25-October-2002-D2A-Rollout-Licensed

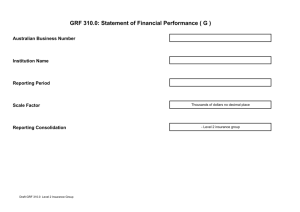

advertisement

Policy, Research and Consulting Telephone: 61 2 9210 3078 Facsimile: 61 2 9210 3021 E-Mail: steve.davies@apra.gov.au 25th October 2002 «RelatedTitle» «RelatedGivenName» «RelatedFamilyName» «RelatedPosition» «OrganisationName» «AddressLine1» «AddressLine2» «City» «State» «PostCode» Dear «RelatedGivenName» DATA SUBMISSION SOFTWARE – DIRECT TO APRA (D2A) Please find enclosed a D2A pack to be used when submitting returns under the new reporting requirements that came into force on 1 July 2002. The D2A pack includes: • The D2A Help Guide containing complete instructions on how to install D2A, how to request & install a digital certificate, and how to download & submit forms. There is also a section on frequently asked questions. • A CD-ROM containing the D2A software and an electronic version of the D2A Help Guide. • A list of the key validation checks that are built into the system. This list is provided for your reference to aid you in filling in the forms. Note 1: You will have received and may have installed a test version of D2A as part of the Open Test phase. It is important that this test version be uninstalled and the directory it was installed in deleted before installing the enclosed version of D2A. Specific instructions are at the end of this letter. Note 2: You will need to go through the process of sending in a challenge letter and requesting & installing a digital certificate, even if you had already done this for the Open Test phase. Please refer to the D2A Help Guide for specific instructions. You will by now have become familiar with the new reporting requirements and may have a number of specific questions on particular forms or items on the forms. A complete set of instructions for filling in the forms can be found on APRA’s website at www.apra.gov.au/statistics/Prudential-Forms.cfm . Queries relating to the forms and instructions should be directed to your responsible supervisor who will be able to answer your questions. From time to time we will compile a digest of questions and answers and post this on the APRA website. Questions relating to the functioning of the D2A software can be directed to the D2A Helpdesk on (02) 9210 3400. It is helpful to us if you have read the relevant parts of the D2A Help Guide before doing this. As previously advised, The new D2A quarterly reporting forms for September 2002 should be received by APRA no later than 26 November 2002. You are also required to lodge returns under the previous reporting regime for the September 2002 quarter only. These ISCGEN returns should be received by APRA no later than 12 November 2002. Yours sincerely Dr Steve Davies Head of Statistics What to do if you have another version of D2A already installed. As mentioned above you will need to uninstall any previously installed version of D2A and delete the folder that it was installed in. To do this: 1. run the Uninstall D2A function, that can be found from the Start menu under Programs then APRA tools, and follow the instructions; then 2. using windows explorer, delete the folder you installed D2A into. By default this folder is C:\D2A although you may have specified an alternative when you installed D2A Quick Reference Guide There are basically eight key steps to using D2A for the first time. Below is a list of the steps and references to the appropriate pages in the D2A Help Guide. Install D2A………………………. p1-6 Set transport options……………... p1-11 Send in a challenge letter…………p1-19 Changing you key store password...p1-21 Request a digital certificate……… p1-22 Install a digital certificate………... p1-25 Download forms…………………. p2-3 Submit completed forms………….p2-30 2 General Insurers Key Validation Checks Australian Prudential Regulation Authority 2002 Form Validation Requirement for Data item Data Item GRF 110.0 1. GRF 130.0 Off Balance Sheet Business Credit Substitutes Provided and Risk Charge The risk charge entered in the data item must agree to the total risk charge calculated in item 13. “TOTAL Off balance sheet required risk charge” in form GRF 130.0 ‘Off Balance sheet Business – Credit Substitutes Provided and Risk Charge”. GRF 110.0 2. GRF 130.2: Off Balance Sheet Business Charges Granted and Risk Charge The risk charge entered must agree to the total risk charge calculated in item “ADJUSTED REQUIRED CAPITAL CHARGE (column 10 - 11)” in form GRF 130.2 ‘Off Balance Sheet Business – Charges Granted and Risk Charge”. GRF 110.0 3. Investment Risk Charge. Must equal total investment risk charge calculated per the following forms: GRF 110.0 3.1. GRF 140.0: Investments - Direct Interest Holdings and Risk Charge The risk charge entered must agree to the sum of the individual investment risk charges calculated under column heading “Investment Capital Charge $'000” in form GRF 140.0 ‘Investments – Direct Interest Holdings and Risk Charge’. GRF 110.0 3.2. GRF 140.1: Investments - Direct Equity Holdings and Risk Charge’ The risk charge entered must agree to the sum of the investment risk charge calculated in column headed “Investment Risk (Capital) Charge $'000” in form GRF 140.1 ‘Investments – Direct Equity Holdings and Risk Charge’ for the following: Ø Ø Line items 3. “Total equity securities listed on primary board of stock exchanges” “Investment Risk (Capital) Charge $'000” for; plus Line item “4. Total not listed on primary board of stock exchanges”. GRF 110.0 3.3. GRF 140.2 ‘Investments - Direct Property Holdings and Risk Charge’ The risk charge entered must agree to the total risk charge calculated in column headed “Investment Risk (Capital) Charge $'000” for line item “Total direct property investments” in form GRF 140.2 ‘Investments - Direct Property Holdings and Risk Charge’. GRF 110.0 3.4. GRF 140.3 ‘Investments – Loans and Advances and Risk Charge’ The risk charge entered must agree to the sum of the individual risk charges in the column headed “Investment Risk (Capital) Charge $'000” in form GRF 140.3 ‘Investments – Loans and Advances and Risk Charge’ GRF 110.0 3.5. GRF 140.4 ‘Investments – Assets Indirectly Held and Risk Charge’ The risk charge entered in this field must agree to the sum of the individual investment risk charges calculated in Table 2 under the column headed “Investment Risk (Capital) Charge $'000” in form GRF 140.4 ‘Investments – Assets Indirectly Held and Risk Charge’. GRF 110.0 3.6. GRF 300.0: Position The risk charge entered must agree to the item “Total investment risk / capital charge” as calculated under column headed “Investment Risk (Capital) Charge $'000” in form ‘GRF 300.0: Statement of Financial Position – Licensed Insurer. Statement of Financial 2 Form Data Item Validation Requirement for Data item GRF 110.0 4. GRF 130.3: Off Balance Sheet Business Credit Support Received (Investment Risk Charge Reduction) The risk charge (reduction) entered in this item must agree to the sum of the investment risk charge (reduction) calculated in column headed “Adjustment to Investment Capital Charge $'000” in form GRF 130.3: Off Balance Sheet Business - Credit Support Received (Investment Risk Charge Reduction)’ for the following: Ø ‘Part A - Eligible Collateral Provided to Reporting Insurer’; plus Ø ‘Part B - Guarantees Provided to Reporting Insurer’. GRF 110.0 5. ‘GRF 150.0: Asset Exposure Concentration Risk Charge’. The risk charged entered for this item must agree to the risk charge calculated in line item “TOTAL ADJUSTED CONCENTRATION RISK CHARGE” under column headed “Investment Risk Charge on Exposure in Excess of Threshold A$'000” in form ‘GRF 150.0: Asset Exposure Concentration Risk Charge’. GRF 110.0 6. ‘GRF 160.0: Derivatives Activity and Risk Charge’ The risk charged entered must agree to the sum of the total investment risk charges for each derivative market / contract type calculated under the column headed “Investment Risk (Capital) Charge $'000” in form ‘GRF 160.0: Derivatives Activity and Risk Charge’. GRF 110.0 7. ‘GRF 170.0: Maximum Event Retention Risk Charge’. The risk charged entered must agree to the total risk / capital charge disclosed in item “Total Maximum Event Retention Charge” in form GRF 170.0: Maximum Event Retention Risk Charge. GRF 110.0 8. GRF 210.0: OCP Insurance Risk Charge The risk charged entered for this field must agree to the total Insurance Risk Charge calculated in the “TOTAL” line item under column headed “OCP Insurance Risk Charge $'000” in form GRF 210.0: OCP Insurance Risk Charge’. GRF 110.0 9. GRF 210.1: Premium Liabilities Insurance Risk Charge The risk charged entered must agree to the total Insurance Risk Charge calculated in the “TOTAL” line item under column headed “Premium Liabilities Insurance Capital Charge $'000” in form GRF 210.1: Premium Liabilities Insurance Risk Charge”. GRF 110.0 11. GRF 120.0: Determination of Capital Base The total eligible capital base entered in this item must agree with figure calculated in line item “Total Capital Base” under column headed “Eligible Capital $'000” in form GRF 120.0: Determination of Capital Base”. GRF 110.0 15. Net Assets in Australia Net Assets in Australia determined from the following: GRF 110.0 15.1. Net Assets per form GRF 300.0: Statement of Financial Position The figure for net assets in Australia reported for this data item must agree with the value calculated for “Net Assets” as reported in item 35 on either of the applicable forms: Ø ‘GRF 300.0: Statement of Financial Position – Inside Australia’ will be the appropriate forms where the insurer has business outside Australia. This form is only completed by insurers that have business outside of Australia (ie assets, liabilities, equity); or Ø ‘GRF 300.0: Statement of Financial Position – Licensed Insurer’. Will be the appropriate form where the insurer has no business outside of Australia (ie assets, liabilities, equity). 3 Form Data Item Validation Requirement for Data item GRF 110.0 15.2.1. Goodwill. The figure for goodwill entered for this data item, must agree with the value of item 14. “Goodwill” in form ‘GRF 120.0: Determination of Capital Base’. GRF 110.0 15.2.2. Other Intangible Assets. . The figure for other intangible assets entered for this data item must agree with the value of item 15. “Identifiable Intangible Assets” in form ‘GRF 120.0: Determination of Capital Base’. GRF 110.0 15.2.3. Future income tax benefits / Deferred Tax Assets (net of any Deferred Tax Liabilities). The figure for Future income tax benefits / Deferred Tax Assets (net of any Deferred Tax Liabilities) to be entered for this data field must agree with the value of item 16. “Future income tax benefits / Deferred Tax Assets (net of any Deferred Tax Liabilities)” in form ‘GRF 120.0: Determination of Capital Base’. GRF 110.0 15.3. The figure to be entered for this data field must agree with the total of all items reported in column headed “Excess of Charge Assets over Liabilities Supported” in form GRF 130.2: ‘Off Balance Sheet Business Charges Granted and Risk Charge’. GRF 120.0 Paid-up ordinary shares Assets under a fixed or floating charge, mortgage or other security to the extent of the indebtedness secured by the value of those assets. Valued entered for this data item: Ø Ø GRF 120.0 General reserves Valued entered for this data item: Ø Ø GRF 120.0 Retained profits Ø Ø Current years earnings Must Equal total of items 37.1 “General Reserve” and 37.2 “Capital Profits Reserve” and 37.5 “Other Reserves” in shareholders Equity section of GRF 300.0: Statement of Financial Position – Licensed Insurer’. Can be zero, positive or negative. Valued entered for this data item: Ø GRF 120.0 Must equal item 36.1 “Ordinary Shares” in shareholders Equity section of GRF 300.0: Statement of Financial Position – Licensed Insurer’. Must be positive. Must equal total of item 38.1 “Retained profits or accumulated losses at the end of the period” in shareholders Equity section of GRF 300.0: Statement of Financial Position – Licensed Insurer’ Must equal total of “Retained profits or accumulated losses at the end of the reporting period” as calculated in GRF 310.0: ‘Statement of Financial Performance’. Can be zero, positive or negative. Valued entered for this data item: Ø Ø Must equal total of item “Net profit or loss after income tax” as calculated in GRF 310.0: ‘Statement of Financial Performance’. Can be zero, positive or negative. 4 Form GRF 120.0 Data Item Technical provisions in excess of liability valuation Validation Requirement for Data item (A) If an amount is reported in this data item it must agree to the following calculation: 1. Sum of the values reported for the following items in form GRF 300.0: Statement of Financial Position – Licensed Insurer: Ø item 18. “Outstanding claims provision”; plus Ø item 19. “Premium Liabilities”; plus Ø item 27“Outstanding claims provision”; plus Ø item 28. “Premium Liabilities”. 2. Less the sum of the values reported for the following items: 2.1. form GRF 210.0: ‘OCP and Risk Charge’: Ø “Total OCP Gross of Reinsurance Recoveries classified as current liabilities” (total for both direct and reinsurance business); plus Ø “Total OCP Gross of Reinsurance Recoveries classified as non-current liabilities” (total for both direct and reinsurance business); plus 2.2. form GRF 210.1: ‘Premium Liabilities and Risk Charge’: Ø “Total Premium liabilities Gross of Reinsurance Recoveries classified as current liabilities” (total for both direct and reinsurance business); plus Ø “Total Premium liabilities Gross of Reinsurance Recoveries classified as non-current liabilities” (total for both direct and reinsurance business). (B) Item reported must be zero or positive. GRF 120.0 Goodwill deduction If an amount is reported in this data item it: Ø Must equal sum of item 11.1 “Goodwill” less item 11.2 “Accumulated amortisation – goodwill” in the “Intangible Assets” heading, plus any values disclosed in items 9.5.1.1 and 9.5.2.1 of the “Other Investments” heading in the non current asset section of form GRF 300.0: Statement of Financial Position – Licensed Insurer. Ø Can be zero or positive. GRF 120.0 Intangible assets deduction If an amount is reported in this data item it: Ø Ø GRF 120.0 FITB (net of PDIT) deduction Must equal sum of items 11.3 “Identifiable Intangible Assets” less 11.4 “Accumulated amortisation – Identifiable Intangible Assets” in “Intangible Assets” heading of the (non current asset section of form GRF 300.0: Statement of Financial Position – Licensed Insurer Can be zero or positive. If an amount is reported in this data item it: Ø Ø Must equal sum of items 4.4 “Total tax assets” current assets plus 12.4 “Total tax assets” non-current assets” less 21.2 “Provision for deferred income tax” current liability less 30.2 “Total income tax liability” non-current liability of GRF 300.0: Statement of Financial Position – Licensed Insurer Must be zero or positive. 5 Form Data Item Validation Requirement for Data item GRF 140.0 3. Total direct interest rate investments classified into the following (excluding government issued securities that are risk weighted above) Total value of items 4.1 to 4.5 must equal sum of values for section 1, 2 and 3, minus the values reported for items 2.10; 2.11; 2.12(i); 3.8; 3.9; 3.10(I). GRF 140.0 4. Total direct interest rate investments which represent the following Total value of Section 5 (ie sum of items 5.1 and 5.2) should equal sum of values for section 1, 2 and 3. GRF 140.1 3. Total direct equity investments which represent: 5.1 "Current Assets" and 5.2 "Non-Current Assets" Total of values disclosed for Items 5.1 and 5.2 must agree to total value of sections 3 plus total value of section 4. GRF 140.1 5. Total direct equity investments, which represent: 5.3 "Policyholders" funds and 5.4 "Shareholders" funds. If values are entered for items 5.3 and 5.4, the sum of the values entered for these items should agree to total value of sections 3 plus total value of section 4. GRF 140.1 7. Total direct equity investments of Licensed Insurer which represent exposure to the following sectors: Total value of items listed in section 7 should equal the sum of the value of item 3 plus value of item 4. GRF 140.2 1. Total direct property investments which represent 1.1 "Current Assets" plus 1.2 "Non-Current Assets" Total value of items 1.1 plus items 1.2 must agree to total value reported for item “Total direct property investments”. GRF 140.2 1. Total direct equity investments, which represent: 1.3 "Policyholders" funds and 1.4 "Shareholders" funds If values are entered for items 1.3 and 1.4, the sum of the values entered for these items should agree to total value reported for item “Total direct property investments” GRF 140.3 2. Total loans and advances which can be classified into the following: Total of items 2.1 to 2.5 must agree to value calculated for “Total Loans and Advances”. GRF 140.4 Table 2 - total of all items under section 7 must agree to the total value of “Total holdings” as per table 1. 6 Form Data Item Validation Requirement for Data item GRF 150.0 Capital Base Value entered for ‘capital base’ data item must agree to the figure calculated in line item 45 “Total Capital Base” under column headed “Eligible Capital $'000” in form GRF 120.0: Determination of Capital Base”. GRF 210.0 Total OCP Gross of Reinsurance Recoveries Classified as Current Liabilities $'000 The total reported for “OCP Gross of Reinsurance Recoveries Classified as Current liabilities” in GRF 210.0: ‘OCP and Risk Charge’, must not be less than the value of item 18 ‘Outstanding Claims Provision’ as reported in form GRF 300.0: Statement of Financial Position – Licensed Insurer. GRF 210.0 Total OCP Gross of Reinsurance Recoveries Classified as Non-Current Liabilities $'000 The total reported for “OCP Gross of Reinsurance Recoveries Classified as Non - Current liabilities” in GRF 210.0: ‘OCP and Risk Charge’, must not be less than the value of item 27 ‘Outstanding Claims Provision’ as reported in form GRF 300.0: Statement of Financial Position – Licensed Insurer. GRF 210.1 Total Premium Liabilities Gross of Reinsurance Recoveries Classified as Current Liabilities $'000 The total reported for “Premium Liabilities Gross of Reinsurance Recoveries Classified as Current liabilities” in GRF 210.0: ‘OCP and Risk Charge’, must not be less than the value of item 19 ‘Premium Liabilities’ as reported in form GRF 300.0: Statement of Financial Position – Licensed Insurer. GRF 210.1 Total Premium Liabilities Gross of Reinsurance Recoveries Classified as Non-Current Liabilities $'000 The total reported for “Premium Liabilities Gross of Reinsurance Recoveries Classified as Non - Current liabilities” in GRF 210.0: ‘OCP and Risk Charge’, must not be less than the value of item 28 ‘Premium Liabilities’ as reported in form GRF 300.0: Statement of Financial Position – Licensed Insurer. GRF 300.0 Item 3. “Investments Integral to Insurance Operations” (ie current asset) and Item 8 “. “Investments Integral to Insurance Operations” (ie non-current asset). The sum of the values reported for item 3. “Investments Integral to Insurance Operations” (ie current asset section) and Item 8 “. “Investments Integral to Insurance Operations” (non-current asset section) In form GRF 300.0: ‘Statement of Financial Position – Licensed Insurer’, must agree to the sum of the following: Ø Total fair / market value reported for item headed “Total direct interest rate investments” (ie represents total value of items reported in sections 1, 2 and 3) in form GRF 140.0: Investments – Direct Interest Rate Holdings; plus Ø Total fair / market value reported for item 5.1. “Total direct equity investments which represent; current assets” plus item 5.2. “Total direct equity investments which represent; non-current assets“ in form GRF 140.1: Investments – Direct Equity Holdings; plus Ø Total fair / market value for item 1.1 “Total direct property investments which represent; current assets”, plus item 1.2. “Total direct property investments which represent; non-current assets” in form GRF 140.2: Investments – Direct Property Holdings and Risk Charge; plus Ø Total Balance Outstanding Net of Provision for item headed “Total Loans and advances” in form GRF 140.3: Investments – Loans and Advances and Risk Charge; plus Ø Total Closing Value for item headed “Total holdings” in table 1 of forms GRF 140.4: Investments – Assets Indirectly Held by the Insurer. GRF 300.0 Item 38.1 “Retained profits or accumulated losses at the end of the reporting period” Item 38.1 must equal “Retained profits or accumulated losses at the end of the reporting period” must equal the item equal “Retained profits or accumulated losses at the end of the reporting period” per form GRF 310.0: Statement of Financial Performance’. 7 Validation Requirement for Data item Form Data Item GRF 310.0 “Total premium revenue from Direct business” Total premium revenue from Direct business must equal “Total Premium Revenue” from direct business per form GRF 310.1: Premium Revenue and Reinsurance Expense. GRF 310.0 “Total premium revenue from Inwards Reinsurance” Total premium revenue from Inwards Reinsurance must equal “Total Premium Revenue” from reinsurance business per form GRF 310.1: Premium Revenue and Reinsurance Expense GRF 310.0 “Outwards reinsurance expense” “Outwards reinsurance expense relating to future years cover” plus “Outwards reinsurance business relating to current and prior years cover” must equal Total “Reinsurance Expense” per form GRF 310.1: Premium Revenue and Reinsurance Expense GRF 310.0 “Claims expense associated with direct business - Relating to future years”; and “Claims expense associated with reinsurance business - Relating to future years”. The sum of the following items must agree to the change in the value of Premium Liabilities (disclosed as a current liability plus non-current liability) from the last quarter to the current quarter per form GRF 300.0: Statement of Financial Position – Licensed Insurer: GRF 310.0 “Claims expense associated with direct business relating to current and prior years” “Claims expense associated with direct business relating to current and prior years” must equal value reported for “Total Claims Expense from direct business” per form GRF 310.2: ‘Claims Expense and Reinsurance Recoveries’. GRF 310.0 “Claims expense associated with reinsurance business relating to current and prior years” “Claims expense associated with reinsurance business relating to current and prior years” must equal value reported for “Total Claims Expense from reinsurance business” per form GRF 310.2: ‘Claims Expense and Reinsurance Recoveries’. GRF 310.0 “Reinsurance recoveries revenue relating to future years (ie premium liabilities)” “Reinsurance recoveries revenue relating to future years (ie premium liabilities)”, must agree to the value of the change from current quarter to prior quarter in the total value of “Expected Reinsurance Recoveries” (recorded as both a current asset and a non-current asset) per form GRF 300.0: Statement of Financial Position – Licensed Insurer. GRF 310.0 “Reinsurance recoveries revenue relating to current years (ie OCP)” “Reinsurance recoveries revenue relating to current years (ie OCP)”, must agree to the value reported for “Total reinsurance recoveries received / receivable” for all lines of business in form GRF 310.2: Statement of Claims Expense and Reinsurance Recoveries. GRF 310.0 “Investment income” Value reported for “Investment income” must equal value reported for “Total Investment Income” in form GRF 310.3: ‘Investment and Operating Income and Expense’. GRF 310.0 “Other operating income” Value reported for “Other operating income” must equal the value reported for “Total other operating income” in form GRF 310.3: ‘Investment and Operating Income and Expense’. GRF 310.0 “Other operating expenses” Value reported “Other operating expenses” must equal the value reported for “Total Operating Expenses” per form GRF 310.3: ‘Investment and Operating Income and Expense’. GRF 310.1 Cross form validations Applicable cross form validations covered under form GRF 310.0 above. Ø Ø “Claims expense associated with direct business - Relating to future years”; plus “Claims expense associated with reinsurance business - Relating to future years”. 8 Form Data Item Validation Requirement for Data item GRF 310.2 Cross form validations Applicable cross form validations covered under form GRF 310.0 above. GRF 310.3 Cross form validations Applicable cross form validations covered under form GRF 310.0 above. GRF 420.0 Total Premium Revenue Where the insurers operations are only inside Australia, the total premium revenue reported in column headed “TOTAL” in line item headed “Total business” on form GRF 420.0: Premium Revenue by State and Territory of Australia, must agree to the value reported under column headed “Total premium revenue” in line item headed “TOTAL” in form GRF 310.1: ‘Premium Revenue and Reinsurance Expense’. GRF 430.0 Total Claims Expense Where the insurers operations are only inside Australia, the total claims expense reported in column headed “TOTAL” in line item headed “Total business” on form GRF 430.0: Claims Expense by State and Territory of Australia, must agree to the value reported under column headed “Total Claims Expense” in line item headed “TOTAL” in form GRF 310.2: ‘Claims Expense and Reinsurance Recoveries’. 9