2014 annual report - Rogers Corporation

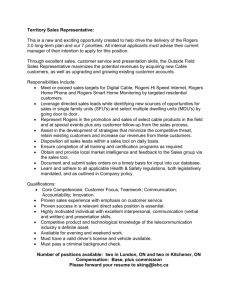

advertisement