2015 Annual Report – print- and mobile version

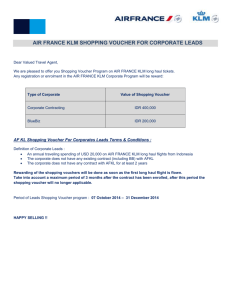

advertisement