Chain Letter - Zacks Investment Research

advertisement

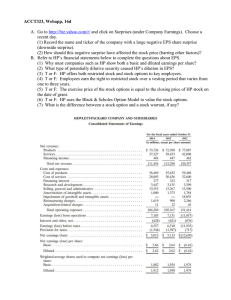

Technology Distribution, EMS, PCB, Connectors and Passives Chain Letter Thoughts and news from the Technology Supply Chain August 8, 2016 Industry Overview Technology Supply Chain Weekly Matthew Sheerin msheerin@stifel.com (212) 271-3753 Nikhil Kumar, CFA kumarn@stifel.com (212) 271-3635 Alvin Park, CFA parka@stifel.com (212) 271-3809 The Week Ahead (Aug 8 – Aug 12) Monday: Semiconductor manufacturers Texas Instruments (TXN) and Intel (INTC) are schedule to present at a competitor’s conference. The commentary from management will provide color on end demand. Tuesday: Fuse manufacturer Littelfuse (LFUS) and EMS company Flex (FLEX) are scheduled to present at a competitor’s conference. We will look for color on end demand. Wednesday: EMS company Flex (FLEX) and IT solutions provider ePlus (PLUS) are scheduled to present at conferences at two of our competitors. We will look for color on end demand. Avnet (AVT) is scheduled to report earnings before the market open. Call is scheduled for 11:00 a.m. ET. Thursday: IT solutions provider Datalink (DTLK) and EMS company Celestica (CLS) are scheduled to present at a competitor’s conference. We will look for color on end demand. Prices as of 8/5/2016 market close SPOTLIGHT: Final Take on Q2 Earnings Earnings season wraps-up for our covered universe this week with Avnet on Wednesday, but we don’t see any major surprises given the company already pre-announced negatively due to ERP issues. Overall, we would rate results across the supply chain as better than expected, though outlooks remain mixed. Of the 16 companies in our space reporting this quarter, we saw six clean "beat and raises", two were inline to slightly better, and eight misses. Amid a generally stable overall demand environment, we saw divergent performance across the companies, perhaps a reflection of end market focus, and company- specific strategies. Most end markets remain flattish; on the negative front, telecom infrastructure remains week, with no signs of a near-term recovery. And automotive remains a bright spot, driven by continued electronic content growth. Although data points around PC this quarter were a welcome addition after several quarters of downdraft, overall IT spending remains muted, particularly for legacy products. In addition, concern around impact from Brexit remains (though only a few companies were blaming this for weak results). Industrial markets overall remain muted, particularly in N. America, while defense/aerospace remains healthy long-term. Stock to highlight post-earnings: In the technology distribution space, Arrow Electronics continues to benefit from a series of internal investments and M&A in both business segments (computing and components). We believe shares remain attractive, at less than 9x forward earnings. Among the resellers/solution providers, we believe CDW should see above-market growth by taking advantage of its diversified portfolio as well as on market share gains. Among EMS stocks, Flex continues to shift its portfolio toward diversified markets (such as industrials, healthcare, energy), which should expand margins overtime with a more stable topline; in addition fee cash flow should remain healthy at the firm. We expect Flex’s multiple to expand on consistent execution. While Plexus remains well positioned in its key verticals— healthcare, defense and industrial – valuation at 14x forward earnings keep us on sidelines. PCB maker TTM Technologies is in the midst of Apple-driven program ramps that combined with benefits from the recent cost actions could drive upside to estimates in the later part of this year. We also remain positive sensor maker Sensata, which trades at ~13x forward earnings, yet is poised to see margin improvements over the next few quarters on cost cutting and volume growth. Stifel does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. All relevant disclosures and certifications appear on pages 11 through 12 of this report. Technology Supply Chain August 8, 2016 Stifel SPOTLIGHT: Final Take on Q2 Earnings Technology Supply Chain June Quarter Earnings Calendar Jun Q Actual Rev (mn) EPS Prior SN Estimates Rev (mn) EPS Sep Q Guidance Rev (mn) EPS Prior SN Estimates Rev (mn) EPS Beat/Miss/ Inline Reported Companies Week of July 18 TE Connectivity Ltd. (TEL) 20-Jul $3,121 $1.08 $3,099 $1.03 $3,339 $1.20 $3,309 $1.22 Miss Amphenol Corporation (APH) 20-Jul $1,548 $0.65 $1,514 $0.63 $1,567 $0.68 $1,606 $0.69 Miss Celestica Inc. (CLS) 21-Jul $1,486 $0.29 $1,460 $0.28 $1,521 $0.30 $1,473 $0.29 Beat Flex (FLEX) 21-Jul $5,877 $0.27 $5,709 $0.27 $6,018 $0.28 $6,229 $0.29 Miss Plexus Corp. (PLXS) 21-Jul $668 $0.82 $656 $0.77 $672 $0.81 $678 $0.82 Miss Week of July 25 Sensata Technologies Holding NV (ST) 26-Jul $828 $0.73 $819 $0.71 $793 $0.73 $815 $0.75 Miss AVX Corporation (AVX) 27-Jul $315 $0.19 $311 $0.19 $316 $0.16 $319 $0.20 Miss TTM Technologies, Inc. (TTMI) 27-Jul $602 $0.28 $599 $0.19 $640 $0.32 $633 $0.26 Beat KEMET Corporation (KEM) 28-Jul $185 $0.06 $183 $0.04 $188 $0.06 $187 $0.07 Miss Ingram Micro Inc. (IM) 28-Jul $10,123 $0.61 $9,520 $0.44 $10,426 $0.62 $9,889 $0.54 Beat Week of August 2 Vishay Intertechnology, Inc. (VSH) 2-Aug $590 $0.23 $585 $0.22 $590 $0.24 $595 $0.25 Miss Arrow Electronics, Inc. (ARW) 2-Aug $5,972 $1.65 $6,009 $1.65 $5,855 $1.51 $5,802 $1.48 Beat ePlus (PLUS) 2-Aug $299 $1.54 $303 $1.38 $336 $2.02 $340 $1.99 Beat CDW Corp. (CDW) 3-Aug $3,665 $0.93 $3,590 $0.86 $3,750 $0.92 $3,726 $0.91 Beat Insight Enterprises (NSIT) 3-Aug $1,456 $0.97 $1,400 $0.75 $1,381 $0.50 $1,348 $0.57 In-Line Littelfuse, Inc. (LFUS) 4-Aug $272 $1.44 $271 $1.42 $268 $1.43 $272 $1.47 Miss Companies Scheduled to Report Earnings Jun Quarter Estimates Release Date SN Estimates Rev (mn) EPS Sep Quarter Estimates Consensus Estimates SN Estimates Rev (mn) EPS Rev (mn) EPS Consensus Estimates Rev (mn) EPS Technology Distribution Avnet, Inc. (AVT) 10-Aug $6,200 $0.83 $6,212 Note: Estimates are as of the market close on 8/5/16. Source: Factset and Stifel estimates Page 2 $0.88 $6,157 $0.84 $6,178 $0.86 Technology Supply Chain August 8, 2016 Stifel SPOTLIGHT: Final Take on Q2 Earnings Earnings recap of companies in our universe: VSH, ARW, PLUS, CDW, NSIT, and LFUS Vishay Q2 revenue and adjusted EPS of $590.1mn and $0.23 were modestly above our estimate on generally seasonal demand trends, highlighted by continued strength in automotive, while operating margin of 9.1% was the best showing in nearly two years on good leverage as well as ongoing restructuring efforts. Revenue guidance was flat q/q, which is seasonal, while GM is expected to modestly improve on the completion of restructuring in the MOSFET (power semiconductor) segment, which will save $23mn annually. Shares were trading down mid-day, we believe on the flattish sales guide, but we note that management appears to have more confidence in the company's bookings trends. We tweak estimates but maintain our FY17 EPS of $1.03. Our estimate reflects just 3% top-line growth next year, while we expect double-digit EPS growth on continued margin leverage. Lastly, we note that the company has begun to repatriate cash back to the U.S. and also began buying back stock, which should be a positive catalyst over the next couple of years. We maintain our Buy rating. VSH Product Line Revenue FY14 ($ in millions) FY15 FY16 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q Resistors/Industors 294 188 304 192 297 190 287 186 281 187 272 179 257 173 248 166 270 182 277 192 Capacitors 106 112 107 101 94 93 84 82 88 85 308 337 341 324 312 318 303 307 299 312 Siliconix 113 124 122 112 107 106 109 104 101 102 Weakness in computers offset by strenght in auto Diodes 137 150 151 141 137 139 124 135 135 142 Recovering from a soft 2H'2015 58 63 68 71 68 73 70 68 63 68 602 641 638 611 593 590 560 555 569 589 Passives Actives Optoelectronics Total Comments Continued growth in Asia (China) Negatively impacted by weak oil & gas and computers Strength in sensors Q/Q Performance Passives -2% 3% -2% -3% -2% -3% -6% -4% 9% 3% Resistors/Industors -1% 2% -1% -2% 1% -4% -3% -4% 10% 5% Capacitors -4% 6% -4% -6% -7% -1% -10% -2% 7% -3% -3% 9% 1% -5% -4% 2% -5% 1% -3% 4% Siliconix -4% 10% -2% -8% -4% -1% 3% -5% -3% 1% Diodes -3% 9% 1% -7% -3% 1% -11% 9% 0% 5% Optoelectronics 2% 9% 8% 4% -4% 7% -4% -3% -7% 8% -2% 6% 0% -4% -3% -1% -5% -1% 3% 4% Actives Total Source: Company data How the stock reacted: Shares traded down 1.9% vs. down 0.6% for the S&P Page 3 Technology Supply Chain August 8, 2016 Stifel SPOTLIGHT: Final Take on Q2 Earnings Arrow reported Sales and adjusted-EPS were $5.97bn (up 9% q/q, up 2% y/y, flat y/y ex-M&A/FX) and $1.65, vs. our estimates of $6.00bn and $1.65 (Street was at $6.04bn and $1.64).We maintain our positive stance on ARW shares and reiterate our $72 PT following a solid Q2, including record sales and earnings within its computing segment, and an overall seasonal guide for Q3. The outlook, which was slightly ahead of our estimate but just in line with Consensus, clearly disappointed investors, with the stock down ~5% today (vs. down ~1% for the S&P 500). To be fair, expectations heading into the print were high given the recent run in Arrow shares as well as the relatively upbeat results from several key suppliers and other distributors. But we saw few reasons to be concerned with the quarter, the quality of earnings, or Arrow's strategic vision. Indeed, Arrow has made a series of internal investments and M&A in both businesses that should position it well going forward. We raised our forward estimates, moving FY17 EPS to $7.12 from $7.02, as we expect modest margin improvements in a slow-growth environment, as well as good cash flow. Our estimates do not factor in additional share repurchases, and we note that Arrow has $286mn left in its existing program, which would add roughly $0.35-$0.40 in annual EPS if completed. Arrow Electronic Components $ in millions 1Q15 2Q15 Total Sales $3,347 $3,699 % Sales growth, y/y growth, q/q 67% (2%) (7%) 63% 4% 11% Operating Income Op Margin North America 1Q16 $3,676 54% 2% (1%) 67% 10% 0% 171 177 172 157 179 4.8% 4.7% 4.3% 4.9% $1,458 $1,481 $1,440 40% (4%) 2% 39% 3% (3%) $972 $1,058 26% 8% (2%) 29% 15% 9% $1,215 $1,178 33% 5% (2%) 32% 15% (3%) $1,398 $1,474 42% (0%) (9%) 40% 0% 5% Europe $923 $987 % Sales growth, y/y growth, q/q 28% (7%) 3% 27% 0% 7% $1,026 $1,238 31% (0%) (11%) 33% 11% 21% % Sales growth, y/y growth, q/q 65% (1%) (0%) 4Q15 $3,669 5.1% % Sales growth, y/y growth, q/q Asia 3Q15 $3,692 39% (4%) (1%) $993 27% 5% 1% $1,241 34% (2%) 0% 2Q16 Comments $3,833 Previous 2Q16 Guide: $3.75bn-$3.95bn (up 4.7% q/q at the midpoint) 64% up ~1% y/y ex-M&A and FX 4% B:B 1.03 in the Jun-Q 4% B:B above parity four weeks into the Sep-Q 187 Sep-Q Guide: $3.725bn-$3.825bn (roughly flat q/q at the midpoint) 4.9% $1,478 39% Growth in SMB customers offset by large supply-chain oriented 0% customers 3% Y/y strength from medical and lighting verticals $1,057 28% Strong transportation and lighting 7% Y/y strength from aerosapce & defense (0%) $1,298 34% Strength from core SMB offset by large supply chain customers 5% Strong growth in transportation and growth in wireless y/y 10% Source: Company reports Arrow Computer Products $ in millions 1Q15 2Q15 Total Sales $1,656 $2,132 % Sales growth, y/y growth, q/q 33% (0%) (41%) 37% 1% 29% Operating Income Op Margin North America 3Q15 $2,006 35% 7% (6%) 4Q15 1Q16 $3,083 $1,798 46% 10% 54% 33% 9% (42%) 2Q16 36% down 3% y/y ex-FX and ex-M&A 0% Sep-Q Guide: $1.925bn-$2.125bn (down ~5% q/q at the midpoint) 19% 73 105 91 179 83 115 4.4% 4.9% 4.5% 5.8% 4.6% 5.4% $1,407 $2,028 $1,191 $1,419 66% 11% 44% 66% 11% (41%) 66% Growth in infrastructure software (2%) Weak legacy storage 19% $1,055 $607 $720 34% 7% 76% 34% 4% (42%) 34% Growth in infrastructure software and proprietary servers 6% Weak legacy storage 19% $1,074 $1,454 % Sales growth, y/y growth, q/q 65% 8% (41%) 68% 9% 35% 70% 11% (3%) Europe $582 $678 $599 % Sales growth, y/y growth, q/q 35% (12%) (41%) 32% (13%) 17% 30% (3%) (12%) Source: Company reports Comments $2,139 Previous 2Q16 Guide: $2.075bn-$2.275bn (up ~21% q/q at midpoint) How the stock reacted: Shares traded down 5.3% vs. down 0.6% for the S&P Page 4 Technology Supply Chain August 8, 2016 Stifel SPOTLIGHT: Final Take on Q2 Earnings ePlus reported June quarter revenue of $298.5mn and was just short of our estimate, while EPS of $1.54 handily beat our estimate on higher-than-expected GM due to mix. Year-on-year growth was a solid 11% as the IT solution provider continues to gain share in a very fragmented market. As per its policy, the company issued no guidance for the September quarter other than to acknowledge that comps will be quite tough, as ePlus grew a robust 25% q/q a year ago, which we do not expect to repeat. In addition, new CEO Mark Marron, who was just promoted from COO, said the company would continue to add headcount, particularly customer-facing sales and engineers, which also could weigh on margins near-term. Looking at our model, we are raising forward EPS largely to account for the exclusion of amortization of acquisition-related intangibles, which adds roughly 16 cents in EPS. Shares are trading at less than 11x our new FY17 EPS of $7.31. While not expensive, we maintain our Hold rating due to lack of better visibility on sales growth and margin leverage. Sales Breakdown Technology Segment Sales y/y growth q/q growth Gross Profit Q1-June 14 Q2-Sep14 Q3-Dec14 Q4-Mar 15 FY15-Mar Q1-June 15 263.4 288.4 297.8 258.9 1,108.4 261.5 6.0% 9.6% 15.5% 2.8% 8.5% -0.7% 4.6% 9.5% 3.3% -13.1% 1.0% 50.5 gross margin 19.2% Operating profit 12.5 op-margin 4.7% Financing segment Sales 8.9 y/y growth -17.8% q/q growth 10.7% Gross Profit 5.9 gross margin 66.8% Operating profit 2.3 op-margin 25.8% Source: Company reports and Stifel estimates Q2-Sep15 Q3-Dec 15 Q4-Mar 16 FY16-Mar Q1-June 16 326.0 289.4 292.2 1,169.1 291.5 13.0% -2.8% 12.9% 5.5% 11.5% 24.7% -11.2% 1.0% -0.3% 57.6 59.6 53.0 220.8 53.8 64.8 57.9 60.9 237.3 61.6 20.0% 17.6 6.1% 20.0% 18.0 6.1% 20.5% 12.9 5.0% 19.9% 61.1 5.5% 20.6% 13.0 5.0% 19.9% 22.7 7.0% 20.0% 14.7 5.1% 20.8% 13.4 4.6% 20.3% 63.8 5.3% 21.1% 14.6 5.0% 9.1 13.6% 2.3% 6.3 69.2% 2.7 29.7% 8.4 -8.9% -7.5% 5.8 69.1% 2.5 30.2% 8.4 4.5% -0.2% 5.7 67.9% 2.2 26.1% 34.8 -3.6% 8.4 -6.1% -0.5% 5.3 63.9% 2.0 24.4% 10.3 13.2% 23.3% 7.1 69.4% 4.0 38.9% 9.3 10.2% -10.0% 6.2 66.8% 3.0 32.1% 7.2 -14.4% -22.5% 6.1 84.6% 3.0 42.2% 35.1 0.9% 7.0 -15.7% -2.0% 6.1 85.9% 2.9 40.6% 23.8 68.2% 9.8 28.0% 24.8 70.5% 12.1 34.3% How the stock reacted: Shares traded up 4.8% vs. up 0.3% for the S&P CDW reported June-quarter sales and adjusted EPS of $3.66bn and $0.93 beat our estimates of $3.59bn and $0.86 (vs. consensus of $3.65bn and $0.85). We maintain our positive stance on CDW shares following a good first quarter despite a mixed demand picture. Sales to medium-and-large corporate customers (40% of sales) continued to be sluggish, down 2% y/y, but this was largely offset by robust demand within CDW's education and government verticals, which grew low double-digits. Indeed, CDW's diversified portfolio of customers across commercial and public sectors enables it to withstand volatile movements within specific end markets, in our opinion. While management expects corporate demand to pickup in the second half, it now expects overall IT spending in N. America to come in at the low end of previous expectations for 2-3% growth. It still expects to outgrow the market by 200-300bp and continues to invest in sales and technical-support staff to help take share in a very fragmented market. We tweaked forward estimates, raising FY17 EPS to $3.61 from $3.59, and raised our PT from $46 to $48, which represents 13.5x FY17 EPS Risk to Target Price: Our 12-month target price of $48 is based on ~13.5x our FY17 non-GAAP EPS estimate of $3.61, or ~10x FY17E EV/EBITDA. Risks to our target price include decline in technology spending; pricing pressure among peers, particularly in softer demand environments; technology disruption (including the migration to cloud computing among small business customers); lack of acquisition experience; and relatively heavy debt burden. Page 5 Technology Supply Chain August 8, 2016 Stifel SPOTLIGHT: Final Take on Q2 Earnings Quarterly Sales By Segment (1Q14-2Q16) $ in millions Q1-Mar-14 Q2-Jun-14 Q3-Sep-14 Q4-Dec-14 Q1-Mar-15 Q2-Jun-15 Q3-Sep-15 Q4-Dec-15 Q1-Mar-16 Q2-Jun-16 Corporate: Medium/Large 1,296.4 1,417.7 1,396.6 1,467.6 1,341.9 1,521.3 1,490.6 1,521.5 1,410.7 1,489.0 % of sales 48.9% 45.6% 42.8% 48.1% 48.7% 45.9% 42.6% 44.5% 45.3% 40.6% q/q -2.0% 9.4% -1.5% 5.1% -8.6% 13.4% -2.0% 2.1% -7.3% 5.6% y/y 9.8% 8.3% 12.5% 11.0% 3.5% 7.3% 6.7% 3.7% 5.1% -2.1% Small Business 239.8 270.0 256.9 259.0 268.5 277.3 274.1 273.1 281.6 290.2 % of sales 9.0% 8.7% 7.9% 8.5% 9.7% 8.4% 7.8% 8.0% 9.0% 7.9% q/q 3.9% 12.6% -4.9% 0.8% 3.7% 3.3% -1.2% -0.4% 3.1% 3.1% y/y 7.3% 18.0% 14.4% 12.3% 12.0% 2.7% 6.7% 5.4% 4.9% 4.7% $1,536.2 $1,687.7 $1,653.5 $1,726.6 $1,610.4 $1,798.6 $1,764.7 $1,794.6 $1,692.3 $1,779.2 Total Corporate Public: Govt. 259.5 319.5 449.4 447.5 294.2 390.8 493.9 522.0 339.9 456.6 % of sales 9.8% 10.3% 13.8% 14.7% 10.7% 11.8% 14.1% 15.3% 10.9% 12.5% q/q -20.7% 23.1% 40.7% -0.4% -34.3% 32.8% 26.4% 5.7% -34.9% 34.3% y/y 2.9% 8.0% 19.7% 36.7% 13.4% 22.3% 9.9% 16.6% 15.5% 16.8% Education 323.8 529.9 639.0 346.0 345.4 548.9 583.3 341.2 341.0 640.0 % of sales 12.2% 17.1% 19.6% 11.3% 12.5% 16.6% 16.7% 10.0% 10.9% 17.5% q/q 14.5% 63.7% 20.6% -45.9% -0.2% 58.9% 6.3% -41.5% -0.1% 87.7% y/y 39.4% 26.0% 24.5% 22.3% 6.7% 3.6% -8.7% -1.4% -1.3% 16.6% 398.7 435.8 398.7 390.5 377.6 448.8 406.7 430.8 388.5 450.4 15.0% 14.0% 12.2% 12.8% 13.7% 13.5% 11.6% 12.6% 12.5% 12.3% 15.9% Healthcare % of sales q/q 4.8% 9.3% -8.5% -2.1% -3.3% 18.9% -9.4% 5.9% -9.8% y/y 10.0% 19.0% 12.0% 2.7% -5.3% 3.0% 2.0% 10.3% 2.9% 0.4% $982.0 $1,285.2 $1,487.1 $1,184.0 $1,017.2 $1,388.5 $1,483.9 $1,294.0 $1,069.4 $1,547.0 134.1 133.1 125.5 139.5 127.6 126.9 252.5 329.8 355.0 338.4 5.1% 4.3% 3.8% 4.6% 4.6% 3.8% 7.2% 9.6% 11.4% 9.2% -21.0% -0.7% -5.7% 11.2% -8.5% -0.5% 99.0% 30.6% 7.6% -4.7% Total Public Other (inc. Kelway) % of sales q/q . y/y -16.7% -16.4% -18.5% -17.8% -4.8% -4.7% 101.2% 136.4% 178.2% 166.7% $2,652.3 $3,106.0 $3,266.1 $3,050.1 $2,755.2 $3,314.0 $3,501.1 $3,418.4 $3,116.7 $3,664.6 q/q -2.2% 17.1% 5.2% -6.6% -9.7% 20.3% 5.6% -2.4% -8.8% 17.6% y/y 10.0% 11.8% 14.0% 12.4% 3.9% 6.7% 7.2% 12.1% 13.1% 10.6% Total Net sales Note: There were 64 selling days in 2Q16 and 63 days in 2Q15. Reflect changes due to sales move from Small Business to Medium/Large business. Note: Kelway contribution is included the "other" segment. Source: Company reports How the stock reacted: Shares traded up 3.7% vs. up 0.3% for the S&P Insight (NSIT) reported June quarter (F2Q16) revenue and adjusted-EPS of $1.46bn (up 25% q/q, up 2% y/y, and up 3% y/y ex-FX) and $0.97, significantly above our estimates of $1.40bn and $0.75. : Insight posted impressive Q2 results, with revenue and adjusted EPS of $1.46bn and $0.97 well above our estimates of $1.4bn and $0.75. Operating margin was a strong 4%, the best performance in several quarters, due to strong gross margin (largely due to mix) and benefits from a $20mn cost-cutting program. Although Insight took up its full year guidance to $2.42 at the midpoint, from $2.30, the guidance implies a drop in EBIT margin to well below 3%, as Insight expects lower software sales, which will negatively impact gross margin. It also expects some FX headwinds due to its exposure to the U.K. We raise our FY16E EPS to $2.43 from $2.26 and FY17E EPS to $2.57 from $2.49. Insight North America Sales ($mn) Q/Q growth Y/Y growth Gross margin Operating margin Jun-15 $978.7 19.0% 10.1% 13.1% 3.0% Sep-15 $1,022.4 4.5% 14.7% 13.3% 3.1% Dec-15 $999.7 (2.2%) (0.2%) 12.6% 2.4% Mar-16 $826.9 (17.3%) 0.5% 13.5% 1.4% Jun-16 Comments $1,036.3 Growth in large enterprise 25.3% Hardware sales up 8% (strength in devices, server, storage) 5.9% Software up 3% y/y; driver of margin growth 13.8% 4.0% Source: Company reports Page 6 Technology Supply Chain August 8, 2016 Stifel SPOTLIGHT: Final Take on Q2 Earnings Insight EMEA Sales ($mn) Q/Q growth Y/Y growth Gross margin Operating margin Jun-15 $380.6 7.3% (14.8%) 13.9% 2.6% Sep-15 $293.6 (22.9%) (6.4%) 13.9% 0.4% Dec-15 $342.0 16.5% (12.6%) 13.9% 2.1% Mar-16 $303.4 (11.3%) (14.5%) 14.3% 0.9% Jun-15 $64.8 53.7% (20.8%) 16.0% 6.4% Sep-15 $26.1 (59.7%) (20.0%) 20.3% 0.1% Dec-15 $45.4 73.8% (14.6%) 16.1% 4.4% Mar-16 $38.7 (14.7%) (8.1%) 15.3% 1.4% Jun-16 $361.7 19.2% (5.0%) 15.2% 3.3% Comments Down 2% y/y ex-FX Weakness in the UK hardware Greater mix in software drove margins Source: Company reports Insight Asia-Pac Sales ($mn) Q/Q growth Y/Y growth Gross margin Operating margin Jun-16 Comments $58.3 Higher mix in cloud and software sales drove margins 50.4% (10.0%) 18.5% 8.5% Source: Company reports How the stock reacted: Shares traded up 14.4% vs. flat for the S&P Littelfuse reported Jun-Q revenue of $271.9mn was roughly in line with our expectation, and EPS was two cents above of our $1.42 estimate. Sep-Q guide of down ~2% q/q at midpoint was below our estimates on incremental weakness from the solar, oil & gas and mining markets. Although the company is seeing healthy trends from Asian and European automotive customers, the decline in N. American heavy truck market is impacting it negatively. In addition, the exit of certain lower margin sensor products is expected to impact y/y comps until Q1 next year. On the positive side, acquisition of PolySwitch is tracking in-line to modestly ahead of expectation with the deal expected to be modestly accretive in the Sep-Q (excluding amortization expenses). Management remains on track to expand op-margin in the core business (ex-M&A) by about 150bp in FY16, and is further looking to realign costs in industrial which has been seeing weakness for last several quarters. We revise our FY16 EPS estimates to $5.60 (from $5.61) and FY17 to $6.30 (from $6.18), which now includes $8.5mn in annual negative impact from amortization expenses (vs. prior expectations of ~$12mn). Shares are trading at ~19x our forward estimates or ~12x EBITDA, slightly above its peers; we maintain our Hold rating. Electronics Segment (49% of total sales) Revenue ($mn) Non-GAAP Operating Margin Strengths Weaknesses change y/y $132 25.2% 19.1% -189 bp Europe and China; N. America Stable Japan and Korea change q/q 33.8% -358 bp So urce: Co mpany data, Stifel Automotive Segment (41% of total sales) Revenue ($mn) Non-GAAP Operating Margin Strengths Weaknesses change y/y change q/q $111 29.6% 21.1% 14.8% 5 bp -423 bp Asia and Europe; passenger car fuses & sensors Commercial vehicles in N. America So urce: Co mpany data, Stifel Page 7 Technology Supply Chain August 8, 2016 Stifel SPOTLIGHT: Final Take on Q2 Earnings Industrial Segment (10% of total sales) Revenue ($mn) Non-GAAP Operating Margin Strengths Weaknesses change y/y $28 (7.1%) 7.1% -827 bp Some strength in Asia and Europe Solar, Mining (potash), and Oil & Gas So urce: Co mpany data, Stifel How the stock reacted: Shares traded down 6.7% vs. flat for the S&P Page 8 change q/q (1.0%) 131 bp Technology Supply Chain August 8, 2016 Stifel News PLXS Roadshow Highlights: New Program Wins Should Drive Strong Top-Line Growth in FY17 We hosted investor meetings last week with Plexus’ incoming CEO Todd Kelsey and CFO Patrick Jermain. The roadshow follows the EMS company's recent earnings results and upbeat outlook on revenue growth and further margin expansion. The meetings centered around new business pipeline, operating leverage, capital allocation, and Plexus' ability to sustain its competitive advantage. We believe the company continues to execute well in a mixed demand environment by focusing on its key verticals (medical, defense/aero and industrial), which should enable it to grow above markets. Indeed, at its analyst day in June, PLXS management laid out plans to grow at CAGR of ~12% over the next several years. Consensus estimates peg FY17 top-line growth at ~9%, and EPS of $3.28. Double-digit sales growth could drive EPS in the range of $3.40-$3.50, by our estimate, but at this point that appears to be an ambitious target. We maintain our Hold rating on valuation, with shares trading at 14x forward earnings, a deserved premium to its peer group. Page 9 Technology Supply Chain August 8, 2016 Stifel Valuations Technology Supply Chain Valuation Comparison EMS/PCB Celestica Inc. Flex Jabil Circuit Plexus Corp. TTM Technologies Components & Connectors AVX Corp Kemet Corp Littelfuse Inc. Vishay Intertechnology Amphenol Sensata TE Connectivity Ltd. IT Technology Distribution Arrow Electronics Avnet Ingram Micro CDW Corp. ePlus inc. Insight Enterprises Tech Data Synnex Ticker Stifel Rating 8/5/2016 Price 52 Wk Hi 52 Wk LO % off HI Shares Out. Market Cap. Ent. Value CLS FLEX JBL PLXS TTMI H B H H B $11.14 $12.65 $20.72 $46.15 $10.49 $13.42 $13.37 $26.00 $46.88 $10.59 $8.07 $8.85 $16.78 $28.72 $4.67 -17.0% -5.4% -20.3% -1.6% -0.9% 144.1 551.0 193.1 33.8 100.4 $1,605 $6,971 $4,000 $1,561 $1,053 $1,428 $8,050 $5,264 $1,391 $1,914 9.5x 10.7x 13.1x 15.6x 9.7x 8.9x 9.7x 9.1x 13.8x 9.1x 0.2x 0.3x 0.3x 0.5x 0.8x 0.2x 0.3x 0.3x 0.5x 0.7x 5.1x 6.4x 4.2x 8.1x 5.4x AVX KEM LFUS VSH APH ST TEL H H H B H B B $13.56 $3.37 $118.42 $13.50 $59.92 $37.94 $58.98 $14.32 $3.62 $126.32 $13.51 $60.50 $52.58 $67.99 $10.43 $1.26 $82.53 $9.22 $44.50 $29.92 $51.70 -5.3% -6.9% -6.3% -0.1% -1.0% -27.8% -13.3% 167.6 52.1 22.7 150.6 315.4 171.5 361.0 $2,273 $176 $2,685 $2,033 $18,899 $6,507 $21,292 $1,215 $509 $2,870 $1,700 $20,940 $9,600 $24,634 18.7x 15.6x 21.2x 15.2x 22.9x 13.2x 14.2x 17.1x 9.6x 18.8x 13.1x 21.3x 11.8x 13.8x 1.0x 0.7x 2.8x 0.7x 3.4x 3.0x 2.0x 1.0x 0.7x 2.6x 0.7x 3.3x 3.0x 1.9x ARW AVT IM CDW PLUS NSIT TECD SNX B B H B H H H H $65.19 $40.67 $33.89 $44.73 $84.96 $30.49 $78.01 $101.40 $68.07 $46.95 $36.66 $46.92 $109.33 $32.77 $83.51 $103.11 $45.23 $36.42 $23.79 $30.40 $61.78 $18.26 $54.88 $72.06 -4.2% -13.4% -7.6% -4.7% -22.3% -7.0% -6.6% -1.7% 92.7 131.7 154.7 168.9 7.1 36.6 35.4 39.5 $6,043 $5,354 $5,244 $7,555 $604 $1,116 $2,759 $4,003 $8,277 $6,635 $5,680 $10,666 $572 $1,028 $2,300 $4,128 9.7x 10.5x 12.8x 13.4x 12.9x 12.5x 12.6x 16.1x 9.1x 8.6x 11.9x 12.4x 12.1x 11.8x 12.2x 16.0x 0.3x 0.3x 0.1x 0.8x 0.5x 0.2x 0.1x 0.3x CY15 Revenue CY16E CY17E CY15 Estimates EPS CY16E CY17E CY15 EBITDA CY16E CY17E Cash Debt $0.92 $1.12 $2.39 $2.54 $0.87 $1.17 $1.18 $1.58 $2.96 $1.08 $1.25 $1.31 $2.28 $3.34 $1.15 $257 $1,223 $1,299 $158 $286 $280 $1,254 $1,256 $172 $353 $294 $1,319 $1,421 $194 $355 $473 $1,679 $887 $434 $216 $0.78 $0.11 $5.05 $0.70 $2.43 $2.75 $3.55 $0.72 $0.22 $5.60 $0.89 $2.62 $2.87 $4.16 $0.80 $0.35 $6.30 $1.03 $2.82 $3.22 $4.27 $214 $86 $191 $354 $1,282 $717 $2,537 $190 $97 $223 $366 $1,410 $812 $2,559 $214 $105 $247 $391 $1,502 $859 $2,652 $6.18 $4.54 $2.63 $2.96 $5.98 $2.11 $5.69 $6.25 $6.69 $3.89 $2.64 $3.33 $6.57 $2.43 $6.17 $6.32 $7.12 $4.73 $2.84 $3.61 $7.04 $2.57 $6.40 $6.32 $1,049 $1,064 $774 $1,018 $79 $170 $352 $466 $1,118 $897 $791 $1,092 $83 $190 $365 $481 $1,168 $1,045 $849 $1,164 $90 $197 $383 $489 EMS Celestica Inc. $5,639 $5,937 $6,174 Flex $24,598 $23,950 $24,492 Jabil Circuit $18,588 $17,682 $18,600 Plexus Corp. $2,606 $2,635 $2,856 TTM Technologies $2,095 $2,480 $2,566 Components & Connectors AVX Corp $1,207 $1,236 $1,264 Kemet Corp $745 $742 $760 Littelfuse Inc. $868 $1,024 $1,103 Vishay Intertechnology $2,298 $2,335 $2,407 Amphenol $5,569 $6,167 $6,419 Sensata $2,975 $3,206 $3,206 TE Connectivity Ltd. $12,017 $12,457 $12,657 IT Technology Distribution Arrow Electronics $23,282 $24,098 $24,707 Avnet $27,351 $25,212 $26,047 Ingram Micro $43,026 $41,832 $42,801 CDW Corp. $12,989 $14,057 $14,847 ePlus inc. $1,172 $1,255 $1,321 Insight Enterprises $5,373 $5,578 $5,790 Tech Data $26,332 $26,830 $27,470 Synnex $13,313 $13,784 $14,315 Stifel Rating Legend: B = Buy, H = Hold, S = Sell, and NR = Rating Suspended Source:First Call, Company Reports and Stifel estimates Matt Sheerin, Analyst Nikhil Kumar, CFA, Associate Alvin J Park, CFA, Associate 212.271.3753 212.271.3635 212.271.3809 Page 10 Price/Earnings CY16E CY17E TEV/Sales CY16E CY17E Ent. Val./EBITDA CY16E CY17E TBV Price/ TBV 4.9x 6.1x 3.7x 7.2x 5.4x $7.74 $2.44 $8.28 $26.19 $8.21 1.4x 5.2x 2.5x 1.8x 1.3x 6.4x 5.2x 12.9x 4.6x 14.8x 11.8x 9.6x 5.7x 4.8x 11.6x 4.3x 13.9x 11.2x 9.3x $11.43 $0.30 $9.87 $7.28 $8.35 1.2x 11.3x 12.0x 1.9x 7.1x 0.3x 0.3x 0.1x 0.7x NA 0.2x 0.1x 0.3x 7.4x 7.4x 7.2x 9.8x 6.9x 5.4x 6.3x 8.6x 7.1x 6.3x 6.7x 9.2x 6.4x 5.2x 6.0x 8.4x $17.96 $26.32 $17.61 $36.17 $16.51 $51.40 $39.93 3.6x 1.5x 1.9x 2.3x 1.8x 1.5x 2.5x Net Cash/ (Net Debt) Equity Inv. Turns ROE Short Interest % Short $296 $2,759 $2,151 $263 $1,078 $1.23 ($1.96) ($6.55) $5.05 ($8.58) $1,162 $2,667 $2,492 $895 $830 6.2x 6.2x 7.0x 4.3x 7.4x 14.4% 22.3% 5.1% 12.5% 13.7% 0.63 6.95 5.89 0.47 7.37 0.4% 1.3% 3.1% 1.4% 7.3% $1,058 $53 $183 $1,021 $794 $309 $694 $0 $386 $368 $688 $2,835 $3,402 $4,036 $6.31 ($6.39) ($8.14) $2.21 ($6.47) ($18.03) ($9.26) $2,186 $88 $775 $1,328 $3,574 $1,788 $8,265 2.0x 3.4x 5.4x 4.3x 4.5x 6.2x 5.1x 5.9% 15.0% 16.9% 10.3% 23.1% 27.8% 18.9% 1.20 2.38 0.51 21.52 5.03 9.61 3.48 0.7% 4.6% 2.3% 14.3% 1.6% 5.6% 1.0% $496 1,036 $879 $129 $79 $175 $826 $591 $2,730 2,317 $1,315 $3,241 $47 $87 $367 $716 ($24.11) ($9.73) ($2.82) ($18.42) $4.46 $2.40 $12.98 ($3.17) $4,449 $4,760 $4,064 $1,013 $310 $681 $2,135 $1,875 8.4x 7.7x 10.1x 0.0x 15.8x 34.2x 10.8x 9.0x 0.0% 11.1% 9.1% 0.0% 14.2% 20.9% 6.9% 11.6% 1.93 3.63 1.34 4.82 0.24 0.53 3.11 1.59 2.1% 2.8% 0.9% 2.9% 3.4% 1.5% 8.8% 4.0% 8/5/2016 Technology Supply Chain August 8, 2016 Stifel Important Disclosures and Certifications I, Matthew Sheerin, certify that the views expressed in this research report accurately reflect my personal views about the subject securities or issuers; and I, Matthew Sheerin, certify that no part of my compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this research report. Our European Policy for Managing Research Conflicts of Interest is available at www.stifel.com. For applicable current disclosures for all covered companies please visit the Research Page at www.stifel.com or write to the Stifel Research Department at the following address. US Research Stifel Research Department Stifel, Nicolaus & Company, Inc. One South Street 16th Floor Baltimore, Md. 21202 The equity research analyst(s) responsible for the preparation of this report receive(s) compensation based on various factors, including Stifel’s overall revenue, which includes investment banking revenue. Our investment rating system is three tiered, defined as follows: BUY -We expect a total return of greater than 10% over the next 12 months with total return equal to the percentage price change plus dividend yield. HOLD -We expect a total return between -5% and 10% over the next 12 months with total return equal to the percentage price change plus dividend yield. SELL -We expect a total return below -5% over the next 12 months with total return equal to the percentage price change plus dividend yield. Occasionally, we use the ancillary rating of SUSPENDED (SU) to indicate a long-term suspension in rating and/or target price, and/or coverage due to applicable regulations or Stifel policies. SUSPENDED indicates the analyst is unable to determine a “reasonable basis” for rating/target price or estimates due to lack of publicly available information or the inability to quantify the publicly available information provided by the company and it is unknown when the outlook will be clarified. SUSPENDED may also be used when an analyst has left the firm. Of the securities we rate, 49% are rated Buy, 42% are rated Hold, 3% are rated Sell and 6% are rated Suspended. Within the last 12 months, Stifel or an affiliate has provided investment banking services for 15%, 7%, 0% and 13% of the companies whose shares are rated Buy, Hold, Sell and Suspended, respectively. Additional Disclosures Please visit the Research Page at www.stifel.com for the current research disclosures and respective target price methodology applicable to the companies mentioned in this publication that are within Stifel's coverage universe. For a discussion of risks to target price please see our stand-alone company reports and notes for all Buy-rated and Sell-rated stocks. The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation or needs of individual investors. Employees of Stifel, or its affiliates may, at times, release written or oral commentary, technical analysis or trading strategies that differ from the opinions expressed within. Past performance should not and cannot be viewed as an indicator of future performance. As a multi-disciplined financial services firm, Stifel regularly seeks investment banking assignments and compensation from issuers for services including, but not limited to, acting as an underwriter in an offering or financial advisor in a merger or acquisition, or serving as a placement agent in private transactions. Affiliate Disclosures “Stifel”, includes Stifel Nicolaus & Company (“SNC”), a US broker-dealer registered with the United States Securities and Exchange Commission and the Financial Industry National Regulatory Authority and Stifel Nicolaus Europe Limited (“SNEL”), Page 11 Technology Supply Chain August 8, 2016 Stifel which is authorized and regulated by the Financial Conduct Authority (“FCA”), (FRN 190412) and is a member of the London Stock Exchange. Registration of non-US Analysts: Any non-US research analyst employed by SNEL contributing to this report is not registered/qualified as a research analyst with FINRA and is not an associated person of the US broker-dealer and therefore may not be subject to NASD Rule 2711 or NYSE Rule 472 restrictions on communications with a subject company, public appearances, and trading securities held by a research analyst account. Country Specific and Jurisdictional Disclosures United States: Research produced and distributed by SNEL is distributed by SNEL to “Major US Institutional Investors” as defined in Rule 15a-6 under the US Securities Exchange Act of 1934, as amended. SNEL is a non-US broker-dealer and accordingly, any transaction by Major US Institutional Investors in the securities discussed in the document would need to be effected by SNC. SNC may also distribute research prepared by SNEL directly to US clients that are professional clients as defined by FCA rules. In these instances, SNC accepts responsibility for the content. Research produced by SNEL is not intended for use by and should not be made available to retail clients, as defined by the FCA rules. Canadian Distribution: Research produced by SNEL is distributed in Canada by SNC in reliance on the international dealer exemption. This material is intended for use only by professional or institutional investors. None of the investments or investment services mentioned or described herein is available to other persons or to anyone in Canada who is not a “permitted client” as defined under applicable Canadian securities law. UK and European Economic Area (EEA): This report is distributed in the EEA by SNEL, which is authorized and regulated in the United Kingdom by the FCA. In these instances, SNEL accepts responsibility for the content. Research produced by SNEL is not intended for use by and should not be made available to non-professional clients. Brunei: This document has not been delivered to, registered with or approved by the Brunei Darussalam Registrar of Companies, Registrar of International Business Companies, the Brunei Darussalam Ministry of Finance or the Autoriti Monetari Brunei Darussalam. This document and the information contained within will not be registered with any relevant Brunei Authorities under the relevant securities laws of Brunei Darussalam. The interests in the document have not been and will not be offered, transferred, delivered or sold in or from any part of Brunei Darussalam. This document and the information contained within is strictly private and confidential and is being distributed to a limited number of accredited investors, expert investors and institutional investors under the Securities Markets Order, 2013 ("Relevant Persons") upon their request and confirmation that they fully understand that neither the document nor the information contained within have been approved or licensed by or registered with the Brunei Darussalam Registrar of Companies, Registrar of International Business Companies, the Brunei Darussalam Ministry of Finance, the Autoriti Monetari Brunei Darussalam or any other relevant governmental agencies within Brunei Darussalam. This document and the information contained within must not be acted on or relied on by persons who are not Relevant Persons. Any investment or investment activity to which the document or information contained within is only available to, and will be engaged in only with Relevant Persons. In jurisdictions where Stifel is not already licensed or registered to trade securities, transactions will only be affected in accordance with local securities legislation which will vary from jurisdiction to jurisdiction and may require that a transaction carried out in accordance with applicable exemptions from registration and licensing requirements. Non-US customers wishing to effect transactions should contact a representative of the Stifel entity in their regional jurisdiction except where governing law permits otherwise. US customers wishing to effect transactions should contact their US salesperson. Additional information is available upon request © 2016 Stifel. This report is produced for the use of Stifel customers and may not be reproduced, re-distributed or passed to any other person or published in whole or in part for any purpose without the prior consent of Stifel. Stifel, Nicolaus & Company, Incorporated, One South Street, Baltimore, MD 21202. The recommendation contained in this report was produced at 7 August 2016 22:38EDT and disseminated at 7 August 2016 22:38EDT Page 12