Page 1 of 1

Gleim CPA Review

Updates to Financial

2013 Edition, 1st Printing

March 2013

NOTE: Text that should be deleted from the outline is displayed with a line through the text.

New text is shown with a blue background.

Study Unit 16 – Business Combinations and Consolidated Financial Reporting

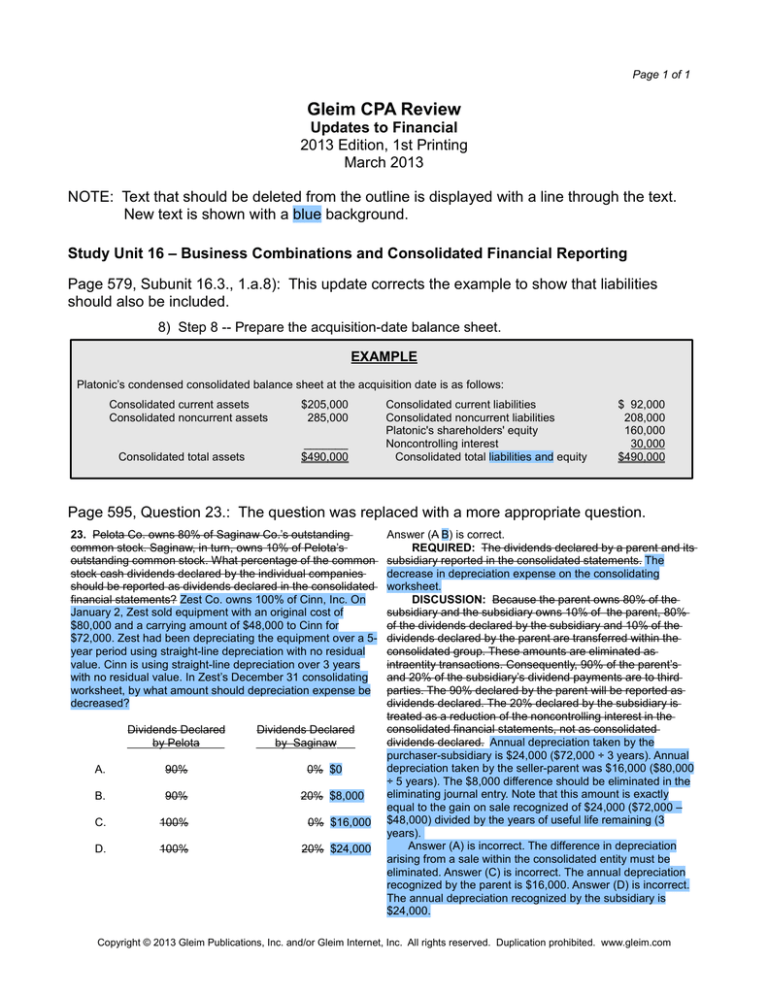

Page 579, Subunit 16.3., 1.a.8): This update corrects the example to show that liabilities

should also be included.

8) Step 8 -- Prepare the acquisition-date balance sheet.

EXAMPLE

Platonic’s condensed consolidated balance sheet at the acquisition date is as follows:

Consolidated current assets

Consolidated noncurrent assets

Consolidated total assets

$205,000

285,000

_______

$490,000

Consolidated current liabilities

Consolidated noncurrent liabilities

Platonic's shareholders' equity

Noncontrolling interest

Consolidated total liabilities and equity

$ 92,000

208,000

160,000

30,000

$490,000

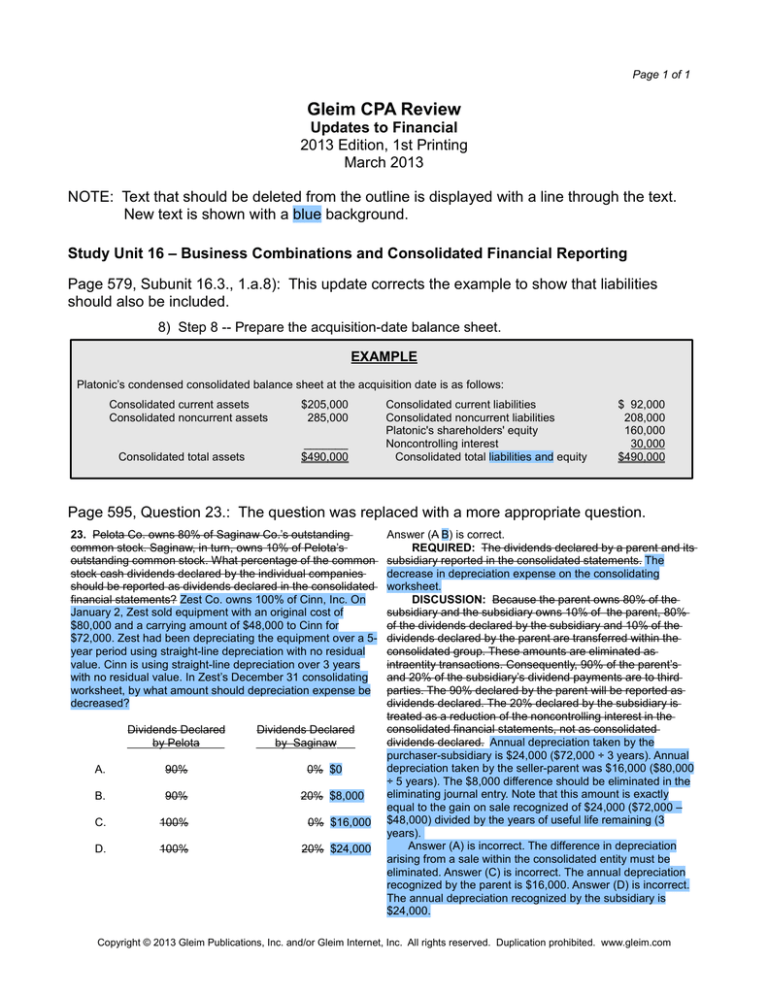

Page 595, Question 23.: The question was replaced with a more appropriate question.

23. Pelota Co. owns 80% of Saginaw Co.’s outstanding

common stock. Saginaw, in turn, owns 10% of Pelota’s

outstanding common stock. What percentage of the common

stock cash dividends declared by the individual companies

should be reported as dividends declared in the consolidated

financial statements? Zest Co. owns 100% of Cinn, Inc. On

January 2, Zest sold equipment with an original cost of

$80,000 and a carrying amount of $48,000 to Cinn for

$72,000. Zest had been depreciating the equipment over a 5year period using straight-line depreciation with no residual

value. Cinn is using straight-line depreciation over 3 years

with no residual value. In Zest’s December 31 consolidating

worksheet, by what amount should depreciation expense be

decreased?

Dividends Declared

by Pelota

Dividends Declared

by Saginaw

A.

90%

0% $0

B.

90%

C.

100%

0% $16,000

D.

100%

20% $24,000

20% $8,000

Answer (A B) is correct.

REQUIRED: The dividends declared by a parent and its

subsidiary reported in the consolidated statements. The

decrease in depreciation expense on the consolidating

worksheet.

DISCUSSION: Because the parent owns 80% of the

subsidiary and the subsidiary owns 10% of the parent, 80%

of the dividends declared by the subsidiary and 10% of the

dividends declared by the parent are transferred within the

consolidated group. These amounts are eliminated as

intraentity transactions. Consequently, 90% of the parent’s

and 20% of the subsidiary’s dividend payments are to third

parties. The 90% declared by the parent will be reported as

dividends declared. The 20% declared by the subsidiary is

treated as a reduction of the noncontrolling interest in the

consolidated financial statements, not as consolidated

dividends declared. Annual depreciation taken by the

purchaser-subsidiary is $24,000 ($72,000 ÷ 3 years). Annual

depreciation taken by the seller-parent was $16,000 ($80,000

÷ 5 years). The $8,000 difference should be eliminated in the

eliminating journal entry. Note that this amount is exactly

equal to the gain on sale recognized of $24,000 ($72,000 –

$48,000) divided by the years of useful life remaining (3

years).

Answer (A) is incorrect. The difference in depreciation

arising from a sale within the consolidated entity must be

eliminated. Answer (C) is incorrect. The annual depreciation

recognized by the parent is $16,000. Answer (D) is incorrect.

The annual depreciation recognized by the subsidiary is

$24,000.

Copyright © 2013 Gleim Publications, Inc. and/or Gleim Internet, Inc. All rights reserved. Duplication prohibited. www.gleim.com