ESMA LIBRARY

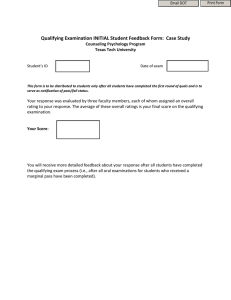

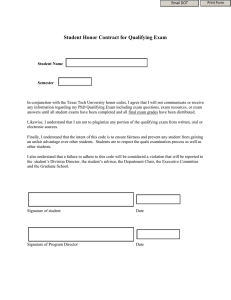

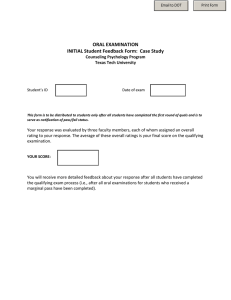

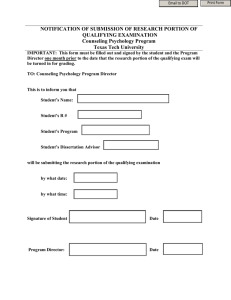

advertisement