CMR UK 2015.docx - Stakeholders

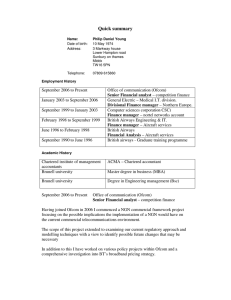

advertisement