2 0 16

Investment Directions

SEPTEMBER 2016

Entering the Homestretch to the U.S. Election

Judging by the frequency of questions we are asked these days about the

implications of the upcoming U.S. election, it has become top of mind for many—

if not most—investors. And for good reason: To say the least, this has been an

unusual election in the United States and regardless of which candidate you

support, we can all agree that the November election will be historic in many

ways. With the election now entering the homestretch, the market will be closely

following the political machinations in the United States.

Looking Beyond the Cycle

The long-term implications of either Hillary Clinton or Donald Trump winning will likely

have less of an impact on the market than many investors are anticipating. If history is

any guide, election results have had a relatively minimal impact on longer-term U.S. or

global equity returns. What matters more: Growth, earnings, interest rates, inflation—

and how Federal Reserve (Fed) policy responds to all of those.

Swing States

Should it occur, volatility is likely to persist across the broad market, but specific sectors

may be particularly vulnerable or, conversely, offer some opportunity. Among those to be

cautious on is health care. The sector has historically underperformed in election years,

due in large part to concerns over pricing pressure. There could well be longer-term

implications on policy changes, but any significant changes to the health care system

will likely take years. Financials could be affected in a similar fashion.

Counting the Ballots

There are likely still to be many twists and turns ahead in this most curious election,

but a few trends have emerged. Partisanship and gridlock show no signs of ending.

And policies of the next administration will be shaped by rising populist sentiment

in the country, including opposition to global trade, which could be a headwind to

growth. In short, uncertainty and volatility are unlikely to end on November 8.

WHAT’S NEW:

�Upgrade China to (slight)

Overweight – Pg. 6

�Downgrade Municipal Bonds to

Neutral – Pg. 8

�A Bridge to Somewhere? – Pg. 9

Ap

pe

Less R

is k

Vulnerable Incumbents

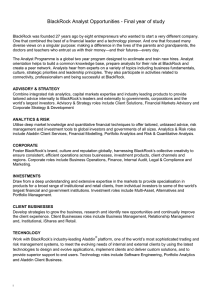

RISK APPETITE DIAL

M

o

e

tit

last

month

etite

App

sk

Ri

re

Over the short term, however, the election cycle can influence markets in

unpredictable ways. Historically, volatility typically picks up in the month before a

U.S. election. Given that markets have been unusually quiet the last several weeks,

a spike in volatility could be unnerving.

Risk Appetite Index

Investor risk appetite tempered in

August after spiking in July when

markets bounced back after a sell-off

following the Brexit result. Although

the S&P 500, as well as other indexes,

reached new highs last month, mixed

data suggested that uneven economic

growth, as well as the policies

implemented to spur it, are still cause

for concern. Nevertheless, global

exchange traded products brought in

$39.8 billion in August; year-to-date

flows are now ahead of 2015’s pace on

the strength of flows into U.S. equities

and emerging markets. Both EM

equity and debt funds are gathering

assets at record year-to-date paces.

United States

Turning Insight Into Action

U.S. economic activity is mixed,

earnings are lackluster and stock

prices remain elevated. Slower Fed

tightening could support the asset

class, but selectivity is important in

the U.S. market, where value will vary

by sector and individual company.

Consider blending opportunities for

core market exposure with highconviction active solutions that focus

on finding value in the market.

C ONSIDER

iShares Core Dividend Growth ETF

(DGRO), iShares Edge MSCI Min Vol

USA ETF (USMV), Basic Value Fund

(MABAX), Global Dividend Fund

(BIBDX), Equity Dividend Fund

(MADVX)

We remain neutral on U.S. equities. U.S. stocks finished the summer again

approaching all-time highs, but autumn brings with it two important events that are

commanding our attention. The first is the contentious U.S. election, which enters its

final stretches with the onset of the debates, and which will be the major focus for

investors for the next couple of months. The second may take longer than the election

cycle to play out, but looms larger over investors’ heads today, and that is, of course, the

actions of the Federal Reserve. The uncertainty brought about by almost weekly

changes in the forecast is causing shifts in the tides for investors.

Macro data continues to ebb and flow. After two consecutive months of flow in monthly

jobs data, the August report provided some ebb, cooling off from the torrid pace set

early in the summer. At the same time, the Institute of Supply Management surveys

have also slowed, putting doubt into investors' minds about the probability of a

September rate hike. Yet Fed officials, including Chair Yellen, have emphasized the

"strengthening" of the case for another rate hike.

When you add all this together, it's clear that uncertainty rules. The experience of 2016

so far has taught us that big periods of multiple expansion, or contraction, have

followed the establishment of some degree of certainty, like the first rate hike or the

Brexit vote. Going forward, this means that the recent range-bound regime may not

change until we receive further clarity from the election and the Fed's next move, which

could come as soon as the end of the month. Meanwhile, as we’ve long emphasized,

without earnings growth, we favor companies with healthy balance sheets (profitable,

consistent and light on leverage) and dividend growers.

EQUITY VOLATILITY AROUND U.S. ELECTIONS

1992-2016

30

Election

VIX LEVEL

25

20

15

10

120

90

60

30

0

30

60

DAYS BEFORE/AFTER ELECTION

High - Low Range

Average

2016

Sources: BlackRock Investment Institute, Bloomberg.

Notes: Chart shows the VIX before and after the November presidential elections from 1992-2012, excluding 2008

due to its outlier status.

[2]

BB LL AA CC KK RR OO CC KK II N

N VV EE SS TT M

M EE N

N TT D

D II RR EE CC TT II OO N

N SS

International Developed Markets

We remain underweight European equities. The latest PMI data in the euro

area suggest contained contagion from the Brexit vote in the United Kingdom.

However, the outlook for the region remains uncertain. For example, the latest

ZEW and Ifo surveys from Germany have pointed in different directions in terms of

investors’ take on the region’s outlook. Both inflation and inflation expectations

also continue their weak trend. The European Central Bank is expected to take

further action, although the lack of immediate negative spillover from the United

Kingdom has likely bought the governing council time. While it is highly likely that

it would need to extend its QE program, the actual timing of the announcement

may well be later this year.

EUROPE: EXPECTATIONS OF GROWTH TICKED UP WHILE

BUSINESS EXPECTATIONS SLIPPED

110

80

105

40

100

0

95

-40

90

-80

85

2/12

8/12

2/13

8/13

2/14

ZEW Expectation of Economic Growth (LHS)

8/14

2/15

8/15

2/16

8/16

Ifo Business Expectations (RHS)

Source: Bloomberg, as of 8/31/16.

SEP T EMBER [3]

Turning Insight Into Action

Selectivity is key. Consider using an

active manager with strong stock

selection expertise or be selective

with index-based exposures.

C ONSIDER

Global Long/Short Equity Fund

(BDMIX), Global Dividend Fund

(BIBDX), Global Allocation Fund

(MALOX), iShares MSCI Canada ETF

(EWC), iShares Edge MSCI Min Vol

Europe ETF (EUMV), iShares

International Select Dividend ETF (IDV)

We remain neutral on Japanese stocks. Confusion in the Japanese market remains

a central theme for 2016. A sharp sector rotation in August has seen cyclical

stocks, particularly financials, rally without much of an improvement in data to

support the rotation. The Bank of Japan (BoJ) is quickly becoming the largest

shareholder in the Nikkei 225, driving performance differences between local

indexes. BoJ Governor Haruhiko Kuroda used his concluding remarks at the

Jackson Hole symposium to emphasize the BoJ will act “without hesitation” and

defend negative rates as a “powerful tool.” Yet speculation of the bank’s purchase

activity at the long end of the Japanese government bond curve, thought to help

steepen the curve for the aid of financial institutions, could backfire without credit

creation. Japanese stocks may need a stronger or more singular catalyst than

central bank action to drive further gains.

JAPAN 10-YEAR JGB YIELD

2.5

2.0

YIELD %

1.5

1.0

0.5

0.0

-0.05

-0.5

1998

2000

2002

2004

2006

2008

2010

2012

Sources: Thomson Reuters Datastream, BlackRock Investment Institute, as of 9/1/16.

[4]

BLACKROCK INVESTMENT DIRECTIONS

2014

2016

We remain cautious toward the United Kingdom. The Bank of England (BoE)

introduced the largest stimulus package since 2009 and cut the base interest rate

by 25 basis points to 0.25%, leaving the door wide open for further cuts this year in

order to fight a potential slowdown of the U.K. economy following the Brexit vote.

The stimulus package included an increase in gilt and corporate bond purchases

and an introduction of the new Term Funding Scheme (TFS), which could support

profitability of commercial banks that could be weighed down by reduction in the

benchmark rate. The BoE stimulus supported U.K. assets on both the equity and

fixed income sides. Meanwhile, U.K. data showed some resilience post the Brexit

vote: The business sentiment dip that we saw in July reversed in August, with both

manufacturing and services PMIs strongly rebounding back into expansion territory.

While the reversal shows that the initial reaction of businesses had been somewhat

overblown, the details around Brexit negotiations are still unclear. Such protracted

uncertainty could weigh on business sentiment as well as investment and hiring

decisions going forward. We continue to prefer U.K. large caps to domestically

oriented small and mid-caps as GBP weakness post the Brexit vote could further

support earnings growth of U.K. exporters.

U.K. BUSINESS SENTIMENT HAS REBOUNDED

65

60

55

53.3

52.9

50

45

2/14

8/14

2/15

8/15

U.K. Manufacturing PMI

2/16

8/16

U.K. Services PMI

Source: Bloomberg, 8/31/16.

Canada shows signs of earnings improvement. Earnings growth has been tough

to come by in Canada in recent years, but the outlook appears to be brightening.

If current estimates prove correct, Canadian earnings will grow as much as 20% during

2017, representing only the second year of earnings growth since 2011. The profits

downturn during the past two years can be almost entirely attributed to the commodity

price collapse since mid-2014 and the effect this had on energy and materials sector

earnings. By contrast, earnings estimates for resource sectors have turned sharply

higher for this year and next, reflecting expectations for stable to slightly higher prices

for precious metals, industrial metals and crude oil, as well as leaner operations

following sharp cuts to capex and employment. Whether this pace of earnings growth

is achievable remains to be seen: The most recent meeting of the Bank of Canada

raised cautionary overtones about the outlook for the Canadian economy.

SEP TEMBER [5]

Emerging Markets

Turning Insight Into Action

The stars may be aligned for a rally in

emerging markets, at least in the short

term, but investors should be aware of

the risks and remain very selective.

Consider accessing specific countries

or regions, or use an active manager

with expertise to identify potential

opportunities.

C ONSIDER

iShares Core MSCI Emerging Markets

ETF (IEMG), iShares MSCI India ETF

(INDA), iShares Edge MSCI Min Vol

Emerging Markets ETF (EEMV), Total

Emerging Markets Fund (BEEIX)

We are overweight emerging market equities. Given recent macroeconomic data, we

see potential upside to consensus estimates of global growth, which, combined with the

continued slow path of interest rate normalization in the United States, supports EM

currency stability, as well as commodity prices and recovery in emerging market export

growth. From a fundamental perspective, we are seeing positive macro adjustments

across many EM economies, which is starting to feed into upgrades of corporate

earnings. Meanwhile, valuations remain attractive in comparison to developed markets

and the asset class is broadly underowned in global portfolios. We see a sudden

appreciation in the U.S. dollar as the main risk to our outlook to emerging markets,

although this is not our base case scenario. We continue to favor countries with reform

catalysts and solid economic improvements, including India and ASEAN countries.

EM EARNINGS REVISIONS AND EXPORTS

75

ANNUAL CHANGE (%)

50

25

0

-25

-50

9/06

9/07

9/08

Exports

9/09

9/10

9/11

9/12

9/13

9/14

9/15

9/16

MSCI Emerging Market 12-Month Forward Earnings

Sources: Thomson Reuters, MSCI Emerging Market Index, as of 9/3/2016.

We've become more constructive and are slightly overweight China. As expected,

macroeconomic indicators have been showing signs of a moderate deceleration as

the impact of stimulus earlier in the year fades. We continue to see China’s economic

transition as ongoing, yet we expect a nonlinear growth path as policymakers juggle

between fiscal and monetary stimulus, and structural reform. After months of slow

and steady devaluation, the renminbi has found some stability; the currency will be

added next month to the IMF Special Drawing Rights basket, which should provide

further support. Going forward, many of the risks, including lower GDP growth rates,

seem to be priced into Chinese stock markets. We believe China offers selective

opportunities for long-term investors and have a preference for offshore equities,

mostly based on valuations.

[6]

BLACKROCK INVESTMENT DIRECTIONS

We are overweight India. The country continues to demonstrate the best structural

growth profile among emerging markets, in our view. Measures of domestic consumption

continue to pick up and should help support growth for the remainder of the year.

Despite an uptick in inflation over the summer, the data overall continue to point toward

moderation in prices and reinforce the central bank’s easing bias. Sustained government

capital expenditure is also likely to help support a recovery in corporate earnings.

Meanwhile, structural reform momentum continues, including recent further

liberalization of foreign direct investments and noteworthy progress in the process

of reforming the country’s tax system. Private investment remains the missing link.

3,000

5,000

2,500

3,500

MILLIONS OF USD

BILLIONS OF INR

INDIAN GOVERNMENT EXPENDITURE AND FDI

2,000

2,000

2/12

5/12

8/12

11/12

2/13

5/13

8/13

11/13

2/14

5/14

8/14

11/14

Government Consumption - 1yr Moving Avg. (LHS)

2/15

5/15

8/15

11/15

2/16

5/16

Gross FDI - 1yr Moving Avg. (RHS)

Source: Thomson Reuters Datastream, as of 5/13/16.

We have a long-term favorable outlook for the ASEAN region. Growth in the region

has been picking up, partly reflecting the impact of fiscal stimulus in Indonesia.

The region is benefiting from many of the same tailwinds as other emerging markets,

while significant economic adjustments are now behind us. The latter have allowed for

interest rate cuts in many countries, and the global outlook provides space for further

monetary policy accommodation. Prospects of political change are driving expectations

of structural reform and fiscal stimulus across the region—particularly in areas such as

infrastructure—which would bolster growth. Valuations remain on the cheaper side,

particularly in comparison to developed markets and other emerging regions.

We maintain our neutral stance on Brazil. The presidential impeachment saga seems to

have reached an end. With a new president sworn in, market focus is likely to shift toward

the new administration and its ability to deliver on reform promises. Although a new

government committed to policy changes may go a long way toward restoring investor

confidence, the approval process for many necessary structural reforms will be

complicated and may result in a higher degree of political uncertainty going forward.

Strong performance this year indicates that good news has been embedded into

markets and therefore, there is room for disappointment. From an economic perspective,

the Brazilian economy is showing the first signs of a turnaround from one of the country’s

deepest recessions in history, but we do not anticipate a fast economic recovery.

SEP T EMBER [7]

Fixed Income

With interest rates still at historic lows

in the United States, fixed income

investors continue to face challenges

in their bond portfolios.

Manage Interest Rate Duration

Consider a flexible strategy with the

ability to actively manage duration.

CONSIDER

Strategic Income Opportunities Fund

(BSIIX), Strategic Municipal

Opportunities Fund (MAMTX), Global

Long/Short Credit Fund (BGCIX)

Manage Interest Rate Risk

Seek to reduce interest rate risk

through time by using a diversified

bond ladder and matching term

maturity to specific investing needs.

CONSIDER

iBonds® ETFs

Seek Income

Cast a wider net for income while

seeking to carefully balance the

tradeoffs between yield and risk.

With the dollar more stable, seek

opportunities outside the U.S.

CONSIDER

Multi-Asset Income Fund (BIICX), High

Yield Bond Fund (BHYIX), Strategic

Global Bond Fund (MAWIX), iShares

iBoxx $ High Yield Corporate Bond ETF

(HYG), iShares iBoxx $ Investment Grade

Corporate Bond ETF (LQD), iShares

International Treasury Bond ETF (IGOV),

iShares National Muni Bond ETF (MUB),

National Municipal Fund (MANLX)

Build a Diversified Core Action

Consider using core bonds for potential

diversification benefits and possible

protection from unforeseen shocks to

equity markets.

CONSIDER

Total Return Fund (MAHQX), iShares

Core U.S. Aggregate Bond ETF (AGG),

iShares Edge U.S. Fixed Income

Balanced Risk ETF (FIBR), iShares Core

International Aggregate Bond ETF

(IAGG), iShares TIPS Bond ETF (TIP)

We remain neutral U.S. Treasuries. Interest rates have broken out of their range and

moved higher on a significant increase in volatility surrounding uncertain global

central bank policy evolution. The back end of global curves appears more

vulnerable, leaving less support for longer duration bonds. For the longer-term, TIPS

also provide some attractive opportunities as valuations are compelling compared

to the future inflation outlook.

We maintain a benchmark view in high yield. Yield levels have compressed compared

to earlier in the year and rising risk-free rates make the prospect of further price

appreciation challenging. Income remains an attractive source of return, but

heightened downside risks versus valuations keep us neutral.

We remain overweight investment grade corporates. While spreads have recently

stabilized after several months of tightening, fundamentals remain intact as global

demand for high quality income persists.

We have downgraded municipal bonds to neutral. Municipal bond valuations have

tightened significantly over the past few months, and in the near term supply and

demand technicals could worsen. Higher risk-free rates and steeper curves also

challenge the near-term outlook. Longer term, municipal bonds' consistent,

tax-preferred income makes them a core holding for income-seeking investors, but

rate risks and valuations drop this sector to neutral.

We are neutral on non-U.S. developed market debt. The absolute level of yields

makes most of this sovereign debt challenging on a risk/return basis. There is also

vulnerability to currency volatility, as evidenced by the reaction to hawkish Fed

posturing and dollar strengthening in late August.

We remain overweight EM debt. While spreads have tightened significantly over the

course of the year and further tightening may be limited, we believe that the global

backdrop of low/negative rates will result in ongoing demand for higher yielding

assets such as EM debt. That said, we favor hard currency EM debt over local

currency due to USD currency volatility that is likely to persist as the Fed wrestles

with the timing of the next rate hike.

J.P. MORGAN EMBI GLOBAL SPREAD

600

550

SPREAD (bps)

Turning Insight Into Action

500

450

400

350

300

12/15

[8]

1/16

2/16

Source: Bloomberg, as of 9/8/16.

BLACKROCK INVESTMENT DIRECTIONS

3/16

4/16

5/16

6/16

7/16

8/16

9/16

Hot Topic: A Bridge to Somewhere?

In an election marked by wide differences on most policies, there is one area of

rare agreement between Hillary Clinton and Donald Trump: The need to increase

spending on infrastructure projects. (They disagree on how to fund such spending.)

Indeed, a growing consensus of the need for increased infrastructure project

spending is a global trend. In Japan, the government announced in July a 28 trillion

yen ($273 billion) stimulus package, of which 13.5 trillion yen ($132 billion) is

earmarked as fiscal spending, with the main focus on public infrastructure projects.

Similarly, the United Kingdom appears ready to incorporate aggressive stimulus.

An important catalyst for the interest in increased infrastructure spending is a

sense that monetary policy as a way to boost growth seems to have reached its

effectiveness. It is no coincidence that countries like Japan, which has been

engaged in a multi-year quantitative easing program, or the United Kingdom, facing

its first recession since the financial crisis, are the ones moving forward with the

effort. And in the United States, San Francisco Fed President John Williams recently

published a paper discussing the importance of fiscal policy for longer-run goals.

Turning Insight Into Action

To gain exposure to global

infrastructure companies, investors

may want to consider the iShares

Global Infrastructure ETF (IGF). For

U.S. exposures, clients may consider

the iShares Transportation Average

ETF (IYT) or the iShares U.S.

Industrials ETF (IYJ).

Meanwhile, central bank policies, which have pushed interest rates to all-time lows

(even negative in many cases), have driven down the cost to borrow. This has

conveniently created an environment that could be advantageous for funding

stimulus programs. Using government debt to finance infrastructure projects is the

cheapest it’s been in decades.

This bodes well for companies working on infrastructure projects—but comes with

some significant caveats. It is important to note that there will most likely be a

significant delay between proposals of greater infrastructure spending and passage

of bills to actually disburse money, as the example of President Obama’s stimulus

program in 2009 shows. And even if there is some consensus on the issue, one

should not underestimate the ongoing political gridlock in the United States.

Still, should the stars align for greater infrastructure spending, equity sectors and

industries related to infrastructure activities, like industrials or transportation in

the United States specifically, may stand to benefit.

8

13

12

11

10

9

8

7

6

5

4

3

ANNUALIZED GDP (%)

6

4

2

0

-2

-4

-6

-8

-10

5/07 11/07 5/08 11/08 5/09 11/09 5/10 11/10 5/11 11/11 5/12 11/12 5/13 11/13 5/14 11/14 5/15 11/15 5/16

U.S. GDP

Eurozone GDP

Japan GDP

U.K .GDP

Cumulative Central Bank Balance Sheet Assets

CUMULATIVE BALANCE SHEET ASSETS ($tn)

IMPACT OF EXPANSIVE CENTRAL BANK STIMULUS ON GDP

Sources: Thomson Reuters Datastream, National Statistics Offices, global central banks, BlackRock Investment Institute, as of 8/22/16.

Note: The GDP lines show the year-over-year GDP growth for specific economies. The cumulative central bank balance sheet assets line sums USD balance sheet assets for the Federal

Reserve, European Central Bank, Bank of Japan and Bank of England.

SEP T EMBER [9]

DRILLING DOWN: EQUITY AND FIXED INCOME OUTLOOKS

OUR VIEW AND OUTLOOK

Global Region

neutral

underweight

United States

Canada

Eurozone

United Kingdom

DEVELOPED MARKETS

overweight

North America

Asia Pacific

Japan

Asia Pacific

China

India

South Korea

Brazil

Mexico

underweight

neutral

overweight

U.S. TIPS

U.S. Investment Grade Credit

U.S. High Yield Credit

U.S. Municipals

U.S. Mortgage-Backed Securities

Non-U.S. Developed Markets

Emerging Markets

U.S. Treasuries

underweight

Gold

– unattractive

neutral

+ attractive

underweight outlook

slightly underweight outlook

slightly overweight outlook

overweight outlook

neutral

David Kurapka, Editor, is Head of Investment Communications

for the ISI group.

Stephen Laipply is Product Strategist for BlackRock’s ModelBased Fixed Income Portfolio Management Group.

Kurt Reiman is BlackRock’s Chief Investment Strategist for

Canada and is a member of the BlackRock Investment

Institute (BII).

Heidi Richardson is the Head of Investment Strategy for U.S.

iShares, part of the ISI group.

Latin America

Fixed Income Sector

Heather Apperson is an Investment Strategist for the iShares

Investment Strategies and Insight (ISI) group.

Maria Eugenia Heyaca is an Investment Strategist for the

ISI group.

Europe

EMERGING MARKETS

Contributors

Matt Tucker, CFA, is the Head of North American Fixed Income

iShares Strategy within BlackRock’s Fixed Income Portfolio

Management team.

Tushar Yadava is an Investment Strategist for the ISI group.

Madeline Zeiss is an Analyst for the ISI group.

overweight

current neutral outlook

LET US KNOW…

How do you use this market commentary and do

you find it useful? Please share your feedback

and any questions or concerns you have at

blackrockinvestments@blackrock.com.

You also can find the latest market

commentary from the Investment Strategy

Group at BlackRockblog.com, BlackRock.com

and iShares.com.

Underweight: Potentially decrease allocation

Neutral: Consider benchmark allocation

Overweight: Potentially increase allocation

This information is strictly for illustrative and educational purposes and is subject to change. This information does not represent the actual current, past or future holdings or portfolio of any

BlackRock client.

[10]

BLACKROCK INVESTMENT DIRECTIONS

WHY BLACKROCK®

BlackRock helps people around the world, as well as the world’s largest institutions and governments, pursue their

investing goals. We offer:

}A comprehensive set of innovative solutions, including mutual funds, separately managed accounts,

alternatives and iShares® ETFs

} Global market and investment insights

} Sophisticated risk and portfolio analytics

We work only for our clients, who have entrusted us with managing $4.89 trillion, earning BlackRock the distinction

of being trusted to manage more money than any other investment firm in the world.*

Want to know more?

blackrock.com

* Source: BlackRock. Based on $4.89 trillion in AUM as of 6/30/16.

SEP T EMBER [11]

This material represents an assessment of the market environment as of the date indicated; is

subject to change; and is not intended to be a forecast of future events or a guarantee of future

results. This information should not be relied upon by the reader as research or investment advice

regarding the funds or any issuer or security in particular. The strategies discussed are strictly for

illustrative and educational purposes and should not be construed as a recommendation to

purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. There is no

guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other

transactions costs, which may significantly affect the economic consequences of a given strategy

or investment decision. This document contains general information only and does not take into

account an individual's financial circumstances. An assessment should be made as to whether the

information is appropriate in individual circumstances and consideration should be given to talking

to a financial advisor before making an investment decision.

Carefully consider the Funds’ investment objectives, risk factors, and charges

and expenses before investing. This and other information can be found in the

Funds’ prospectuses or, if available, the summary prospectuses which may be

obtained by visiting iShares.com or BlackRock.com. Read the prospectus

carefully before investing.

Investing involves risk, including possible loss of principal.

The BlackRock funds are actively managed and their characteristics will vary. Investing in long/

short strategies presents the opportunity for significant losses, including the loss of your total

investment. Such strategies have the potential for heightened volatility and, in general, are not

suitable for all investors.

International investing involves risks, including risks related to foreign currency, limited liquidity, less

government regulation and the possibility of substantial volatility due to adverse political, economic

or other developments. These risks often are heightened for investments in emerging/developing

markets, in concentrations of single countries or smaller capital markets. Frontier markets involve

heightened risks related to the same factors and may be subject to a greater risk of loss than

investments in more developed and emerging markets. There is no guarantee that any fund will

pay dividends.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is

a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will

not be able to make principal and interest payments. There may be less information on the financial

condition of municipal issuers than for public corporations. The market for municipal bonds may

be less liquid than for taxable bonds. Some investors may be subject to federal or state income

taxes or the Alternative Minimum Tax (AMT). Capital gains distributions, if any, are taxable.

Noninvestment-grade debt securities (high-yield/junk bonds) may be subject to greater market

fluctuations, risk of default or loss of income and principal than higher-rated securities.

The iShares Currency Hedged Fund's use of derivatives may reduce the Fund's returns and/or

increase volatility and subject the Fund to counterparty risk, which is the risk that the other party

in the transaction will not fulfill its contractual obligation. The Fund could suffer losses related to its

derivative positions because of a possible lack of liquidity in the secondary market and as a result

of unanticipated market movements, which losses are potentially unlimited. There can be no

assurance that the Fund's hedging transactions will be effective. Investment in the Fund is subject

to the risk of the underlying Funds.

An investment in the Fund(s) is not insured or guaranteed by the Federal Deposit Insurance

Corporation or any other government agency and its return and yield will fluctuate with market

conditions.

There can be no assurance that performance will be enhanced for funds that seek to provide

exposure to certain quantitative investment characteristics ("factors"). Exposure to such investment

factors may detract from performance in some market environments, perhaps for extended

periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment

factors and not adjust to target different factors, which could result in losses.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may

underperform or be more volatile than other industries, sectors, markets or asset classes and than

the general securities market. Technology companies may be subject to severe competition and

product obsolescence. The iShares Minimum Volatility ETFs may experience more than minimum

volatility as there is no guarantee that the underlying index's strategy of seeking to lower volatility

will be successful.

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Markit Indices

Limited, MSCI Inc., or S&P Dow Jones Indices LLC. None of these companies make any

representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with

the companies listed above. Index data related to the underlying indexes is provided by the

respective companies above.

The iShares Funds and BlackRock mutual funds that are registered with the U.S. Securities and

Exchange Commission under the Investment Company Act of 1940 (“Funds”) are distributed in

the U.S. by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

This material is solely for educational purposes and does not constitute an offer or solicitation to

sell or a solicitation of an offer to buy any shares of any fund (nor shall any such shares be offered

or sold to any person) in any jurisdiction in which an offer, solicitation, purchase or sale would be

unlawful under the securities law of that jurisdiction.

In Latin America: FOR INSTITUTIONAL AND PROFESSIONAL INVESTORS ONLY

(NOT FOR PUBLIC DISTRIBUTION)

It is possible that some or all of the funds mentioned or inferred to in this material have not been

registered with the securities regulator of Brazil, Chile, Colombia, Mexico, Peru, Uruguay or any

other securities regulator in any Latin American country, and thus, might not be publicly offered

within any such country. The securities regulators of such countries have not confirmed the

accuracy of any information contained herein. No information discussed herein can be provided

Not FDIC Insured • May Lose Value • No Bank Guarantee

Lit. No. MKT-ID-0916

USR-10273-0916 / 169744T-0916

to the general public in Latin America.

In Hong Kong, this information is issued by BlackRock Asset Management North Asia Limited.

This material is for distribution to “Professional Investors” (as defined in the Securities and Futures

Ordinance (Cap.571 of the laws of Hong Kong)) and should not be relied upon by any other

persons. In Singapore, this document is issued by BlackRock (Singapore) Limited (company

registration number: 200010143N) for institutional investors only. For distribution in Korea and

Taiwan for Institutional Investors only (or “professional clients,” as such term may apply in local

jurisdictions). This document is for distribution to professional and institutional investors only and

should not be relied upon by any other persons. This document is provided for informational

purposes only and does not constitute a solicitation of any securities or BlackRock funds in any

jurisdiction in which such solicitation is unlawful or to any person to whom it is unlawful. Moreover,

it neither constitutes an offer to enter into an investment agreement with the recipient of this

document nor an invitation to respond to it by making an offer to enter into an investment

agreement. Past performance is not a guide to future performance. There are risks associated

with investing, including loss of principal. Changes in the rates of exchange between currencies

may cause the value of investments to fluctuate. This document is for informational purposes only

and does not constitute an offer or invitation to anyone to invest in any BlackRock fund and has

not been prepared in connection with any such offer. Any research in this document has been

procured and may have been acted on by BlackRock for its own purpose. The results of such

research are being made available only incidentally. The views expressed do not constitute

investment or any other advice and are subject to change. They do not necessarily reflect the

views of any company in the BlackRock Group or any part thereof and no assurances are made

as to their accuracy. This document contains general information only and does not take into

account an individual’s circumstances and consideration should be given to talking to a financial

or other professional adviser before making an investment decision. You are reminded to refer to

the relevant prospectus for specific risk considerations which are available from BlackRock

websites. BlackRock® is a registered trademark of BlackRock, Inc., or its subsidiaries in the

United States and elsewhere. All other trademarks, servicemarks or registered trademarks are the

property of their respective owners. © 2016 BlackRock Inc. All rights reserved.

Notice to residents in Australia:

FOR WHOLESALE CLIENTS AND PROFESSIONAL INVESTORS ONLY –

NOT FOR PUBLIC DISTRIBUTION

Issued in Australia by BlackRock Investment Management (Australia) Limited ABN 13 006 165

975, AFSL 230523 (“BlackRock”). This information is provided for ‘wholesale clients’ and

‘professional investors’ only. Before investing in an iShares exchange traded fund, you should

carefully consider whether such products are appropriate for you, read the applicable prospectus

or product disclosure statement available at iShares.com.au and consult an investment adviser.

Past performance is not a reliable indicator of future performance. Investing involves risk including

loss of principal. No guarantee as to the capital value of investments nor future returns is made by

BlackRock or any company in the BlackRock group. Recipients of this document must not

distribute copies of the document to third parties. This information is indicative, subject to change,

and has been prepared for informational or educational purposes only. No warranty of accuracy

or reliability is given and no responsibility arising in any way for errors or omissions (including

responsibility to any person by reason of negligence) is accepted by BlackRock. No representation

or guarantee whatsoever, express or implied, is made to any person regarding this information.

This information is general in nature and has been prepared without taking into account any

individual's objectives, financial situation, or needs. You should seek independent professional

legal, financial, taxation, and/or other professional advice before making an investment decision

regarding the iShares funds. An iShares fund is not sponsored, endorsed, issued, sold or

promoted by the provider of the index which a particular iShares fund seeks to track. No index

provider makes any representation regarding the advisability of investing in the iShares funds.

Notice to investors in New Zealand:

FOR WHOLESALE CLIENTS ONLY – NOT FOR PUBLIC DISTRIBUTION

This material is being distributed in New Zealand by BlackRock Investment Management

(Australia) Limited ABN 13 006 165 975, AFSL 230523 ("BlackRock"). In New Zealand, this

information is provided for registered financial service providers and other wholesale clients only

in that capacity, and is not provided for New Zealand retail clients as defined under the Financial

Advisers Act 2008. BlackRock does not offer interests in iShares to the public in New Zealand,

and this material does not constitute or relate to such an offer. Before investing in an iShares

exchange traded fund, you should carefully consider whether such products are appropriate for

you, read the applicable prospectus or product disclosure statement available at iShares.com.au

and consult an investment adviser. Past performance is not a reliable indicator of future

performance. Investing involves risk including loss of principal. No guarantee as to the capital value

of investments nor future returns is made by BlackRock or any company in the BlackRock group.

Recipients of this document must not distribute copies of the document to third parties. This

information is indicative, subject to change, and has been prepared for informational or

educational purposes only. No warranty of accuracy or reliability is given and no responsibility

arising in any way for errors or omissions (including responsibility to any person by reason of

negligence) is accepted by BlackRock. No representation or guarantee whatsoever, express or

implied, is made to any person regarding this information. This information is general in nature and

has been prepared without taking into account any individual's objectives, financial situation, or

needs. You should seek independent professional legal, financial, taxation, and/or other

professional advice before making an investment decision regarding the iShares funds. An iShares

fund is not sponsored, endorsed, issued, sold or promoted by the provider of the index which a

particular iShares fund seeks to track. No index provider makes any representation regarding the

advisability of investing in the iShares funds.

©2016 BlackRock, Inc. All rights reserved. BLACKROCK, iSHARES, iBONDS and SO

WHAT DO I DO WITH MY MONEY are registered trademarks of BlackRock, Inc. in the United

States and elsewhere. All other marks are the property of their respective owners.