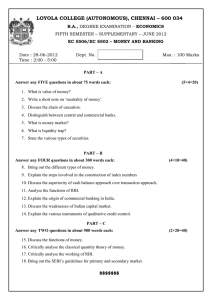

Analysis of Financial Ratios

advertisement

Analysis of Financial Ratios CV.Alexander DGM &FM Version: College of Agricultural Banking, RBI, PUNE 1 Definition • The relationship between two accounting figures expressed mathematically is known as financial ratio Date: College of Agricultural Banking, RBI, PUNE 2 Introduction • What is the purpose of analysis of financial ratios – It is for a meaningful study of information in the financial statements – Ascertaining overall financial position of a business organisation – Interpretation of key information in the financial statements Date: College of Agricultural Banking, RBI, PUNE 3 Objective • The objectives: – Assess credit risk profile of the borrower – Stipulation of terms and conditions – Assess utilization of credit facility – Establish sound well defined credit granting criteria – Ensure safety of bank funds Date: College of Agricultural Banking, RBI, PUNE 4 Factors that banks consider • • • • • • • • Date: Credit worthiness of the borrower Integrity/reputation Credit risk profile Sensitivity to economic and market developments Liquidity Solvency Profitability of business Resource efficiency College of Agricultural Banking, RBI, PUNE 5 Financial Analysis • Trends in the financial planning • Analysis of projected financial statements Date: College of Agricultural Banking, RBI, PUNE 6 Assets & Liabililities (Rs.crore) Liabilitiesm Year 3 Year 2 Year 1 Category Category Year 1 Year 2 Year 3 2652 2308 2249 Current Liabilities Current Assets 2868 2867 3088 (436) (559) (619) Net Working Capital 039 3688 3279 Deferred Liability Net Fixed Assets 5394 5527 6300 4065 3974 3742 Net Worth Misc. Assets 840 1298 1071 Intangible Assets 168 278 297 9270 9970 10756 10756 Date: Assets 9970 9270 Total Total College of Agricultural Banking, RBI, PUNE 7 Measures of Liquidity • • • • • Date: Net Working Capital Current Ratio Quick Ratio Net Working Capital/Net Assets Net Working Capital/Current Assets College of Agricultural Banking, RBI, PUNE 8 Net Working Capital • Gross Working Capital ( GWC) • is the investment required to be made by the borrower in Current Assets • How • From own contributions • From creditors, borrowings • Other short term resources Date: College of Agricultural Banking, RBI, PUNE 9 Gross Working Capital • • • • Date: Gross Working Capital How funded From own resources and other long term sources Short fall if any from short term resources College of Agricultural Banking, RBI, PUNE 10 Short Term Resources • Short term resources constitute what are known as ‘ Current Liabilities’ • Current Liabilities should be lower than Current Assets • Excess o0f Current Assets over Current Liabilities is Net Working Capital • Contribution from long term resources applied to financing of Current Assets ( excess of Current Assets) is owner’s stake or margin money Date: College of Agricultural Banking, RBI, PUNE 11 Financing of Current Assets (National Steel Corporation) • 1.Current Assets • = Current Liabilities + NWC or 3088 = 2652 + 436 • 2. NWC = Current Assets – Current Liabilities or • 436 = 3088 – 2652 • 3. Current Assets = Current Liabilities + Contribution from Long Term Liabilities • 3088 = 2249 +[(8104-7668)] =2652+436 • (i.e.NWC = 3088) Date: College of Agricultural Banking, RBI, PUNE 12 Concept of NWC • NWC represents the surplus long term funds applied towards financing of Current Assets • Current assets are financed from two sources – Surplus from Long Term Liabilities – Current Liabilities Difference between Current assets and Current Liabilities should always be positive Date: College of Agricultural Banking, RBI, PUNE 13 NWC • Negative Net Working Capital • What is the Implication • Business has applied part of surplus Current Liabilities towards meeting shortfall in Long Term resources Date: College of Agricultural Banking, RBI, PUNE 14 NWC • Positive NWC means i.Borrower has brought in his contribution ii.Any fall in value of Current Assets will be cushioned by borrower’s stake iii.Loss in sale of Current Assets will not affect Short term creditors Date: College of Agricultural Banking, RBI, PUNE 15 NWC • Net Working Capital ( NWC ) is a measure of liquidity • Sources for NWC Long Term Liabilities net of Long Term Assets ( LTLs including Net Worth less LTAs which includes Fixed Assets, miscellaneous assets and intangibles. Another measure of liquidity is the Current Ratio) Date: College of Agricultural Banking, RBI, PUNE 16 Current Ratio • Current Ratio: Current Assets/ Current Liabilities If Net Working Capital is to be of positive value the Current Ratio must be higher than 1. Ideally for calculating MPBF Current Ratio should be 1.33: 1 Date: College of Agricultural Banking, RBI, PUNE 17 Liquidity Ratios Year 1 1. Current Assets 2.Quick Assets 3.Current Liabilities 4.NWC (1-3) 5.Current Ratio 6.Quick Ratio 7.Net Sales 8 NWC/Net Sales (%) 9NWC/Current Assets(%) Date: Year 2 2868 1792 2249 619 1.28 0.80 5635 10.98 21.58 College of Agricultural Banking, RBI, PUNE 2867 1846 2308 559 1.24 0.80 5526 10.12 19.50 Year 3 3088 1040 2652 436 1.16 0.77 6104 7.14 14.12 18 Quick Ratio • From the ‘gone concern’ approach inventory is the least liquid of Current Assets • Quick Ratio or Acid Test Ratio = Current AssetsInventory/Current Liabilities • Norm the QR should not be less than 1. • 1:1 is satisfactory Date: College of Agricultural Banking, RBI, PUNE 19 NWC/Net Sales • This percentage should be around 8-12 % • NWC is lower: • Business is growing too fast without building an adequate cushion in the form of NWC • It indicates symptom of overtrading and • Undue reliance on borrowed short term funds Date: College of Agricultural Banking, RBI, PUNE 20 Falling NWC/Net Sales • Indicative of overtrading and serious liquidity problems • It needs to be investigated Date: College of Agricultural Banking, RBI, PUNE 21 NWC/Current Assets • This measures contribution of Long Term funds towards financing Current Assets • Method of Lending • 1st Method Amt. 2nd Method Current Assets 370 25 (LTS) Less CLs -150 WCG 220 25% -55 MPBF 165 CR 1.17 CR Date: College of Agricultural Banking, RBI, PUNE Amt. 370 278 -150 128 1.33 22 Debt Equity Ratio • DER = TLT Liabilitie/TNW • Low ratio has a better leverage for borrowing • Not more than 1.5 for providing finance by banks Date: College of Agricultural Banking, RBI, PUNE 23 DSCR • DSCR =( Net profit +Depcn+ Annual amount of int.on LTLs)/Interest + principal • Indicative of funds available for servicing long term debt • DSCR = 6+4+2/6 = 12/6= 2 • This is comfortable • Should not be less than 1.5:1 while considering projects Date: College of Agricultural Banking, RBI, PUNE 24 Return on Assets • RoA = PBIT/Total Assets • To measure profitability and efficiency • Higher the ratio, the more efficient is the firm in using resources Date: College of Agricultural Banking, RBI, PUNE 25 Gross Profit Margin • The surplus of sales over cost of goods sold • Gross profit Margin= (Sales sold )x 100/Sales minus Cost of goods • A higher ratio indicates better managerial efficiency and profitability Date: College of Agricultural Banking, RBI, PUNE 26 Interest Coverage Ratio • ICR = PBDIT/Annual Int.Obligation • To find out whether business generates sufficient profit to service interest payment • Interest Coverage Ratio of 3 is reasonable and below 2 is considered risk prone Date: College of Agricultural Banking, RBI, PUNE 27 Summary – Ratio analysis is used as a major tool for financial analysis – For a meaningful study of information contained in the financial statements – Ascertaining the overall financial position of a Business Organization – Ratios are calculated from the past financial statements – Ratios could also be worked out based on the projected financial statements of the same firm Date: • Easiest way of evaluating the performance of a firm is by comparing past and present ratios • Used to judge operational efficiency, financial health, solvency or soundness • To find out the liquidity position • Major categories of ratios 9 9 9 9 Liquidity ratios Leverage or solvency ratios Activity Ratios Profitability Ratios College of Agricultural Banking, RBI, PUNE 28 • ANY ???? • THANK YOU Date: College of Agricultural Banking, RBI, PUNE 29