International Journal of Management Cases

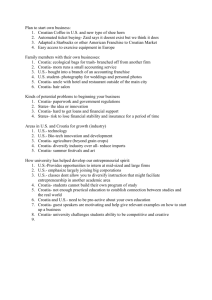

advertisement