TACTICAL INVESTMENT

Some Frequently Asked Questions

In Warrants Trading

In this sixth and final instalment of the BNP Paribas Warrants Education Series, we address some frequently asked

questions in warrants trading. The warrants under discussion here refer only to structured warrants listed on the

Singapore stock exchange or more specifically, Singapore Exchange Securities Trading Limited (“SGX-ST”).

1 What is the difference between a company warrant and a struc-

value of the warrant from the favourable price performance of the

tured warrant?

underlying asset. Hence, warrant prices may still decrease in these

Company warrants are call warrants issued by companies with their

conditions.

own stock as the underlying asset to raise capital. When the warrants

Warrant prices are also subject to market conditions. The actual

are exercised, the company issues new shares to the warrant-holders

price of warrants may exceed its theoretical price when there is huge

for settlement.

market demand. Conversely, it may fall below its theoretical price

Structured warrants are issued by third-party financial institu-

when there is a strong selling pressure.

tions to provide investors with an alternative form of investment

Lastly, structured warrants are issued by third-party financial in-

instruments listed on the stock exchange. These issuers do not issue

stitutions. Investors are exposed to counterparty risk where there is

warrants to raise capital for the underlying companies.

a possibility of default by the issuers. For warrants with underlying

assets denominated in foreign currency, investors are also exposed

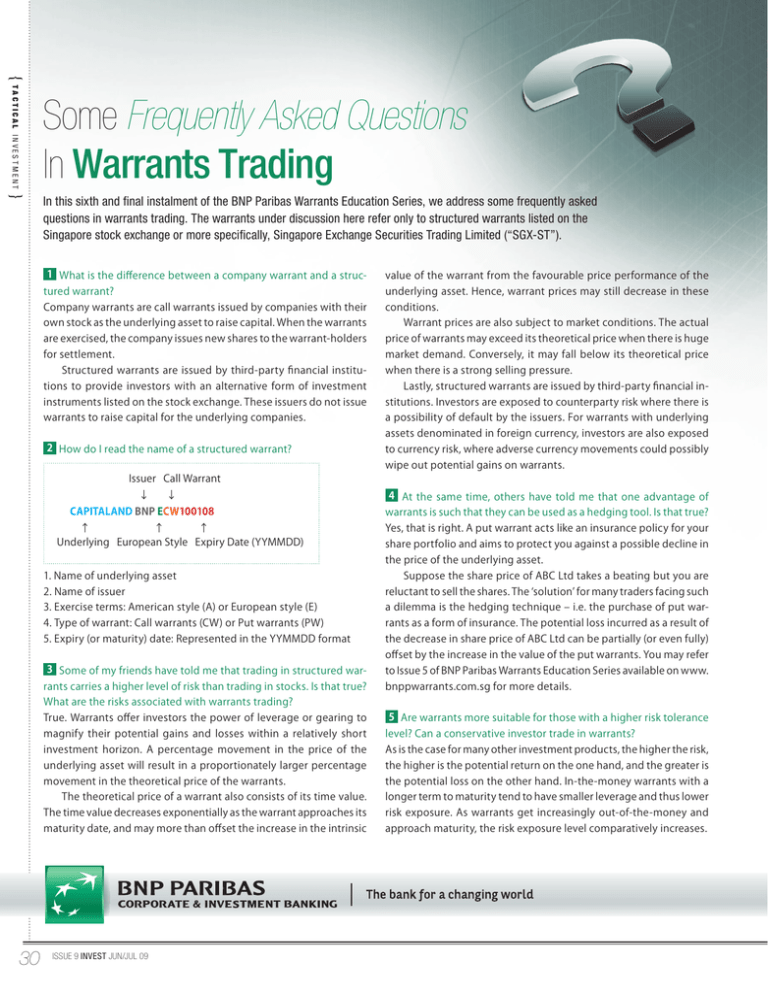

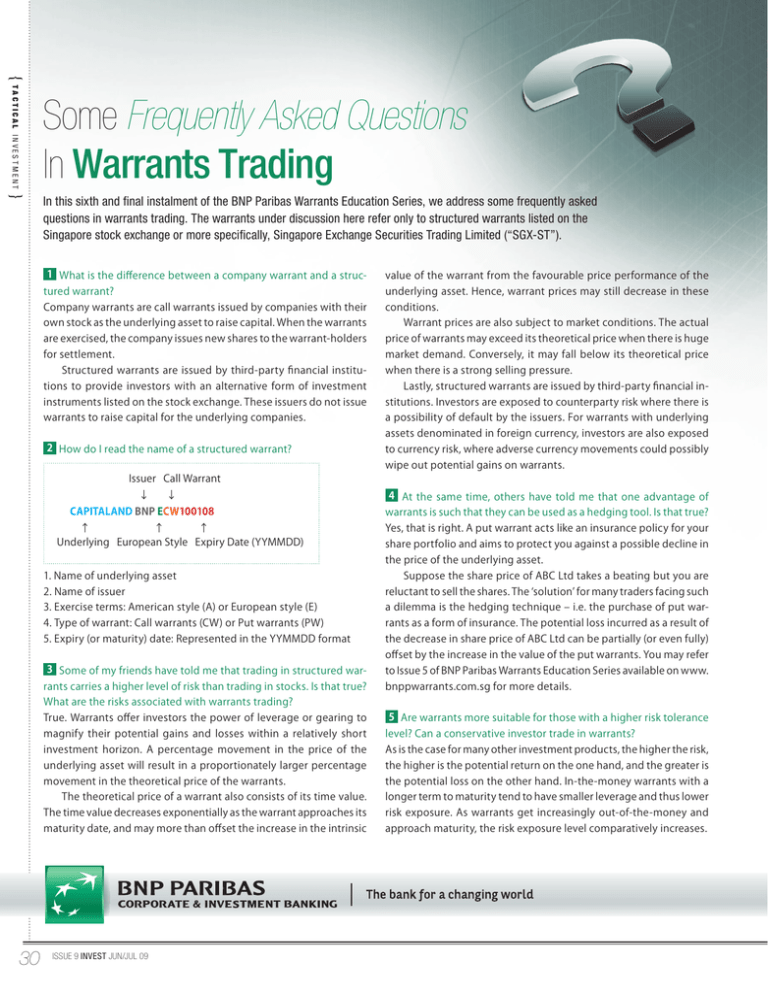

2 How do I read the name of a structured warrant?

Issuer Call Warrant

↓

↓

CAPITALAND BNP ECW100108

↑

↑

↑

Underlying European Style Expiry Date (YYMMDD)

to currency risk, where adverse currency movements could possibly

wipe out potential gains on warrants.

4 At the same time, others have told me that one advantage of

warrants is such that they can be used as a hedging tool. Is that true?

Yes, that is right. A put warrant acts like an insurance policy for your

share portfolio and aims to protect you against a possible decline in

the price of the underlying asset.

1. Name of underlying asset

Suppose the share price of ABC Ltd takes a beating but you are

2. Name of issuer

reluctant to sell the shares. The ‘solution’ for many traders facing such

3. Exercise terms: American style (A) or European style (E)

a dilemma is the hedging technique – i.e. the purchase of put war-

4. Type of warrant: Call warrants (CW) or Put warrants (PW)

rants as a form of insurance. The potential loss incurred as a result of

5. Expiry (or maturity) date: Represented in the YYMMDD format

the decrease in share price of ABC Ltd can be partially (or even fully)

offset by the increase in the value of the put warrants. You may refer

3 Some of my friends have told me that trading in structured warrants carries a higher level of risk than trading in stocks. Is that true?

to Issue 5 of BNP Paribas Warrants Education Series available on www.

bnppwarrants.com.sg for more details.

What are the risks associated with warrants trading?

True. Warrants offer investors the power of leverage or gearing to

30

5 Are warrants more suitable for those with a higher risk tolerance

magnify their potential gains and losses within a relatively short

level? Can a conservative investor trade in warrants?

investment horizon. A percentage movement in the price of the

As is the case for many other investment products, the higher the risk,

underlying asset will result in a proportionately larger percentage

the higher is the potential return on the one hand, and the greater is

movement in the theoretical price of the warrants.

the potential loss on the other hand. In-the-money warrants with a

The theoretical price of a warrant also consists of its time value.

longer term to maturity tend to have smaller leverage and thus lower

The time value decreases exponentially as the warrant approaches its

risk exposure. As warrants get increasingly out-of-the-money and

maturity date, and may more than offset the increase in the intrinsic

approach maturity, the risk exposure level comparatively increases.

ISSUE 9 INVEST JUN/JUL 09

At-the-money

Out-of-the-money

Call Warrant

Strike price < Underlying

spot price

Strike price = Underlying

spot price

Strike price > Underlying

spot price

Put Warrant

Strike price > Underlying

spot price

Strike price = Underlying

spot price

Strike price < Underlying

spot price

Investors with higher risk tolerance levels may therefore wish to

expired in-the-money). Call warrants will have value at expiry if the

choose warrants that are more out-of-the-money with a shorter time

spot level of the underlying asset at expiry is higher than the strike

to maturity. For more conservative investors, they may wish to look

level of the warrant. Conversely for a put warrant to have any value

for a longer term in-the-money warrant with the risk/return ratio that

at expiry, the spot level of the underlying asset at expiry has to be

is acceptable to their risk appetite. It all ultimately depends on the

lower than the strike level. Investors usually receive the settlement

risk tolerance level of the individual investor.

amount within 5 business days from the expiry date.

6 Some believe that trading in warrants is a “win-lose” game as it

TACTICAL INVESTMENT

In-the-money

9 Would I typically incur more costs in trading warrants as compared

has been said that the warrant issuers will seek to make a profit at

to traditional stock trading?

the expense of the warrant-holders by taking a position opposite to

No. You can trade warrants the way you trade shares through a securi-

that of the warrant-holder. How true is that?

ties trading account. As compared to traditional stock trading, you

Not necessarily true. When buying or selling the warrants it has

could be paying lower transaction costs when trading warrants. One

issued, warrant issuers will typically delta hedge their position. This

appealing factor of trading in warrants is that the contract value of

means that the issuers would buy the underlying shares or futures or

warrants is lower than the contract value of a comparable amount of

Over-The-Counter (“OTC”) options relating to those shares to hedge

the underlying asset. Hence, the brokerage and associated transac-

the call warrants they issued, and would sell the underlying shares

tion charges when trading warrants could be lower.

or futures or OTC options relating to those shares to hedge the put

warrants they issued.

Assuming a warrant issuer bought underlying shares relating to

10 What are the key considerations for someone like me who is new

to warrants trading?

their call warrants for hedging purposes, an increase in the price of

As with all investment products, a potential investor should always

the underlying asset – which will lead to an increase in the theoreti-

ensure that he or she understands the nature of warrants before

cal price of the call warrants – will generate potential gains for the

making an investment decision. It is advisable for beginners to invest

issuer and the warrant-holders. Similarly, if the price of the underlying

a relatively small portion of their total investment capital on warrants

asset decreases, both the issuer and the warrant-holders will suffer a

due to the high-risk and high-return nature of warrants. If you have

potential loss. Therefore, a loss incurred by warrant-holders does not

any doubts, you should seek advice from a professional investment

necessarily translate into a profit for the warrant issuer.

advisor. Investors should monitor their positions closely as there is

greater fluctuation in warrants prices in percentage terms as com-

7 Is it advisable to hold warrants to maturity?

pared to shares. As a matter of trading strategy, warrant-holders

Investors should note that warrants have a limited lifespan. The time

should set a cut-loss point prior to entering a trade. He or she must

to maturity of warrants listed on SGX-ST ranges from 1 day to 3 years.

be very disciplined as trading in warrants carries greater risk com-

Assuming all other things constant, the longer you hold on to the

pared to trading in shares.

warrants, the greater the decrease in the theoretical value of the warrants. This effect is known as time value decay. The time value decay

11 How do I choose the issuer?

of a warrant increases exponentially as it approaches the maturity

Each structured warrant has a designated market-maker (DMM) that

date. For warrants with a very short term to maturity, potential gains

provides competitive buy and sell quotes in the stock exchange on

from a favourable price movement of the underlying may be offset by

behalf of the third-party warrant issuer. It is important to choose

aggressive time decay. Warrants with a longer term to maturity tend

a warrant issuer that offers good market-making service. Investors

to have smaller time decay, and offer investors a longer investment

should select a warrant issuer that they believe or perceive to have

horizon to realize potential investment gains. Investors who have a

the capability to provide competitive bid and offer prices and en-

long-term perspective on the underlying asset may choose warrants

hance market liquidity for their warrants. This way, it will be easier

with a longer time to maturity.

for investors to trade during trading hours. Potential investors are

advised to always read the relevant details in the listing documents

8 What will happen to my warrants on expiry (or maturity) date?

before selecting warrants from a warrant issuer.

What happens if I forget to exercise my warrants before they expire?

For structured warrants listed on SGX-ST, warrant issuers will auto-

12 I hold call (put) warrant XYZ. The underlying stock price had

matically exercise the warrants and pay the warrant-holder the settle-

moved up (down) significantly but the warrant price hardly changed.

ment amount (if any) in cash, which is usually the difference between

Why is this so?

the average spot level at expiry and the strike level (if the warrants

Aside from the price of the underlying share, warrant price is influ-

YOUR INVESTMENT INSPIR ATIONS

31

enced by many other factors as well. These factors include implied

one may question if the adjustment of the warrants’ implied volatil-

volatility level, time to maturity, interest rate, dividend expectation,

ity is fair. However, since the warrants market is very competitive,

and the market demand and supply.

market-makers that mark their implied volatility unfairly or unfavour-

Implied volatility level fluctuates during the day. When the im-

ably will tend to lose out to competition in the market.

plied volatility level increases, the warrant price will move up for

Although OTC implied volatilities are not made available to retail

both call and put warrants and vice versa. Investors should expect an

investors, one could take the underlying share’s historical volatility

intra-day movement on the implied volatility of all warrants.

data as a reference point for the change in implied volatility.

Theoretically, Warrant Price = Intrinsic Value + Time Value. Time

Investors should also pay attention to warrants with high open

value is the value attached to the time left to maturity. As the war-

interest. Open interest is the total number of warrants sold in the

rant gets closer to maturity, time value decreases. This is called “time

market. The price of such warrants is often being pushed higher than

value decay”. The rate of time value decay does not have a linear re-

the theoretical value, hence the increase in implied volatility.

lationship with time. Therefore, the closer a warrant is to its maturity

Implied volatility also reflects the market supply and demand

date, the faster is the decrease in its time value. As a result, when the

conditions of the warrant. If the demand for a particular warrant in-

underlying share price goes up (down), the value of very short-term

creases dramatically, the warrant price may be pushed up by the

out-of-the-money call (put) warrants may nevertheless go down if

strong demand, hence the implied volatility increases. On the other

the favourable price movement of the underlying share is unable to

hand, if warrant-holders are dumping a particular warrant at the same

compensate for the time value decay.

time, the selling pressure will drive the warrant price down, hence

the implied volatility decreases.

13 Market-makers often cite changes in the implied volatility levels

as a factor that affects pricing. How are the implied volatilities de-

14 Can I always sell a warrant? What if no one is trading it?

termined and why do they change? How may I be assured that the

The liquidity of structured warrants depends on the market-maker.

changes are fair and reasonable?

All structured warrants listed on SGX-ST have a designated market-

Implied volatility is the estimated volatility of a structured warrant,

maker (DMM) appointed by the warrant issuer that is obligated to

and is used to calculate its risk premium. It can be used to measure

provide liquidity for the warrants. Therefore, even if the warrant is

the expensiveness of a warrant i.e. the risk premium. For warrants of

thinly traded, the DMM will still provide a bid and offer quotation at

similar terms, the higher the implied volatility, the more expensive

a fair value, subject to terms and conditions in the base listing docu-

a warrant is. Designated market-makers use different products such

ment. However, investors should not expect the DMM to buy back a

as Over-The-Counter (“OTC”) options, equity-linked notes and other

warrant that is worthless.

structured products, or the underlying asset to hedge their warrants

position. When there is an adjustment to the OTC implied volatility,

For any queries related to warrants, investors may contact BNP Pari-

these market-makers often tend to adjust the implied volatility of

bas via email (singaporewarrants@asia.bnpparibas.com) or toll-free

their warrants. As the OTC market is not transparent to retail investors,

hotline (800-852-3577).

DISCLAIMER:

This article is sponsored by BNP Paribas. All rights reserved. No part of this article may be reproduced, distributed or transmitted in any form or

by any means or incorporated into or quoted or referred to in any way in any document or material without the written permission of the copyright

holder, BNP Paribas. Such written permission must also be obtained before any part of this article is stored in a retrieval system of any nature.

Nothing herein (a) constitutes or forms an (or any part of an) offer, or invitation, to subscribe for or to sell, or solicitation of any offer to subscribe for

or to purchase, warrants or other investments; and/or (b) should be considered as investment or financial advice or any form of recommendation

to purchase or sell the products described herein or generally any warrants or other investments. Information herein is intended as general

information only and does not take into account the specific investment objectives, financial situation and the particular needs of any particular

person, and BNP Paribas, its related and affiliated corporations and their respective associated and connected persons, affiliates, directors,

officers and employees (collectively the “BNP Paribas Group”) do not accept any responsibility in respect thereof. The BNP Paribas Group

does not represent nor warrant (whether expressly or impliedly) that information or statements contained herein are accurate or complete, and

they should not be relied upon as such. Information and statements contained in this article are not to be relied upon as authoritative or taken

in substitution for exercise of judgment by any recipient, and are subject to change without notice. Nothing contained herein shall form the basis

of, or be relied upon in connection with, any contract or commitment whatsoever. The price of warrants may fall in value as rapidly as it may rise

and holders may sustain a total loss of their investment. It is not possible to predict whether the secondary market for warrants will be liquid or

illiquid. Investments in warrants carry risks. Warrants are a leveraged product and investors should ensure they understand the nature, terms

and conditions of the warrants, make their own independent appraisal and consult their own legal, financial, tax and professional advisers

regarding the suitability and risks before committing to any investment. The BNP Paribas Group is not acting as your adviser or agent, and

does not accept any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this article or its contents

or otherwise arising in connection therewith. Without prejudice to the generality of the foregoing, none of the members of the BNP Paribas Group

will be liable to anyone for any inaccuracy, error or omission, regardless of cause, in the information in this article or for any kind of damages

arising in connection therewith. Members of the BNP Paribas Group may take proprietary positions and may have long or short positions or other

interests in the warrants and may purchase and/or sell the warrants at any time in the open market or otherwise, in each case whether as principal,

agent or market maker. The BNP Paribas Group is or may also be involved in other financial, investment and professional activities which may on

occasion give rise to interests or a conflict of interests in respect of the warrants described herein.

32

ISSUE 9 INVEST JUN/JUL 09