2014 Submarine Cable Market Industry Report

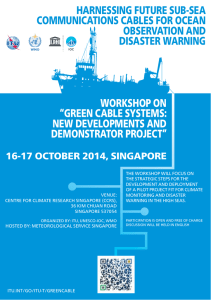

advertisement