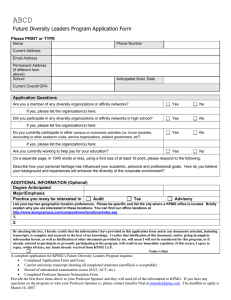

KPMG INTERNATIONAL

Confronting Complexity

Research Findings and Insights

kpmg.com

SECTORS AND THEMES

MAY 2011

Title set in

univers 65 bold

33pt on 36pt

leading, white

Additional infor Univers

45 light 12pt on16pt leading

kpmg.com

Credits and authors in Univers

45 light 12 pt on14 pt leading

Contents

Introduction1

Global executive summary –

a world striving for simplicity 2

The story from the research

4

Information management –

problem or solution?

14

Managing increasing risk

16

Speed of innovation

20

The need for new skills

22

Government and regulation

24

Management actions –

what works and what doesn’t

26

Conclusion27

Appendix – Country Reports

28

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

C o n f r o n t i n g C o m p l exi t y | 1

Introduction

In recent years we have seen profound

changes in our economic, regulatory,

political, and social environments. The

result is a world of increasing complexity,

where markets and systems are more

interconnected, and where organizations

must learn to navigate uncertainty,

innovate, and adapt to changing realities

as well as new market opportunities.

More transactions are taking place

across more borders, and the changing

global regulatory environment is

forcing businesses to react to ensure

compliance while managing new risks.

Technology is a hot-spot – it’s changing

business models, improving processes,

and opening new markets, but also

creating volumes of new data that must

be managed, supported, and secured.

To gain greater insight into how

increasing complexity is impacting

business around the world, and how

business leaders are responding,

KPMG International conducted research

globally, speaking with 1,400 senior

corporate decision makers from 22

countries representing seven main

business sectors.

The research shows that the issue

of complexity has risen to the top of

the business agenda. Senior decision

makers we spoke with recognize

complexity as a critical issue that their

companies must take significant actions

to address.

The vast majority of executives say

complexity has increased in the last

two years, and most expect it to

increase over the next two years.

These executives see complexity

not only as a source of additional

risk and cost, but most also believe

that complexity is creating new

opportunities. Opportunities to take a

fresh look at their strategy, rethink their

business model, and make operational

improvements to gain competitive

advantage.

The following report provides an

in-depth review of findings from the

research along with insights from KPMG

business leaders on what the findings

mean and how businesses can address

the critical issues raised. We hope the

report will help you to better understand

the causes and impact of complexity,

and ways to integrate actions into your

strategies that will not only help you to

manage the challenges that lie ahead,

but also to take better advantage of new

opportunities.

Timothy P. Flynn

Chairman

KPMG International

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

2 | C onf ron ting Com p lex it y

Global executive summary –

a world striving for simplicity

The world is undoubtedly becoming a

more complex place. The rise of new

industrial powers adds new layers

of complexity to global trade. New

technology challenges conventional

thinking as it provides radical new forms

of production and communication.

And in an attempt to exert control over

these factors, to minimize the harm

they can cause and bend them to the

public good, new layers of regulation are

added with increasing speed.

For business, increasing complexity

is not just an inconvenience. It can

radically affect the way that businesses

are managed, challenging profitability

with new costs, adding new risks and

creating opportunities.

To measure the causes and impact of

complexity KPMG commissioned one

of its largest ever surveys among large

companies around the world (40 percent

of the companies have global revenues

of US$1 billion or more).

Between October and December 2010,

we interviewed 1,400 senior executives.

They included CEOs, CFOs, and finance

directors in a wide range of industries in

22 countries: Australia, Brazil, Canada,

China, Denmark, France, Germany,

India, Ireland, Italy, Japan, Mexico,

Netherlands, Russia, Singapore, South

Africa, South Korea, Spain, Sweden,

Switzerland, the UK and the US.

The initial results of this survey were

released at the World Economic Forum

in Davos in January 2011. This document

is a more detailed review of the results,

with additional insights, drawing on the

practical experience of KPMG experts

from all over the world. The key findings

of the study are:

• Rising complexity is an issue in

all the countries surveyed, and in

all sectors. But the experience of

complexity differs around the world.

Mature economies in Europe and the

Americas are feeling the dual effects

of recession and increased regulation,

while developing economies and

those in Asia-Pacific are focused on

the accelerating speed of innovation

and rising costs.

• Information management stands

out as both a cause of complexity

and a solution. It is a challenge for

modern, international corporations to

understand the range of enterprises

they control. Outdated IT systems

are a significant barrier to managing

complexity.

• Complexity is not static. Its causes

change as companies move through

the business cycle and economies

develop. New technologies lead

companies to seek people with new

skills, mergers and acquisitions lead

to issues over information flows and

management, and new regulations

are a constant source of change.

Companies need to be agile to cut

through these layers of complexity

and achieve growth.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

C o n f r o n t i n g C o m p l exi t y | 3

• The actions many companies

take to deal with complexity are,

at best, moderately effective.

Improving information management,

reorganizing the business or changing

the approach to people management,

are all popular responses to

complexity. But less than half of the

people who undertook them thought

they were particularly effective. Least

effective of all is direct lobbying of

policymakers.

• Opportunities do exist in complex

situations. Most people think

complexity provides opportunities for

change, but companies in developing

economies are more likely than

those in mature economies to see

complexity as an opportunity to

develop new strategies and new

products.

• Broadly, there are two alternative

strategies for dealing with

complexity. Embrace it as a spur

to innovation and change; or try

and avoid it by keeping business

processes simple. Executive teams

need to decide which path is more

appropriate for their companies.

KPMG’s view

In each contribution to this report from

KPMG’s member firm professionals,

the central theme focuses on stepping

back from the operational side of the

business and thinking more strategically

about the nature of the organization.

A clear view of the purpose of an

organization, combined with an

understanding of its overriding culture,

provides a vital framework for coherent

thinking. It gives guidance on important

practical matters like the appetite for

risk; decision making; how traditional

functions need to change to meet new

challenges and working with external

partners.

It’s easy to lose this clarity as companies

get larger and more diverse. But

for those who can read them, there

are always signals that show where

operations can be improved.

Regulation is a strong signal that

companies need to take action.

Although it may appear to be an

additional burden, a new regulation can

help an organization to re-focus on its

overall purpose. It can then examine

what each part should be contributing to

that purpose, and review the common

platforms that are needed to manage

risk and create value.

It is not the nature of the complexity

that a company faces that will

determine its success; it is the extent

to which the company can analyze the

problem, identify the most effective

way to address it, and then implement

appropriate action. In doing so, the

challenges of complexity can be turned

into opportunities for growth.

It is not the nature of the

complexity that a company

faces that will determine

its success; it is the extent

to which the company

can analyze the problem,

identify the most effective

way to address it, and then

implement appropriate

action.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

4 | C onfron ting Com p lex it y

94%

Complexity is a major issue

for businesses globally –

94 percent of executives

believe managing

complexity is important

to the success of their

company.

The story from the research –

managing complexity is at the

top of the business agenda

Complexity is a major issue for businesses globally – 94 percent of executives

believe managing complexity is important to the success of their company

Managing complexity

is important to my

company’s success

94%

Increasing complexity

is one of the biggest

challenges my company faces

6%

70%

0

20

Agree

30%

40

60

80

100

Disagree

Source: KPMG International, 2010

Respondents were virtually unanimous

on the importance of managing

complexity, while 70 percent said that

increasing complexity is one of their

biggest challenges.

For most of these people, the increase

in complexity over the past two years

has been substantial. Nearly half

(44 percent) reported a ‘somewhat

significant’ increase in complexity over

this time, while for 28 percent there had

been a ’very significant’ rise.

The impact of complexity is global, but

it is not felt everywhere to the same

extent. Even those countries reporting

the lowest increases in complexity

(Denmark and the Netherlands) 52

percent and 44 percent respectively

said that for them, complexity

had increased very or somewhat

significantly since 2008.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

C o n f r o n t i n g C o m p l exi t y | 5

“You have to make sure you understand what is making your

business complex and understand the consequences before

doing something too quickly.”

HR Director, Transport/Logistics, Germany

Net increase in complexity (%)

Italy, China, South Korea and South Africa saw the largest net increase in complexity

80

70

70%

69%

68%

68%

64%

64%

63%

60

62%

61%

61%

58%

56%

56%

54%

52%

52%

48%

50

44%

44%

40%

40

30

20

10%

10

10%

0

Italy

Singapore

Japan

France

Mexico

Denmark

China

Australia

Germany

Switzerland

Sweden

Netherlands

South Korea

US

UK

India

Russia

South Africa

Brazil

Canada

Spain

Ireland

Net increase in complexity = (increased very significantly + increased somewhat significantly + increased minimally) – (decreased + stayed the same)

Source: KPMG International, 2010

From a regional perspective, the data

shows there is little to choose between

the Asia-Pacific countries, where

33 percent of respondents reported a

very significant increase in complexity,

and the Americas, where 32 percent

said the same thing. But in Europe,

only 24 percent responded that

complexity had increased very

significantly for them.

The difference is even more marked

between the emerging economies

of Brazil, Mexico, Russia, South

Africa, China and India and the mature

economies of Europe and North America.

Among the emerging economies,

34 percent reported a very significant

increase, while among the mature

economies the figure is 26 percent.

Estimating changes in the next two

years, there is a similar pattern. Among

the Asia-Pacific economies 24 percent

expect a very significant increase in

complexity, compared with 16 percent

in the Americas and only 9 percent in

Europe. In the emerging economies,

the same view is held by 20 percent,

compared with an average of only

13 percent among the mature economies.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

6 | C onfron ting Com p lex it y

Net future increase in complexity (%)

Australia, China, South Africa, Brazil and US expect the largest net increase in complexity

50

44%

43%

40

38%

36%

35%

34%

34%

34%

30

26%

21%

20

18%

16%

13%

10%

10

6%

4%

2%

0

0%

-2%

-8%

-10

-12%

-14%

-20

Australia

US

Sweden

Germany

Spain

Ireland

China

South Africa

India

Japan

UK

France

Canada

Denmark

South Korea

Netherlands

Italy

Brazil

Singapore

Switzerland

Mexico

Russia

Net increase in complexity = (increased very significantly + increased somewhat significantly + increased minimally) – (decreased + stayed the same)

Source: KPMG International, 2010

An industry view

At a sector level, complexity affects

all industries. More than 70 percent

of executives from five key areas

said that complexity had increased.

Financial services has seen the

greatest increase in complexity, with

44 percent of respondents reporting

a significant increase in the past

two years, and 33 percent saying

the increase was very significant.

Technology is next, with 47 percent

seeing a significant increase, and

29 percent seeing a very significant

increase. In each of these sectors,

clear majorities expect complexity to

continue to increase at a rapid rate

over the next two years.

Significant increases in complexity

over the next two years are also

predicted by around half the

executives in the energy and natural

resources, diversified industrials and

consumer sectors.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

C o n f r o n t i n g C o m p l exi t y | 7

Source: KPMG International, 2010

Causes of complexity

Globally, the most common cause of

complexity is regulation, cited by

71 percent. Among the sectors,

78 percent of respondents in financial

services saw regulation as the major

cause in their industry and both

regulation and government oversight

were seen as significant causes of

complexity by 75 percent across

all sectors.

At a regional level, 73 percent

and 74 percent in the Americas and

Europe, respectively, cited regulation

as their primary cause of complexity.

This compares with 65 percent in the

Asia-Pacific countries.

71%

Globally, the most

common cause of

complexity is regulation,

cited by 71 percent.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

8 | C onfron ting Com p lex it y

84%

Information management

stands out in this survey as

both an important cause

of complexity and the

most popular means

of managing it. It was

chosen as a solution to

complexity by 84 percent

of respondents.

Identifying and ranking the causes of complexity

Greatest causes

of complexity

Regulation (other than tax)

71%

Information management

63%

42%

25%

Government oversight

60%

21%

Increased speed of innovation

59%

25%

Tax policy

Operating in more countries

Doing mergers or acquisitions

57%

55%

50%

26%

16%

18%

Source: KPMG International, 2010

One of the main concerns with

regulation is its inconsistency

across borders. Nearly 90 percent of

respondents said that governments

should work together to make the global

regulatory environment less complex.

Information management is key

The second most frequently cited cause

of complexity at a global and regional

level was information management. In

the Americas, 71 percent chose this

as a key cause, rising to 80 percent in

Brazil. In Europe this was the choice

of 60 percent and among the AsiaPacific countries, it was the choice of

63 percent. Indian businesses were

particularly concerned about information

management, chosen as a cause by

72 percent.

Information management stands

out as both an important cause of

complexity and the most popular means

of managing it. 84 percent chose it as a

solution to complexity. In both senses,

this is consistent with managements

working hard to understand exactly

what is going on in increasingly complex

and widely spread organizations. They

often have to cope with incompatible

and inadequate IT systems that need

substantial investment to provide good

quality information, both as an aid to

good decision-making and a means of

controlling the organization. At the same

time, the pace of change in information

management is dramatic, as with the

rapid emergence of cloud computing as

a possible solution to IT issues.

Mixed views on speed of innovation

Among the Asia-Pacific economies,

65 percent of respondents also cited

speed of innovation as a primary cause

of complexity, ranking it alongside

regulation. Among the emerging

economies, speed of innovation was

marginally ahead of regulation as the

main cause, chosen by 67 percent.

This compares with only 57 percent of

respondents from the mature economies.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

C o n f r o n t i n g C o m p l exi t y | 9

Factors causing complexity by region

Regulation and information management a bigger concern in Americas and Europe. M&A, increased speed of innovation and operation in

more countries a bigger concern in Asia-Pacific

80

75

74%

73%

71%

70%

70

65

65%

65%

63%

60%

60

58%

55%

57%

55

59%

58%

56%

61%

60%

57%

51%

50

45

42%

42%

40

Regulation

(other than tax)

Americas

Information

management

Europe

Government

oversight

Increased speed

of innovation

Tax policy

Operating in

more countries

Doing mergers

or acquisitions

Asia-Pacific

Americas – Brazil, Canada, Mexico, US

Europe – Denmark, France, Germany, Ireland, Italy, Netherlands, Spain, Sweden, Switzerland, UK

Asia-Pacific – Australia, China, India, Japan, Singapore, South Korea

Source: KPMG International, 2010

This is not to say that the speed

of innovation is an issue limited to

developing countries. Across all sectors,

speed of innovation is identified as a

leading cause of complexity by more

than half of respondents.

Moreover, the speed of innovation is

expected to have a much greater impact

on complexity going forward. 70 percent

of respondents in developing economies

and over 60 percent in the Americas and

Asia-Pacific economies expect rapid

innovation to increase its impact on their

companies over the next two years.

Challenges and opportunities

One of the greatest long-term

challenges is that complexity is not

static. Its causes will likely change

over time as economies develop and

become more complex. This view is

held particularly strongly in the AsiaPacific region, where 60 percent of

respondents expected changes in the

nature of complexity.

The respondents expect these

changes to be driven primarily by faster

innovation. But where innovation

leads, regulation will likely follow, so

companies will find themselves dealing

with successive waves of additional

complexity as their markets develop.

Today, three immediate challenges

stand out.

• More risks to manage

• Increased costs

• The need for new skills

The greatest of these is a

straightforward increase in the number

of risks that need to be managed.

Globally, 84 percent of respondents

opted for increased risk as their main

challenge, (87 percent in the Americas).

The increase in the number of risks

organizations manage is itself a cause of

additional complexity. Many businesses

routinely react to a new regulation by

introducing a new compliance initiative.

It does not take too long before the

number of overlapping initiatives is so

great that the sheer complexity of the

compliance arrangements within an

organization is itself a new source of

risk. We look at this in more detail in the

section on managing risk.

Closely linked to risk is increased cost.

Globally, 78 percent of respondents

thought that this was the principal

challenge of complexity. This rose to

88 percent in the Asia-Pacific economies.

The impact on cost was particularly strong

in China (93 percent), Japan (90 percent),

India (86 percent). In the UK the figure

was 86 percent which, alone among the

European nations, chose increasing costs

as the principal challenge.

The third most frequently identified

challenge was the availability of new

skills. This seems to correlate closely

with those economies where speed

of innovation is a strong cause of

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

10 | C onfro ntin g Co m pl ex it y

Challenges of complexity by region

More new skills needed and a greater cost in Asia-Pacific due to complexity

100

90

80

88%

87%

84%

82%

84%

82%

79%

73%

70%

70

71%

66%

69%

60%

60

64%

66%

63%

64%

55%

54%

50

55%

51%

40

More risks

to manage

Americas

Increased

cost

Europe

Need new

skills

More difficult

to implement

change

More difficult

to compete

More difficult

to make

management

decisions

Deals and

transactions

take more time

Asia-Pacific

Source: KPMG International, 2010

complexity. This is true of Brazil

(where 92 percent identified the need

for new skills as a major challenge),

Japan (90 percent) and China (92 percent).

It is also a major factor for the technology

sector, where more than 80 percent say it

is a significant challenge.

Creating new opportunities

Increasing complexity is also a source of

new opportunities. Three-quarters of all

respondents agreed that opportunities

can arise from complexity, with gaining

competitive advantage and creating new

and better strategies as the two most

common opportunities identified.

There were some interesting alternative

views, however. Among German

respondents, for example, 40 percent

did not think there were opportunities to

be had. Those who did see advantages

were focused mainly on the need for

new products.

At a regional level, there was a

slightly higher tendency to see new

opportunities in Asia-Pacific and the

Americas (78 percent and 79 percent,

respectively, compared to 69 percent for

Europe). But the emerging economies

were significantly more positive, with 81

percent seeing opportunities compared

with 72 percent for the mature

economies. Large majorities in Brazil,

Mexico, India and China see complexity

as a stimulus to improve existing

corporate strategies or create new and

better ones.

optimistic about new opportunities. Their

optimism might be a reaction to the

recession, which hit these economies

particularly hard.

All told, at least 70 percent of

respondents said complexity can create

opportunities for:

• Gaining competitive advantage

• Creating new and better strategies

• Expanding into new markets

• Improving efficiency

Among the more mature economies, the

Irish, Spanish and Japanese were most

“Keep an open eye on all the new complexities that occur in some countries; if

you are the first to resolve them you will have an advantage on the challenger.”

Consumer Market respondent, Germany

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

C o n f r o n t i n g C o mp l exi t y | 11

Complexity can create new opportunities

Opportunities created by complexity

Gain competitive advantage

6%

73%

72%

Create new and better strategies

20%

Expand into new markets

70%

Make my company more efficient

70%

74%

Create new products

60%

Focus our existing business strategy

Yes

No

58%

Don’t know/Can’t say

Source: KPMG International, 2010

The response from business – actions

to address the challenge

Businesses around the world are

working hard to meet the challenges

of increased complexity. Respondents

from all regions, all sectors and both

emerging and mature economies chose

better management of information

as their main response. This perhaps

explains the proliferation of solutions

being developed for business

intelligence, data analytics and cloud

computing.

Reorganizing all or part of the business

came second, chosen by 70 percent of

the global sample and, again, a popular

response across all regions and sectors.

It was particularly popular among

respondents who also said that they had

experienced a very significant increase

in complexity over the past two years.

81 percent of this group said that their

response was some form of business

reorganization.

Businesses are addressing complexity in a variety of ways ... with mixed success*

Actions taken to address complexity

Improved information management

84%

Reorganized all or part of your business

70%

53%

Significantly changed approach to human resources

49%

Invested in new countries or geographies

16%

30%

47%

51%

Influenced regulation or public policy

46%

54%

Did mergers or acquisitions

45%

55%

42%

Outsourced functions

58%

Effectiveness of the actions

44%

48%

8%

45%

47%

9%

39%

49%

43%

29%

42%

48%

43%

34%

Yes

Very effective

No

Somewhat effective

12%

15%

23%

42%

49%

15%

17%

Minimally effective

*Due to rounding, graphs may not add up to 100%

Source: KPMG International, 2010

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

12 | C onfron ting Com p lex it y

These options may have been the

most popular, but there is some

doubt as to how effective they have

been. Around half of respondents

whose organizations tried improving

information management or business

reorganization said that their actions

had been only moderately effective in

solving their problems.

A need for new skills

The impact of the third most popular

option, changing the approach to human

resources, was equally mixed. Although

this was a favored option for 53 percent

of respondents, overall it was seen as

very effective by only 39 percent.

The least effective option was to try

to influence regulation or public policy

directly through lobbying or other

representations. However, this was a

popular option in financial services and

energy and natural resources. It was

also relatively popular in the Asia-Pacific

countries, where 53 percent chose it as

an option, compared with 47 percent in

the Americas and 42 percent in Europe.

the complexity that an organization has

to manage.

Despite this enthusiasm, nearly a

quarter of respondents said that

direct representations were minimally

effective in controlling complexity, and

only 29 percent were prepared to say

they were very effective.

Future plans to meet the challenge

of complexity

Just over half of the people interviewed

expected that in the next two years

their companies would be taking

different or additional actions to deal

with complexity. But responses varied

significantly between countries.

Outsourcing functions was popular

as an option in China, Japan, Brazil,

Russia and Ireland, but it has a mixed

following among other countries, with

only 34 percent declaring it a very

effective response.

These results show that simply taking

on new tasks or outsourcing functions

to respond to complexity is not a

guarantee of success. If these actions

are not integrated into the existing

business model, there are likely to be

overlaps, duplications and conflicting

initiatives. These, in turn will increase

The most active countries looking forward

are South Africa, where 76 percent expect

to increase or change their activity, Ireland

where the figure was 74 percent, and

the US with 71 percent. At the other end

of the spectrum, the countries where

companies are least likely to change

or increase their anti-complexity activity

are Italy, where 56 percent expected

no change, the Netherlands where the

figure was 66 percent and Spain, with

68 percent.

Improving information management is the number one action taken across all market sectors

Market sector (%)

Actions taken

Overall

Financial

services

Technology

Communication

media

Consumer

Chemicals and

pharmaceuticals

Diversified

industrials

Energy and natural

resources

Improved information

management

84

83

88

85

83

81

82

82

Reorganized all or part of

your business

70

69

78

76

65

67

76

65

Significantly changed

approach to human

resources

53

51

57

44

54

54

58

54

Invested in new countries

or geographies

49

44

60

40

45

58

52

44

Influenced regulation or

public policy

46

55

43

47

40

40

40

53

Did mergers or acquistions

45

41

51

36

44

50

48

43

Outsourced functions

42

44

50

49

38

39

44

39

Source: KPMG International, 2010

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

C o n f r o n t i n g C o mp l exi t y | 13

Actions to address complexity, in order of importance

Action to address complexity

over the past 2 years

Action to address complexity

over the next 2 years

Improved information management

Improve information management

Reorganized all or part of

your business

Reorganize all or part of

your business

Significantly changed approach

to human resources

Significantly change approach

to human resources

Invested in new countries

or geographies

Do mergers and acquisitions

Influenced regulation

or public policy

Invest in new countries

or geographies

Did mergers or acquisitions

Outsource functions

Outsourced functions

Try to influence regulation

or public policy

Source: KPMG International, 2010

Again, the most popular action by

a long way is improving information

management, followed by reorganizing

all or part of the business, and changing

the approach to human resources.

The option of doing more mergers and

acquisitions is proving relatively more

attractive, particularly among emerging

economies, while the option of seeking

to influence regulation directly is

becoming even less popular.

Next steps

Although there are clear differences in

the impact of complexity on different

countries, regions and business sectors,

there is consistency in the importance

decision-makers place on it and in the

actions they are taking to address it.

It is also clear that these actions have

met with limited success so far. There

is wide agreement on the need for new

and better approaches.

In the face of complexity, leadership

needs to be a management priority.

Leaders need to ask themselves

the following:

• What are the specific causes of

complexity facing my business

and industry?

• How can I best address the

challenges of complexity?

• How can I use our knowledge and

insight into complexity to drive

opportunity creation and growth?

• How do we ensure that our company

is managing these responsibilities

effectively today, while also planning

for the complexity of tomorrow?

In the rest of this report, we look

more closely at some of the key

themes arising from our research

and offer some thoughts on how

companies may choose to meet the

challenges and take advantage of the

opportunities it presents.

59%

Looking ahead to the

next two years, just

over half of the people

interviewed expected that

their companies would

be taking different or

additional actions to deal

with complexity. But there

was a significant variation

between countries.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

14 | C onfron ting Com p lex it y

Information management –

problem or solution?

If regulation, speed of innovation and

the economic environment are the three

main external causes of complexity, the

three main internal causes are managing

information, operating in multiple

countries and the effects of mergers and

acquisitions on internal organization.

The implications of this are profound.

This report suggests that companies

are struggling to find out what is

happening in their own organizations,

either through lack of good quality data,

inconsistent information, or through

problems interpreting what they have.

Among these, the only element

identified as both a cause of complexity

and a method of dealing with it is

managing information. It is the most

popular technique for dealing with

complexity, both now and in the next

two years, in all regions and in

all sectors.

Short versus long term

This idea is supported by the results

of another KPMG survey, (A New

Role for New Times, KPMG and CFO

Research, 2011), which examines the

role of the chief financial officer (CFO)

and the finance department in a modern

international corporation.

59% to take different or additional actions to address complexity

Improving information management (73%) and reorganizing all or part of your business (59%) the most important future actions

Additional or different actions to address

complexity over the next two years

Improve information

management

73%

Reorganize all or part of

your business

11%

59%

Significantly change

approach to human resources

46%

Do mergers and acquisitions

31%

Yes

59%

No

Don’t know/Can’t say

43%

Invest in new countries or

geographies

42%

Outsource functions

41%

Try to influence regulation

or public policy

40%

None of these

5%

Source: KPMG International, 2010

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

C o n f r o n t i n g C o mp l exi t y | 15

The two greatest challenges cited by

the CFOs interviewed are the internal

complexity of their organizations

and difficulties in finding and using

an effective IT system that is able

to collect, analyze and present the

information needed.

Problems with IT systems frequently

arise because executives find

themselves needing more and better

information from systems that were not

designed to carry such a burden. This

is especially common in organizations

that have been through a large M&A

program and have to cope with several

different legacy systems.

The only long-term answer to this

problem is a complete structural review

of the system. Short-term fixes can help

for a while, and some KPMG teams

have been able to reduce 250-page

management information packs to 50-60

pages by careful selection and analysis

of the information available. But modern

organizations need modern information

systems. To better obtain the benefits of

an accurate and comprehensive view of

a company’s performance, there is often

little alternative to investing in proper

integration of information management

systems to create a common, reliable

and effective platform.

Embedding controls at the right level

Focusing on managing information

suggests a widespread need to

develop an accurate central view

of the risks and performance of an

organization. It is a short step from

here to developing centralized controls

in the belief that these are an effective

method of solving problems.

However, although an accurate central

view is clearly important, KPMG’s

experience shows that heavily

centralized controls are rarely the most

effective way to manage a diverse,

multinational enterprise. The reality is

that in a modern corporation it simply

may not be possible or even desirable

to run things from the center with good

IT, when agility and responsiveness to

complex, rapidly changing markets is

what is really needed.

KPMG subject matter experts talk

instead of embedding best practice at

the lowest possible level, whether this

is in a tax, finance, or risk management

function, or in an operational department.

This view was expressed eloquently

by a Russian finance director in the

consumer sector, whose comment

on complexity was, “Every single

employee should be responsible for

what they do. Give them the power to

make decisions on what they specialize

in, as if every member of staff owns the

company they work for. Because, today,

even if you know what to do and that

this is the right thing to do, you still need

approval from a director or manager who

may not be competent on that issue.”

Although an accurate

central view is clearly

important, KPMG’s

experience shows that

heavily centralized

controls are rarely the

most effective way

to manage a diverse,

multinational enterprise.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

16 | C onfron ting Com p lex it y

Managing increasing risk

A large majority of the businesses

polled in this survey feel the effects of

increased complexity primarily through

an increase in the number of risks they

have to manage. As we noted earlier,

a common response to identifying a

new risk is to create a new program to

handle it. It doesn’t take long before

the number of programs is itself a new

cause of complexity, not least because

these programs often overlap and,

once in place, it can be very difficult to

remove or consolidate them.

This is not just a problem of organization,

it can be a major contributor to costs.

A survey carried out for KPMG in

September 2009 (The Convergence

Challenge, KPMG and EIU, 2010)

revealed that 50 percent of respondents

thought governance, risk and

compliance costs account for 5 percent

of overall revenues, while for 20 percent

they were as high as one-tenth.

These costs might not be a significant

problem if they were seen to be providing

a good return on investment. But only

one-third said they were able to see this

as an investment. For the rest, it was

simply a (rising) cost of doing business.

Governance, risk and compliance

convergence and integration

In larger companies, especially when

highly regulated, the expansion of

governance, risk and compliance activity

has created many large, unwieldy and

often autonomous risk and control

functions. It is not uncommon to have

dozens of committees dealing with

different aspects of risk, many of them

overlapping yet not communicating.

In the midst of this bureaucracy

and duplication, many organizations

are drowning in a sea of their own

complexity. They are unable to

distinguish the critical business risks at

both the group and entity level, and may

come to mistrust some of the business

intelligence they are receiving.

One approach to resolve this problem is

to align and converge the organization’s

governance, risk and compliance

functions and processes (i.e. internal

audit, regulatory compliance,

operational risk, information security,

and risk management) to help

provide increased confidence in, and

transparency of, information. Once risk

and compliance functions and process

silos are removed, the organization

can gain broader insight and can foster

improved decision-making, choosing

how and where they want to assume

greater risk to enhance performance.

An increasingly common strategy

for dealing with the complexity of

governance, risk and compliance is

to tackle head-on the difficult task

of converging or integrating risk

management, creating simpler, more

effective governance and information

management structures.

Organizations are viewing enterprisewide risk management more

strategically, while also looking to draw

more efficiency out of existing risk and

control functions. This combination

results in pre-existing silos being broken

down from a risk information perspective

(risk convergence), allowing for more

efficient identification and management

of risk, including emerging risks.

Although this may sound logical and

practical, it can meet with some

resistance from the risk and control

functions who may not fully understand

the impact on their work. The

Convergence Challenge found that

44 percent of respondents thought

simple resistance to change was

the largest single barrier to greater

convergence of governance, risk and

compliance. These efforts therefore

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

C o n f r o n t i n g C o m p l exi t y | 17

“Most countries’ tax authorities purport to follow the OECD

transfer pricing guidelines, but each authority interprets the

guidance differently. Everyone likes it, but everyone has their

own take on how it should be done.”

Steven Fortier, Global Head of Transfer Pricing, KPMG International

require senior management support

and careful consideration to change

management. It needs to be clear

to everyone in the risk and control

functions that the goal is to identify

opportunities to share risk information

more efficiently, and to leverage and

coordinate activities and resources.

The business is no longer accepting

multiple requests to the same people

from various risk and control oversight

functions, asking for similar information.

This approach will ultimately require the

risk and control functions to coordinate

activities from risk assessment and

planning through to execution of work

and managing issues. To allow this,

there will need to be agreement of

guiding principles by all stakeholders

to establish protocols and to assist in

decision making throughout the risk

convergence initiative.

These guiding principles may include

statements related to the establishment

of a common risk language,

simplification of processes, protocols

for working together and others.

They will set the basis for improved

cooperation across functions.

Clear establishment of roles and

responsibilities is critical in any risk

convergence initiative along with a

transparent change management plan to

embed the right behavior in people and

processes. With these functions working

in harmony and by leveraging appropriate

technology to manage risk information,

an organization should be able to

combine the necessary risk oversight

with continuously improved performance.

But, effective though it is, risk

convergence is not an easy process, and

many companies have tried alternative

methods of reducing complexity.

Popular options are reorganization and

transformation.

Reorganization as a solution to

increased risk

Respondents to the complexity survey

chose reorganizing the business as

the second most popular method of

dealing with complexity, after improving

information management. Seven out

of 10 respondents to the survey said

they had already done this, and a clear

majority expect to do this within the

next two years.

It is likely that many of the organizations

that were polled in the study had taken

part in the very active mergers and

acquisitions market leading up to 2008,

and are still dealing with the issues

raised by bringing together separate

businesses and groups of people.

Mergers and acquisitions were clearly

identified as a cause of complexity

by 50 percent of respondents. It

does not take much thought to

conclude that bringing together

businesses from different countries,

as many companies were doing in a

response to the boom in international

trading opportunities, would present

formidable organizational difficulties.

But, like information management,

mergers and acquisitions were cited

both as a cause and a solution for

complexity. More surprising still, M&A

was thought to be a good solution to the

problem, and said by 43 percent to be

very effective.

Improved integration techniques

For insight on this, it is helpful to turn to

KPMG’s long-running series of studies

on post-merger integration techniques.

This survey has been conducted

every second year since 2000, and

has charted a steady rise in the level

of professionalism, the understanding

of organizational problems and the

standardization of methods applied to

large-scale reorganizations of business.

Supply chain

reorganization

One area in which we have seen

direct evidence of a widespread

move to reduce complexity

through reorganization is in

international supply chains.

This comes from the most recent

of KPMG’s regular surveys of

global manufacturing. Published

in late 2010, it showed clearly

that large companies are actively

reorganizing their supply chains

specifically to reduce cost and risk.

The focus for many was on cutting

down the number of suppliers they

deal with, and on taking the time

and trouble to check the financial

health of this reduced number to

cut down the risk of a failure, which

might affect the whole group.

Although cost reduction

was a declared aim of these

reorganizations, many conceded

that an excessive concentration

on cost reductions in the past

had damaged relationships with

important suppliers. As a direct

consequence, risk had increased,

either through poorer quality, late

deliveries, less co-operation on

product development or a mixture

of all three.

By choosing instead to deal with

fewer suppliers, but to take time

to build improved relations of trust

between supplier and principal,

these organizations have sought

to simplify their operations and

improve management of risk

through reorganization. Many have

conceded that pursuing the lowest

possible cost in all cases carries too

high a risk, and have opted to take

a broader, longer-term view of cost

management in the expectation of

better long-term results.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

18 | C on fron ting Com p lex it y

Risk management still a

challenge

An underlying theme of this survey is that executives

globally see complexity as a source of additional risk

that they must manage. They recognize that poor risk

management in increasingly complex environments

has contributed both to the international financial

crisis of the late 2000s and to more industry-specific

incidents, at great cost to all involved.

KPMG recently sponsored a research report in cooperation with the Economist Intelligence Unit that

examined the post-recession role of risk management

in international organizations (Fall Guys – Risk

Management in the Front Line – KPMG/ACE/EIU 2010).

The key findings from this research were that:

• Strategic risk management remains an immature

activity in many companies

• Only a minority of companies involve risk functions

in key business decisions

• There is limited appetite for investment in the

risk function

• Risk functions have increased in authority, but

there is a danger that this will not be a permanent

change; and

• There are doubts about the level of risk expertise

among non-executive directors.

So has anything really changed in the last couple

of years? While these findings may suggest not,

KPMG member firm practitioners’ experience in this

area suggests that some companies are working

hard to embed sophisticated risk management in

their decision-making. The goal is to turn risk, or at

least the effective management of risk, into a positive

advantage that can generate value.

These organizations view risk as an issue that

affects everyone, not the sole responsibility of a risk

management department. People who can clearly

articulate and quantify the risks they face and their

probable impact on performance are likely to make

better business decisions.

The latest study, to be published later in 2011, reaffirms

some key lessons from previous surveys; that successful

integrations/reorganizations are done fast, they integrate the

new/reorganized business completely, and they are planned

very thoroughly in advance.

In terms of complexity, the most difficult issue that arises,

and one which consistently receives less attention in

the due diligence phase, is merging different cultures. In

extreme cases, problems in getting people to understand

and work with each other can prove to be a deal breaker,

either because key people leave, or because the

accumulated problems of communicating effectively become

overwhelming.

There is further evidence of this problem in the complexity

survey, where 53 percent of respondents said they had made

significant changes in their approach to human resources in

an attempt to deal with complexity, but only 39 percent were

prepared to say that this had been very effective.

Both surveys suggest that there has been much

improvement in the techniques of business reorganization,

and that using these techniques can bring a new logic and

structure to complex organizations that can improve their

performance. But both also suggest that there is work still to

be done on the effective management of cultural complexity,

and that this has become more urgent as businesses expand

further beyond their national borders.

Transformation of traditional functions

Major reorganizations require good information and vision,

and it is in pursuit of these that many organizations have

taken an alternative route to better management of risk and

cost – transformation of core functions like finance and tax

from their traditional transactional role into active providers of

insight and value.

KPMG’s forthcoming survey of CFOs shows that finance

departments, in particular, are coming under increasing

pressure to provide high-quality business analysis of the

information that they routinely collect. Typically, a finance

department that yesterday might have spent 15 percent of

its time on supporting decision making for value creation,

30 percent of its time on financial controls to protect value

and 55 percent of its time on transactional processing, will

today be expected to spend 50 percent of its time on value

creation, and only 20 percent on processing transactions,

often at a much reduced cost to the organization.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

C o n f r o n t i n g C o mp l exi t y | 19

“The answer for many organizations is to take their approach to

risk back to basics, review compliance in the light of how their

business looks today, and rebuild on a more rational basis.”

Mike Nolan, Global Head of Risk and Compliance Services , KPMG International

This is clearly a major challenge for

CFOs – the need to provide an accurate,

understandable picture of what is

happening in increasingly complex

organizations, and to interpret it for

opportunities, while making sure that

the core transactional work of the

function is still being done flawlessly.

But among participants in KPMG’s

CFO survey, just under half said they

were already playing a larger role in

business strategy than five years ago,

and 62 percent expected to increase

this part of their work in the next

five years. A CFO from Singapore

commented, “This role means to

actively participate in decision making,

providing high-quality analysis that is

fact-based and objective. By and large

finance is able to play this role, but it

struggles with catching up with the

constantly changing environment.”

There are many techniques for

managing this kind of transformation

within large organizations, but no one

method that is guaranteed to provide

a perfect result every time. In most

instances, the basic requirements of

those driving these programs are a deep

understanding of the organization’s

goals and business, a strong adherence

to processes and policies, and, in many

cases, the ability to acquire a new and

different set of skills.

CFOs say their finance functions play a much larger role in

decision-making now than they did five years ago, and they expect

this involvement to increase in the future

70

62%

60

50

49%

40

38%

36%

30

20

12%

10

2%

0

Five years ago

Smaller role

Source: KPMG CFO survey 2011

Similar role

Five years from now

Larger role

This is clearly a major

challenge for CFOs –

the need to provide an

accurate, understandable

picture of what is

happening in increasingly

complex organizations,

and to interpret it for

opportunities, while

making sure that the core

transactional work of

the function is still being

done flawlessly.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

20 | C on fron ting Com p lex it y

Speed of innovation

Although the pace of change is

increasing for all respondents,

speed of innovation is a major cause

of complexity for the emerging

economies. In China and Brazil, it

is cited as the number one cause,

ahead of regulation or tax issues. In

India, it is second only to information

management, and in Mexico it comes

second after tax policy.

Among the mature economies, speed

of innovation is the top cause of

complexity for Japanese businesses.

But elsewhere, in the US, Germany,

Canada and the UK, for example, it

comes well down the list, after regulation

and information management.

For the mature economies, this may

say more about the relative importance

of regulation than it does about speed

of innovation as a cause of complexity.

Nevertheless, innovation is being used

throughout the world as a stimulus for

new structures, new thinking and new

solutions to problems.

On one level, companies in emerging

economies are finding growth

opportunities driven by demographics.

In many cases, they already have much

larger, faster growing populations than

in the developed world. This rapidly

growing domestic market means

that organizations that can develop

efficient manufacturing and distribution

processes can gain an advantage.

It requires continuous innovation

to exploit this opportunity, adapting

existing products and solutions to

local requirements. This is a challenge

that European companies know well.

One German respondent said, “You

must keep an open eye on all the new

complexities that may occur in your

countries; if you are the first to resolve

them you will have an advantage over

your challenger.”

A Swiss CFO added, “Keep your ears

open, everything is changing very fast.

It’s death for those not adapting their

business.” In this environment, the drive

for growth drives relentless innovation.

On another level, many global

manufacturing firms are locating

research and development centers in

emerging economies. This is to take

advantage of a lower-cost base and the

availability of highly skilled workers to

ensure that products and services meet

local customer needs.

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

C o n f r o n t i n g C o m p l exi t y | 21

A premium on agility

Most emerging markets suit highly

diverse conglomerates. These are the

companies best able to adapt to fastchanging opportunities in the drive

to grow. Indeed, they have to do so,

which in turn places a premium on

agility and innovation.

Techniques for developing these qualities

vary widely. One Korean respondent

spoke proudly of the “Intrapreneuriat”

which his company had established as

a successful focus for entrepreneurial

thinking within the company. This

formalized approach can work very well

in one company, but may not be suitable

for those with a different culture.

For any company, harnessing the

creativity and imagination of employees

is necessary to remain competitive. This

is clearly a complex task. It could involve

adapting technology to create new

products, reducing the cost of products

to appeal to markets in emerging

economies, or adapting products and

solutions to meet new regulations.

The key to managing innovation is to

maintain an open and receptive policy

on new ideas, and to avoid internal

complexities that might stifle or divert

creativity. Those who get this right

will succeed.

“Businesses in emerging economies are finding greater

growth opportunities and acting upon them more quickly than

those in the developing world. The companies that are most

successful have efficient manufacturing and distribution

processes that deliver profitable, low-cost products and

solutions. This requires continuous innovation to adapt existing

products and solutions to local requirements.”

Adam Bates, Partner, Risk and Compliance Services, KPMG LLP (UK)

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

22 | C on fron ting Com p lex it y

Changing demographics

presents a number of

challenges for human

resources: businesses

will have to adopt

new approaches to

recruitment.

The need for new skills

Economies in a period of rapid

technological change will naturally be

hungry for people with the necessary

new skills to help build and maintain a

competitive advantage.

In this survey, speed of innovation

is identified as a leading cause of

complexity in Brazil, Mexico, China and

India, so it’s not unreasonable that these

countries should also identify the need

for new skills as a top priority.

If we compare emerging with mature

economies, the need for new skills is

identified as a major challenge by

81 percent and 76 percent respectively.

It is interesting that the gap between

the two is not wider.

In Japan, for example, the need for new

skills is rated as the top challenge of

complexity, chosen by 90 percent of

respondents, alongside increased costs.

In Europe and North America the figures

are between 70 percent and 80 percent.

Demographic changes driving

changing labor force

Part of this may be simply due to the

pace of technological change in these

countries, but for further insight it is

helpful to look at some of the work

on demographic change that is being

done by Bernard Salt, a KPMG partner

in Australia who has specialized in

analyzing the global impact on business

of changes in population.

His work on population trends in large

economies has identified a widespread

decline in the rate of growth in

numbers of active working age people

(defined as 15–64 years of age) in

these countries. Aging populations and

declining birth rates have meant that,

taking Japan once again as an example,

the number of Japanese working age

people began to fall in 1994 and has

fallen every year since then.

In France, the rate of growth has

declined substantially from the peaks of

the 1970s and 1980s, and is expected

to tip into a net reduction in the working

age population by 2012. China is

expected to reach the same point

in 2016.

India does not have the same problem.

Its relatively young population is

expected to provide growth in the

number of working age people for

decades to come. But in the UK

and the US, declines in the growth

of the indigenous population have

been overcome only by large-scale

immigration; in the UK, migrants have

come largely from former colonies and

from the EU, and in the US they have

come from Latin America.

For businesses faced with a labor force

where the average age is steadily

rising, there may be a desire to bring

in new people with fresh skills and

different ideas. If these people are not

available in the domestic workforce,

then this is clearly going to be easier

to do in countries where there is a

tradition of immigration to fall back on,

as in the US and the UK.

As to where these people might come

from, India would seem to be a good

place to look. UN statistics suggest that

over the past four years, around

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

C o n f r o n t i n g C o m p l exi t y | 23

14 million working age people a year have

been added to the Indian workforce.

These changing demographics present

a number of challenges for human

resources. Businesses will have to

adopt new approaches to recruitment

and start to look outside their traditional

marketplaces for resources. A more

proactive and flexible approach to

workforce planning may be required.

The development of new skill sets

among existing workforces will also

become more important. Finally, for

many countries it appears that the war

for talent is imminent, which means

attracting and retaining resources will

become a business priority.

The results of Bernard Salt’s research were published as The Global Skills

Convergence. This included interviews with senior HR executives in several

global companies. Their preferences for the ideal corporate recruit are

summarized in the table below, and set alongside their actual experiences

of recruiting among “Generation Y,” people coming into the workforce in the

mid-2000s. The differences between the two may go some way to explain the

problems businesses are having in filling their need for new skills.

Ideal Corporate Citizen

Reality of Generation Y

Age 38-42

Age 15-30

Agreeable or moveable spouse/partner

No relationship commitments

Law degree and business degree, e.g. MBA

No mortgage, deferrable debt

Second language as well as English

Widely travelled, possibly second language

May have lived abroad in youth

Backpacker, gap year

Experience in running a division or program

Possibly involved in volunteer work abroad

Possesses and employs cultural sensitivity

Exposure to different cultures via technology

Possibly spent time in military

Children of rich, guilty and indulgent parents

“Known” within the industry

Moves frequently between jobs

Technically excellent

Prefers autonomy to corporate direction

“Businesses will have to adopt new approaches to recruitment

and start to look outside their traditional marketplaces for

resources.”

Rachel Campbell, Global Head of People, Performance and Culture, KPMG International

© 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

24 | C on fron ting Com p lex it y

Government and regulation

For companies in Europe and the

Americas, particularly the more mature

economies, regulation is the number

one cause of complexity. Corporate

leaders talk of the problems of dealing

with a constant stream of new

legislation, with less and less time for

effective preparation.

“Increasing regulation can

be a catalyst for companies

to focus on areas of their

business that could operate

more efficiently and create

greater value. The tax

function is a good example.

As businesses globalize,

they seek tax-efficient ways

to expand. At the same time

more tax authorities are

requesting evidence that

tax decisions are made

in accordance with clear

corporate governance

guidelines. This provides

the tax function with a need

and an opportunity to adopt

better processes, new

controls and improved use

of technology to feed their

increasing need for accurate

and up-to-date information.”

Loughlin Hickey, Global Head of Tax,

KPMG International

For companies in the Asia-Pacific region,

regulation remains a major cause

of complexity, but it is matched by

speed of innovation. Among the major

emerging economies – Brazil, Mexico,

Russia, South Africa, China and India

regulation is the number one cause

of complexity.

This suggests that while companies

in these countries will share some of

the concerns of their US and European

competitors over increased government

activity, more of their energies are

being spent working out how to stay

ahead of the new ideas, products and

competitors in their markets.

These results are entirely consistent

with the conclusions of a 2009 KPMG

survey, Never catch a falling knife,

which examined how companies

around the world reacted to recession.

It found that while European and North

American companies tended to see the

problems of recession as a matter for

governments, requiring more regulation

and oversight to solve them, companies

in other parts of the world saw

recession as an opportunity to review

practices and find a new path to growth.

Regulation is, however, a fast-developing

field. Several of the most impressive

economic success stories of the past

decade have been accompanied by

common complaints. Firstly, that legal

systems are not sufficiently reliable for

international trade, and secondly that

labor, product quality or health and safety

legislation is undeveloped in comparison

with international standards.

The survey indicates that a majority

of the Asia-Pacific and emerging

economies believe that speed of

innovation could become their biggest

cause of complexity in the next

two years. However, it is possible

that the demands of consumers

in other countries, combined with

increasing international cooperation

on financial regulation, tax legislation

and environmental issues, may drive

regulation to the top of their list.

Regulation as a catalyst for

improvement

Increasing regulation may appear

to present nothing but problems for

business, but regulation is created to

deal with specific problems. For many

businesses, the complexity that new

regulations generate can be used as a

catalyst to identify and focus on areas

of the operation that are not working