1065 East Morehead Street, Charlotte, NC 28204 704.332.1181

advertisement

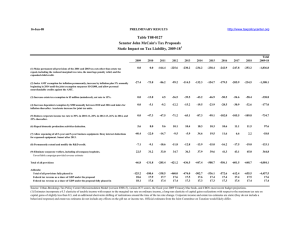

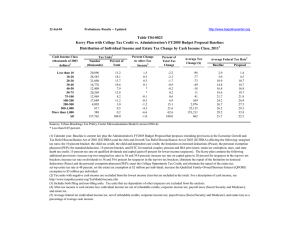

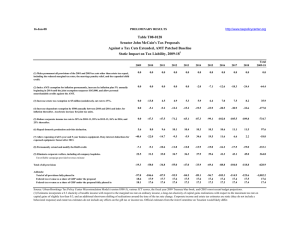

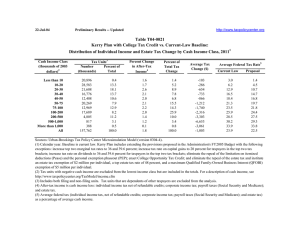

Established in 1912, Johnston, Allison & Hord offers clients an exceptional level of legal services with a uniquely personal touch. We provide thoughtful counsel that assimilates quality legal advice with pragmatic business considerations. As we celebrate our firm’s centennial, we pride ourselves on our continued ability to serve our clients’ legal needs on a variety of matters. Based in Charlotte, North Carolina, we employ over 40 attorneys specializing in a variety of practice areas, including financial services, construction, litigation, corporate, trusts and estates, employment, real estate, health care and creditors’ rights. Pictured, from left to right is the Trusts & Estates Group: First Row: Lucy Siler, Ray Farris, Holly Norvell Second Row: Darrell Shealy, David Lewis, Melissa Gray, Morry Johnston 1065 East Morehead Street, Charlotte, NC 28204 704.332.1181 www.jahlaw.com And You Thought 2010 Was Confusing? In late December 2010, a lame duck session of Congress passed and the President signed into law the 2010 Tax Act. The Act extended the so-called “Bush tax cuts,” that otherwise would have expired at the end of 2010, and provided significant taxpayer-friendly provisions for gift, estate, and generation-skipping transfer taxes. The provisions of the 2010 Tax Act are scheduled to sunset at the end of 2012, and once again we are left trying to plan for potentially valuable tax exemptions in an extremely unpredictable environment. If it feels a lot like the dilemma faced in 2010, it is, except the stakes are even higher this year. Transfer Taxes • An increase in the estate, gift, and GST tax exemptions to $5,120,000 (including the inflation index for 2012); The 2010 Tax Act made significant changes to the estate, gift, and generation-skipping transfer (GST) tax laws for 2010, 2011 and 2012. Most of these changes are favorable for the taxpayer, and all are scheduled to expire at the end of 2012. Given the uncertainty and the potential economic impact of the sunset, most estate planners recommend a thorough review of estate planning opportunities before year end. The most significant taxpayer-friendly revisions include the following: • A reunification of the estate and gift tax exemptions so that an individual can give away during life or at death the maximum exemption (through 2012); • The introduction of “portability,” which permits the estate of a surviving spouse to take advantage of the unused exemption of the first spouse to die (provided that the first death occurred in 2011 or 2012). • A reduction of the estate, gift, and GST tax rates to 35%; 2012 2013 and after 35% 55% $5,120,000 $1,000,000 Portability Of Estate Tax Exemption Yes No Top Gift Tax Rate 35% 55% $5,120,000 $1,000,000 35% 55% $5,120,000 $1,400,000 million (approximately) Top Estate Tax Rate Estate Tax Exemption Gift Tax Exemption GST Tax Rate GST Tax Exemption a $1,000,000 exemption for estate and gift tax purposes, a $1,400,000 GST exemption, and a 55% maximum rate. If Congress fails to take action before the end of 2012 (or in the early days of 2013) the estate, gift and GST tax laws in existence before the 2001 Tax Act will return in 2013. This will mean 2 Transfer Taxes Continued whether to use all or part of this exemption can be a difficult decision, and the decision depends on the total current and expected taxable estate of the client, the basis of the assets to be transferred, the potential income tax “costs” of transferring assets with a carry over basis, and the amount of assets needed to support the client through retirement. If structured properly, the $5,120,000 gift exemption that is available through the end of 2012 can remove significant assets and appreciation from the potential estate or generation-skipping transfer tax system. Estate freeze techniques that take advantage of the current low interest rate environment also are highly effective and can be combined to leverage the use of the gift exemption. These techniques, such as intra-family loans and grantor retained annuity trusts (GRATS), have been discussed in previous newsletters. The future for federal transfer taxes remains uncertain, at best. Absent any legislative relief, the 2010 Tax Act will sunset and rates and exemptions will revert to those mentioned above (before the enactment of the 2001 Tax Act). Although this is a punitive default rule, President Obama is on record supporting a $3,500,000 estate and GST tax exemption, a $1,000,000 gift tax exemption and a uniform tax rate of 45%. Republican Presidential candidate Mitt Romney is on record favoring a full repeal of the estate tax, while others in Congress support a continuation of the favorable rules in existence today. Uncertainty in the transfer tax environment produces several reactions. Many knowledgeable advisors recommend aggressively taking advantage of increased gift tax exemptions to move assets to beneficiaries before the end of 2012. Time may well be expiring on the largest estate and gift tax exemption in U.S. history. Considering Income Taxes of the itemized deductions. Most deductions will be subject to this limitation, including mortgage interest, state and local taxes, and charitable contributions. Many taxpayers’ effective tax rate will increase approximately 1%. The 2010 Tax Act extended most of the income tax benefits of the Bush tax cuts. Like the transfer tax provisions of the 2010 Tax Act, these too are scheduled to expire at the end of 2012. In 2013, the top marginal ordinary income tax rate is scheduled to increase to 39.6% from the current rate of 35%. With the addition of the “investment surtax” and additional limitations on itemized deductions, the effective top marginal rate will approach 44%. Although not part of the 2010 Tax Act because it was introduced as part of the 2010 Health Care Act, the year 2013 also will usher in a new 3.8% net investment surtax (sometimes referred to as a Medicare surtax). The surtax will be imposed on taxpayers with modified adjusted gross income in excess of $250,000 for joint filers (or $125,000 for single persons and those filing separately). The surtax will be imposed on the individual’s “net investment income.” Investment income is defined broadly as income from interest, dividends, annuities, royalties The long term capital gains tax rate will increase from 15% to 20% in 2013 (or 23.8% with the investment surtax), and dividends will again be taxed as ordinary income. Also returning in 2013 is the limitation on itemized deductions, so that itemized deductions will be reduced by an amount equal to 3% of adjusted gross income above the threshold, but not more than 80% 3 Income Taxes Continued interest rates and the Applicable Federal Rate (AFR) to record lows. In a low interest rate environment, certain estate planning techniques such as grantor retained annuity trusts, charitable lead trusts and even intra-family loans increase the likelihood that there will be remaining principal to be distributed to beneficiaries at little or no transfer tax costs. These specific techniques have been discussed in previous newsletters, but they have increased importance when considered with the political uncertainty and potential tax changes discussed in greater detail below. and rents. Notably, capital gains and certain income from partnerships and subchapter S corporations will be subject to the surtax. Also introduced as part of the 2010 Health Care Act and beginning in 2013, an additional 0.9% hospital insurance tax will be imposed on “high income” wage earners. For purposes of this additional tax, a high income taxpayer is one who has a combined wage income in excess of $200,000, or $250,000 if married filing jointly (not indexed for inflation). Planning With Low Interest Rates Uncertainty in the global equities market has caused the value of U.S. Treasuries to soar. This has pushed Like 2010, Only Worse the same. In any of those combinations it is difficult to predict what the outcome will be on the Federal transfer tax system. Many clients may recall from 2010 the challenges associated with planning in an uncertain tax environment. In 2010, the result of the potential sunset was the same (the transfer tax system as it existed before the 2001 Tax Act); however, in 2010 taxpayers had a $1,000,000 gift tax exemption instead of the $5,120,000 current gift tax exemption. Therefore, the potential reduction in value of the available exemption and corresponding planning opportunity is even more significant in 2012. Compounding this year’s uncertainty is a Presidential election as well as significant Congressional elections. Thirty-three of the 100 seats in the Senate will be contested in November. Currently, Democrats are expected to have 23 seats up for election (including two independents that caucus with Democrats), while Republicans are expected to have only 10 seats up for election. All potential combinations are “too close to call” as of the date of this newsletter. Control of the White House and both houses of Congress could change, or all could remain Universally, we encourage clients to begin the planning and thought process now. If you wait until after the elections in November to begin your planning process, you likely will not have better information than presently available to you, and you are more likely to make a hasty decision and have insufficient time to implement the plan before year-end. Our Trusts and Estates Group, like most other planners with whom we have discussed this topic, are experiencing heavy volume already in 2012 and may be unable to accommodate last minute planning decisions at the end of the year. We encourage you to contact one of the members of our Trusts and Estates Group listed on the front of this newsletter and begin the discussion around how and whether to do planning before the potential tax change that occurs at the end of 2012. 4

![----Original Message----- From: [ ] Sent: Monday, March 14, 2005 1:52 PM](http://s2.studylib.net/store/data/015588457_1-c7ec3906ed94c9019b2101e3ce2ab4ac-300x300.png)