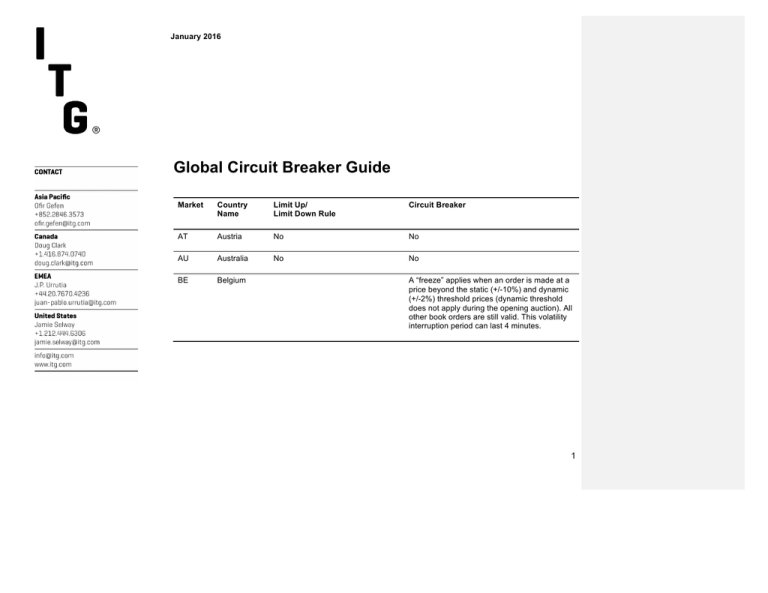

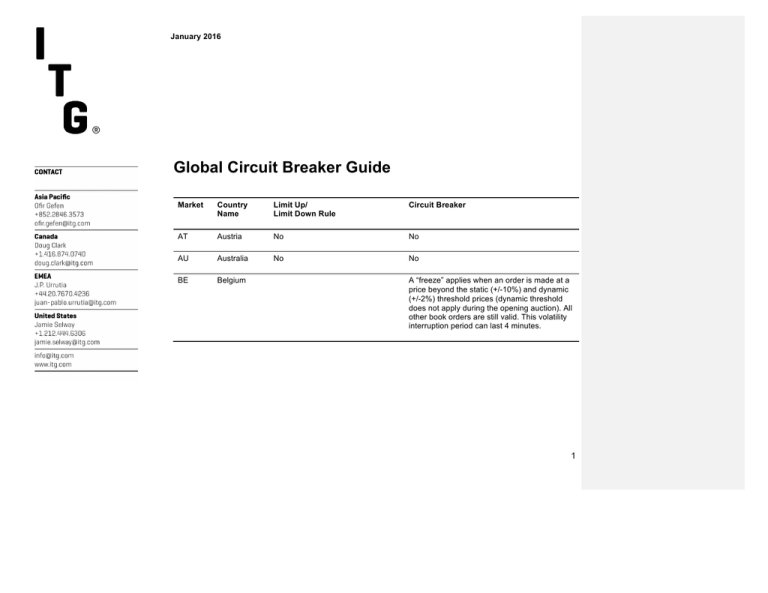

January 2016

Global Circuit Breaker Guide

Market

Country

Name

Limit Up/

Limit Down Rule

Circuit Breaker

AT

Austria

No

No

AU

Australia

No

No

BE

Belgium

A “freeze” applies when an order is made at a

price beyond the static (+/-10%) and dynamic

(+/-2%) threshold prices (dynamic threshold

does not apply during the opening auction). All

other book orders are still valid. This volatility

interruption period can last 4 minutes.

1

January 2016

Market

Country

Name

Limit Up/

Limit Down Rule

Circuit Breaker

BR

Brazil

No

RULE 1: If Ibovespa falls 10% in relation to the

closing index of the previous day, trading on all

the Exchange markets will be interrupted for

30 minutes.

RULE 2: As trading is resumed, if Ibovespa

falls 15% in relation to the previous day's

closing index, trading on all the Exchange

markets will be interrupted for one hour.

RULE 3: As trading is resumed, if Ibovespa

falls 20% in relation to the previous day’s

closing index, the Exchange may determine

the suspension of trading in all markets for a

defined period and such decision must be

disclosed to the market through News Agency

(ABO – Operations).

Note:

• RULES 1, 2 and 3 will not be applicable

during the last half hour of the trading

session;

• If any trading is interrupted during the

second to last half hour of a session, at the

time trading is resumed, the schedule will

be extended for at most a further 30

minutes, without any further interruption, in

order to ensure a final trading period of 30

consecutive minutes.

2

January 2016

Market

Country

Name

Limit Up/

Limit Down Rule

Circuit Breaker

CA

Canada

No

Canada follows the U.S. on market wide

breakers: if the U.S. halts, so does Canada. In

the event the U.S. market is closed for a

holiday, there are currently no market wide

breakers in Canada. On a stock specific basis:

Canadian SSCB system applies to all stocks in

the S&P/TSX Composite Index, certain ETFs

that are comprised of exchange traded

securities and any other securities that meet

the IIROC threshold of being “actively traded.”

In total this accounts for roughly 470 securities.

The circuit breaker regime only operates from

market open until 3:30 p.m. In order to trigger

an SSCB halt, a stock must endure a price

increase or decrease of at least the greater of

10% or 20 trading increments in a 5 minute

period. This threshold is doubled during the

first 20 minutes of trading, and also during the

first 30 minutes after a halted stock resumes

trading. When triggered all markets are

informed electronically to halt trading for 5

minutes. This process currently takes about 2

seconds, during which further trading can

occur. During the 5 minute halt IIROC staff

review the trading leading up to the halt, and

have the option to extend the halt a further 5

minutes to create a more orderly market.

3

January 2016

Market

Country

Name

Limit Up/

Limit Down Rule

Circuit Breaker

CH

Switzerland

No

A volatility auction is triggered if either a static

or dynamic price range is exceeded. The

volatility auction ends with price determination

– if price is > 2% extent of reference price (last

closing price), volatility auction can be

extended.

CL

Chile

No

Not automated. Decision to halt sits with Stock

Exchange board member. Liquid names have

discretional halt at +/- 10% Illiquid stocks are

halted after +/- 25% variation.

CN

China

Limit up/down to 10% move on the

individual stocks/5% for special

treatment (ST and S* shares).

Based on the CSI 300 move, applies to cash

equities, index futures and options: Move of +/5% trading suspended for 15 minutes. Move of

+/- 5% after 2:45 pm, trading halted for the

day. Move of +/- 7%, trading halted for the day.

CO

Colombia

No

Based on liquidity of security, automated circuit

breakers at +/- 6.5%, 7.5% or 10% variation.

4

January 2016

Market

Country

Name

Limit Up/

Limit Down Rule

Circuit Breaker

DE

Germany

No

A Volatility Interruption Auction is instigated if

price ranges (static or dynamic) are exceeded

(3-10% static reference prices or 1-5% for

dynamic reference prices). Price ranges are

adjusted after auction price determination.

Volatility Interruption Auctions last approx. 5

minutes, with a random end. If a Volatility

Interruption Auction occurs during an auction

period, the auction period is extended by 2

minutes.

DK

Denmark

No

No

EE

Estonia

No

Circuit Breakers – 10% dynamic & 15% static.

ES

Spain

No

If execution reaches/breaches static or

dynamic price limits, the stock will be

suspended from automatic trading and an

auction will be initiated. Volatility auctions last

5 minutes. This auction may close at any

moment without prior warning. Unlike

opening/closing auctions, volatility auctions are

never extended.

FI

Finland

No

No

5

January 2016

Market

Country

Name

FR

France

GB

Great Britain

Limit Up/

Limit Down Rule

Circuit Breaker

A “freeze” applies when an order is made at a

price beyond the static (+/-10%) and dynamic

(+/-2%) threshold prices (dynamic threshold

does not apply during the opening auction). All

other book orders are still valid. This volatility

interruption period can last 4 minutes.

Automatic Execution Suspension

Period (5 minutes +30sec end)

occurs during continuous trading

when order >5% of last order book

trade.

Automatic Execution Suspension Period (5

minutes +30sec end) occurs during continuous

trading when order entered for price which

deviates from last order book trade by:

• 25%: for stocks priced below specific share

price.

• A maximum spread band-dependent, for

stocks priced below a specified share price

- Band 1: 10%, Band 2: 5%.

N.B. A trading halt occurs if Exchange believes

disorderly market has developed for a stock. If

an execution reaches/breaches either static or

dynamic price limit then security will suspend

from automatic trading without the trade

occurring.

GR

Greece

No

Stock Suspension occurs if price increases or

decreases by 10% since the closing price from

the day before.

6

January 2016

Market

Country

Name

Limit Up/

Limit Down Rule

Circuit Breaker

HK

Hong Kong

No

No

ID

Indonesia

Limit down 10% / Limit up 20 - 35%

based on stock price.

No

IE

Ireland

No

No

IL

Israel

No

No

IN

India

Four tiers: 2%, 5%, 10%, and 20%.

A 3-stage system based on size of move

(either way) of the BSE Sensex or the Nifty 50

indices (whichever breaches earlier). The

moves are 10%, 15% and 20% (halt) the

market wide suspension duration (or a halt for

the rest of the day) and will depend on the time

of day. A 20% move any time of the day will

trigger a halt for the rest of the day.

IT

Italy

No

No

JP

Japan

Based on price bands. With rules

to double daily price limit under

certain circumstances.

No

KR

Korea

30% from “Base Price”

3 Phases of CBs on 8% / 15% / 20% drop on

KOSPI.

7

January 2016

Market

Country

Name

Limit Up/

Limit Down Rule

Circuit Breaker

LT

Lithuania

No

Circuit Breakers – 10% dynamic & 15% static.

LV

Latvia

No

Circuit Breakers – 10% dynamic & 15% static.

MX

Mexico

No

Dynamic Fluctuation:

• 5% above/below the last max/min price of

the last 5 minutes results in security halt,

than auction for 2 minutes Static

Fluctuation.

• 15% from opening price or day before

results in security halt until BMV receives

news or pertinent information from the price

fluctuation.

MY

Malaysia

30% in general - exception limit up

400% for first day of trading.

3 Phases of Circuit Breaker – KLCI declines

10%, 15%, and 20%.

NL

Netherlands

No

No

NO

Norway

No

Trading can be halted in the event an “error”

resulting in price movement.

NZ

New Zealand

No

No

8

January 2016

Market

Country

Name

Limit Up/

Limit Down Rule

Circuit Breaker

PE

Peru

No

Circuit breaker is activated when the General

Index (IGBVL) falls more than 7% on the day.

Exchange determines length of suspension.

Stocks have a halt at +/-15% variation. No

fluctuation limit for listed foreign securities.

PH

Philippines

Limit up 50% / Limit Down 40%.

Based on the PSEi a negative 10% move

triggers a 15 minutes suspension.

PT

Portugal

No

A “freeze” applies when an order is made at a

price beyond the static (+/-10%) and dynamic

(+/-2%) threshold prices (dynamic threshold

does not apply during the opening auction). All

other book orders are still valid. This volatility

interruption period can last 4 minutes.

RU

Russia

No

Price Deviation limits – on the main market the

maximum price deviation from previous closing

price is -/+30%, for other Listing Level the max.

price deviation from previous closing price is /+40%.

SE

Sweden

No

No

SG

Singapore

Listed companies may appeal SGX

to halt trading for a specified

duration.

SGX intervenes when deemed necessary.

9

January 2016

Market

Country

Name

Limit Up/

Limit Down Rule

Circuit Breaker

TH

Thailand

Local board: +/-30. Foreign board

+/-60% relative to previous Close of

the local.

First stage: If the SET index falls by 10% from

the previous day's close, all trading in listed

securities will be halted for 30 minutes.

Second stage: If the SET index falls by 20%

from the previous day's close (i.e., another

10%), trading in all listed securities will be

halted for one hour.

TR

Turkey

No

Borsa İstanbul Regulation Article 25 paragraph

(b) envisages that trading of an equity may be

suspended in the event that orders of an

abnormal price or quantity are sent to Borsa

İstanbul Equity Market trading system, or that

the occurrence of some other elements inhibit

the formation of a healthy market. By the same

token, according to the provisions of Borsa

İstanbul Settlement and Custody Centers

Regulation, Borsa İstanbul is authorized to

change the settlement method of securities.

TW

Taiwan

10% from Open auction reference

price.

No

10

January 2016

Market

Country

Name

Limit Up/

Limit Down Rule

Circuit Breaker

US

U.S.

During market hours an upper and

lower band is calculated for all stocks.

The low end of the band for Tier One

stocks, trading above $3.00, is the

mean of the last 5 minutes of trading

minus 5%, and the high end is the 5

minute mean plus 5%. For stocks in

Tier Two the band is 10% either side of

the mean. (Stocks under $3.00 have

larger percentage bands.) Rather than

have no protections around the open

and close, the U.S. markets double the

band from 9:30 a.m. to 9:45 a.m., and

again from 3:35 p.m. to 4:00 p.m. If the

offer on a security is equal to the lower

end of the permissible trading band, the

stock goes into a “limit state” for 15

seconds. During that time the market

may trade higher, but cannot trade

below the band. If after 15 seconds the

limit state persists, the security is

paused for 5 minutes, to allow the

market to assess any news, and

hopefully aid the efficient discovery of a

new equilibrium price. At the end of the

five minutes the security is re-opened

via an auction on the primary listings

exchange. The same process is used

when the bid on a security is equal to

the higher end of the permissible

trading band.

At the start of each quarter, the NYSE sets three

circuit breaker levels at levels of 7% (Level 1), 13%

(Level 2), and 20% (Level 3) of the average closing

price of the S&P 500 for the month preceding the

start of the quarter, rounded to the nearest 50-point

interval. Depending on the point drop that happens

and the time of day when it happens, different

actions occur automatically: Level 1 and Level 2

declines result in a 15-minute trading halt unless

they occur after 3:25pm, when no trading halts

apply. A Level 3 decline results in trading being

suspended for the remainder of the day.

11

January 2016

Market

Country

Name

Limit Up/

Limit Down Rule

Circuit Breaker

ZA

South Africa

No

Circuit Breakers 5% in continuous trading,

10% in opening and closing auctions in leader

stocks and SA/UK dual listed shares; and 10%

in continuous trading, 20% in opening and

closing auctions in medium liquid non-leader

stocks.

© 2016 Investment Technology Group, Inc. All rights reserved. Not to be reproduced or retransmitted without permission. 10716-10359.

These materials are for informational purposes only, and are not intended to be used for trading or investment purposes or as an offer to sell or the solicitation of an offer to buy any security or

financial product. The information contained herein has been taken from trade and statistical services and other sources we deem reliable but we do not represent that such information is

accurate or complete and it should not be relied upon as such. No guarantee or warranty is made as to the reasonableness of the assumptions or the accuracy of the models or market data

used by ITG or the actual results that may be achieved. All trademarks, service marks, and trade names not owned by ITG are the property of their respective owners. The screen shots

provided herein contain sample data and represent hypothetical examples of certain products available from ITG. All functionality described herein is subject to change without notice.

Broker-dealer products and services are offered by: in the U.S., ITG Inc., member FINRA, SIPC; in Canada, ITG Canada Corp., member Canadian Investor Protection Fund (“CIPF”) and

Investment Industry Regulatory Organization of Canada (“IIROC”); in Europe, Investment Technology Group Limited, registered in Ireland No. 283940 (“ITGL”) and/or Investment Technology

Group Europe Limited, registered in Ireland No. 283939 (“ITGEL”) (the registered office of ITGL and ITGEL is Block A, Georges Quay, Dublin 2, Ireland). ITGL and ITGEL are authorized and

regulated by the Central Bank of Ireland; in Asia, ITG Hong Kong Limited (SFC License No. AHD810), ITG Singapore Pte Limited (CMS License No. 100138-1), and ITG Australia Limited (AFS

License No. 219582). All of the above entities are subsidiaries of Investment Technology Group, Inc. MATCH NowSM is a product offering of TriAct Canada Marketplace LP (“TriAct”), member

CIPF and IIROC. TriAct is a wholly owned subsidiary of ITG Canada Corp.

Standard & Poor's and S&P 500 are trademarks of the McGraw-Hill Companies, Inc.

12

Farley, James 2016-1-7 2:18 PM

Formatted: Not Highlight