Offer to Purchase for Cash all issued and outstanding

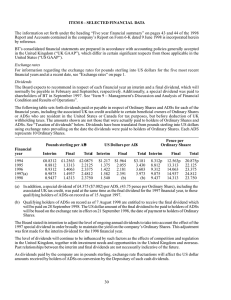

advertisement