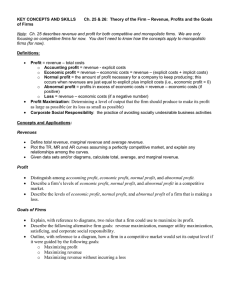

Selection or Influence? Institutional Investors and

advertisement