Annex 6 Public Annuity Scheme Proposed by Dr Law Chi

advertisement

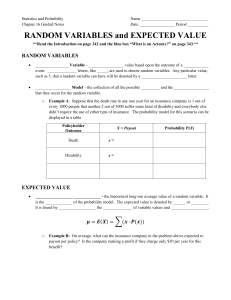

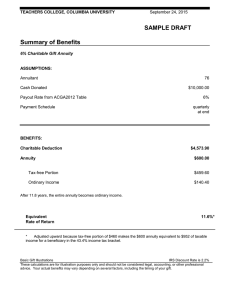

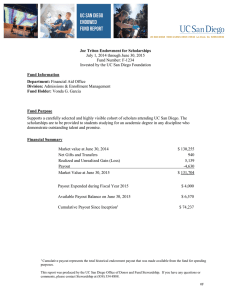

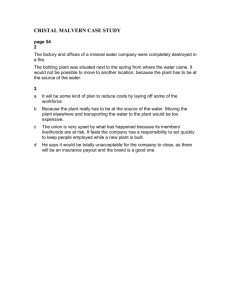

Annex 6 Public Annuity Scheme Proposed by Dr Law Chi-kwong The proposal 1. According to Dr Law Chi-kwong’s proposal, participants of the scheme have to pay a lump sum (such as MPF benefits and private savings), and in return they will receive for the rest of their life a fixed monthly payment (known as payout) based on average life expectancy and pre-determined interest rates. As participants differ in their lifespan, the scheme operators can use risk pooling to reduce the overall financial burden brought about by longevity risk on them. Details of the scheme 2. At present, there are only a limited number of annuity products available on the private market. Dr Law proposes that the scheme can be run by the Government or a statutory body. In the early stage of its implementation (e.g. in the first three years), the elderly may enrol on a voluntary basis. At a later stage (e.g. after three years), consideration may be given to mandating enrolment of those retired persons who have accumulated MPF benefits for more than 15 years. There is no restriction on the sources of the money a participant puts into the scheme. The money may come from MPF benefits or other private savings. It can also be paid by family members of the participants. For voluntary enrolment, the money that can be put in will not be capped nor will there be a minimum amount stipulated. In the case of mandatory enrolment, a minimum amount will be set. Three plans are available under the scheme: Standard Plan This plan has a higher monthly payout. There will be no remaining value in the plan no matter when the participant dies. Basic Plan This plan has a lower monthly payout. If the participant dies before the age of 80, there will be remaining value in the plan which will be treated as part of his/her estate. The remaining value will reduce gradually as monthly payouts are made and become zero when the participant turns 80. Enhanced Plan The monthly payout made by this plan is the lowest among the three. If the participant dies before he/she reaches the age of 90, there will be remaining value in the plan as part of his/ her estate. The remaining value will reduce gradually as monthly payouts are made and become zero when the participant turns 90. 3. Payout calculation is based on the age of the participants upon enrolment, average life expectancy and return rate. Assuming that all participants put the same amount of money into the scheme, the older a participant is, the higher payout he/she will get. The payout calculation of the Basic Plan/Enhanced Plan is based on the life expectancy of the participants when they reach the age of 80/90. On the return rate, Dr Law suggests that it should be inflation-linked and the payout will be calculated at a guaranteed real rate of return of 1%. If the investment return is higher than the guaranteed return, half of the surplus return will be paid to the participants in form of dividend, while the other half will be allocated to a fund to ensure the stable development of the scheme in the long run. 104 4. Participants of the scheme meeting the eligibility criteria for the CSSA, OALA or OAA can continue to receive the social security benefits. However, the monthly payouts they receive will be regarded as income, and the remaining value owned by the participants of the Basic Plan or Enhanced Plan will be counted as their assets. 5. As the scheme does not require government subsidies, there is no need to estimate the Government’s financial commitment and assess the sustainability. However, there are certain risk factors that the Government needs to consider, such as the need to use public money to maintain the guaranteed return rate when the scheme fails to yield the desirable investment return, the need for government injection if the money the participants put into the scheme is unable to cover the payouts when the participants live longer than the life expectancy assumed in the payout calculation, and the administrative fees to be incurred. These risk factors may substantially increase the public expenditure relating to the scheme. Views of the CoP 6. Although the number and proportion of elderly people holding assets are increasing, the public have little understanding of annuity. Many elderly people still prefer to retain the ownership of their assets. It remains to be seen whether they will accept the arrangement of requiring investment of their assets before they can withdraw benefits from it at regular intervals. 7. Generally speaking, the CoP shares the view that the annuity proposal is worth further exploring as it can help elderly people turn a lump sum of their savings into a stable monthly retirement income. As the MPF System becomes better developed, the focus of reform should shift from the accumulation stage to the withdrawal period, helping employees convert their MPF benefits into monthly incomes through annuity plans to better support their retirement life. The CoP considers it necessary to examine issues including the prerequisites for introducing a publicly-managed annuity scheme in Hong Kong (e.g. the role of the Government, the Government’s financial commitments involved in the annuity scheme, the need for mandatory enrolment and guaranteed return) and its interface with other retirement protection pillars. 105