Turkey-A detailed look at the CBRT`s macro-prudential policy

advertisement

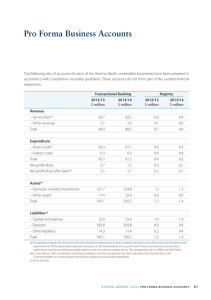

abc Flashnote Global Research Macroeconomics Turkey Turkey A detailed look at the CBRT’s macro-prudential policy framework Since December 2012, the Central Bank of Turkey has been lowering interest rates and raising required reserve ratios (RRR) This combination was used actively in 2011. But the bank has expanded its macro-prudential policy toolkit since then As a result, small RRR hikes similar to those the CBRT delivered in the December-February period are unlikely to slow credit growth in a meaningful way. They may be more effective in preventing excessive lira appreciation Déjà vu? The Central Bank of Turkey (CBRT) has been easing policy since September 2012, but it was the bank’s last rate decision of 2012 that gave markets a feeling of déjà vu. On 18 December, the CBRT cut the policy rate by 25bp and raised required reserve ratios (RRR) for the banking sector, after leaving them unchanged for 14 months. In January and February 2013, the CBRT pushed down the overnight rate corridor, by 25bp in each meeting, and hiked RRR further. 6 March 2013 Melis Metiner Economist, Turkey HSBC Yatırım Menkul Değerler A.Ş. +90 212 376 4618 melismetiner@hsbc.com.tr View HSBC Global Research at: http://www.research.hsbc.com Issuer of report: HSBC Yatirim Menkul Degerler A.S. Disclaimer & Disclosures This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it Typically, the central bank has used this policy mix to achieve two objectives. Rate cuts are aimed at reducing the carry for the Turkish lira, discouraging short-term portfolio flows, and preventing excessive lira appreciation. Reserve requirement hikes are used to cool down credit growth. This combination of lower rates and higher reserve requirements was first introduced in late 2010, but the CBRT continued to implement it throughout 2011 even though growth was nearing overheating territory, inflation was significantly above target, and the current account deficit was widening at an alarming pace. Sharp reserve requirement hikes did help slow credit growth to a certain extent that year, but macro-prudential tightening by the banking regulator also played a role. This time around, two new policy tools, the reserve option mechanism (ROM) and reserve option coefficients (ROC), complicate the picture. In this note, we provide detail on what these acronyms mean and argue that small RRR hikes similar to what the CBRT delivered in the December-February period are unlikely to slow down credit growth in a meaningful way. They may be effective liquidity management tools however, and help prevent excessive lira appreciation. abc Macroeconomics Turkey 6 March 2013 Expanding the reserve requirement framework Required reserve ratios (RRR) are precautionary reserves that must be kept by commercial banks. Currently, Turkish banks must keep 11.0% of their lira liabilities and 11.5% of their FX-denominated liabilities as required reserves at the central bank. Ever since October 2010, reserve requirements do not earn any interest. Starting in September 2011, the CBRT gradually phased in two new policy tools that work in conjunction with the RRR framework. First, the central bank allowed commercial banks to hold some of their lira reserve requirements in hard currencies or in gold. This is called the reserve option mechanism, or ROM. The cost of funding for raising hard currencies or gold to keep in a non-interest bearing account is lower than that of raising liras, so the introduction of ROM was aimed at reducing the opportunity cost associated with holding reserve requirements. Currently, banks can keep up to 60% of their lira liabilities in FX and up to 30% in gold. The remaining 10% must be kept in Turkish liras. RRR for FX-liabilities must be held in hard currencies only (Table 1). Table 1. Evolution of the reserve option mechanism (ROM) Announcement date Effective on For TRY reserve requirements For FX reserve requirements 12-Sep-11 05-Oct-11 27-Oct-11 01-Nov-11 27-Mar-12 29-May-12 21-Jun-12 30-Sep-11 14-Oct-11 11-Nov-11 11-Nov-11 13-Apr-12 22-Jun-12 06-Jul-12 20-Jul-12 03-Aug-12 31-Aug-12 14-Sep-12 10% can be kept in FX 20% can be kept in FX 40% can be kept in FX 10% can be kept in gold 20% can be kept in gold 45% can be kept in FX 50% can be kept in FX 25% can be kept in gold 55% can be kept in FX 60% can be kept in FX 30% can be kept in gold 10% can be kept in gold 19-Jul-12 16-Aug-12 0% can be kept in gold Source: CBRT Then, starting in May 2012, the central bank of Turkey imposed a haircut of sorts on banks who wanted to take advantage of the reserve option mechanism. By setting reserve option coefficients (ROC) for reserve holding tranches, the CBRT started to ask banks to hold more FX or gold for each lira of reserves not held in liras. How exactly does ROC work? Assume that a bank needs to keep TRY100 in reserve requirements. Further, assume that this bank would like to keep 60% of its lira reserve requirements in hard currency, taking advantage of the reserve option mechanism for holding FX to its fullest extent. If there were no reserve option coefficents, this bank would set aside the dollar equivalent of TRY60 as reserve requirement, parking it at the central bank. Assuming a USDTRY exchange rate of 1.80, this would remove USD33 of liquidity from the banking sector. Following the introduction of reserve option coefficients, the same bank now has to park TRY99 at the central bank. At the same exchange rate, this corresponds to USD55. . Reserve requirement that must be parked at the CBRT=TRY100* [(40%*1.4)+(5%*1.8)+(5%*2.1)+(5%*2.3)+(5%*2.4) ] =TRY99.0 or USD55.0 2 abc Macroeconomics Turkey 6 March 2013 Put in the simplest terms, higher reserve option coefficients drain more FX liquidity from the banking sector, for as long as the sector chooses to hold some FX (or gold) in lieu of liras. Charts 1 and 2 show the ROC for each FX- or gold-holding tranche. The weighted ROC for holding FX or gold now stands at 1.65. This means that for each unit of lira reserve requirement not kept in liras, banks now have to forego 1.65 times the euro, dollar or gold bullion equivalent, and keep it at the CBRT. Many advantages… What is the advantage of this new framework? According to the CBRT, the reserve option mechanism (ROM) accomplishes four goals: 1) reducing lira volatility, 2) reducing the need for lira sterilisation by the CBRT, 3) reducing the need for short-term currency swaps, and 4) providing an incentive for the banking sector to build reserves, even if the central bank’s own net reserve position is unchanged. 1 The most important function of ROM is that it acts as an automatic stabiliser against capital inflows. If global liquidity is plentiful and risk appetite is strong, portfolio inflows into Turkey are likely to accelerate. In such a scenario, the central bank would increase reserve option coefficients (ie. draining more FX from the banking sector for each lira RRR not kept in liras). Reducing the amount of FX liquidity available to the banking sector would ease the appreciation pressure on the lira, offsetting the impact of strong inflows. In the opposite scenario where risk appetite is weak and Turkey experiences capital outflows, the CBRT could reduce reserve option coefficients, increasing the available amount of FX liquidity. This would support the lira and offset depreciation pressure. Bank officials have described the ROM framework as a “pressure release valve for the currency.” This description is apt. Chart 3 shows that lira volatility has been on a downwards trend ever since June 2012. Reserve option coefficients were raised for the first time at the end of May. ROM also reduces the need for lira sterilisation by the central bank. In a scenario where strong inflows are causing lira appreciation, a more orthodox policy response would be for the CBRT to purchase FX in open market operations and to sterilise the excess lira liquidity that this would create. The CBRT is hesitant to resort to this tool for two reasons. First is the difficulty associated with conducting effective Chart 1. Reserve option coefficients (ROC) for holding FX in lieu of liras Chart 2. Reserve option coefficients (ROC) for holding gold in lieu of liras 3.0 2.5 2.1 2.0 2.3 2.4 1.8 1.4 1.5 1.0 0.5 Reserve option coefficient Reserve option coefficient 3.0 2.4 2.5 1.9 2.0 1.4 1.5 1.0 0.5 0.0 0.0 0 Source: CBRT 5 10 15 20 25 30 35 40 45 50 55 60 % of lira reserve requirement 0 5 10 15 20 % of lira reserve requirement 25 30 Source: CBRT ______________________________________ 1 "Rezerv Opsiyonu Mekanizması,'' by Koray Alper, Hakan Kara and Mehmet Yörükoğlu. 22 October 2012. Available in Turkish at: www.tcmb.gov.tr 3 abc Macroeconomics Turkey 6 March 2013 Chart 3. Lira volatility has come down in the second half of 2012 % 20 18 16 14 12 10 8 6 4 2 0 Jan-10 Chart 4. Outstanding stock of currency swap transactions for the banking sector has been reduced TRY bn 120 100 80 60 40 20 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 0 Jan-10 USDTRY 3m implied volatility Source: Bloomberg Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Stock of outstanding cross currency swaps Source: BRSA sterilisations. Because lira liquidity is distributed unevenly in the Turkish banking sector, sterilising large amounts of dollar purchases could squeeze the lira liquidity of certain banks that are more dependent on the CBRT’s funding. Another reason has to do with the stigma associated with FX interventions. The CBRT believes that dollar purchase (or sale) auctions are sometimes misinterpreted and lead to questions regarding the nature of the exchange rate regime. More specifically, interventions aimed at reducing the volatility in the exchange rate may sometimes be interpreted as interventions targeting a specific exchange rate level. ROM, on the other hand, gets around this issue by reducing amount of lira liquidity that would have to be sterilised by the central bank. Third, ROM reduces the need for the banking sector to enter into short-term currency swap agreements. Prior to the introduction of this framework, banks would fund their lira reserve requirements by entering currency swaps with parties abroad. Allowing the banks to keep RRR in hard currency reduces the need for cross currency swaps. The CBRT believes that less frequent use of currency swaps is healthier as it reduces short-term foreign borrowing of the banking sector. Chart 4 shows that the outstanding stock of cross currency swaps has also been trending downwards ever since June. Chart 5 on the next page illustrates the same point, in a different way: the off-balance sheet long FX position of the banking sector has been reduced by roughly USD11bn since early June, pointing to a smaller on-balance sheet short FX position. Finally, this new policy tool boosts the FX reserves of the banking sector. Hard currency reserve requirements are kept at the central bank, and as a result, figure into the CBRT’s gross reserves, but they leave the central bank’s net FX position unchanged (Chart 6). For the banking sector though, keeping a portion of lira reserve requirements in FX, could provide a hard-currency buffer against unexpected capital outflows. 4 abc Macroeconomics Turkey 6 March 2013 Chart 5. The banking sector’s off-balance sheet long FX position has been reduced, pointing to a smaller on-balance sheet short FX position USD bn 35 30 25 20 15 10 5 0 -5 2008 USD bn 110 2010 2011 2012 Off-balance sheet net FX position (LHS) USD bn 140 100 120 90 100 80 80 70 60 60 2009 Chart 6. The CBRT’s gross reserves have risen sharply as reserve requirements are kept at the bank in hard currencies. The central bank’s net FX position is little changed, however 40 20 2008 2010 FX and gold reserves CBRT's gross FX reserves (RHS) Source: BRSA, CBRT 2009 2011 2012 2013 Net FX position Source: CBRT …and one major drawback Recent communication by the central bank has put a lot of emphasis on the fact that annual loan growth is now running at above 20%, much faster than the CBRT’s 15% guidance. Despite this, the CBRT has cut the overnight lending rate four times in five MPC meetings, bringing it to 8.50% as of February, from 11.50% in August last year. Over the past three months, the CBRT has also been hiking reserve requirements, albeit much less aggressively than in 2011. In December, FX-RRR was hiked 40bp. In January, FX-RRR was hiked 50bp, and TRY-RRR 20bp. Finally, in the February MPC meeting, FX-RRR was pushed up by 40bp, and TRY-RRR, by 20bp. What is the cumulative impact of this policy mix? Are reserve requirement hikes offsetting the easing that has come via rate cuts, and will we see a sharp slowing in credit growth similar to what happened in late 2011? We think this is unlikely. The fact that banks hold the majority of their reserve requirements either in FX or in gold renders lira reserve requirement hikes less effective. Currently, banks hold 53% of their reserve requirements in foreign currencies (out of a possible 60%) and 25% in gold (out of a possible 30%). The remaining 22% is held in Turkish liras. So when the CBRT raises (or cuts) required reserve ratios for lira liabilities, the impact for the banking sector is rather muted. For instance, in the most recent MPC meeting, the CBRT hiked lira RRR by 20bp. Assuming that banks’ usage of reserve options remains unchanged, this is expected to remove 320 million of lira liquidity, 660 million of dollar liquidity and USD290 million of gold from the banking system. What is the opportunity cost of having to hold this amount in a no-interest account? A back-of-the-envelope calculation assuming lira yields for interest earning assets at 11% , FX-yields at 3.4%, and gold yields at zero works out to a mere TRY76m (or USD42m). Another way to get a sense of the actual magnitude of a 20bp hike in lira RRR is to calculate the effective RRR for lira and FX liabilities. Total lira liabilities for the banking sector is around TRY700bn. If the reserve option mechanism were not in play, banks would be required to hold TRY77bn of reserve requirements at the central bank (assuming lira RRR of 11%, Charts 7 and 8). Currently however, banks hold only TRY14.0bn of lira reserves, with the remainder held in FX or gold. This corresponds to an effective TRY-RRR of 2.0% (=14/700). 5 abc Macroeconomics Turkey 6 March 2013 Chart 7. Weighted average* required reserve ratios (RRR) for TRY- and FX- liabilities Chart 8. Because the majority of lira RRR is held in foreign currencies, the effective TRY-RRR is low. So the impact of small TRY-RRR hikes is limited % 14 % 25 11.0 12 9.0 10 8 6 5.0 10.6 10.2 10.610.2 11.0 11.5 20 15 6.0 23.2 11.5 11.0 10 4 5 2 2.0 0 0 end-2009 end-2010 end-2011 TRY RRR end-2012 current FX RRR * A weighted average is given because reserve requirements in Turkey vary by the maturity of liability. Shorter maturities are subject to higher reserve requirements Source: CBRT Actual Effective TRY RRR Actual Effective FX RRR Source: CBRT, HSBC Let’s look at the FX side. Total foreign-currency denominated liabilities for the banking sector is around USD235bn. With a weighted average FX-RRR of 11.5%, banks will soon be holding USD27bn as FX reserve requirements at the central bank.2 In addition to this however, 53% of lira RRR is also held in FX, and 25% is held in gold (Chart 9). To simplify, we treat gold as a hard currency, and calculate that banks are holding a total of USD54.6bn of reserve requirements, against both lira- and FX- liabilities, in hard currencies. This corresponds to an effective FX-RRR of 23.2% (=54.6/235). Looking at charts 7 and 8 together shows that the magnitude of the macro-prudential tightening delivered over the past three months is not similar to what happened in 2011. In 2011, the CBRT was primarily concerned with curbing lira-denominated consumer loan growth, so TRY-RRR was hiked sharply while FX-RRR was reduced throughout the year. Currently, however, the CBRT’s macro-prudential tightening is coming through the FX-channel. Banks keep the majority of their reserves in hard currencies, which drains FX liquidity from the system. On top of this, the CBRT is hiking FX-RRR more aggressively than TRY-RRR, even though FX-credit growth is rising at roughly half the pace of TRY-credit growth (Chart 10). The 130bp of cumulative FX-RRR hikes since December have drained USD2.54bn of liquidity from the banking system, whereas the 40bp of TRY-RRR hikes have drained only TRY0.62bn (USD0.34bn). ______________________________________ 2 In the February MPC meeting, lira RRR was raised to 11% and FX RRR to 11.5%. These new ratios will become effective on 15 March 2013. 6 abc Macroeconomics Turkey 6 March 2013 This time is different Putting all this together, we come to two conclusions. First, if RRR hikes are not combined with dramatic reductions in reserve options (i.e. CBRT forcing banks to hold a larger portion of their lira reserve requirements in liras), they are unlikely to slow down credit growth in a meaningful way. This is why we believed that a policy mix combining rate cuts, RRR hikes, and reserve option cuts was a possible outcome for the February MPC meeting. But as the central bank shifted down the rate corridor by 25bp and hiked lira- and FX- reserve requirements by 20bp and 40bp respectively, it made no change to the current ROM settings. This brings us to our second conclusion. Because the majority of lira reserve requirements are held in FX and because the CBRT is hiking FX-RRR more sharply than TRY-RRR, the current iteration of the “rate cut, RRR hike” policy mix is squeezing FX liquidity more than lira liquidity. As a result, it is likely to be more effective in curbing excessive lira appreciation and less effective in slowing loan growth. Chart 9. How do banks hold their lira reserve requirements? in liras 22% in gold 25% in FX 53% Chart 10. FX loan growth is rising at a 10% annual pace, versus 20% for lira loans. Yet the CBRT is hiking FX-RRR more aggressively % Yr 60 50 40 30 20 10 0 -10 -20 2008 2009 2010 TRY-loans Source: CBRT 2011 2012 2013 FX-loans * FX-loan growth has been adjusted for currency movements Source: BRSA, HSBC 7 Macroeconomics Turkey 6 March 2013 abc Disclosure appendix Analyst Certification The following analyst(s), economist(s), and/or strategist(s) who is(are) primarily responsible for this report, certifies(y) that the opinion(s) on the subject security(ies) or issuer(s) and/or any other views or forecasts expressed herein accurately reflect their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report: Melis Metiner Important Disclosures This document has been prepared and is being distributed by the Research Department of HSBC and is intended solely for the clients of HSBC and is not for publication to other persons, whether through the press or by other means. This document is for information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other investment products mentioned in it and/or to participate in any trading strategy. Advice in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice. Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document and take into account their specific investment objectives, financial situation or particular needs before making a commitment to purchase investment products. The value of and the income produced by the investment products mentioned in this document may fluctuate, so that an investor may get back less than originally invested. Certain high-volatility investments can be subject to sudden and large falls in value that could equal or exceed the amount invested. Value and income from investment products may be adversely affected by exchange rates, interest rates, or other factors. Past performance of a particular investment product is not indicative of future results. Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC which includes investment banking revenues. For disclosures in respect of any company mentioned in this report, please see the most recently published report on that company available at www.hsbcnet.com/research. * HSBC Legal Entities are listed in the Disclaimer below. Additional disclosures 1 2 3 8 This report is dated as at 06 March 2013. All market data included in this report are dated as at close 05 March 2013, unless otherwise indicated in the report. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner. Macroeconomics Turkey 6 March 2013 abc Disclaimer * Legal entities as at 8 August 2012 Issuer of report ‘UAE’ HSBC Bank Middle East Limited, Dubai; ‘HK’ The Hongkong and Shanghai Banking Corporation Limited, HSBC Yatirim Menkul Degerler A.S. Hong Kong; ‘TW’ HSBC Securities (Taiwan) Corporation Limited; 'CA' HSBC Bank Canada, Toronto; HSBC Bank, Buyukdere Caddesi No: 122 / D Kat:9 Paris Branch; HSBC France; ‘DE’ HSBC Trinkaus & Burkhardt AG, Düsseldorf; 000 HSBC Bank (RR), Moscow; Esentepe/Sisli 34394 Istanbul, Turkey ‘IN’ HSBC Securities and Capital Markets (India) Private Limited, Mumbai; ‘JP’ HSBC Securities (Japan) Limited, Tokyo; ‘EG’ HSBC Securities Egypt SAE, Cairo; ‘CN’ HSBC Investment Bank Asia Limited, Beijing Representative Telephone: +90 212 376 46 00 Office; The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch; The Hongkong and Shanghai Fax: +90 212 376 49 13 Banking Corporation Limited, Seoul Securities Branch; The Hongkong and Shanghai Banking Corporation Limited, www.research.hsbc.com Seoul Branch; HSBC Securities (South Africa) (Pty) Ltd, Johannesburg; HSBC Bank plc, London, Madrid, Milan, www.hsbcyatirim.com.tr Stockholm, Tel Aviv; ‘US’ HSBC Securities (USA) Inc, New York; HSBC Yatirim Menkul Degerler AS, Istanbul; HSBC México, SA, Institución de Banca Múltiple, Grupo Financiero HSBC; HSBC Bank Brasil SA – Banco Múltiplo; HSBC Bank Australia Limited; HSBC Bank Argentina SA; HSBC Saudi Arabia Limited; The Hongkong and Shanghai Banking Corporation Limited, New Zealand Branch incorporated in Hong Kong SAR This document has been issued by HSBC Yatırım Menkul Degerler A.S. (HSBC) for the information of its customers only. If it is received by a customer of an affiliate of HSBC, its provision to the recipient is subject to the terms of business in place between the recipient and such affiliate. HSBC has based this document on information obtained from sources it believes to be reliable but which it has not independently verified; HSBC makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of the Research Department of HSBC only and are subject to change without notice. The information, comments and recommendations involved here are not within the scope of investment consultancy. Investment consultancy services are only provided within the framework of the investment consultancy agreement as agreed between brokerage companies, portfolio management companies, banks not accepting deposits, and the customer. The conclusions arrived at here are based upon the preferred calculation method and/or the personal opinions of the individuals responsible for the comments and recommendations, so they may not be appropriate for your financial situation and risk and return preferences. Therefore, any investment decision made only on the basis of the information involved here may not lead to the optimum results. HSBC and its affiliates and/or their officers, directors and employees may have positions in any securities mentioned in this document (or in any related investment) and may from time to time add to or dispose of any such securities (or investment). HSBC and its affiliates may have assumed an underwriting commitment in the securities of companies discussed in this document (or in related investments), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking or underwriting services for or relating to those companies and may also be represented in the supervisory board or any other committee of those companies. The information and opinions contained within the research reports are based upon rates of taxation applicable at the time of publication but which are subject to change from time to time. Past performance is not necessarily a guide to future performance. The value of any investment or income may go down as well as up and you may not get back the full amount invested. Where an investment is denominated in a currency other than the local currency of the recipient of the research report, changes in the exchange rates may have an adverse effect on the value, price or income of that investment. In case of investments for which there is no recognised market it may be difficult for investors to sell their investments or to obtain reliable information about its value or the extent of the risk to which it is exposed. HSBC Securities (USA) Inc. accepts responsibility for the content of this research report prepared by its non-US foreign affiliate. All U.S. persons receiving and/or accessing this report and wishing to effect transactions in any security discussed herein should do so with HSBC Securities (USA) Inc. in the United States and not with its non-US foreign affiliate, the issuer of this report. In the UK this report may only be distributed to persons of a kind described in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001. The protections afforded by the UK regulatory regime are available only to those dealing with a representative of HSBC Bank plc in the UK. In Singapore, this publication is distributed by The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch for the general information of institutional investors or other persons specified in Sections 274 and 304 of the Securities and Futures Act (Chapter 289) (“SFA”) and accredited investors and other persons in accordance with the conditions specified in Sections 275 and 305 of the SFA. This publication is not a prospectus as defined in the SFA. It may not be further distributed in whole or in part for any purpose. The Hongkong and Shanghai Banking Corporation Limited Singapore Branch is regulated by the Monetary Authority of Singapore. Recipients in Singapore should contact a "Hongkong and Shanghai Banking Corporation Limited, Singapore Branch" representative in respect of any matters arising from, or in connection with this report. In Canada, this publication may be distributed by HSBC Securities (Canada) Inc for the information of its customers only. All inquiries by such recipients must be directed to HSBC Securities (Canada) Inc. In Australia, this publication may be distributed by HSBC Stockbroking (Australia) Pty Limited. In Malaysia, this publication may be distributed by HSBC Research (Malaysia) Sdn Bhd. In Korea, this publication is distributed by either The Hongkong and Shanghai Banking Corporation Limited, Seoul Securities Branch ("HBAP SLS") or The Hongkong and Shanghai Banking Corporation Limited, Seoul Branch ("HBAP SEL") for the general information of professional investors specified in Article 9 of the Financial Investment Services and Capital Markets Act (“FSCMA”). This publication is not a prospectus as defined in the FSCMA. It may not be further distributed in whole or in part for any purpose. Both HBAP SLS and HBAP SEL are regulated by the Financial Services Commission and the Financial Supervisory Service of Korea. This publication is distributed in New Zealand by The Hongkong and Shanghai Banking Corporation Limited, New Zealand Branch incorporated in Hong Kong SAR. In Japan, this publication may be distributed by HSBC Securities (Japan) Limited. It may not be reproduced or further distributed in whole or in part for any purpose. In Australia, this publication has been distributed by The Hongkong and Shanghai Banking Corporation Limited (ABN 65 117 925 970, AFSL 301737) for the general information of its “wholesale” customers (as defined in the Corporations Act 2001). Where distributed to retail customers, this research is distributed by HSBC Bank Australia Limited (AFSL No. 232595). These respective entities make no representations that the products or services mentioned in this document are available to persons in Australia or are necessarily suitable for any particular person or appropriate in accordance with local law. No consideration has been given to the particular investment objectives, financial situation or particular needs of any recipient. In Canada, this document has been distributed by HSBC Bank Canada and/or its affiliates. Where this document contains market updates/overviews, or similar materials (collectively deemed “Commentary” in Canada although other affiliate jurisdictions may term “Commentary” as either “macro-research” or “research”), the Commentary is not an offer to sell, or a solicitation of an offer to sell or subscribe for, any financial product or instrument (including, without limitation, any currencies, securities, commodities or other financial instruments). This communication is only intended for investment professionals within Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001. Persons who do not have professional experience in matters relating to investments should not rely on it. HSBC Yatırım Menkul Degerler A.S. is regulated and authorised by the Central Bank of Turkey, Capital Markets Board, Ministry of Finance, Takasbank and is a member of Istanbul Stock Exchange, Takasbank (Turkish Custodian Bank) and the Association of Capital Market Intermediary Institutions of Turkey. © Copyright 2013, HSBC Yatirim Menkul Degerler A.S., ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC. MICA (P) 038/04/2012, MICA (P) 063/04/2012 and MICA (P) 110/01/2013 9