These releases will typically be around 6 months apart and may be scheduled to coincide with regulatory changes mandated by ASIC. ASX may also need to schedule a Mandatory Release in the case of a critical production fault. ASX may also implement one or more Enhancement Releases during the year. An Enhancement Release will not be scheduled within four weeks of a Mandatory Release. Release Terminology Enhancement Release – Enhancement releases are incremental updates without the need for users to upgrade all applications at the same time. This release is voluntary and enables users to prioritise business objectives and allocate resources as required. Mandatory Release – Mandatory releases are required to be implemented by all users and vendors to upgrade all applications. A mandatory release may comprise any change, including improvements and corrections to the messaging structure, logic (API in some instances) or content associated with the relevant system. Informational – This is not a release, but more of an item to be noted. This functionality may potentially have an impact as it is a change to existing business processes. Technical Go-Live – Technical Go-Live is the date the release is installed into production. Functionality may be disabled until Business Go-Live. Business Go-Live – Business Go-Live is the date when the functionality is enabled in production. Associated Releases ASX has an ongoing commitment to conduct disaster recovery testing across all ASX platforms. Refer to the ASX Business Continuity Management Testing Schedule on the Participants Welcome page on ASXOnline for more information. COMMUNICATION Detailed documentation on the scope, technical specifications and projected timeframes for individual Mandatory and Enhancement releases will be provided by ASX no later than 90 days prior to the implementation date (unless required to do otherwise by a regulator or regulatory obligation, or to resolve a critical production issue). ASX will confirm the Go-Live date of each release by ASX Notice, generally at least two weeks prior to implementation (unless otherwise agreed with stakeholders). The trademarks listed below are trademarks of ASX. Where a mark is indicated as registered it is registered in Australia and may also be registered in other countries. Nothing contained in this document should be construed as being any licence or right to use of any trade mark contained within the document. ASX®, CHESS®, Austraclear®, ASX Trade24®, LEPO®, ASX Trade® 6/6