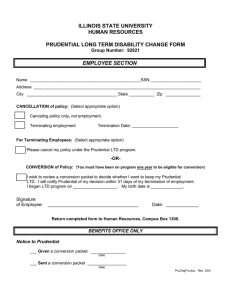

THE PRUDENTIAL ASSURANCE COMPANY LIMITED Year ended

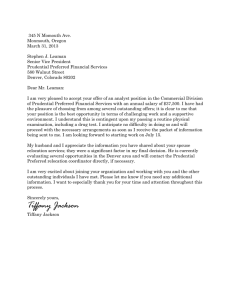

advertisement