COURSE GOALS The course aims to familiarize students with the

advertisement

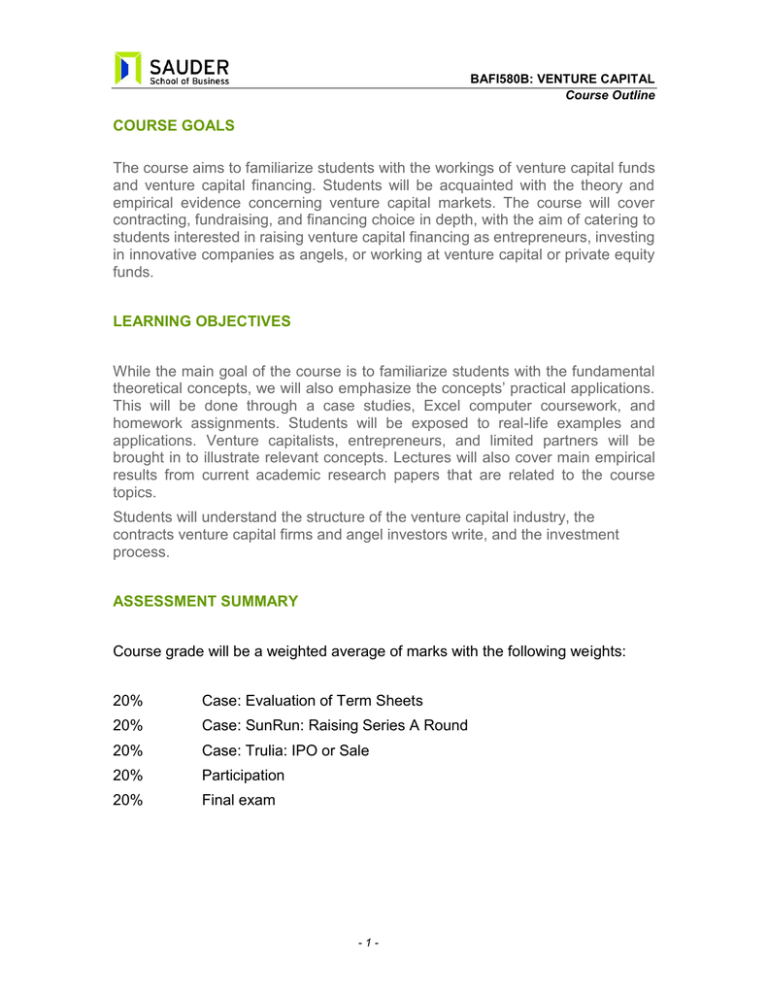

BAFI580B: VENTURE CAPITAL Course Outline COURSE GOALS The course aims to familiarize students with the workings of venture capital funds and venture capital financing. Students will be acquainted with the theory and empirical evidence concerning venture capital markets. The course will cover contracting, fundraising, and financing choice in depth, with the aim of catering to students interested in raising venture capital financing as entrepreneurs, investing in innovative companies as angels, or working at venture capital or private equity funds. LEARNING OBJECTIVES While the main goal of the course is to familiarize students with the fundamental theoretical concepts, we will also emphasize the concepts’ practical applications. This will be done through a case studies, Excel computer coursework, and homework assignments. Students will be exposed to real-life examples and applications. Venture capitalists, entrepreneurs, and limited partners will be brought in to illustrate relevant concepts. Lectures will also cover main empirical results from current academic research papers that are related to the course topics. Students will understand the structure of the venture capital industry, the contracts venture capital firms and angel investors write, and the investment process. ASSESSMENT SUMMARY Course grade will be a weighted average of marks with the following weights: 20% Case: Evaluation of Term Sheets 20% Case: SunRun: Raising Series A Round 20% Case: Trulia: IPO or Sale 20% Participation 20% Final exam -1- BAFI580B: VENTURE CAPITAL Course Outline PROGRAM GOALS B.COM Critical Thinking Analytical Decision-making Oral & Written Communication Ethics & Sustainability COURSE INFORMATION Division: Finance Instructor: Will Gornall Email: will.gornall@sauder.ubc.ca Phone: (604) 827 4372 Office: Henry Angus 877 Office hours: Monday and Tuesday 2:00–3:00 Sections: 001 (HA 133, Monday & Wednesday 10:00-12:00) Course duration: Mar 07, 2016 to Apr 16, 2016 Pre-requisites: MBA Course website: www.connect.ubc.ca BRIEF COURSE DESCRIPTION This course covers all the stages of investment in early stage high-growth companies, from the seed funding of a novel idea to venture capital rounds to a successful exit, be it an IPO or through M&A. We will concentrate on how investors and entrepreneurs make and should make important decisions at different stages. Some questions that we will discuss are the following: How do angels and VCs generate and process their deal flow and select companies? What are typical mistakes of entrepreneurs in raising capital and negotiating with financiers? How do VC funds operate and make decisions? How are VCs involved in business decisions such as recruiting talent and replacing CEOs? What are the important provisions of financial contracts between VCs and founders? How to value early-stage companies? The course is mostly case- -2- BAFI580B: VENTURE CAPITAL Course Outline based and as a part of the course we will simulate angel group and VC partner meetings. The course is for both those who want to become entrepreneurs and thus likely consumers of angel and VC financing and those who want to pursue a career in the financial services industry. No prior knowledge of the VC industry is needed. COURSE MATERIALS & REQUIREMENTS Lecture notes There is no textbook for this course. Handouts will cover a lot of material. There will be teaching notes and cases posted online and distributed in class. Excel spreadsheets Complementary material in the form of Excel spreadsheets will be available on the course VISTA website. These Excel files contain the details of calculations presented in lectures. Further / more specialized reading If you are interested in supplementary reading on the subject, the following two books can be of interest. The Venture Capital and the Finance of Innovation, by Andrew Metrick. The Venture Capital Cycle, by Paul Gompers and Josh Lerner. ASSESSMENT Final Exam There will be a closed book final exam. You are required to take the exam. The exam has not been scheduled yet. Cases To help you better understand the material, the course has weekly cases, some of which will be graded. Please work through all cases in small groups (3-5) and be ready to discuss the cases. Graded cases should be submitted by one student in a group of 3 to 5 students. You can, and are encouraged to, form different groups for different assignments. All cases are due at 11:59 PM on the due date. -3- BAFI580B: VENTURE CAPITAL Course Outline You do not have to hand in the remaining (unmarked) cases; however, understanding cases will be crucial to class discussion. Participation Please make every effort to attend the class meetings and come well-prepared. Students are expected to be able to answer questions and participate in discussion on the case. Clickers will be used on a trial basis to assess understanding of the material. Please ask questions or contribute to lecture discussions at any time. I also encourage you to provide feedback about how to improve the course. SCHEDULE Please note that we may deviate from our plan and that some cases and materials can be updated/changed. The new versions will be posted online and highlighted in class. The course may “pivot” to add guest speakers or meet student demand. Week 1 Materials: HANDOUTS: Slides will be posted online, so that you can review the class material beforehand. We will start with the general overview of the world of angel and venture capital investment. We will talk about problems that effective innovative ecosystems should solve, and why Silicon Valley became such an ecosystem. We will identify the major players and issues. We then overview the major trends in recent years. We spend most of the time on contracting between entrepreneurs and venture capitalists (contracting between entrepreneurs and angels will be dealt next week). This is a building block for all our discussions in the course. We will start by discussing the major issues in negotiations and contracting, as well as the purpose of the term sheet. We then devote most of our time understanding, step by step, various securities issued in the process of funding start-ups, their purpose and their differences, and then will go into great detail about important features of contracts. Week 2 Materials: -4- BAFI580B: VENTURE CAPITAL Course Outline NOTE: Note on Angel Financing Read and discuss in groups. Prepare questions to our guests (angel investors) CASE: Sand Hill Angels Refer to case study questions. Please come fully prepared. We will start by introducing in more detail the world of angels. We then discuss the contracting issues between entrepreneurs and angel investors. We will spend most of the time discussing how angel investors select deals, advise companies, and value deals. We will also talk about the dynamics of angel decision-making process as well as types of angels (individuals, groups, incubators, superangels). Week 3 Assignment to be submitted: CASE: Choosing VCs: Evaluation of Term Sheets Refer to case study questions. Please come fully prepared. Materials: CASE: VC Deal Sourcing and Screening Refer to case study questions. Please come fully prepared. NOTE: Day in Life of Venture Capitalist Read and discuss in groups. Prepare questions to VCs In the first part of the class, we will discuss the structure of VC funds, compensation of VCs, and the relationship between VCs and their investors. We then will discuss the case on VC Deal Sourcing and how VCs spend most of their day. Week 4 Assignment to be submitted: CASE: SunRun: Raising Series A Round Refer to case study questions. Please come fully prepared. Materials: CASE: SunRun: Raising Series A Round We will start the class by discussing in depth the valuation methods used in venture capital. -5- BAFI580B: VENTURE CAPITAL Course Outline We will then turn our attention to the process of Series A funding. We will discuss the dynamics of fund-raising, the relationship between VCs and founders, and revisit practical implementation of the term sheet. Week 5 Assignment to be submitted: CASE: Trulia: IPO or Sale Materials: CASE: Trulia: IPO or Sale Refer to case study questions. Please come fully prepared. We will spend this and next sessions discussing exit options. We will also concentrate on the dynamics of the board decisions in entrepreneurial firms, postinvestment relationship between VCs and founders, and valuation of late-stage entrepreneurial ventures. -6-