September 2013

Understanding

sanctions

Wire stripping: managing

compliance risk

by Jason Wingo and Julien Chanier

Recently, there has been an increasing amount of press coverage and news about

financial institutions failing to comply with requirements to screen and block

payments linked to sanctioned individuals, entities and countries. Many of these

institutions have demonstrated an inability to monitor or prevent wire stripping.

Wire stripping is the deliberate act of changing or removing material

information from wire payments or instructions, thereby making it

difficult to identify and restrict payments to and from sanctioned

parties or countries. Facilitating or turning a blind eye to such activity

may subject financial institutions and their most senior executives to

regulatory actions and criminal proceedings.

In recent wire-stripping incidents identified by US regulatory

authorities, certain institutions were involved in concealing, or simply

removing, true originators from transactions processed through

US banks in order to avoid the sanctions-monitoring programs put

in place by those institutions. A number of these institutions even

went a step further, advising originating banks on how to format

their transfers in a manner that would allow the transactions to avoid

detection completely. As a result of their activities, the institutions

were subjected to substantial regulatory fines, in addition to the

reputational damage they suffered. While the actual number of

true violations uncovered at these institutions was relatively small

compared to their total wire activity, and also as compared to

their actual transactions “stripped,” the absence of controls and

compliance culture at these institutions led directly to significant

regulatory actions.

With the closer scrutiny now imposed by regulatory authorities,

highly public investigations and a growing number of regulatory

enforcement actions, financial institutions have begun to take a

much more proactive approach to identifying, communicating

and mitigating wire-stripping activities. While implementation

approaches may vary, the core concepts of developing people,

improving processes and leveraging available technology appear

consistently when examining how best to hinder such activity from

occurring within the walls of an organization, and they are necessary

components of an effective compliance program.

Developing people

A recurring theme emerging from the analysis of recent events

suggests that most wire-stripping activity occurs when management

oversight or attitude is lax. Educating employees on the practice of

wire stripping and providing them with an understanding of why it

is important to identify this type of activity should be the first line

of defense. However, the impact of such education will be limited if

a culture of compliance does not exist within an institution, senior

management is complacent or doesn’t emphasize it as a priority, or if

there are concerns about retaliation against whistleblowers.

Establishing a culture of compliance at all levels within an organization

is a crucial step that companies must take to empower their people

to remain vigilant and cognizant of situations or activities that would

be deemed non-compliant. However, a culture of compliance is

not something that simply happens overnight; it requires ongoing

and committed efforts from senior management. The tone from

the top must thus enable compliance rather than facilitate noncompliance. Organizations can potentially prevent or mitigate wire-

2

| Wire stripping: managing compliance risk

stripping activities by empowering highly trained employees who

are adequately informed and who maintain a heightened sense of

awareness toward non-compliant activity.

This said, the next questions that organizations may ask are, “What

else can we do to prevent these activities?” and “How can we

implement additional controls to prevent or detect these risks?”

Improving processes and controls

Defining or improving processes and controls within different

functions of the organization can significantly mitigate risks and

enhance the detection and prevention of wire-stripping activities

over time. These processes can be implemented within customer

relationship management, operations and compliance functions and

typically fall into three broad categories:

• Assessments — Improving self- and independent assessment

processes while simultaneously coordinating with internal audit to

identify potential areas of concern in sanctions programs, including

wire stripping

• Monitoring — Developing both preventive and detective processes

and tools and utilizing visual analytics environments for examining

large data sets to help organizations understand where future

compliance risks and concerns may occur based on several

different factors, such as historical issues, contextual data or

industry-related events

• Governance — Improving overall governance and the level of

management reporting available within an organization to measure

progress against objectives and requirements

Although certain process improvements can allow organizations to

increase compliance awareness, it is essential for organizations to

continue leveraging available and emerging technologies for ongoing

improvement of their compliance-monitoring and assessment

programs. This will also permit better management of ever-changing

business models and the regulatory landscape.

Leveraging technology

Organizations can implement detection processes to monitor and

act upon wire-stripping activity. There are a variety of different

options for organizations to consider, depending on the capabilities or

limitations within their current operating environments.

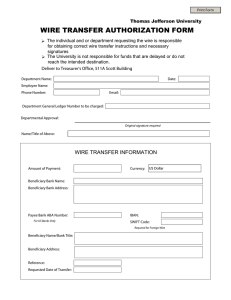

Compare payment before entering or leaving the

organization

In some situations, someone inside the organization may manipulate

the contents of a payment transaction once it is received but prior

to its being processed by the institution’s payment or settlement

systems. A possible solution to identify this type of activity is

to compare the payment before it enters and after it leaves the

organization’s SWIFT gateway. Hash keys could be systematically

generated and then compared for similarity before notifying the

appropriate resources if they do not match in a particular transaction.

Mismatched hash keys may signal that wire data within the payment

transaction message was changed once it entered the SWIFT gateway

and before it was processed by payment systems.

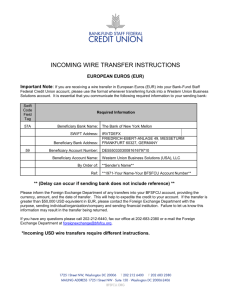

• Checking for suspicious phrases usually used to conceal originator

or beneficiary identity (e.g., “No name,” or “On behalf of a

customer”)

Alternatively, organizations can maintain archives of all raw SWIFT

payload messages either entering or leaving the organization and

then create processes that would reconstruct transaction records

into their corresponding SWIFT payload format. These reconstructed

SWIFT messages could then be compared to the archived SWIFT

messages during assessments or internal audits so that any potential

violations can be identified.

• Deriving the country of the sending institution from the BIC code

in the SWIFT message and comparing it to the country code of the

originator’s address

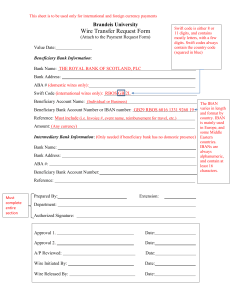

Compare key attributes of payment pairs

In some cases, payments are linked to other payments, and

discrepancies between these payment pairs may indicate that wire

stripping has occurred. A possible detection method for this situation

is to compare certain key fields of these payment pairs. For example:

• When a financial institution acts as a correspondent bank and

processes payments, key attributes of incoming and outgoing

messages that are expected not to be altered or changed should

be compared to confirm that, in fact, the information has not been

altered (e.g., beneficiary and remitter).

• When the financial institution is the remitting bank, it should be

confirmed that the remitter and beneficiary fields are the same for

matched pairs (e.g., MT103 and MT202-COV pairs).

Perform field level checks and detect common wire-stripping

techniques

As wire stripping can also occur before an organization receives the

payment, automated red-flag checks can also be a useful means of

detecting potential wire-stripping activities being performed, most

likely, by other institutions along the payment path. Some typical

red-flag checks that can be implemented against payment

transactions include:

Identify similar payments that have already been blocked

or rejected

An additional method for detecting potential wire-stripping activity

focuses on comparing previously submitted and rejected payments.

This method will require financial institutions to maintain and leverage

historical profiles of payment messages that were blocked or rejected.

The institutions would then be able to monitor SWIFT messages

against a set of payments that had previously been submitted and

rejected in an effort to identify messages subsequently resubmitted

without material data elements, such as originator or beneficiary

name and address.

While technology, as well as any of these methods, may be leveraged

for detection, it often needs to be supplemented by changes in

people and processes to forestall wire-stripping activities more

efficiently. Wire stripping remains a concern for regulators as it can be

viewed as an overt act of non-compliance. Many institutions cannot

demonstrate strong controls and validation processes to evaluate

efficacy or even awareness of the potential for wire stripping; this can

raise additional concerns. As several high-profile regulatory actions

have occurred with regard to this issue, financial institutions would be

well advised to take proactive steps to evaluate their exposure to wire

stripping and begin to implement strategies to mitigate that exposure.

• Checking for suspicious patterns of characters in originator or

beneficiary fields, such as sequences of digits, special characters

or empty spaces. (e.g., “AAAA”, “ “, “$%&#”)

September 2013 |

3

About the authors

Jason Wingo

Julien Chanier

Ernst & Young LLP

tel: +1 212 773 5228

email: jason.wingo@ey.com

Jason is a senior manager in EY’s Financial Services Advisory practice.

He has more than 15 years of experience in the IT industry serving

capital markets, retail and banking clients in the areas of anti-money

laundering, economic sanctions, trading and regulatory compliance.

Ernst & Young LLP

tel: +1 212 773 2925

email: julien.chanier@ey.com

Julien is a manager in EY’s Financial Services Advisory practice.

He has more than three years of experience in advising clients

with sanction screening technology and seven years of experience

in application design and development. His past professional

experience also includes two years in the compliance software

industry, helping top-tier US and global financial institutions

implement and integrate Actimize sanction screening solutions.

EY | Assurance | Tax | Transactions | Advisory

About EY

EY is a global leader in assurance, tax, transaction and advisory services. The

insights and quality services we deliver help build trust and confidence in the

capital markets and in economies the world over. We develop outstanding

leaders who team to deliver on our promises to all of our stakeholders. In so

doing, we play a critical role in building a better working world for our people,

for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the

member firms of Ernst & Young Global Limited, each of which is a separate

legal entity. Ernst & Young Global Limited, a UK company limited by

guarantee, does not provide services to clients. For more information about

our organization, please visit ey.com.

Ernst & Young LLP is a client-serving member firm of Ernst & Young Global

Limited operating in the US.

EY is a leader in serving the global financial services marketplace

Nearly 35,000 EY financial services professionals around the world provide

integrated assurance, tax, transaction and advisory services to our asset

management, banking, capital markets and insurance clients. In the Americas,

EY is the only public accounting organization with a separate business unit

dedicated to the financial services marketplace. Created in 2000, the Americas

Financial Services Office today includes more than 4,000 professionals at

member firms in over 50 locations throughout the US, the Caribbean and

Latin America.

EY professionals in our financial services practices worldwide align with key

global industry groups, including EY’s Global Asset Management Center, Global

Banking & Capital Markets Center, Global Insurance Center and Global Private

Equity Center, which act as hubs for sharing industry-focused knowledge

on current and emerging trends and regulations in order to help our clients

address key issues. Our practitioners span many disciplines and provide a wellrounded understanding of business issues and challenges, as well as integrated

services to our clients.

With a global presence and industry-focused advice, EY’s financial services

professionals provide high-quality assurance, tax, transaction and advisory

services, including operations, process improvement, risk and technology, to

financial services companies worldwide.

© 2013 Ernst & Young LLP.

All Rights Reserved.

SCORE No. CK0688

1308-1124709 NY

ED None

This publication contains information in summary form and is therefore intended for general guidance

only. It is not intended to be a substitute for detailed research or the exercise of professional judgment.

Neither Ernst & Young LLP nor any other member of the global Ernst & Young organization can accept

any responsibility for loss occasioned to any person acting or refraining from action as a result of any

material in this publication. On any specific matter, reference should be made to the appropriate advisor.

ey.com