INTEREST RATES

Interest Rate Futures

Quick Reference Guide

BLOCKS, PRE-EXECUTION COMMUNICATIONS,

SIMULTANEOUS ORDERS

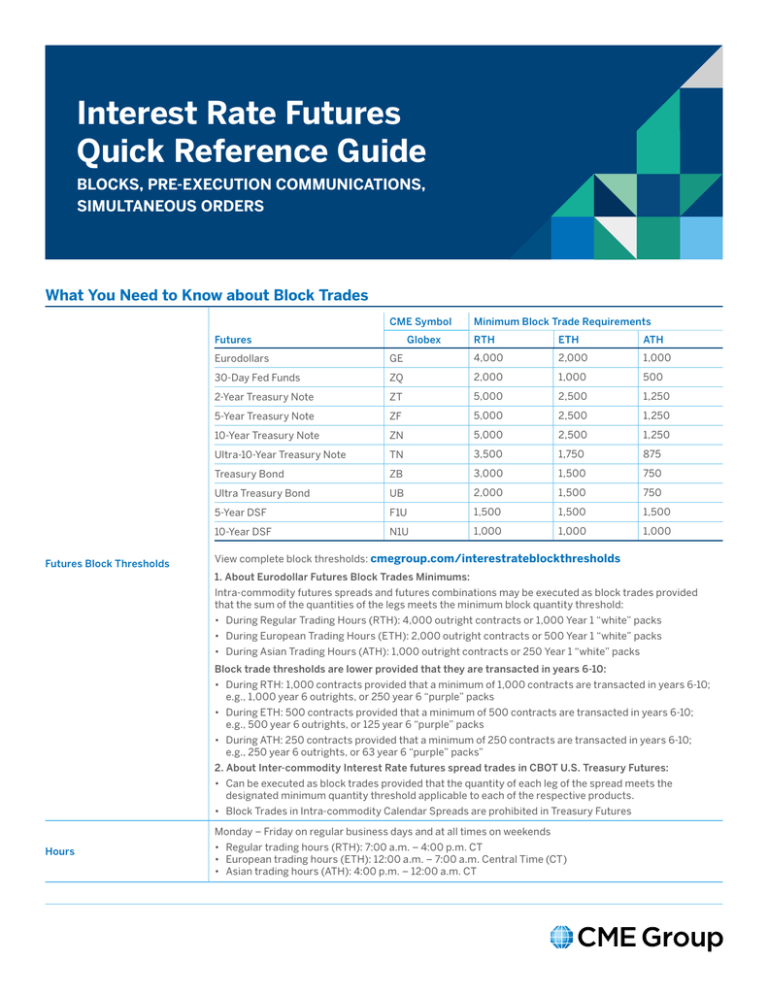

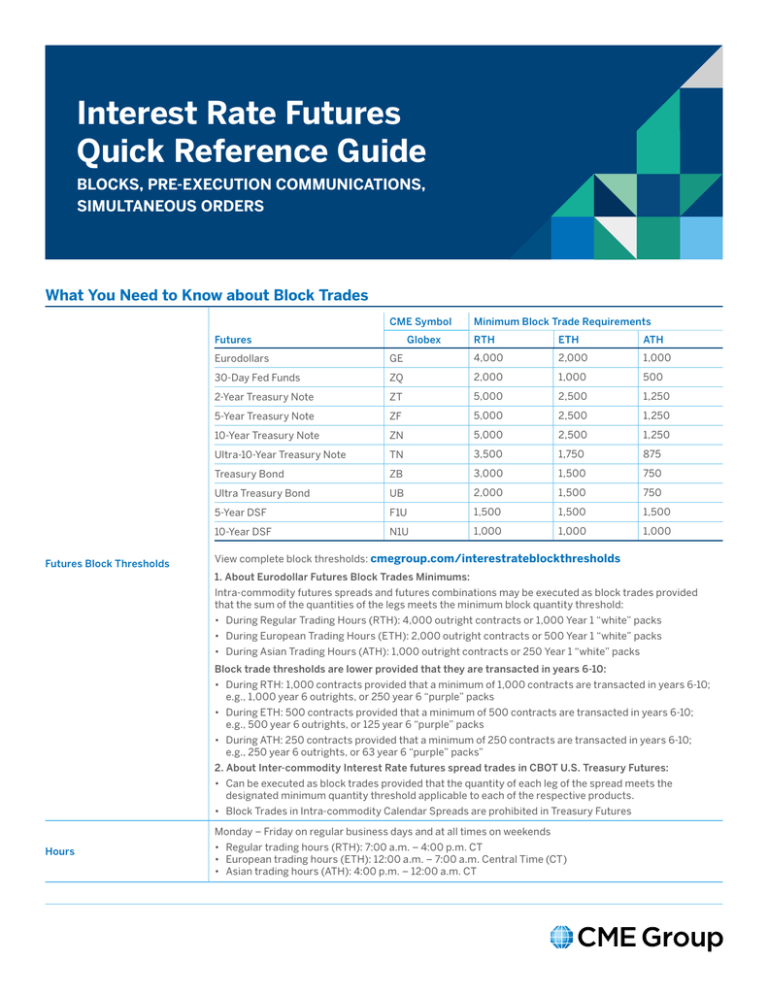

What You Need to Know about Block Trades

CME Symbol

Futures

Futures Block Thresholds

Globex

Minimum Block Trade Requirements

RTH

ETH

ATH

Eurodollars

GE

4,000

2,000

1,000

30-Day Fed Funds

ZQ

2,000

1,000

500

2-Year Treasury Note

ZT

5,000

2,500

1,250

5-Year Treasury Note

ZF

5,000

2,500

1,250

10-Year Treasury Note

ZN

5,000

2,500

1,250

Ultra-10-Year Treasury Note

TN

3,500

1,750

875

Treasury Bond

ZB

3,000

1,500

750

1,500

750

Ultra Treasury Bond

UB

2,000

5-Year DSF

F1U

1,500

1,500

1,500

10-Year DSF

N1U

1,000

1,000

1,000

View complete block thresholds: cmegroup.com/interestrateblockthresholds

1. About Eurodollar Futures Block Trades Minimums:

Intra-commodity futures spreads and futures combinations may be executed as block trades provided

that the sum of the quantities of the legs meets the minimum block quantity threshold:

• During Regular Trading Hours (RTH): 4,000 outright contracts or 1,000 Year 1 “white” packs

• During European Trading Hours (ETH): 2,000 outright contracts or 500 Year 1 “white” packs

• During Asian Trading Hours (ATH): 1,000 outright contracts or 250 Year 1 “white” packs

Block trade thresholds are lower provided that they are transacted in years 6-10:

•During RTH: 1,000 contracts provided that a minimum of 1,000 contracts are transacted in years 6-10;

e.g., 1,000 year 6 outrights, or 250 year 6 “purple” packs

•During ETH: 500 contracts provided that a minimum of 500 contracts are transacted in years 6-10;

e.g., 500 year 6 outrights, or 125 year 6 “purple” packs

•During ATH: 250 contracts provided that a minimum of 250 contracts are transacted in years 6-10;

e.g., 250 year 6 outrights, or 63 year 6 “purple” packs”

2. About Inter-commodity Interest Rate futures spread trades in CBOT U.S. Treasury Futures:

•Can be executed as block trades provided that the quantity of each leg of the spread meets the

designated minimum quantity threshold applicable to each of the respective products.

• Block Trades in Intra-commodity Calendar Spreads are prohibited in Treasury Futures

Monday – Friday on regular business days and at all times on weekends

Hours

• Regular trading hours (RTH): 7:00 a.m. – 4:00 p.m. CT

• European trading hours (ETH): 12:00 a.m. – 7:00 a.m. Central Time (CT)

• Asian trading hours (ATH): 4:00 p.m. – 12:00 a.m. CT

What You Need to Know about Block Trades (continued)

ETH or ATH: Trade must be reported within 15 minutes of the transaction

RTH: Trade must be reported within 5 minutes of the transaction

Reporting Times

Depending on the reporting requirement for the particular product, block trades negotiated when

CME ClearPort is closed must be submitted no later than 5 or 15 minutes after the time it reopens.

When the GCC is closed, for example, during the weekend, block trades must be reported no later than

5 minutes prior to the opening of the next electronic trading session for that product.

•In the case of a brokered transaction, the price reporting obligation is the responsibility of the broker

handling the block trade, unless otherwise agreed to by the principal counterparties to the block trade.

Reporting Obligation

Block Fees

•In non-brokered transactions, price reporting obligations are the responsibility of the seller, unless

otherwise agreed to by the principal counterparties to the block trade. The term “seller” refers to the

principal counterparty acting as the seller of the block trade.

Pit

Globex

Block

Eurodollar Futures Member

$0.09

$0.19

$0.29

Treasury Futures Member

$0.12

$0.12

$0.87

View all-in fee examples: cmegroup.com/interestrateblockfees

View full fee schedule: cmegroup.com/fees

CME Direct provides direct entry into Front-End Clearing (FEC). Block trades reported through CME Direct

fulfill reporting requirements and obligation for entry into front end clearing.

Block Entry and Reporting

Through CME Direct

(PREFERRED)

Use CME Direct, to instantly process voice-negotiated blocks. Brokers using CME Direct can efficiently

open a CME Direct trade ticket, populate the details of a block trade, and submit the deal directly for

clearing, eliminating the need to phone in the details.

CME Direct Block Trade Features:

• Fast booking – immediately submit block trades or EFRPs within the required reporting window

• Pre-confirmation window for trade entry – including CME ClearPort validation checks

• Real-time block ticker – view customizable block data feeds displaying all block trades in real-time

Contact markettechsales@cmegroup.com for access to blocks through CME Direct.

Global Command Center (“GCC”)

Block Reporting Entry

Through GCC and Entry

Through Front-End Clearing

Block trades price reported to the GCC or Exchange staff must be submitted to CME Clearing through the

FEC user interface via the portal under block entry.

Reporting the trade to GCC only fulfills the reporting requirements, so must be entered into FEC.

Report the block trade by calling the GCC at:

+44 20 7623 4747 (Europe), +1 800 438 8616 (US), +65 6532 5010 (Asia)

• C

ontract, month, year (for options, also include strike price; for standard options, whether put/call;

for flex options, expiration date and exercise style)

Information Required When

Reporting a Block to GCC

• Quantity and price (on each leg for spreads/combinations)

• Buyer’s and seller’s clearing firms

• Name and phone number of party reporting if reported to GCC

• Execution time (to nearest minute in CST): Execution time is the time the trade was consummated.

Pricing a Block

•Must be “fair and reasonable” based on the size of the block, market conditions in the contract and

related products, and the circumstances of the market and parties to the trade

• Pricing must be in minimum tick increments

Block Market Makers

View Block Trades

Register to receive contact

information for market makers:

cmegroup.com/mmcontact

You can view block trades on:

•CME Direct, which offers a live block trade window

•CME Group App, available through iTunes

•CME Group’s website at cmegroup.com/blocktrading

Request for Cross for Interest Rate Futures

Brokers engaging in pre-execution (pre-ex) communications with market makers must enter a Cross via either the Committed

Cross (C-Cross) or the Globex Cross (G-Cross)

Committed Cross

•In a C-Cross, subsequent to the pre-ex communication, an

RFC is entered into CME Globex which contains both the

buy and the sell orders

–The C-Cross price is equal to or better than the current

market at end of the pre-cross period when the cross

takes place

•Upon entry of the RFC, CME Globex will display an

indication that a cross has been committed to the market

and will occur in five (5) seconds. Price and size are not

disclosed to the market

Globex Cross

• In a G-Cross, the order of the party that initiated the preexecution must be entered into CME Globex first. The

second party’s order may not be entered into CME Globex

until a period of 5 seconds has elapsed from the time of

entry of the first order. No Request for Quote (“RFQ”) is

required in a G-Cross.

•If eligible, a Better Price Match (BPM) allocation may match

a percent of the cross order, provided the following price

improvement conditions are met:

–The C-Cross price betters the current market upon entry,

and

For more information, including the full regulatory advisory, a complete list of crossing protocols, and a

demonstration of the process through a 4 minute video can be found at: cmegroup.com/committedcross.

Simultaneous Buy and Sell Orders for Different Beneficial Owners

Full details of Rule 533 can be found at cmegroup.com/rulebook/files/cme-group-ra1301-5.pdf

When pre-ex communications have not taken place, a broker in possession of opposite orders for different beneficial owners

for the same product and expiration month, and, for a put or call option, the same strike price, may execute such orders for and

directly between such beneficial owners provided that:

Globex Trading:

• Opposite orders for different beneficial owners that are

simultaneously placed by a party with discretion over both

accounts may be entered into the CME Globex platform

provided that one order is exposed for a minimum of

5 seconds in the case of futures or swaps orders or a

minimum of 15 seconds in the case of options orders

• An order allowing for price and/or time discretion, if not

entered immediately upon receipt, may be knowingly

entered opposite another order entered by the same firm

only if this other order has been entered immediately upon

receipt and has been exposed on the Globex platform for a

minimum of 5 seconds for futures or orders or a minimum of

15 seconds for options orders

For more information about block trading for Interest Rate options visit

cmegroup.com/interestrateblocks.

For questions, contact:

Dave Reif

david.reif@cmegroup.com

+1 312 648 3839

Agha Mirza

agha.mirza@cmegroup.com

+1 212 299 2833

CME GROUP HEADQUARTERS

CME GROUP GLOBAL OFFICES

20 South Wacker Drive

Chicago, Illinois 60606

cmegroup.com

Chicago

+1 312 930 1000

New York

+1 212 299 2000

London

+44 20 3379 3700

Singapore

+65 6593 5555

Calgary

+1 403 444 6876

Hong Kong

+852 2582 2200

Houston

+1 713 658 9292

São Paulo

+55 11 2787 6451

Seoul

+82 2 6336 6722

Tokyo

+81 3 3242 6228

Washington D.C.

+1 202 638 3838

Futures trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose

more than the amount of money deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a portion of those funds should

be devoted to any one trade because they cannot expect to profit on every trade. All examples in this brochure are hypothetical situations, used for explanation purposes only, and should not be considered

investment advice or the results of actual market experience. CME Group is a registered trademark of Chicago Mercantile Exchange Inc. The Globe logo, Globex, CME and Chicago Mercantile Exchange are

trademarks of Chicago Mercantile Exchange Inc. Chicago Board of Trade is a trademark of the Board of Trade of the City of Chicago, Inc. NYMEX is a trademark of the New York Mercantile Exchange, Inc. The

information within this brochure has been compiled by CME Group for general purposes only and has not taken into account the specific situations of any recipients of this brochure. CME Group assumes no

responsibility for any errors or omissions. Additionally, all examples in this brochure are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the

results of actual market experience. All matters pertaining to rules and specifications herein are made subject to and are superseded by official CME, NYMEX and CBOT rules. Current CME/CBOT/NYMEX rules

should be consulted in all cases before taking any action.

The content of this marketing collateral should not be taken as a recommendation or endorsement to buy sell or retain any specific product, security investment or other service nor does it constitute a

Prospectus. The content of this presentation is intended solely for the use of Eligible Counterparties and Professional (non-retail) Clients as defined under FSMA 2000 and circulation must be restricted

accordingly. Potential users of the services herein described are recommended to take independent advice. This communication is issued by CME Marketing Europe Limited. CME Marketing Europe Limited

(FRN: 220523) is authorised and regulated by the Financial Conduct Authority in the United Kingdom for the conduct of investment business.

Copyright ©2016 CME Group Inc. All rights reserved.

PM1335/00/0716