Page 1 de 1

Quantitative Equity Report | Release: 30 Sep 2016, 20:57 UTC | Reporting Currency: TWD | Trading Currency: USD | Exchange:XLON

Hon Hai Precision Industry Co Ltd ADR HHPG

Last Close

Fair ValueQ

Market Cap

30 Sep 2016

30 Sep 2016 02:00 UTC

30 Sep 2016

5,35

—

—K

There is no one analyst in which a Quantitative Fair Value Estimate and Quantitative

Star Rating are attributed to; however, Mr. Lee Davidson, Head of Quantitative

Research for Morningstar, Inc., is responsible for overseeing the methodology that

supports the quantitative fair value. As an employee of Morningstar, Inc., Mr.

Davidson is guided by Morningstar, Inc.’s Code of Ethics and Personal Securities

Trading Policy in carrying out his responsibilities. For information regarding Conflicts

of Interests, visit http://global.morningstar.com/equitydisclosures

Sector

Industry

Country of Domicile

a Technology

Electronic Components

TWN Taïwan

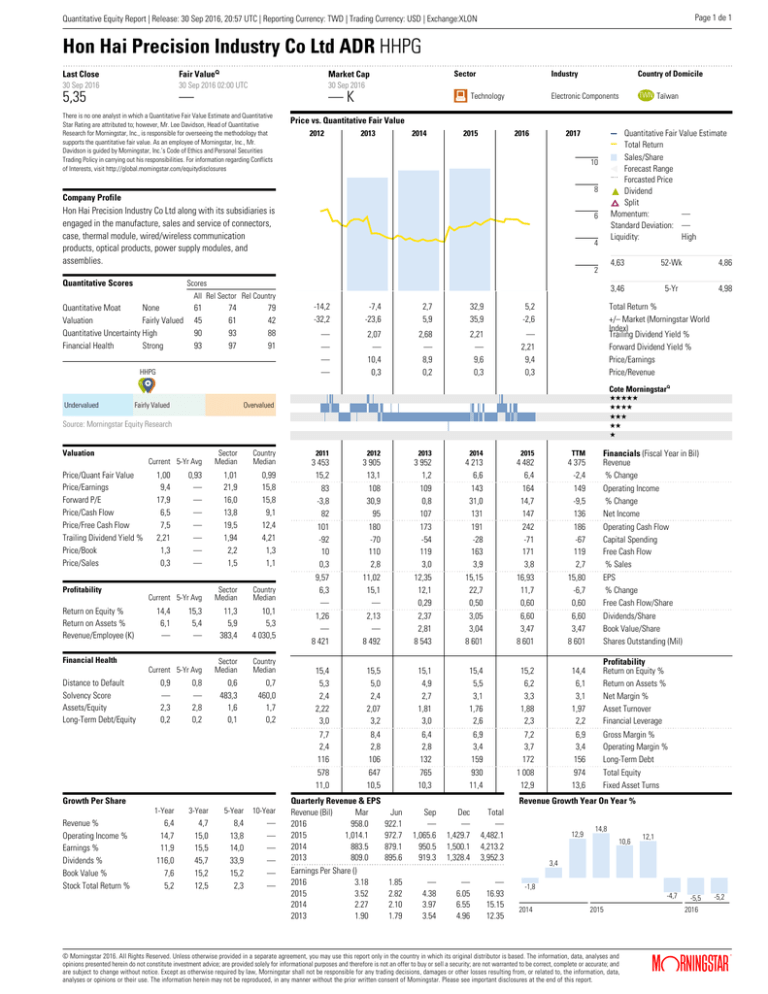

Price vs. Quantitative Fair Value

2012

2013

2014

2015

2016

Quantitative Fair Value Estimate

Total Return

Sales/Share

Forecast Range

Forcasted Price

Dividend

Split

Momentum:

—

Standard Deviation: —

Liquidity:

High

2017

10

8

Company Profile

Hon Hai Precision Industry Co Ltd along with its subsidiaries is

engaged in the manufacture, sales and service of connectors,

case, thermal module, wired/wireless communication

products, optical products, power supply modules, and

assemblies.

6

4

2

Quantitative Scores

Scores

All Rel Sector Rel Country

Quantitative Moat

None

Valuation

Fairly Valued

Quantitative Uncertainty High

Financial Health

Strong

61

45

90

93

74

61

93

97

79

42

88

91

HHPG

-14,2

-32,2

-7,4

-23,6

2,7

5,9

32,9

35,9

5,2

-2,6

—

—

—

—

2,07

—

10,4

0,3

2,68

—

8,9

0,2

2,21

—

9,6

0,3

—

2,21

9,4

0,3

Profitability

Return on Equity %

Return on Assets %

Revenue/Employee (K)

Sector

Median

Country

Median

0,93

—

—

—

—

—

—

—

1,01

21,9

16,0

13,8

19,5

1,94

2,2

1,5

0,99

15,8

15,8

9,1

12,4

4,21

1,3

1,1

Current 5-Yr Avg

Sector

Median

Country

Median

15,3

5,4

—

11,3

5,9

383,4

10,1

5,3

4 030,5

Current 5-Yr Avg

Sector

Median

Country

Median

0,6

483,3

1,6

0,1

0,7

460,0

1,7

0,2

Current 5-Yr Avg

1,00

9,4

17,9

6,5

7,5

2,21

1,3

0,3

14,4

6,1

—

Financial Health

Distance to Default

Solvency Score

Assets/Equity

Long-Term Debt/Equity

0,9

—

2,3

0,2

0,8

—

2,8

0,2

Growth Per Share

Revenue %

Operating Income %

Earnings %

Dividends %

Book Value %

Stock Total Return %

3,46

5-Yr

4,98

QQQQQ

QQQQ

QQQ

QQ

Q

Overvalued

Source: Morningstar Equity Research

Price/Quant Fair Value

Price/Earnings

Forward P/E

Price/Cash Flow

Price/Free Cash Flow

Trailing Dividend Yield %

Price/Book

Price/Sales

4,86

Cote MorningstarQ

Fairly Valued

Valuation

52-Wk

Total Return %

+/– Market (Morningstar World

Index)

Trailing Dividend Yield %

Forward Dividend Yield %

Price/Earnings

Price/Revenue

TWNa

Undervalued

4,63

1-Year

3-Year

5-Year

10-Year

6,4

14,7

11,9

116,0

7,6

5,2

4,7

15,0

15,5

45,7

15,2

12,5

8,4

13,8

14,0

33,9

15,2

2,3

—

—

—

—

—

—

2011

2012

2013

2014

2015

TTM

3 453

15,2

3 905

13,1

3 952

1,2

4 213

6,6

4 482

6,4

4 375

-2,4

83

-3,8

82

108

30,9

95

109

0,8

107

143

31,0

131

164

14,7

147

149

-9,5

136

Operating Income

% Change

Net Income

101

-92

10

0,3

180

-70

110

2,8

173

-54

119

3,0

191

-28

163

3,9

242

-71

171

3,8

186

-67

119

2,7

Operating Cash Flow

Capital Spending

Free Cash Flow

% Sales

9,57

6,3

—

11,02

15,1

—

12,35

12,1

0,29

15,15

22,7

0,50

16,93

11,7

0,60

15,80

-6,7

0,60

EPS

% Change

Free Cash Flow/Share

1,26

—

8 421

2,13

—

8 492

2,37

2,81

8 543

3,05

3,04

8 601

6,60

3,47

8 601

6,60

3,47

8 601

Dividends/Share

Book Value/Share

Shares Outstanding (Mil)

15,4

5,3

2,4

2,22

3,0

15,5

5,0

2,4

2,07

3,2

15,1

4,9

2,7

1,81

3,0

15,4

5,5

3,1

1,76

2,6

15,2

6,2

3,3

1,88

2,3

14,4

6,1

3,1

1,97

2,2

Profitability

Return on Equity %

Return on Assets %

Net Margin %

Asset Turnover

Financial Leverage

7,7

2,4

116

8,4

2,8

106

6,4

2,8

132

6,9

3,4

159

7,2

3,7

172

6,9

3,4

156

Gross Margin %

Operating Margin %

Long-Term Debt

578

11,0

647

10,5

765

10,3

930

11,4

1 008

12,9

974

13,6

Total Equity

Fixed Asset Turns

Quarterly Revenue & EPS

Revenue (Bil)

Mar

2016

958.0

2015

1,014.1

2014

883.5

2013

809.0

Earnings Per Share ()

2016

3.18

2015

3.52

2014

2.27

2013

1.90

Financials (Fiscal Year in Bil)

Revenue

% Change

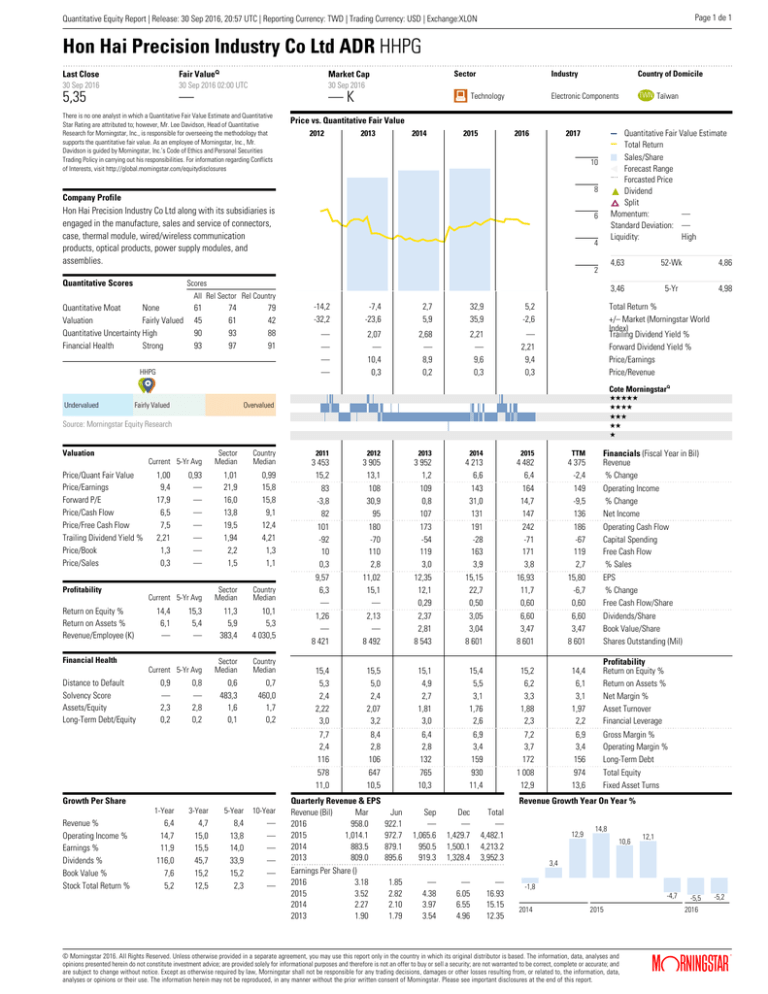

Revenue Growth Year On Year %

Jun

922.1

972.7

879.1

895.6

Sep

—

1,065.6

950.5

919.3

Dec

—

1,429.7

1,500.1

1,328.4

Total

—

4,482.1

4,213.2

3,952.3

1.85

2.82

2.10

1.79

—

4.38

3.97

3.54

—

6.05

6.55

4.96

—

16.93

15.15

12.35

12,9

14,8

10,6

12,1

3,4

-1,8

-4,7

2014

2015

© Morningstar 2016. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. The information, data, analyses and

opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore is not an offer to buy or sell a security; are not warranted to be correct, complete or accurate; and

are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data,

analyses or opinions or their use. The information herein may not be reproduced, in any manner without the prior written consent of Morningstar. Please see important disclosures at the end of this report.

-5,5

-5,2

2016

®

ß