Effective Jan. 1, 2013 - State Forms Online Catalog

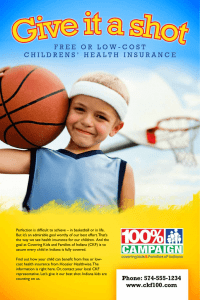

advertisement