Which State Best Suits Your Medical Practice– an Analysis and

advertisement

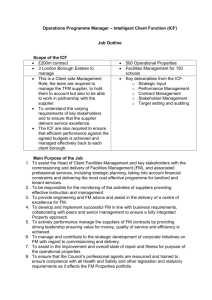

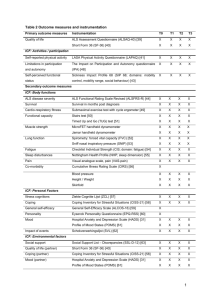

General Considerations The majority of articles discussing the best state in which to practice medicine have offered superficial analyses, focusing on physician satisfaction surveys, a handful of broad taxes (such as income and property), medical liability insurance premiums, and the local weather. A more in-depth guide is needed to make physicians aware of potential pitfalls associated with certain practice models in each state. The best states generally undertake policies designed to reduce the cost of medical care. Decreased cost leads to increased access, and greater access permits physicians to compete for patients based on quality. State methods to reduce costs to physicians and patients generally take the form of lower taxes and fewer regulatory hurdles that interrupt the patient-physician relationship. Less favorable states have generally taken the opposite approach, and have been more likely to “double down,” attempting to address perceived inefficiencies with more regulatory requirements that often fail to achieve desired improvements. Physicians might first look at each state’s comprehensive ranking, which weights all categories equally, then evaluate a narrowed list of states on the basis of considerations most relevant to their practice. Which State Best Suits Your Medical Practice– an Analysis and Reference Guide Philip Eskew, D.O., J.D., M.B.A. Corporate Tax at 0% = +1, above 0% up to 7.99% = 0, at or above 8% = -1 RankingIncome Methodology Sales Tax at 0% = +1, above 0% up to 6% = 0, above 6% = -1 General Gross Receiptscriteria Tax for if present = -1 Classification the tiered are listed in Table 1. Ranked factors ABSTRACT concerning taxas follows: policy are= -1ranking listedsystem in Table 3, and regulatory Physician Grossscores Receipts if present were assigned +1 if pro-physician compared to other states, 0 if neutral, or -1 Tax if anti-physician. policy in Table 4. Provider States’ Taxes overall ranking if = +1 bynone tier ispresent given in Table 2. Details concerning tax policy are listed Medicaid +1inif Table opted 4. not to expand, -1 if expanded, 0 if undecided in Table Expansion 3, and regulatory policy In choosing a state to set up a practice, physicians Certificate of Need +1 if no certificate requirements, -1 if any type of certificate should consider tax and regulatory policy, especially those Table 1. Scoring Table 1. Scoring Factors Factors required In Office Dispensing +1 if easily arranged, 0 if difficult to obtain permit, -1 if regulations most relevant to their specialty or practice Item Scoring prohibited Individual Income Tax at if 0%no=restrictions +1, above 0% up to 7.99% = 0, at amount or abovein8% = -1-1 if Surgical Restrictions +1 enacted, 0 if minimal place, model. Important issues include: certificate-of-need (CON) Corporate Income Tax at = 0, 0, at at or or above above 8% 8%==-1 -1 Corporate Income Tax at0% 0%==+1, +1,above above 0% 0% up up to to 7.99% 7.99% = extensive Sales Tax at 0% = +1, above 0% up to 6% = 0, above 6% = -1 requirements, in-office dispensing regulations, office-based Sales TaxIncome Tax 0%==+1, +1,above above 0%rapidly up to to 7.99% 6% = 0,=above 6% = -1data Pilot Maintenance of no assignment given, changing limited Corporate atat0% 0% up 0,and at or above 8% = -1 General Gross Receipts Tax if present = -1 General present -1 Licensure Sales Tax Gross Receipts Tax atif0% = +1,= above 0% up to 6% = 0, above 6% = -1 surgical restrictions, pilot maintenance-of-licensure efforts, Physician Gross Receipts ififpresent ==-1 Physician Gross Receipts present -1 index <2, 0 if index between 2 to 5, -1 if index >5 Medical Board Actions if per capita General Gross Receipts Tax +1 if present = -1 Tax Tax Medical +1 if in top= ten medical board action climate, medical liability climate, PhysicianMalpractice Gross Receipts if present -1 states per capita, -1 if in the bottom ten states Provider ififnone ProviderTaxes Taxes nonepresent present == +1 +1 Ranking Tax continuing medical education (CME) requirements, and Medicaid Expansion +1 if opted not to expand, -1 if undecided Medicaid Expansion +1 if opted notbetween expand, expanded, ifif undecided Continuing Medical +1 if at present 0, 0 if 0 and 50,expanded, -1 if at 5000 or above Provider Taxes if none =to+1 Certificate +1 any type type of of certificate certificate CertificateofofNeed Need +1ififno nocertificate certificate requirements, requirements, -1 if any Education Medicaid Expansion +1 if opted not to expand, -1 if expanded, 0 if undecided whether the state elected to expand Medicaid. Taxes include: required required Price Transparency Grade No assignment given due to difficulty interpreting limited data Certificate of Need +1 if no certificate requirements, -1 if any type of certificate Office Dispensing +1ifassignment ifeasily easilyarranged, arranged, InInOffice Dispensing +1 obtain permit, permit, -1 -1ifif GME needed for licensure No given 00 if difficult to obtain individual income, corporate income, sales, gross receipts, required prohibited prohibited InSurgical Office Dispensing +1 if easily arranged, 0 if difficult to obtain permit, -1 if -1 if Restrictions +1ififno norestrictions restrictions enacted, enacted, 0 if minimal physician gross income, and various provider taxes. Surgical Restrictions +1 minimal amount amount in inplace, place, -1 if prohibited extensive extensive Table 2. Overall Ranking by State Surgical Restrictionsof +1 ifassignment no restrictions enacted, 0changing if minimal amount in place, -1 if Pilot Maintenance no given, rapidly and limited data Pilot Maintenance of no assignment given, rapidly and limited data extensive Licensure Licensure General Considerations Pilot Maintenance of no and limited dataif index >5 Medical BoardActions Actions +1assignment percapita capitagiven, index rapidly <2, 00 if if changing index between Medical Board +1 ififper index <2, index between 22 to to 5, 5, -1 -1 if index >5 Licensure Professional Liability Medical Malpractice +1ififinintop topten ten states states per per15. capita, -1 states Medical Malpractice +1 capita, -1 if if in in the the bottom bottom ten ten states Tier 1 Oklahoma 1 (+2, -1) >5 Medical Board Actions +1 if per capita index <2, 0 if index between 2 to 5, -1 if index Ranking Ranking 1.to South Dakota 88% (+8,=-0) 16. Georgia 1 (+2, -1) Corporate Income Tax at 0% = +1, above 0% up 7.99% = 0, at or above -1 Corporate Corporate Income Income Tax Tax at at 0% 0% = = +1, +1, above above 0% 0% up up to to 7.99% 7.99% = = 0, 0, at at or or above above 8% 8% = = -1 -1 Medical Malpractice +1 ifif-1) inat top states per capita, ifif in the bottom ten states The majority of articles discussing the best state in which Continuing Medical +1if 0,00ten if between between 017. and 50, -1 -1 at 50 or above 2. Wyoming 5 (+6, Utah 1 (+2, -1) Continuing Medical +1 at 0, if 0 and 50, -1 if at 50 or above SalesTax Tax at0% 0%== =+1, +1,above above0% 0%Ranking upto to6% 6%== =0,0, 0,above above6% 6%== =-1 -1 Sales Sales Tax atat 0% +1, above 0% up up to 6% above 6% -1 Education 18. Florida 1 (+3, -2) Education GeneralGross Gross ReceiptsTax Tax if ifpresent present== =-1 -1 to practice medicine have offered superficial analyses, Continuing Medical Grade +1 at 0, 0 if between 0 19. and 50, -1Carolina if at 50 or above1 (+3, -2) General General Gross Receipts Receipts Tax if present -1 Price Transparency Noifassignment assignment given due due to South difficulty interpreting Tier 2 Transparency Price Grade No given to difficulty interpreting limited limiteddata data PhysicianGross GrossReceipts Receipts ifpresent present== =-1 -1 Education Physician Physician Gross Receipts if if present -1 3. Idaho (+4, -0) 1 (+3, -2) GME neededfor forlicensure licensure 4 No Noassignment assignment given 20. Kansas focusing on physician satisfaction surveys, a handful of GME needed given Tax Price given due21. to Nevada difficulty interpreting limited data 4. Transparency Wisconsin Grade 4 No (+5,assignment -1) 1 (+4, -3) Tax Tax Provider Taxes nonepresent present== =+1 +1 GME 5. needed Indianafor licensure 3 No (+4,assignment -1) given Provider Taxes Taxes none present +1 broad taxes (such as income andProvider property), medicalifififnone liability MedicaidExpansion Expansion +1ifif ifopted optednot notto toexpand, expand, -1if ifexpanded, expanded, ifundecided undecided 6.-1 North Dakota (+4, -1) Tier 4 Medicaid Medicaid Expansion +1 +1 opted not to expand, -1 if expanded, 000ifif undecided Table 2. Overall Ranking by 3State Table Overall Ranking by State 7. 2.Texas 3 (+5, -2) 22. Arizona 0 (+2, -2) insurance premiums, and the local weather. in-depth Certificate ofNeed NeedA more +1 +1ifif ifno nocertificate certificaterequirements, requirements, -1ifif ifany anytype typeof ofcertificate certificate Certificate Certificate of of Need +1 no certificate requirements, -1 -1 any type of certificate 8. Alaska 3 (+5, -2) 23. Tennessee 0 (+3, -3) required Table 2. Overall Ranking by State required required Table 2. Overall Ranking by State 24. guide is needed to make physicians aware of potential Virginia 0 (+1, -1) InOffice OfficeDispensing Dispensing +1ifif ifeasily easilyarranged, arranged,000ifif if difficult difficultto toobtain obtainpermit, permit,-1 -1ifif if In In Office Dispensing +1 +1 easily arranged, to obtain permit, -1 Tier difficult 3 25. Minnesota 0 (+4, -4) prohibited Tier 1 15. Oklahoma 1 (+2, -1) prohibited prohibited pitfalls associated with certain practice models in each state. 2 (+3, -1) 26. West Virginia -1(+2, (+2,-1) -3) Tier9.11. Nebraska 15. -1) Dakotaamount (+8, -0) 16. Oklahoma Georgia 11(+2, SurgicalRestrictions Restrictions +1ifif ifno norestrictions restrictionsenacted, enacted, ifminimal minimal amountin in28place, place, -1ifif if Surgical Surgical Restrictions +1 +1 no restrictions enacted, 00South ifif minimal in -1 -1 10. Colorado (+3, 27. (+2,-1) -3) 1.2. 0 South Dakota amount 85place, (+8, -0) 16. Georgia 1 (+2, -1) Wyoming (+6,-1) -1) 17. Michigan Utah 1-1 The best states generally undertake policies designed extensive Tier11. 15. Oklahoma 11(+2, (+2, -1) extensive extensive 25 (+3, 28. Hawaii -1 (+2, -3) 2.1 Alabama Wyoming (+6, -1) 17. Utah (+2, -1) 18. Florida 1 (+3, -2) 1. South Dakota 8 (+8, -0) 16. Georgia 1 (+2, -1) PilotMaintenance Maintenanceof of noassignment assignmentgiven, given,rapidly rapidly changingand andlimited limiteddata data 29. (+3,-2) -4) 18. Florida 1 (+3, -2) Pilot Maintenance of no no assignment rapidly changing changing and limited 12.2 Missouri 2data (+3, -1) Tier 19. New SouthMexico Carolina 1-1 to reduce the cost of medical Pilot care. Decreased cost leads given, 2. Wyoming 5 (+6, -1) 17. Utah 11(+3, (+2, -1) Licensure 30. (+3,-2) -4) Tier13. 23. Mississippi 19. South (+3, -2) Licensure Licensure 24(+4, Idaho (+4,-2) -0) 20. Pennsylvania KansasCarolina 1-1 18. Florida 11(+3, (+3, -2) 31. Delaware -1 (+3, -4) Medical Board Actions +1 if per capita index <2, 0 if index between 2 to 5, -1 if index >5 3. Idaho 4 (+4, -0) 20. Kansas (+3, -2) -2) Medical Medical Board Boardpermits Actions Actions +1 +1ififper percapita capitaindex indexTier <2, <2,14. 0204.ififMontana index index between between22to to5,5,2-1 -1 ififindex index >5 Wisconsin 4 (+5, -1) >5 21. South NevadaCarolina 11(+4, -3) to increased access, and greater access physicians 19. 33. North MaineCarolina 32. -1 (+3,-2) -4) 4. 4ten -1) 21. Nevada 1 (+3, (+4, -3) MedicalMalpractice Malpractice +1ifif ifin intop topten tenstates statesper percapita, capita, -1ifif ifin inthe thebottom bottomten ten states 5. Wisconsin Indiana 3(+5, (+4, -1) Medical Medical Malpractice +1 +1 in top ten states per capita, -1 -1 in the bottom states states 3. Idaho (+4, -0) 20. Kansas 1-2 34. Kentucky (+1, -3) 33. Maine -1(+3, (+3,-2) -4) 5. Indiana 343(+4, -1) to compete for patients basedRanking on quality. State methods Ranking 6. North Dakota (+4, -1) Tier 4 Ranking 4. Wisconsin 4 (+5, -1) 21. Nevada 1 (+4, -3) (+1,-2)-3) 34. Kentucky 6. Tier35. 4 Arkansas 7. North Texas (+5,-1) -2) 22. Arizona 0-2(+2, ContinuingMedical Medical +1ifif ifatat at0,0, 0,000ifif ifbetween between000and and 50, -1Dakota ifatat at50 50or orabove above333(+4, Continuing Continuing Medical +1 +1 between and 50, 50, -1 -1 if if 50 or above 5. Indiana (+4, -1) 36. Iowa -2 (+2, -4) 35. Arkansas (+1, -3) to reduce costs to physicians and patients generally take 7.8. Texas 33(+5, 22. (+2,-3) -2) Alaska (+5,-2) -2) 23. Arizona Tennessee 00(+3, Education 6. Alaska North Dakota (+4, -2) -1) Tier23. 4 Louisiana Education Education 37. -2(+3, (+2,-3) -4) 36. Iowa 8. 33 (+5, 24. Tennessee Virginia 0 (+1, -1)0 PriceTransparency Transparency Gradehurdles Noassignment assignment givendue due7. todifficulty difficulty interpretinglimited limited data Texas 3 (+5, -2) 22. (+2, -2) Price Price Transparency Grade Grade No No assignment given due to to interpreting interpreting limited data data the form of lower taxes and fewer regulatory that given 38. Vermont* (+3, -5) 37. Louisiana (+2,-4) -4) 24. Virginia 0-2(+4, (+1, -1) Tier 3 difficulty 25. Arizona Minnesota 00 8. Alaska 3 (+5, -2) 23. Tennessee 0 (+3, -3) GME needed for licensure No assignment given 39. Washington (+3,-4) -5) 38. Vermont* GME GMEneeded neededfor forlicensure licensure No Noassignment assignmentgiven givenTier 39. Nebraska 25. 0-2(+4, 2 (+3, -1) 26. Minnesota West Virginia -1 (+2, -3) interrupt the patient-physician relationship. Less favorable states have generally taken the opposite approach, and have Table2.2. 2.Overall Overall Rankingby byState State Table Table Overall Ranking Ranking by State been more likely to “double down,” attempting to address perceived inefficiencies with more regulatory requirements Tier111 Tier that often fail to achieve desiredTier improvements. 1. South SouthDakota Dakota (+8,-0) -0) 1.1. South Dakota 888(+8, (+8, -0) 2. Wyoming Wyoming (+6,-1) -1) 2.2. Wyoming 555(+6, (+6, -1) Physicians might first look at each state’s comprehensive Tier222 Tier Tier ranking, which weights all categories equally, then4 evaluate 3. Idaho Idaho (+4,-0) -0) 3.3. Idaho 44(+4, (+4, -0) 4. Wisconsin (+5,-1) -1) 4.4. Wisconsin Wisconsin 444(+5, (+5, -1) a narrowed list of states on the basis of considerations most 5. Indiana Indiana (+4,-1) -1) 5.5. Indiana 333(+4, (+4, -1) 6. North NorthDakota Dakota (+4,-1) -1) relevant to their practice. 6.6. North Dakota 333(+4, (+4, -1) 7. 7.7. 8. 8.8. Ranking Methodology Texas Texas Texas Alaska Alaska Alaska Tier333 Tier Tier 9. Nebraska Nebraska 9.9. Nebraska 10. Colorado Colorado 10. 10. Colorado 11. Alabama Alabama 11. 11. Alabama 12. Missouri Missouri 12. 12. Missouri 13. Mississippi Mississippi 13. 13. Mississippi 14. Montana Montana 14. 14. Montana (+5,-2) -2) 333(+5, (+5, -2) (+5,-2) -2) 333(+5, (+5, -2) (+3,-1) -1) 222(+3, (+3, -1) (+3,-1) -1) 222(+3, (+3, -1) (+3,-1) -1) 222(+3, (+3, -1) (+3,-1) -1) 222(+3, (+3, -1) (+4,-2) -2) 222(+4, (+4, -2) (+4,-2) -2) 222(+4, (+4, -2) Classification criteria for the tiered ranking system are listed in Table 1. Ranked factors were assigned scores as follows: +1 if pro-physician compared to other states, 0 if neutral, or -1 if anti-physician. States’ overall ranking by tier is given in Table 2. Details Journal of American Physicians and Surgeons Volume 19 Number 4 Winter 2014 9.10.Nebraska Colorado Tier10. 311.Colorado Alabama 9. Alabama Nebraska 11. 12. Missouri 10. Colorado 13.Missouri Mississippi 12. 11. Alabama 14.Mississippi Montana 13. 12. Missouri 14. 33. Montana Maine 13. Mississippi 15. Oklahoma Oklahoma 15. 15. Oklahoma 34. Kentucky 14. Montana 16. Georgia 16. 16. Georgia Georgia 35. Arkansas 33. Maine 17. Utah 17. 17. Utah Utah 36. Iowa 34. Kentucky 18. Florida Florida 18. 18. Florida 37. Louisiana 35. Arkansas 19. South SouthCarolina Carolina 19. 19. South Carolina 38. Vermont* 36. Iowa 20. Kansas 20. 20. Kansas Kansas 39. Washington 37. Louisiana 21. Nevada 21. 21. Nevada 40. New Hampshire 38. Nevada Vermont* 22(+3, (+3,-1) -1) 22(+3, (+3,-1) -1) (+3, -1) -1) 222(+3, (+3, -1) 2 (+3, -1) (+4,-1) -2) 22(+3, 2 (+3, -1) (+4,-2) -2) 22(+4, 2 (+3, -1) 2-1(+4, (+3,-2) -4) 21 (+4, -2) (+2, -1) 112-2 (+2, (+2, -1) (+1,-1) -3) (+4, -2) 1 (+2, -1) 11-2 (+2, (+2, -1) (+1, -3) -1 (+3,-1) -4) 1(+2, (+2, -1) 11-2 (+2, -1) (+2, -4) -2 (+1,-1) -3) 1(+3, (+3, -2) 11-2 (+3, -2) -2) (+2, -4) -2 (+1,-2) -3) 1(+3, (+3, 11-2 (+3, -2) (+3, -5) -2 (+2,-2) -4) 1(+3, (+3, -2) 11-2 (+3, -2) -2) (+3, -5) -2 (+2, -4) 1 (+4, (+4, -3) 11-2 -3) (+4, -6) -2(+4, (+3,-3) -5) 45 46 45 47 46 48 47 49 48 49 Tier 6 Tier50 6 51 50 51 24. 0-1 40. New Hampshire -2(+1, (+4, -6) 39. Washington (+3,-1) -5) 26. West Virginia (+2, -3) 27. Virginia Michigan -1 (+2, -3) 25. 0-1 40. New Hampshire -2(+4, (+4,-4) -6) 27. Michigan (+2, -3) 28. Minnesota Hawaii -1 (+2, -3) 26. West Virginia -1 (+2, -3) 29. Hawaii New Mexico -1 28. -1(+3, (+2,-4) -3) -1 (+2, -3) Tier27. 5 Michigan 30. Pennsylvania -1 29. New Mexico -1(+3, (+3,-4) -4) Hawaii -1 (+2, -3) 41. Connecticut -3 (+2, -5) Tier28. 5 31. Delaware -1 (+3, -4) 30. Pennsylvania -1 (+3, -4) 29. -1 (+3, -4) 42. Rhode Island -3(+3, (+2,-4) -5) 32. New NorthMexico Carolina -1 41. Connecticut 31. Delaware -1 (+3, -4) 45. Maryland -4 (+1, -5) 30. Pennsylvania -1 (+3, -4) 43. DC -3 (+3, (+2, -4) -5) * Will 42. North RhodeCarolina Island 32. -1 46. New -4 (+1, -5) 31. -1 44. Oregon -4 (+1, -5) 43. Delaware DC York -3 (+3, (+2, -4) *establi Will 47. California -4 (+2, -6) 32. Carolina -1 establis 44. Oregon -4 (+3, (+1, -4) -5) 45. North Maryland 48. -5 46. Ohio New York2, the first number -4 (+1, (+1,is-6) -5) In Table the state’s total score, 49. -5 47. Illinois California -4 (+1, (+2, -6) In firstthe number is-6) the state’s total score, number ofTable areas 2, in the which state was above average, and 48. Ohio -5 (+1, -6)below above average, number of areas in which the state was average. and Tier49. 6 Illinois -5 (+1, -6) number of areas in which the state was 50. Massachusetts -7 (+0, -7)below average. Taxation -9 (+0, -9) Tier51. 6 New Jersey Washington -2 (+3, -5) Tier439. Taxation Tier 44 New Hampshire Tier 40. -2(+2, (+4,-2) -6) 50. Massachusetts -7 (+0, -7) 1 22. Arizona [1] corporate,2 [2] a The highest tiers of individual, 22. Arizona (+2,-2) -2) 000(+2, Tier22. 5 Arizona 51. New Jersey -9 (+0, -9) 1 23. Tennessee 0 (+3, -3) The require highestno tiers of individual, [1] corporate, 23. Tennessee (+3, -3) 23. 00-3(+3, 41. Tennessee Connecticut (+2,-3) -5) and should additional explanation. Provider2 [2] taxea 24. Virginia VirginiaIsland 0(+1, (+1, -1) 24. Virginia (+1, -1) 00-3 42. Rhode (+2,-1) -5) and should require no by additional Provider taxe are typically justified states asexplanation. a means of financing Me Tier24. 5 25. Minnesota Minnesota 0(+4, (+4, -4) 25. Minnesota 0 (+4, -4) 25. 0 -4) * Will likely be last in 2017 when single payor is 43. DC -3 (+2, -5) are typically justified by states as a means of financing Me except Alaska levies some type of provider tax, and the thr 41. Connecticut -3 (+2, -5) 26. West WestVirginia Virginia -1(+2, (+2,-3) -3) -1 26. West Virginia -1 (+2, -3) 26. established— could ban private medicine 44. Oregon -4 (+1, -5) except Alaska levies some type of provider tax, and the thr generating provider tax revenue are hospitals, intermediate 42. Rhode Island -3 (+2, -5) 27. Michigan -1 (+2, -3) 27. 27. Michigan Michigan -1 -1 (+2, (+2, -3) -3) generating provider tax revenue are hospitals, *A Will likely be lastofinstates 2017 when payor is intermediate 43. DC -3 (+2, -5) small minority have single enacted a provider tax narro 28. Hawaii Hawaii -1 (+2, -3) 28. 28. Hawaii -1 -1 (+2, (+2, -3) -3) In Table 2, the first number is-5) the state’s totalestablished— number indicates the a provider tax narro couldof ban private medicine 44. Oregon -4 (+1, Ascore, smallthe minority states have enacted receipts. [4]second 29. New NewMexico Mexico -1(+3, (+3,-4) -4) 29. 29. New Mexico -1 (+3, -4) number of areas in which the -1 state was above average, and the[4] second (negative number) is the receipts. 30. Pennsylvania Pennsylvania -1(+3, (+3,-4) -4) 30. 30. Pennsylvania -1 -1 (+3, -4) number of areas in which the state was below average. In Table 2, the first number the state’s totalRegulations score, the second number indicates the 31. Delaware Delaware -1(+3, (+3,is-4) -4) 31. 31. Delaware -1 -1 (+3, -4) number of areas in which the -1 state was and the second (negative number) is the Regulations 32. North North Carolina -1(+3, (+3, -4)above average, 32. 32. North Carolina Carolina -1 (+3, -4) -4) In Table 2, the first number is the state’s total score, the second number indicates the number of areas in which the Taxation number of areas in which the state was below average. Certificate of Need (CON) of (negative Need (CON)(CON) Certificate-of-need laws were initially effec stateThe was above average, and theCertificate second number) [2] and sales taxes [3]Act are listed in Table 3 initially Taxation highest tiers of individual, [1] corporate,Resources Certificate-of-need (CON) laws werewere effec Development of 1974. They designed andthe should require no additional explanation. Provider taxes can come from many categories andwere is number of areas in which the state was below average. Resources Development Act of 1974. mechanisms to ensure that there was aThey need for a designed specified 1 2 3 1 2 Medicaid programs. 3 4 [4] Every state are typically justified by of states as a means financing The highest tiers individual, [1]of corporate, [2] and sales [3] are listed in 3for aAspecified mechanisms to taxes ensure that there was aTable need capital investment. The theory was that hospital might w except Alaska leviesnosome type ofexplanation. provider tax, and the threeinvestment. most popular categories forthat and should require additional Provider taxes can come from many categories andbusiness capital The theory was hospital A might w hospital B, while the town only has enough to sup 4 115 generating hospitals, intermediate care facilities, and[4] nursing homes. [4]business are typicallyprovider justifiedtax byrevenue states asare a means of financing Medicaid programs. Every state hospital B, while the town only has enough to sup hospitals were to purchase machines, the risk of over-use o A smallAlaska minority of states a provider narrowly tailored to gross except levies some have type enacted of provider tax, andtax the three most categories for hospitals were topay purchase the risk ofStates’ over-use o many MRIs) topopular offphysicians’ the machines, machines increases. CON receipts. [4]provider tax revenue are hospitals, intermediate generating care facilities, and nursing [4] radiology many MRIs) to pay off the machines increases. States’ equ CON Independent physicians wishing tohomes. purchase Taxation The highest tiers of individual,1 corporate,2 and sales taxes3 are listed in Table 3 and should require no additional explanation. Provider taxes can come from many categories and are typically justified by states as a means of financing Medicaid programs.4 Every state except Alaska levies some type of provider tax, and the three most popular categories for generating provider tax revenue are hospitals, intermediate care facilities, and nursing homes.4 A small minority of states have enacted a provider tax narrowly tailored to physicians’ gross receipts.4 Regulations Certificate of Need (CON) Certificate-of-need (CON) laws were initially effected as part of the Health Planning and Resources Development Act of 1974. They were designed as state-sponsored costrestricting mechanisms to ensure that there was a need for a specified health service prior to approving capital investment. The theory was that hospital A might want an MRI machine to compete with hospital B, while the town only has enough business to support one MRI machine. If both hospitals were to purchase machines, the risk of overuse of government funds (ordering too many MRIs) to pay off the machines increases. States’ CON laws vary widely in severity.5 Independent physicians wishing to purchase radiology equipment and other items traditionally owned by hospitals should be more cautious about entering states with these regulations. Hospitals often use CON laws to prevent perceived competition from physicians. Only 14 states are entirely free of CON laws, and these deserve special consideration from radiologists and surgeons.5 In-Office Dispensing of Prescription Medications These regulations are most important to direct primary care practices, which often attempt to increase their value to patients by dispensing prescription medications, often at cost lower than the pharmacy. Eleven states prohibit physicians from dispensing even non-narcotic medications on a monthly basis: Arkansas, Maryland, Massachusetts, Montana, New Jersey, New Mexico, New York, North Carolina, Oregon, Texas, and Utah.6 Physicians who have not opted out of Medicare can easily run afoul of Stark regulations in this area, and those dispensing medications priced higher than cost must ensure compliance with anti-kickback statutes.7 Details have unfortunately not been summarized in comprehensive fashion in any single location, and further discussion of this topic would warrant an entire article. The Jasos Group authored a helpful summary,8 and Progressive Medical has the best single-page review.9 The Office of the 116 Inspector General issued a summary report in 1989 that is now outdated.10 Surgical Restrictions These regulations are complex. The Federation of State Medical Boards (FSMB) provides a comprehensive overview of surgical regulations.11 States without specific restrictions on outpatient surgery obviously provide physicians with greater practice flexibility. Surgeons should take note of the 10 states with the most severe restrictions: California, Florida, Kentucky, Louisiana, New Jersey, North Carolina, Ohio, South Carolina, Tennessee, and Texas. A surgeon desiring to open an outpatient surgical center in one of these states should carefully review the regulations prior to making this investment. The Accreditation Association for Ambulatory Health Care also provides a helpful summary.12 Pilot Maintenance of Licensure (MOL) Members of the academic medical community and the FSMB are concerned about the lack of broad physician endorsement of the current maintenance-of-certification (MOC) regime. Physicians have begun to vote with their feet by opting out of the ever more frequent and more expensive examinations, arguing that the process has not been shown to increase quality of care. As a result, efforts are underway in some states to tie MOC to maintenance of licensure (MOL), altering what was designed to be a “feather in your cap” to a new “minimum standard.” These efforts have been well documented by Paul Kempen, M.D., Ph.D.,13 and Kenneth Christman, M.D.,14 in this journal. MOL proposals were defeated in Ohio, other state medical associations have been fighting efforts by the FSMB, and data is gradually being aggregated online.15 While they are not currently incorporated in the rankings because of lack of official action in most states, physicians should follow these developments closely before selecting a new location, and consider promoting the passage of model legislation on this issue in their state.16 Medical Licensure Board Actions The ability to police negligent, corrupt, or otherwise harmful physicians is an important function of state medical boards, but most state medical boards operate outside traditional due process and our court systems’ rules of evidence, making their investigations of physicians ripe for potential abuse. Public Citizen’s Health Research Group historically ranked medical boards based on per capita (physician) actions.17 While this group favored increased board action against physicians, their rankings can be inverted for well-meaning physicians who would like to minimize their risk of an unwarranted investigation. Public Citizen gathered its data largely from reports released by the FSMB, which has now decided to stop releasing the Journal of American Physicians and Surgeons Volume 19 Number 4 Winter 2014 information.18 For smaller states, the limited number of physicians can lead to wide variations on an annual basis. The Texas State Medical Board provides one example of the misery these entities are capable of inflicting on physicians.19 Medical Liability Actions A healthy medical liability climate occurs in states that have lower incidence of nuisance suits, and appears to be less related to the size of verdicts. Diederich Healthcare has the most useful comprehensive rankings, on a per-capita (physician) payout basis.20 Academic studies differ in opinion about why some states have a more favorable climate than others. Readers should note that caps (on non-economic damages) are likely overrated for two reasons: 1) studies have shown that these made little difference in claims,21 and 2) eight states attempting to impose these non-economic damage caps have had them overturned on constitutional grounds at the state supreme court level.22 Continuing Medical Education (CME) Lifelong learning is a wonderful concept, and physicians should not attempt to rest on their laurels after residency or at any other point in their careers. Whether the highly formalized CME process achieves its purported aims, or educates physicians better than other less formalized methods of self-education, is debatable. For physicians who are confident that they do not need an auditor to ensure they are consistently furthering their own medical knowledge, there are five states that have no continuing medical education requirements: Colorado, Indiana, Montana, New York, and South Dakota.23 Many states have multiple subcategories that can make fulfilling these requirements more onerous.24 Twelve states require 50 CME hours per year, an especially burdensome number, while the average for those requiring CME is around 25 hours per year.25 While physicians with a D.O. degree in Vermont are required to have an unremarkable 15 hours of CME per year, in the future physicians with an M.D. degree will have “CME required, with criteria to be determined by the board,” vague language that could lead to unpredictable new requirements during future licensure renewals.26 Price Transparency This remains an important issue for third-party-free practices. Many private entities are attempting to aggregate and disseminate this information, but regulations in this arena have not had much impact. A study by the Health Care Incentives Improvement Institute attempted to give each state a ranking, but the data is limited and rapidly changing.27 The best single resource for a summary in this arena is the National Conference of State Legislature’s summary; of note, California, Florida, Maryland, Oregon, and New Jersey all have online databases representing some attempt at price Journal of American Physicians and Surgeons Volume 19 Number 4 Winter 2014 transparency.28 All five databases fall well short of the simple steps taken by Dr. G. Keith Smith at the Surgery Center of Oklahoma.29 Medicaid Expansion The states are fairly evenly split regarding Medicaid expansion.30 Estimates from The New York Times show that a Medicaid expansion would cause an increase in spending in most states (but not all).31 Not all levels of expansion are equivalent, but the decision to expand should generally be concerning to physicians due to anticipated tax increases needed to fund the higher levels of state spending. Indiana and Utah have not yet made official decisions.31 Special Considerations in Various States Physicians need to be aware of issues unique to individual states that could not be easily worked into the tiered rankings above. Remember that “direct primary care” practices charge a periodic fee for services and do not bill any third parties on a fee-for-service basis. Any per visit charge must be less than the monthly equivalent of the periodic fee. Many describe these practices as “concierge for the masses.” Florida Florida had a 1.5% physician gross receipts tax until around 2001 when the judiciary eliminated it.32 Hawaii Hawaii has a hybrid between a gross receipts tax and a sales tax known as a general excise tax of around 4%.33 This was listed as a sales tax in Table 1 for simplification purposes. Illinois The Medicaid climate in Illinois is yet another reason that it is one of the worst states to practice medicine. “Attorney General Lisa Madigan filed an antitrust lawsuit in June against the Carle Clinic Association and Christie Clinic for declining to enroll new Medicaid patients. The lawsuit alleges that the medical groups collectively boycotted new Medicaid patients by adopting identical policies in 2003.”34 Kentucky Kentucky has experimented with a provider tax in the past. Massachusetts In Massachusetts, a rule to tie licensure to electronic health record proficiency has been proposed.35 Minnesota The MinnesotaCare program enacted in the 1990s placed 117 a 2% gross receipts tax on physicians. It was briefly reduced to 1.5%, and then returned to 2%.32 Efforts to increase the amount of the tax for specific procedures have thus far been unsuccessful.32 Missouri Recently Missouri passed legislation enacting a new class of healthcare provider—the assistant physician.36 Physicians who graduate medical school and pass step 1 and 2 of their national licensure exam (but strangely not step 3), who failed or elected not to obtain a residency spot, will be eligible for this new type of medical licensure if they find a physician willing to sign a collaborative agreement.37 Space precludes a full discussion here. New Hampshire New Hampshire imposes a gross receipts tax, known as a business profits tax, of 8.5% on organizations with $50,000 or more gross business income.38 The state also levies a 0.75% business enterprise tax on all business with gross revenue of $150,000 or more.38 New Mexico New Mexico’s general gross receipts tax applies to physician’s services that are not being delivered by a physician working for a 501(c)(3) nonprofit or employed by HMOs.32 It is levied at rates from 5.125% to 8.6875% depending upon the location of the business.39 New York A New York law requires all health workers to receive the influenza vaccination or wear a mask. New Jersey New Jersey enacted a 6% gross receipts tax on elective cosmetic procedures and a 3.5% flat tax on ambulatory surgical center income greater than $300,000 in 2004. Studies demonstrated that “for every $1.00 New Jersey collects from provider taxes the state actually loses $3.39 in total revenue.”32 Attempts by the legislative authors to later repeal the taxes were vetoed by the governor.32 Ohio The first attempt to implement a pilot Maintenance of Licensure (MOL) program was made in Ohio. Thanks largely to the efforts of Paul Kempen, M.D., and other physicians, this effort was blocked. In addition, the former executive director of the State Medical Board of Ohio, Richard Whitehouse, has now been ousted. 40 Ohio has a gross receipts tax, known as the commercial activity tax, which applies to physicians and most business sectors; it 118 is imposed on businesses with gross receipts of more than $150,000 and is levied at a rate of 0.26% on gross receipts of more than $1 million.41 West Virginia From 1993 to 2010, West Virginia had a 2% physician gross receipts tax.32 A 10-year sunsetting of the 2% tax began around 2001.32 In 2009 the legislature betrayed the trust of the West Virginia State Medical Association and decided to enact separate legislation authorizing a specific physician provider tax of “two percent of the gross receipts derived by the taxpayer from furnishing physicians’ services in this state.”42 West Virginia places control of pricing and operational decisions by direct primary care practices in the hands of the state insurance commissioner and the body that governs CON issues, the West Virginia Health Care Authority.43 Direct primary care physicians would be better off without this legislation. Texas Surprisingly, Texas prohibits physicians from dispensing medications unless they are in a rural area with no pharmacy within a 15-mile radius.44 To obtain a Texas medical license, physicians must pass a separate medico-legal examination, an unnecessary barrier to initial licensure. The Texas Medical Board has been known for attempting to end physician careers based on anonymous allegations backed by little evidence.19 Vermont The Vermont law enacting single-payer medicine as of 2017 gives the Green Mountain Care Board the authority to set all prices, and thus the ability to effectively ban private medicine in Vermont.45 Oregon Oregon has laws designed to regulate direct primary care physicians. The motivation for these types of laws in the five other states with this type of legislation (Washington, West Virginia, Utah, Arizona, and Louisiana) was to provide explicit assurance to physicians that this type of practice model does not amount to the unlawful sale of insurance. Oregon’s language fails to explicitly state that direct primary care is “not insurance,” and allows the insurance commissioner to retain full regulatory control over direct primary care practices.46 Direct primary care physicians in Oregon are severely restricted and would be better off without any legislation at all. Washington Washington’s gross receipts tax, known as the business and occupations tax, has a 1.5% service sector rate.47 Journal of American Physicians and Surgeons Volume 19 Number 4 Winter 2014 service Washington’s sector rate.47 gross receipts tax, known as the business and occupations tax, has a 1.5% service sector rate.47 Table 3. Tax Climate Comparison Table3.3.Tax TaxClimate Climate Comparison Table Comparison Individual Corporate Sales Gross Dr Tax Provider Taxes Medicaid Individual Corporate Sales Gross Income Income Tax Receipt Dr Tax Provider Taxes Medicaid Expansion Income Income Tax Receipt Expansion Tax Tax Tax Tax Tax Tax Alabama 5.00% 6.50% 4.00% Hosp NH No Alabama 5.00% 6.50% 4.00% Hosp NH No No Alaska 0.00% 9.40% 0.00% None Alaska 0.00% 9.40% 0.00% None No Arizona 4.54% 6.50% 6.60% others Yes Arizona 4.54% 6.50% 6.60% others ICF NH Yes Yes Arkansas 7.00% 6.50% 6.00% Hosp Arkansas 7.00% 6.50% 6.00% Hosp ICF NH Yes California 10.30% 8.84% 7.50% Hosp ICF NH Yes California 10.30% 8.84% 7.50% Hosp ICF NH NH Yes Yes Colorado 4.63% 4.63% 2.90% Hosp Colorado 4.63% 4.63% 2.90% Hosp NH Yes Connecticut 6.70% 9.00% 6.35% Hosp ICF NH Yes Connecticut 6.70% 9.00% 6.35% Hosp ICF NH Yes Yes Delaware 6.75% 8.70% 0.00% others Delaware 6.75% 8.70% 0.00% others Yes District of District of D.C. Columbia 8.95% 9.98% 6.00% Hosp ICF NH Yes Columbia 8.95% 9.98% 6.00% Hosp ICF ICF NH NH No Yes Florida 0.00% 5.50% 6.00% Hosp Florida 0.00% 5.50% 6.00% Hosp ICF NH No Georgia 6.00% 6.00% 4.00% Hosp NH No Georgia 6.00% 6.00% 4.00% Hosp NH No Hawaii 11.00% 6.40% 4.00% others Yes Hawaii 11.00% 6.40% 4.00% others Yes Idaho 7.40% 7.40% 6.00% Hosp ICF NH No Idaho 7.40% 7.40% 6.00% Hosp ICF NH No Illinois 5.00% 9.50% 6.25% Hosp ICF NH Yes Illinois 5.00% 9.50% 6.25% Hosp ICF ICF NH NH Undecided Yes Indiana 3.40% 7.50% 7.00% Hosp Indiana 3.40% 7.50% 7.00% Hosp ICF NH Undecided Iowa 8.98% 12.00% 6.00% Hosp ICF NH Yes Iowa 8.98% 12.00% 6.00% Hosp ICF NH NH No Yes Kansas 6.45% 7.00% 6.30% Hosp Maryland 5.75% 8.25% 6.00% ICF Yes Kansas 6.45% 7.00% 6.30% Hosp NH No Kentucky 6.00% 6.00% 6.00% Hosp ICF NH Yes Maryland 5.75% 8.25% 6.00% Hosp ICF ICF NH NH Yes Yes Massachusetts 5.25% 8.00% 6.25% Kentucky 6.00% 6.00% 6.00% Hosp Louisiana 6.00% 8.00% 4.00% Maryland 5.75% 8.25% 6.00% Hosp ICF ICF NH NH No Yes Massachusetts 5.25% 8.00% 6.25% Hosp NH Yes Michigan 4.35% 6.00% 6.00% Hosp Yes Louisiana 6.00% 8.00% 4.00% ICF NH No Maine 8.50% 8.93% 5.00% Hosp ICF NH No Maryland 5.75% 8.25% 6.00% Yes Massachusetts 5.25% 8.00% 6.25% Hosp NH Yes Michigan 4.35% 6.00% 6.00% Hosp ICF NH NH No Yes 2% Maine 8.50% 8.93% 5.00% Hosp Massachusetts 5.25% 8.00% 6.25% Hosp NH Yes Michigan 4.35% 6.00% 6.00% Hosp ICF NH NH Yes Yes 2% Minnesota 7.85% 9.80% 6.88% gross Hosp Michigan 4.35% 6.00% 6.00% Hosp NH Yes 2% Minnesota 7.85% 9.80% 6.88% gross Hosp ICF ICF NH NH No Yes Mississippi 5.00% 5.00% 7.00% Hosp 2% 2% gross Hosp Minnesota 7.85% 9.80% 6.88% gross Hosp ICF ICF NH NH No Yes Mississippi 5.00% 5.00% 7.00% Missouri 6.00% 6.25% 4.23% Hosp Minnesota 7.85% 9.80% 6.88% gross Hosp ICF ICF NH NH No Yes Mississippi 5.00% 5.00% 7.00% Hosp ICF NH No Missouri 6.00% 6.25% 4.23% Hosp ICF ICF NH NH No No Montana 6.90% 6.75% 0.00% Hosp Mississippi 5.00% 5.00% 7.00% Hosp ICF ICF NH NH No No Missouri 6.00% 6.25% 4.23% Hosp Montana 6.90% 6.75% 0.00% Hosp ICF NH No Nebraska 6.84% 7.81% 5.50% Missouri 6.00% 6.25% 4.23% Hosp ICF ICF NH NH No No Montana 6.90% 6.75% 0.00% Hosp ICF NH No Nebraska 6.84% 7.81% 5.50% ICF NH NH Yes No Nevada 0.00% 0.00% 6.85% Montana 6.90% 6.75% 0.00% Hosp ICF ICF NH NH No No Nebraska 6.84% 7.81% 5.50% Nevada 0.00% 0.00% 6.85% NH Yes New Hampshire 0.00% 8.50% 0.00% 8.50% Hosp ICF NH Yes Nebraska 6.84% 7.81% 5.50% NH No Nevada 0.00% 0.00% 6.85% NH Yes Yes New Hampshire 0.00% 8.50% 0.00% 8.50% Hosp ICF NH NH New Jersey 8.97% 9.00% 7.00% Hosp Nevada 0.00% 0.00% 6.85% NH Yes Yes New Hampshire 0.00% 8.50% 0.00% 8.50% Hosp ICF NH NH Yes New Jersey 8.97% 9.00% 7.00% Hosp Yes 5.1 New Jersey Hampshire 0.00% 8.50% 0.00% 8.50% Hosp ICF NH NH Yes Yes New 8.97% 9.00% 7.00% Hosp 5.1 New Mexico 4.90% 7.60% 5.13% -8.7% others Yes New Jersey 8.97% 9.00% 7.00% Hosp ICF NH Yes 5.1 5.1-8.7% New York Mexico 4.90% 7.60% 5.13% -8.7% others ICF NH Yes Yes New 8.82% 7.10% 4.00% Hosp 5.1 New Mexico 4.90% 7.60% 5.13% -8.7% others ICF NH Yes Yes New York 8.82% 7.10% 4.00% Hosp North Carolina 7.75% 6.90% 4.75% Hosp ICF NH No New 4.90% 7.60% 5.13% others New Mexico York 8.82% 7.10% 4.00% -8.7% Hosp ICF ICF NH NH Yes Yes North Carolina 7.75% 6.90% 4.75% Hosp No North Dakota 3.99% 5.15% 5.00% ICF Yes New York 8.82% 7.10% 4.00% Hosp ICF NH Yes North Carolina 7.75% 6.90% 4.75% Hosp ICF NH No North Dakota 3.99% 5.15% 5.00% ICF NH Yes Yes Ohio 5.93% 0.00% 5.50% 0.26% Hosp North 7.75% 6.90% 4.75% Hosp ICF ICF No North Carolina Dakota 3.99% 5.15% 5.00% ICF NH Yes Ohio 5.93% 0.00% 5.50% 0.26% Hosp ICF NH Yes Oklahoma 5.25% 6.00% 4.50% Hosp ICF NH No North 3.99% 5.15% 5.00% Ohio Dakota 5.93% 0.00% 5.50% 0.26% Hosp ICF NH NH Yes Yes Oklahoma 5.25% 6.00% 4.50% Hosp No Oregon 9.90% 7.60% 0.00% Hosp Yes Ohio 5.93% 0.00% 5.50% 0.26% Hosp ICF NH NH Yes Oklahoma 5.25% 6.00% 4.50% Hosp NH No Oregon 9.90% 7.60% 0.00% Hosp ICF NH NH Yes Yes Pennsylvania 3.07% 9.99% 6.00% Hosp Oklahoma 5.25% 6.00% 4.50% Hosp Oregon 9.90% 7.60% 0.00% Hosp ICF NH NH No Yes Pennsylvania 3.07% 9.99% 6.00% Hosp NH Yes Rhode Island 5.99% 9.00% 7.00% Hosp NH Yes Oregon 9.90% 7.60% 0.00% Hosp Pennsylvania 3.07% 9.99% 6.00% Hosp ICF NH NH Yes Yes Rhode Island 5.99% 9.00% 7.00% Hosp NH Yes South Carolina 7.00% 5.00% 6.00% Hosp ICF No Pennsylvania 3.07% 9.99% 6.00% Hosp ICF NH RhodeCarolina Island 5.99% 9.00% 7.00% Hosp ICF NH Yes Yes South 7.00% 5.00% 6.00% Hosp No South Dakota 0.00% 0.00% 4.00% ICF NH No Rhode Island 5.99% 9.00% 7.00% Hosp Yes South Dakota Carolina 7.00% 5.00% 6.00% Hosp ICF ICF No South 0.00% 0.00% 4.00% No Tennessee 0.00% 6.50% 7.00% Hosp ICF NH No South Carolina 7.00% 5.00% 6.00% Hosp ICF No South Dakota 0.00% 0.00% 4.00% ICF No Tennessee 0.00% 6.50% 7.00% Hosp ICF ICF NH No No Texas 0.00% 0.00% 6.25% South Dakota 0.00% 0.00% 4.00% Tennessee 0.00% 6.50% 7.00% Hosp ICF ICF NH No No Texas 0.00% 0.00% 6.25% ICF No Utah 5.00% 5.00% 4.70% Hosp ICF NH Undecided Tennessee 0.00% 6.50% 7.00% Hosp ICF No Texas 0.00% 0.00% 6.25% ICF NH No Utah 5.00% 5.00% 4.70% Hosp ICF ICF NH Yes Undecided Vermont 8.95% 8.50% 6.00% Hosp NH Texas 0.00% 0.00% 6.25% ICF No Utah 5.00% 5.00% 4.70% Hosp ICF NH Undecided Vermont 8.95% 8.50% 6.00% Hosp ICF ICF NH No Yes Virginia 5.75% 6.00% 5.00% Utah 5.00% 5.00% 4.70% Hosp Vermont 8.95% 8.50% 6.00% Hosp ICF ICF NH NH Undecided Yes Virginia 5.75% 6.00% 5.00% ICF No Washington 0.00% 0.00% 6.50% 1.50% Hosp ICF NH Yes Vermont 8.95% 8.50% 6.00% Hosp ICF Yes Virginia 5.75% 6.00% 5.00% ICF NH No Washington 0.00% 0.00% 6.50% 1.50% 2% Hosp ICF NH Yes Virginia 5.75% 6.00% 5.00% ICF No Washington 0.00% 0.00% 6.50% 1.50% Hosp ICF NH Yes 2% West Virginia 6.50% 7.00% 6.00% gross 2% gross Hosp ICF NH Yes Washington 0.00% 0.00% 6.50% 1.50% 2% Hosp West Virginia 6.50% 7.00% 6.00% gross Hosp ICF ICF NH NH Yes Yes Wisconsin 7.75% 7.90% 5.00% Hosp ICF NH No 2% West Virginia 6.50% 7.00% 6.00% gross Hosp ICF NH Yes Wisconsin 7.75% 7.90% 5.00% Hosp ICF NH No Wyoming 0.00% 0.00% 4.00% Hosp ICF NH NH Yes No West Virginia 6.50% 7.00% 6.00% gross Hosp Wisconsin 7.75% 7.90% 5.00% Hosp Wyoming 0.00% 0.00% 4.00% Hosp ICF NH NH No No Wisconsin 7.75% 7.90% 5.00% Hosp Wyoming 0.00% 0.00% 4.00% Hosp ICF NH NH No No [Providers (hosp), intermediate care facilities (ICF), and nursing Wyoming include hospitals 0.00% 0.00% 4.00% Hosp homes NH(NH)]. No State State [Providers include hospitals (hosp), intermediate care facilities (ICF), and nursing homes (NH)]. [Providers include hospitals (hosp), intermediate care facilities (ICF), and homes nursing homes (NH)]. [Providers include hospitals (hosp), intermediate care facilities (ICF), and nursing (NH).] Table 4. Regulatory Climate Comparison [Providers include hospitals intermediate care facilities (ICF), and nursing homes (NH)]. Table 4. Regulatory Climate(hosp), Comparison Table 4.and Regulatory Climate Journal of American Physicians Surgeons Volume 19 Comparison Number 4 Winter 2014 Table 4. RegulatoryCON Climate Comparison Surgery Pilot Licensure Liability CME State CON Surgery Pilot Licensure Liability CME Office Dispensing Restrictions MOL Board State 119 GME GME [Providers include hospitals (hosp), intermediate care facilities (ICF), and nursing homes (NH)]. Table 4. Regulatory Climate Comparison Table 4. Regulatory Climate Comparison Liability20CMECME GME GME Licensure Liability CON Pilot Licensure Office Dispensing Surgery Arizona No LicenseDispensing ($200) Yes 4.12 20 Board Office Restrictions MOL Board Arizona No License ($200) Yes 4.12 20 Arkansas Special Permit None 2.95 20 1 Alabama Yes License ($100) Accreditation 2.69 5.18 25 Arizona No License ($200) Yes 4.12 20 Arkansas Yes Special Permit None 2.95 20 California No Severe 2.86 25 / 50 Alaska Yes Free Laser only 4.69 25 2 Arizona No License ($200) Yes 4.12 20 Arkansas Yes Special Permit None 2.95 California No Free Severe 2.86 25 / 5020 Policy 1 Arizona No License ($200) Yes 4.12 20 Arkansas Yes Special None 2.95 California No Free Permit Severe 2.86 25 / 5020 Policy Colorado No Free statement Attempt 4.08 0 1 Arkansas Yes Special Permit None 2.95 California No Free Severe 2.86 25 / 5020 Policy Colorado No Free statement Attempt 4.08 0 Connecticut Yes CS Lic ($10) Accreditation 1.82 20.98 25 1 California No Free Severe 2.86 25 25/ /5050 Policy Colorado No Free statement Attempt 4.08 0 Connecticut Yes CS Lic ($10) Accreditation 1.82 20.98 25 Delaware Yes Free None 5.32 20 Policy 1 Colorado No Free statement Attempt 4.08 0 Policy Stmt. Connecticut Yes CS Lic ($10) Accreditation 1.82 20.98 25 Delaware Yes Free None 5.32 20 District of Colorado No Free statement Attempt 4.08 0 2 Connecticut Yes CS Lic ($10) Accreditation 1.82 20.98 25 Delaware Yes Free None 5.32 20 District of Columbia Yes license None 1.47 19.31 25 Connecticut Yes CS Lic ($10) Accreditation 1.82 20.98 25 1 Delaware Yes Free None 5.32 20 District of Columbia Yes license None 1.47 19.31 25 Florida Yes License ($100) Severe 2.28 20 Delaware Yes Free None 5.32 20 District of D.C. Columbia Yes license ($100) None 1.47 19.31 25 1 Florida Yes License Severe 2.28 20 Georgia Yes Free Accreditation 2.65 20 District of Columbia Yes license None 1.47 19.31 25 Florida Yes License ($100) Severe 2.28 20 1 Georgia Yes Free Accreditation 2.65 20 Hawaii Yes Free None 3.53 20 Columbia license 1.47 19.31 25 Florida Yes License ($100) Severe 2.28 20 Georgia Yes Free Accreditation 2.65 20 1 Hawaii Yes Free None 3.53 20 Idaho No License ($60) None 2.43 20 Florida Yes ($100) Severe 2.28 Georgia Yes Free Accreditation 2.65 20 Hawaii Yes Free None 3.53 20 1 Idaho No License ($60) None 2.43 20 Illinois Yes Free Minor 3.45 15.64 50 Georgia Accreditation 2.65 20 Hawaii Yes Free None 3.53 20 Idaho No License ($60) None 2.43 20 1 Illinois Yes Free Minor 3.45 15.64 50 Indiana No license(20) Accreditation 3.25 4.18 0 Hawaii Yes Free None 3.53 20 Idaho No License ($60) None 2.43 20 Illinois Yes Free Minor 3.45 15.64 50 2 Indiana No license(20) Accreditation 3.25 4.18 0 Iowa Yes license(50) None Blocked 3.6 20 Idaho No License ($60) 2.43 Illinois Yes Free Minor 3.45 15.64 50 Indiana No license(20) Accreditation 3.25 4.18 0 1 Iowa Yes license(50) None Blocked 3.6 20 Kansas No Free Minor 2.93 50 Illinois Yes 3.45 15.64 Indiana No license(20) Accreditation 3.25 4.18 0 Iowa Yes license(50) None Blocked 3.6 20 1 Kansas No Free Minor 2.93 50 Kentucky Yes Free Severe 3.94 20 Indiana No license(20) Accreditation 3.25 4.18 0 Iowa Yes license(50) None Blocked 3.6 20 Kansas No Free Minor 2.93 50 1 Kentucky Yes Free Severe 3.94 20 Louisiana Yes license(75) Severe 5.58 20 Iowa license(50) None Blocked 3.6 Kansas No Free Minor 2.93 50 Kentucky Yes Free Severe 3.94 20 2 Louisiana Yes license(75) Severe 5.58 20 Maine Yes Free None 3.05 50 Kansas No Minor 2.93 Kentucky Yes Free Severe 3.94 20 Louisiana Yes license(75) Severe 5.58 20 1 Maine Yes Free None 3.05 50 Maryland Yes Special Permit None 2.91 19.27 25 Kentucky Free Severe 3.94 20 Louisiana Yes license(75) Severe 5.58 20 Maine Yes Free None 3.05 50 3 Maryland Yes Special Permit None 2.91 19.27 25 Policy Louisiana Yes license(75) Severe 5.58 20 Maine Yes Free None 3.05 50 Maryland Yes Special Permit None 2.91 19.27 25 1 Policy Massachusetts Yes Prohibited statement Attempt 1.66 22.37 50 Maine Yes Free None 3.05 50 Maryland Yes Special Permit None 2.91 19.27 25 Policy 2 Policy Stmt. Massachusetts Yes Prohibited statement Attempt 1.66 22.37 50 Michigan Yes License ($85) None Fighting 2.56 50 Maryland Yes Special Permit None 2.91 19.27 25 Policy Massachusetts Yes Prohibited statement Attempt 1.66 22.37 50 Michigan Yes License ($85) None Fighting 2.56 50 2 Minnesota No Free None 1.49 25 Policy Massachusetts Yes Prohibited statement Attempt 1.66 22.37 50 Michigan Yes License ($85) None Fighting 2.56 50 Minnesota No Free None 1.49 25 1 Mississippi Yes Free None Attempt 3.56 4.15 20 Massachusetts Prohibited statement 1.66 22.37 50 Michigan Yes License ($85) None Fighting 2.56 50 Minnesota No Free None 1.49 25 Mississippi Yes Free None Attempt 3.56 4.15 20 1 Missouri Yes license(90) None 2.76 25 Michigan License ($85) Fighting 2.56 50 Minnesota No Free None 1.49 25 Mississippi Yes Free None Attempt 3.56 4.15 20 Missouri Yes license(90) None 2.76 25 1 Montana Yes Prohibited None 2.63 0 Minnesota No Free 1.49 25 Mississippi Yes Free None Attempt 3.56 4.15 20 Missouri Yes license(90) None 2.76 25 Montana Yes Prohibited None 2.63 0 2 Nebraska Yes Free None 4.7 25 Mississippi Attempt 3.56 4.15 20 Missouri Yes license(90) None 2.76 25 Montana Yes Prohibited None 2.63 0 Nebraska Yes Free None 4.7 25 1 Nevada Yes license($350+WC) Accreditation 2.07 4.85 20 / 3525 Missouri license(90) None 2.76 Montana Yes Prohibited None 2.63 0 Nebraska Yes Free None 4.7 25 Nevada Yes license($350+WC) Accreditation 2.07 4.85 20 / 35 20 / 35 3 New Hampshire Yes Free None 2.65 16.99 50 Montana Prohibited 2.63 0 Nebraska Yes Free None 4.7 Nevada Yes license($350+WC) Accreditation 2.07 4.85 20 / 3525 New Hampshire Yes Free None 2.65 16.99 50 2 New Jersey Yes Restrictions Severe 2.26 23.24 Nebraska Free None 4.7 25 Nevada Yes license($350+WC) Accreditation 2.07 4.85 20 / 3550 New Hampshire Yes Free None 2.65 16.99 50 New Mexico Jersey Yes Restrictions Severe 2.26 23.24 50 3 New No Restrictions None 5.28 25 Nevada Yes license($350+WC) Accreditation 2.07 4.85 20 / 35 New Hampshire Yes Free None 2.65 16.99 50 New Jersey Yes Restrictions Severe 2.26 23.24 50 New York Mexico No Restrictions None 5.28 25 2 New Yes Prohibited Accreditation Fighting 2.98 38.83 0 Hampshire Free None 2.65 16.99 50 New Jersey Yes Restrictions Severe 2.26 23.24 50 New Mexico No Restrictions None 5.28 25 New Jersey York Yes Prohibited Accreditation Fighting Fighting 2.98 38.83 0 1 North Carolina Yes Restrictions Severe 3.56 4.51 50 New 2.26 23.24 New No Restrictions None 5.28 25 New Mexico York Yes Prohibited Accreditation Fighting Fighting 2.98 38.83 0 North Carolina Yes Restrictions Severe 3.56 4.51 50 1 North Dakota No Free None 3.75 2.96 20 New Mexico Restrictions 5.28 25 New Yes Prohibited Accreditation Fighting 2.98 38.83 0 NorthYork Carolina Yes Restrictions Severe Fighting 3.56 4.51 50 North Dakota No Free None 3.75 2.96 20 1 Ohio Yes Free Severe Blocked 5.52 50 New York Prohibited Accreditation Fighting 2.98 38.83 0 North Carolina Yes Restrictions Severe Fighting 3.56 4.51 50 North Dakota No Free None 3.75 2.96 20 Ohio Carolina Yes Free Severe Blocked 5.52 50 1 Policy North Yes Restrictions Severe Fighting 3.56 4.51 50 North Dakota No Free None 3.75 2.96 20 Ohio Yes Free Severe Blocked 5.52 50 Policy Oklahoma Yes Free statement Blocked 4.65 20 Policy Stmt. 1 20/ /16 16 North Dakota No Free None 3.75 2.96 20 Ohio Yes Free Severe Blocked 5.52 Policy Oklahoma Yes Free approval statement Blocked 4.65 20 / 1650 Oregon Yes OMB Accreditation Attempt 3.36 30 1 Ohio Yes Free Severe Blocked 5.52 Policy Oklahoma Yes Free statement 4.65 20 / 1650 Oregon Yes OMB approval Accreditation Blocked Attempt 3.36 30 Pennsylvania No Free None 2.82 24.76 50 2 Policy Oklahoma Yes Free statement Blocked 4.65 20 / 1630 Oregon Yes OMB Accreditation Attempt 3.36 Pennsylvania No Free approval None 2.82 24.76 50 Rhode Island None 2.02 17.4 20 2 Oklahoma Yes Free statement Blocked 4.65 20 / 16 Oregon Yes OMB approval Accreditation Attempt 3.36 30 Pennsylvania No Free None 2.82 24.76 50 Rhode Island Yes Free None 2.02 17.4 20 South Carolina License ($100) Severe 1.33 20 1 Oregon Yes OMB approval Accreditation Attempt 3.36 30 Pennsylvania No Free None 2.82 24.76 50 Tennessee Severe 2.72 Rhode Island Yes Free None 2.02 17.4 20 South Carolina Yes License ($100) Severe 1.33 20 South Dakota license 2.71 4.88 0 3 Pennsylvania No Free None 2.82 24.76 50 Tennessee Yes Free Severe 2.72 20 Rhode Island None 2.02 17.4 Texas Carolina No Prohibited Fighting 2.79 3.02 24 South Yes License ($100) Severe 1.33 20 South Dakota No license None 2.71 4.88 0 Tennessee Severe 2.72 1 Rhode Island Yes Free None 2.02 17.4 20 Texas No Prohibited Severe Fighting 2.79 3.02 24 South Yes License ($100) 1.33 20 Utah Carolina Prohibited 2.44 South Dakota No license None 2.71 4.88 0 Texas No Prohibited Fighting 2.79 3.02 24 South Carolina Yes License ($100) Severe 1.33 20 1 Utah Dakota Prohibited 2.44 South No license None 2.71 4.88 Bd Cr 20 /0 Utah Prohibited 2.44 South Dakota No license None 2.71 4.88 2 Bd Cr 20 /0 Vermont Yes Free 2.78 4.36 15 Bd Cr//15 Vermont Yes Free None 2.78 4.36 Bd 15Cr Bd of Pharmacy 1 Vermont Yes Free None 2.78 4.36 15 15 of Pharmacy Bd Pharm license Virginia Yes license Yes Attempt 3.11 1 Bd of Pharmacy Virginia Yes license Yes Attempt 3.11 15 Washington Yes Free Accreditation 4.45 50 2 Virginia Yes license Yes 3.11 15 Washington Yes Free ($35) Accreditation Attempt 4.45 50 West Virginia Yes License None 4.32 25 25/ /1616 1 Washington Yes Free Accreditation 4.45 50 West Virginia Yes License ($35) None 4.32 Wisconsin Yes Free None Attempt 1.9 3.07 25 / 1615 1 West Virginia Yes License None 4.32 Wisconsin Yes Free ($35) None Attempt 1.9 3.07 25 / 1620 15 Wyoming No Free None 6.79 2 Wisconsin Yes Free None Attempt 1.9 3.07 15 Wyoming No Free None 6.79 20 Wyoming No Free None 6.79 20 [WC: additional workers’ compensation requirements / restrictions apply to those seeking a [Policy Stmt: policy statement. An agency issues recommended measures, but there is no dispositive statutory language. [WC: additional workers’ compensation requirements / restrictions apply to those seeking a license to dispense medications in the office. WC: additional workers’ compensation requirements / restrictions apply to those a license to dispense [WC: additional workers’ compensation requirements / restrictions applyseeking to those seeking a license to dispense medications in the office. medications in the office.] license to dispense medications in the office. State 120 Conclusions Journal of American Physicians and Surgeons Volume 19 Number 4 Conclusions Conclusions The climate in many states makes it difficult to practice independently or to maintain a Winter 2014 Conclusions The climate in many states makes it difficult to practice independently or to maintain a financially viable practice at an affordable cost to patients. Physicians should research the taxes and regulations in a state before investing in a practice there. Philip Eskew, D.O., J.D., M.B.A., is a third-year resident in family medicine at Heart of Lancaster Regional Medical Center. He is also a member of the Kentucky Bar Association. Contact: philsq@gmail.com. REFERENCES 1. Tax Foundation. State Individual Income Tax Rates, Apr 1, 2013. Available at: http://taxfoundation.org/article/state-individual-income-tax-rates. Accessed Sept 29, 2014. 2. Tax Foundation. State Corporate Income Tax Rates, Mar 22, 2013. Available at: http://taxfoundation.org/article/state-corporate-income-tax-rates. Accessed Sept 29, 2014. 3. Tax Foundation. State and Local Sales Tax Rates, Mar 18, 2014. Available at: http://taxfoundation.org/article/state-and-local-sales-tax-rates-2014. Accessed Sept 29, 2014. 4. National Conference of State Legislatures. Health Provider and Industry State Taxes and Fees, Jul 10, 2014. Available at: www.ncsl.org/research/ health/health-provider-and-industry-state-taxes-and-fees.aspx. Accessed Sept 29, 2014. 5. National Conference of State Legislatures. Certificate of Need State Health Laws and Programs, January 2011. Available at: www.ncsl.org/research/ health/con-certificate-of-need-state-laws.aspx. Accessed Sept 29, 2014. 6. National Association of Boards of Pharmacy. Survey of Pharmacy Law Dispensing Authority; 2012. 7. Hindmand R. Physician in-office prescription drug dispensing. American Health Lawyers Association Physician Organizations Newsletter 2013;16(2). Available at: www.healthlawyers.org/Members/PracticeGroups/PO/ Documents/Newsletters/Physicians_Dec13.pdf. Accessed Sept 29, 2014. 8. Jasos Group. Boards of Pharmacy Regulating Physician Dispensing; 2014. Available at: www.pharmacy.texas.gov/files_pdf/Phcy_Brd_Disp_Prac_ Reg_5_15_14.pdf. Accessed Oct 28, 2014. 9. Progressive Medical. Physician dispensing across the country. Signature Series, August 2013. Available at: http://theworkcompresource.com/wpcontent/uploads/2013/08/Physician-Dispensing-Map_FINAL.pdf. Accessed Oct 28, 2014. 10. Office of Inspector General, Department of Health and Human Services. Physician Drug Dispensing: an Overview of State Regulation, May 1989. Available at: https://oig.hhs.gov/oei/reports/oai-01-88-00590.pdf. Accessed Oct 28, 2014. 11. Federation of State Medical Boards. Regulation of Office-Based Surgery, 2014. Available at: www.fsmb.org/state-medical-boards/advocacy-policy/ key-issues. Accessed Oct 29, 2014. 12. Accreditation Association for Ambulatory Health Care. Ambulatory Health Care Association Current Laws and Regulations, Mar 22, 2011. Available at: https://www.aaahc.org/Global/pdfs/Updated_State_Regulations_3.23.11. pdf. Accessed Oct 29, 2014. 13. Kempen P. Maintenance of certification, maintenance of licensure, and continuing medical education: the regulatory capture of medicine. J Am Phys Surg 2012;17:72-75. 14. Christman K. Maintenance of licensure and continuing medical education: how the regulators prosper. J Am Phys Surg 2012;17:76-79. 15. Change Board Recertification. Maintenance of Licensure. Available at: http://www.changeboardrecert.com/mol.html. Accessed Oct 29, 2014. 16. American Legislative Exchange Council. Patient Access Expansion Act, Jul 1, 2014. Available at: www.alec.org/model-legislation/patient-accessexpansion-act/. Accessed Oct 29, 2014. 17. Wolfe S, Williams C, Zaslow A. Public Citizen’s Health Research Group Ranking of the Rate of State Medical Boards’ Serious Disciplinary Actions 2009-2011, May 17, 2012. Available at: www.citizen.org/documents/2034. pdf. Accessed Oct 20, 2014. 18. Robeznieks A. Where’s doc disciplinary data? Modern Healthcare, Jul 26, 2013. Available at: www.modernhealthcare.com/article/20130726/ MAGAZINE/307279958. Accessed Oct 30, 2014. 19. Huntoon L. Former Texas Medical Board member’s lawsuit dismissed. J Am Phys Surg 2012;17:3-5. 20. Diederich Healthcare. 2014 Medical Malpractice Payout Analysis, Feb 19, 2014. Available at: www.diederichhealthcare.com/the-standard/2014medical-malpractice-payout-analysis/. Accessed Oct 31, 2014. 21. Salvi P. Why medical malpractice caps are wrong. Northern Illinois University Journal of American Physicians and Surgeons Volume 19 Number 4 Winter 2014 Law Review 2006;26:553-562. Available at: http://niu.edu/law/organizations/ law_review/pdfs/full_issues/26_3/Salvi.pdf. Accessed Oct 30, 2014). 22. Menaker P. Caps on non-economic damages held unconstitutional. American Bar Association Litigation News, Jun 2, 2014. Available at: http:// apps.americanbar.org/litigation/litigationnews/top_stories/060214-noneconomic-damage-caps.html. Accessed Oct 30, 2014. 23. Federation of State Medical Boards. Continuing Medical Education BoardBy-Board Overview, March 2014. Available at: https://www.fsmb.org/ Media/Default/PDF/FSMB/Advocacy/GRPOL_CME_Overview_by_State. pdf. Accessed Sept 29, 2014. 24. American Medical Association. State Medical Licensure Requirements and Statistics, Continuing Medical Education for Licensure Reregistration, 2013. Available at: www.acep.org/uploadedFiles/ACEP/CME/CME-State-CMERequirements_2013.pdf. Accessed Sept 29, 2014. 25. Medscape. State CME Requirements, November 2013. Available at: www. medscape.org/public/staterequirements. Accessed Sept 29, 2014. 26. Vermont Medical Society. New Requirement for License Renewal, 2013. Available at: www.vtmd.org/new-requirement-license-renewal. Accessed Sept 29, 2014. 27. Health Care Incentives Improvement Institute. Report Card on State Price Transparency Laws, Mar 25, 2014. Available at: www.hci3.org/sites/default/ files/files/Report_PriceTransLaws_2014.pdf. Accessed Oct 28, 2014. 28. National Conference of State Legislatures. Transparency and Disclosure of Health Costs and Provider Payments State Actions, June 2014. Available at: www.ncsl.org/research/health/transparency-and-disclosure-health-costs. aspx. Accessed Oct 28, 2014. 29. Smith K. How can there be a low price but high quality? J Am Phys Surg 2014;19:17. 30. Kaiser Family Foundation. Status of State Action on the Medicaid Expansion Decision, Aug 28, 2014. Available at: http://kff.org/health-reform/ state-indicator/state-activity-around-expanding-medicaid-under-theaffordable-care-act/. Accessed Sept 29, 2014. 31. Lowrey A. How much would the Medicaid expansion cost your state? New York Times, Jul 2, 2012. Available at: http://economix.blogs.nytimes. com/2012/07/02/how-much-would-the-medicaid-expansion-cost-yourstate/?_r=0. Accessed Nov 12, 2014. 32. American Medical Association Advocacy Resource Center. White Paper: Provider Taxes, 2010. Available at: http://www.ama-assn.org/resources/ doc/clrpd/provider-taxes.pdf. Last accessed March 30, 2014. 33. State of Hawaii Department of Taxation. General Excise Tax. Available at: http://tax.hawaii.gov/geninfo/get. Accessed Nov 12, 2014. 34. Piturro M. What if they gave universal coverage and no doctors came. ENT Today, Feb 1, 2008. Available at: www.enttoday.org/article/what-if-theygave-universal-coverage-and-no-doctors-came/. Accessed Oct 30, 2014. 35. Massachusetts Board of Registration in Medicine. 243 CMR 2.00, Draft Regulations. Available at: www.mass.gov/eohhs/docs/borim/draftregulations-20140821.pdf. Accessed Oct 7, 2014. 36. Missouri Board of Registration for the Healing Arts. Assistant Physician Licensure, 2014. Available at: www.pr.mo.gov/healingarts.asp. Accessed Oct 30, 2014. 37. Crane M. Missouri law creates new assistant physician designation. Medscape, Jul 15, 2014. Available at: www.medscape.com/viewarticle/828255. Accessed Oct 30, 2014. 38. New Hampshire Department of Revenue Administration. Frequently Asked Questions. Available at: www.revenue.nh.gov/faq/gti-rev.htm#mealsrental. Accessed Mar 30, 2014. 39.Taxation and Revenue New Mexico. Gross Receipts Overview. Available at: www.tax.newmexico.gov/Businesses/gross-receipts.aspx. Accessed Mar 30, 2014. 40. Johnson A. State Medical Board Ousts Chief. Columbus Dispatch, Oct 18, 2012, Available at: www.dispatch.com/content/stories/local/2012/10/18/ state-medical-board-ousts-chief.html. Accessed Oct 30, 2014. 41. Ohio Department of Taxation. Commercial Activity Tax. Available at: www.tax.ohio.gov/Portals/0/communications/publications/annual_ reports/2012_annual_report/2012_AR_Section_2_Commercial_Activity_ Tax.pdf. Accessed Mar 30, 2014. 42. W.Va. Code Sec. 11-27-36. 43. W. Va. Code § 16-2J-1 (2013). 44. Texas Occupations Code Title 3 Professions, Subtitle B Physicians, Ch 158. Authority of Physician to Prescribe Certain Drugs and Supplies. Available at: www.statutes.legis.state.tx.us/Docs/OC/htm/OC.158.htm. Accessed on Oct 31, 2014. 45. Johnston D, Emmons R. Vermont’s great experiment in ‘single payer’ healthcare. J Am Phys Surg 2013;8:105-107. 46. ORS § 735.500, 735.510 (2011). Available at: www.oregonlaws.org/ ors/735.500. Accessed Jul 6, 2014. 47. Department of Revenue Washington State. Business & Occupation Tax Classifications. Available at: http://dor.wa.gov/Content/FindTaxesAndRates/ BAndOTax/BandOrates.aspx. Accessed Mar 30, 2014. 121