EQUIT Y INDE X

Weekly and End-of-Month

Equity Index Options on

Futures

PRECISION. FLEXIBILITY. LIQUIDITY.

With equity index options on futures available on a range of

benchmark indices – including the S&P 500, NASDAQ-100

and Dow Jones Industrial Average – and in various

expirations, CME Group provides market participants with

flexible tools to fine tune their equity market exposure.

Trading shorter-term options has become especially popular,

as short-term weekly and end-of-month (EOM) options

complement traditional quarterly options and physically

settle with the front-month futures contract.

•EOM options that expire on the last business day of

the month

WED

Beginning September 26:

S&P 500 and E-mini S&P 500 Wednesday

Weekly options will be available for trading

Quarterly month options are American-style options, while

weeklies and EOM are European-style, restricting the option

buyer’s exercise rights to the expiration day.

Product and Execution Choice

Enjoy flexible execution via:

The suite of options on S&P 500, E-mini S&P 500, E-mini

NASDAQ-100 and E-mini Dow ($5) includes from 4 to 10

distinct option expirations each month.

• CME Globex electronic trading

• Weekly contracts with Friday expirations

•Quarterly contracts with Friday expirations

• Open Outcry for standard S&P 500 (SP) options

•Large Order Execution (LOX) orders for SP options –

with a minimum threshold 125 contracts

•Committed Cross (C-Cross), a new CME Globex

crossing method

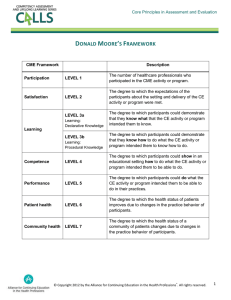

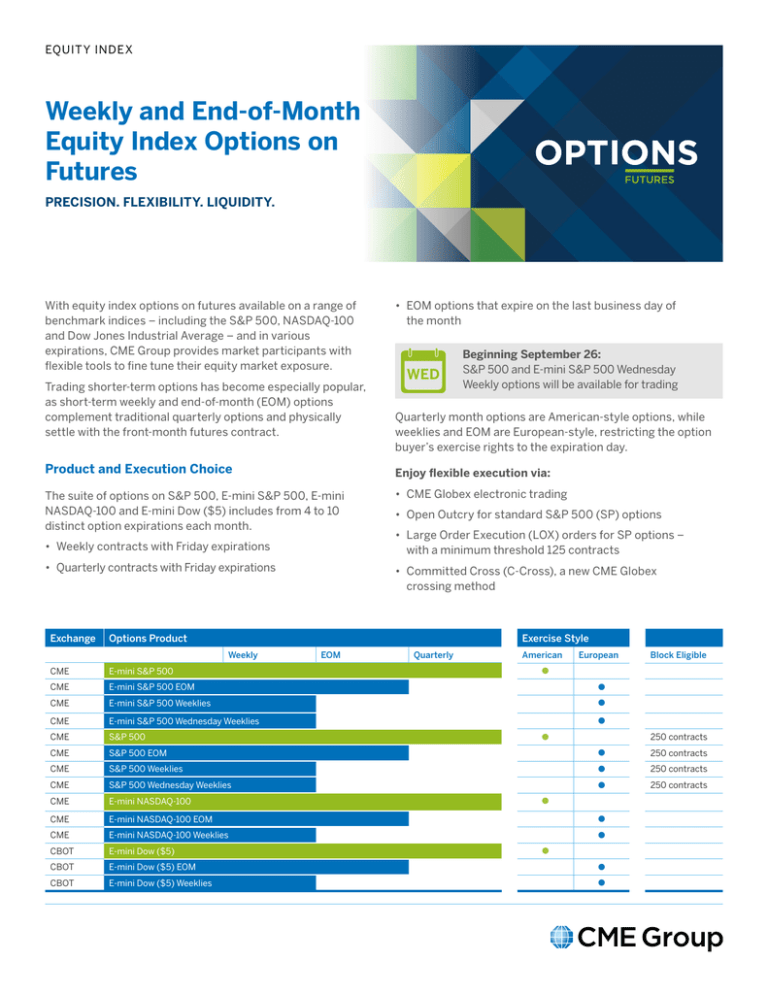

Exchange

Options Product

Exercise Style

CME

E-mini S&P 500

CME

E-mini S&P 500 EOM

●

CME

E-mini S&P 500 Weeklies

●

CME

E-mini S&P 500 Wednesday Weeklies

CME

S&P 500

CME

S&P 500 EOM

●

250 contracts

CME

S&P 500 Weeklies

●

250 contracts

CME

S&P 500 Wednesday Weeklies

●

250 contracts

CME

E-mini NASDAQ-100

CME

E-mini NASDAQ-100 EOM

CME

E-mini NASDAQ-100 Weeklies

CBOT

E-mini Dow ($5)

CBOT

E-mini Dow ($5) EOM

●

CBOT

E-mini Dow ($5) Weeklies

●

Weekly

EOM

Quarterly

American

European

Block Eligible

●

●

250 contracts

●

●

●

●

●

Benefits:

Event-Driven Trading

Choice: complementing the traditional third

Friday Quarterly expiration, market participants

have a recurring schedule of expirations to pin out

targeted risk.

Weekly options provide a deep pool of liquidity for investors

to express views on events and market-moving events and

economic reports, such as the monthly employment and

inflation reports earnings announcements and

dividend changes.

Liquidity: weekly and EOM options have seen

significant growth since their inception, with

excellent screen liquidity through expiration,

especially for the near-the-money strikes where

most of the activity occurs.

On employment report days, which generally coincide with

Week 1 option expiration, trading in the expiring E-mini S&P

500 weekly and the next weekly option often exceeds ADV by

100%. Market participants use weekly options to hedge longterm positions, manage gamma and theta risk and initiate

new positions to anticipate movement of the underlying

equity market for the next one-to-seven days.

Gamma Trading: market participants can take

advantage of the more rapid change in shorter-term

options’ Gamma.

Lower Option Premiums: shorter-term to expiry

options trade at lower premiums due to a lower time

value component of the total option premium.

Time or Calendar Spread Opportunities: weekly

and EOM options combined together may provide

time spread or event driven opportunities, with

greater precision and lower premium.

Weekly E-mini S&P 500 Options Surge Around Non-Farm Payroll

900,000

800,000

700,000

Volume

600,000

500,000

400,000

300,000

200,000

100,000

l

ul

-J

u

29

n

ul

-J

20

11

-J

-J

u

un

n

Ju

-J

29

20

9-

29

-A

pr

10

-M

ay

19

-M

ay

31

-M

ay

pr

ar

-A

pr

20

11

-A

-M

ar

31

ar

M

21

-

-M

10

1M

ar

0

For more information, visit cmegroup.com/equityoptions.

CME Group® is a registered trademark of Chicago Mercantile Exchange Inc. The Globe logo, CME, Chicago Mercantile Exchange, Globex, CME Direct and CME Direct Messenger are trademarks of Chicago Mercantile

Exchange Inc. Chicago Board of Trade is a trademark of the Board of Trade of the City of Chicago, Inc. NYMEX is a trademark of the New York Mercantile Exchange, Inc.

S&P® 500 and S&P MidCap 400™ are trademarks of The McGraw-Hill Companies, Inc., and have been licensed for use by Chicago Mercantile Exchange Inc. Dow Jones is a trademark of Dow Jones & Company, Inc. and

used here under license. All other trademarks are the property of their respective owners. NASDAQ-100 is a trademark of The Nasdaq Stock Market, used under license.

Futures trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the

amount of money deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted to any one

trade because they cannot expect to profit on every trade. All examples in this brochure are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of

actual market experience.

The information within this brochure has been compiled by CME Group for general purposes only and has not taken into account the specific situations of any recipients of this brochure. CME Group assumes no

responsibility for any errors or omissions. All matters pertaining to rules and specifications herein are made subject to and are superseded by official CME, NYMEX and CBOT rules. Current CME/CBOT/NYMEX rules

should be consulted in all cases before taking any action.

Copyright © 2016 CME Group. All rights reserved.

PM400/00/0916