Bloomberg Airlines Index

advertisement

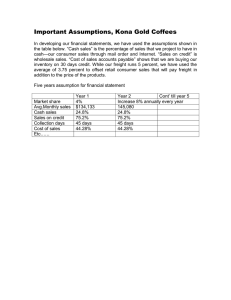

AIRLINES FINANCIAL MONITOR KEY POINTS December-January 2013 Airline share prices continue to outperform as financial markets upgrade their outlook on airline profits; Early Q4 profit results show a pause in the recent improvement, with US results below year ago levels, but the majority of indicators moved in a positive direction in Q4; In the new year, jet fuel prices rose back above $130/bbl, after OPEC cut crude oil production in December; Passenger and freight markets finished 2012 strongly, supported by a further increase in business confidence; Airlines kept capacity growth below the increase in demand, despite an acceleration in the growth of the inservice fleet; As a result, freight load factors improved in December and passenger loads moved up to record levels; Passenger yields have leveled out but remain up on last year after adjusting for exchange rate effects. Financial indicators Airline share prices outperform as market optimism on airline profits increases Bloomberg Airlines Index Source: Bloomberg 180 US $ based index equal to 100 in 2007 160 Asian Airlines 140 120 100 80 60 World Airlines US Airlines 40 European Airlines 20 0 Financial markets continue to improve their outlook for the airline industry, with the Bloomberg Airlines Index up 7% in January compared to December, outperforming the 5% rise in the FTSE Global All Cap Index. Improved efficiency measures and restructuring efforts helped airlines achieve better than expected financial performance in the second half of 2012. As a result, markets continue to upgrade their valuation of airline shares, particularly in Europe and North America, where prices rose 10% in January compared to December. Initial Q4 profits data show a pause in the improvement of airline profits In US $ Million # Airlines 9 4 2 0 0 15 Region North America Asia-Pacific Europe Latin America Others Sample total Q4 2011 Q4 2012 Operating Net post-tax Operating Net post-tax profit profit profit profit 1453 367 845 -181 549 134 468 198 25 2 32 19 0 0 0 0 0 0 0 0 2027 503 1345 36 Identify profitable new markets using IATA’s business intelligence tools. Try it today free! Airlines: www.iata.org/paxis Airports: www.iata.org/airportis www.iata.org/forecast Initial Q4 2012 financial results show positive airline industry profits, but a decline on the year ago period. The sample of 15 airlines shows the improvement in the US stalling across most airlines in the region, and little further improvement in Asia-Pacific. Despite these results most indicators of profitability, described below, were moving in a positive direction in Q4. Airlines financial monitor –December-January 2013 Fuel costs Jet fuel prices rise back above $130/bbl in January Upward pressure on jet fuel prices eased at the end of 2012 but has once again started to rise. Compared to the recent low in November, jet fuel prices have risen 5% in January, edging toward the higher-end of the price range seen over the past 2 years. Jet Fuel and Crude Oil Price ($/barrel) (Source: Platts, RBS) 200 180 Jet fuel price 160 140 120 100 Increasing oil supplies from non-OPEC nations helped stabilize prices at the end of 2012. But this has been countered by Saudi Arabia’s cut in crude oil production in December, leading to rising oil prices in January. 80 60 Crude oil price (Brent) 40 20 Demand Air freight markets rebound as passenger volumes continue to increase steadily Total air travel and air freight volumes Seasonally adjusted 17 Source: IATA 450 16 410 RPKs 15 390 370 14 FTKs 350 13 330 FTKs per month, billion RPKs per month, billion 430 310 Air freight markets contracted 1.5% overall in 2012, but a more supportive business environment and stronger US consumer confidence at the end of 2012 has helped volumes recover to mid2011 levels. 12 290 270 11 2007 2008 2009 2010 2011 Global air travel markets started to improve at the end of 2012, helped by business confidence continuing to increase throughout Q4. Although downward pressure on demand from the Eurozone crisis saw a slowdown in the high growth rates seen at the start of 2012, air travel expanded by 5.3%, only slightly down on 2011 growth of 5.9%. 2012 Capacity Passenger and freight capacity growth kept slower than expansion in demand Total passenger and freight capacity Seasonally adjusted Source: IATA 37 560 36 ASKs ASKs per month, billion 38 540 35 520 34 33 500 AFTKs 32 480 31 460 30 440 29 2007 2008 2009 2010 2011 IATA Economics: www.iata.org/economics 2012 AFTKs per month, billion 580 Passenger capacity increased again in December. But airlines are still keeping the expansion at a slightly slower rate than the increase in demand. And this is being done despite the number of new aircraft deliveries remaining strong. Air freight capacity contracted slightly in December compared to November, despite airlines seeing further growth in air freight volumes over the month. This continues the declining trend in air freight capacity started in mid-2012. 2 Airlines financial monitor –December-January 2013 Growth in seats spikes as aircraft come out of storage Airline fleet development Source: Ascend Other factors Storage activity % change in seats m-o-m 1.1% 150 0.8% 100 0.5% 50 0.2% 0 -0.1% -50 -0.4% -100 -150 -0.7% -200 -1.0% % change in airline seats Change in operating fleet (a/c per month) Deliveries 200 Growth in seats increased significantly in December with 142 new aircraft being delivered and a net 22 aircraft coming out of storage. This has brought the rate of new seats added to the fleet to a 10% annualized growth rate, a significant increase on previous months when the same measure was in the range of 24%. Growth in new seats added to the fleet is now above the highs seen in mid2012, and also above the current expansion in ASKs. A continuation in the trend could see asset utilization rates come under downward pressure. Air freight load factors rebound as passenger loads reach record-high levels Total load factors on passenger and freight markets Seasonally adjusted Source: IATA 82% 52% 50% Freight load factor 80% 48% 78% 46% Passenger load factor 76% 44% 74% 42% 72% 40% 70% 2007 Freight load factor, % AFTKs Passenger load factor, % ASKs 84% 38% 2008 2009 2010 2011 2012 Airline capacity management continues to provide support to passenger load factors, which increased again in December over the prior month. In fact, throughout 2012, load factors have been kept near record-high levels. In December, air freight load factors rose further as demand increased and capacity contracted. In line with the rebound in air freight volumes, load factors have also risen back to mid-2011 levels. Improve profitability through fuel efficiency consulting www.iata.org/fuelconsulting Yields Passenger yields have stabilized but remain up on a year ago in local currency terms Average return fare worldwide and US airlines yields (seasonally adjusted) 550 US airlines yield (left scale) Yield (cents/RPM) 16 525 15 500 14 475 13 450 12 11 2007 Average return fare worldwide (right scale) 425 400 2008 2009 2010 2011 IATA Economics: www.iata.org/economics Fare (US$/passenger) 17 Passenger yields appear to have stabilized. In the US yields have been trending sideways since the second quarter of 2012, after experiencing an increase for more than 2 years. Globally, average passenger fares have diverged from US yields since early 2011, but this has been a result of the translation effect of the strengthening US dollar. In local currency terms, global passenger yields have been increasing and are above year ago levels. 2012 3 Airlines financial monitor –December-January 2013 Data tables Year on Year Comparison Dec 2012 vs. Dec 2011 2012 vs. 2011 RPK ASK PLF FTK AFTK FLF RPK ASK PLF FTK AFTK FLF Africa 6.3% 3.7% 69.0% 10.9% 5.5% 25.4% 7.2% 6.5% 67.7% 7.1% 9.2% 24.7% Asia/Pacific 6.3% 4.6% 76.6% -3.8% -2.9% 58.4% 6.0% 5.2% 77.5% -5.5% -2.4% 56.1% Europe 1.6% -0.2% 77.4% -1.8% -7.7% 52.6% 5.1% 2.9% 79.6% -2.9% 0.3% 47.2% Latin America 7.7% 4.4% 76.2% 3.0% 4.4% 38.6% 9.5% 7.5% 76.1% -1.2% 4.9% 38.3% Middle East 12.6% 11.8% 77.3% 15.7% 10.7% 45.8% 15.2% 12.4% 77.5% 14.7% 11.4% 44.8% North America 1.0% 0.2% 81.5% -0.7% -2.8% 35.6% 1.1% 0.1% 82.9% -0.5% -2.0% 35.0% Total Market 4.2% 2.7% 77.9% -0.3% -1.9% 47.0% 5.3% 3.9% 79.1% -1.5% 0.2% 45.2% RPK: Revenue-Passenger-Kilometers; ASK: Available-Seat-Kilometers; PLF: Passenger-Load-Factor; FTK: Freight-Tonne-Kilometers; AFTK: Available Freight Tonne Kilometers; FLF: Freight Load Factor; All Figures are expressed in % change Year on Year except PLF and FLF which are the load factors for the specific month. IATA Economics th 4 February 2013 IATA Economics: www.iata.org/economics 4