For the fiscal year ended August 31,2013 Tyler, Texas

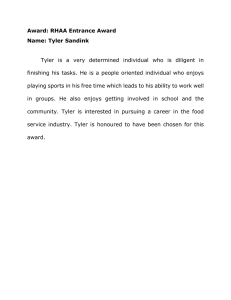

advertisement