Post exit operating performance of PE-backed firms

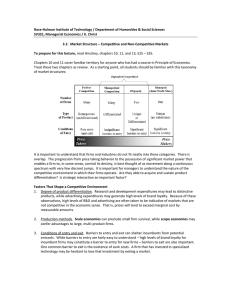

advertisement