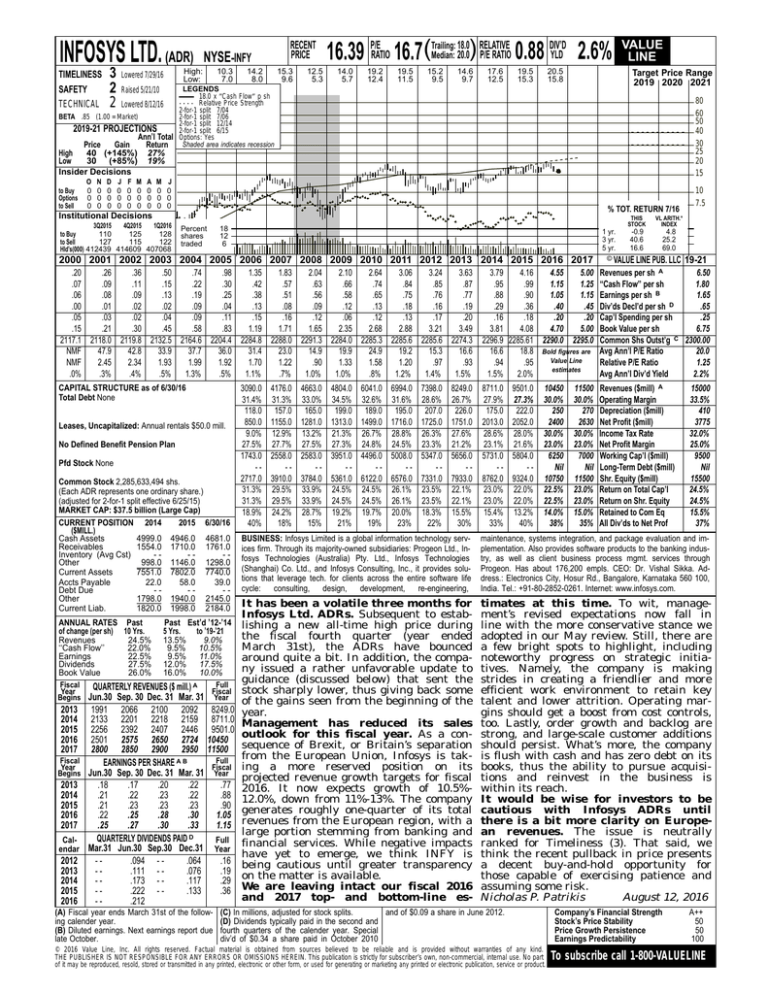

INFOSYS LTD. (ADR)

TIMELINESS

SAFETY

TECHNICAL

3

2

2

High:

Low:

Lowered 7/29/16

RECENT

PRICE

NYSE-INFY

10.3

7.0

14.2

8.0

15.3

9.6

12.5

5.3

18.0 RELATIVE

DIV’D

Median: 20.0) P/E RATIO 0.88 YLD 2.6%

16.39 P/ERATIO 16.7(Trailing:

14.0

5.7

19.2

12.4

19.5

11.5

15.2

9.5

14.6

9.7

17.6

12.5

19.5

15.3

20.5

15.8

Target Price Range

2019 2020 2021

LEGENDS

18.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

Lowered 8/12/16

2-for-1 split 7/04

BETA .85 (1.00 = Market)

2-for-1 split 7/06

2-for-1 split 12/14

2019-21 PROJECTIONS

2-for-1 split 6/15

Ann’l Total Options: Yes

Shaded area indicates recession

Price

Gain

Return

Raised 5/21/10

High

40 (+145%)

Low

30 (+85%)

Insider Decisions

to Buy

Options

to Sell

O

0

0

0

N

0

0

0

D

0

0

0

J

0

0

0

F

0

0

0

M

0

0

0

80

60

50

40

30

25

20

15

27%

19%

A

0

0

0

M

0

0

0

J

0

0

0

% TOT. RETURN 7/16

Institutional Decisions

3Q2015

4Q2015

1Q2016

110

125

128

to Buy

to Sell

127

115

122

Hld’s(000) 412439 414609 407068

Percent

shares

traded

18

12

6

1 yr.

3 yr.

5 yr.

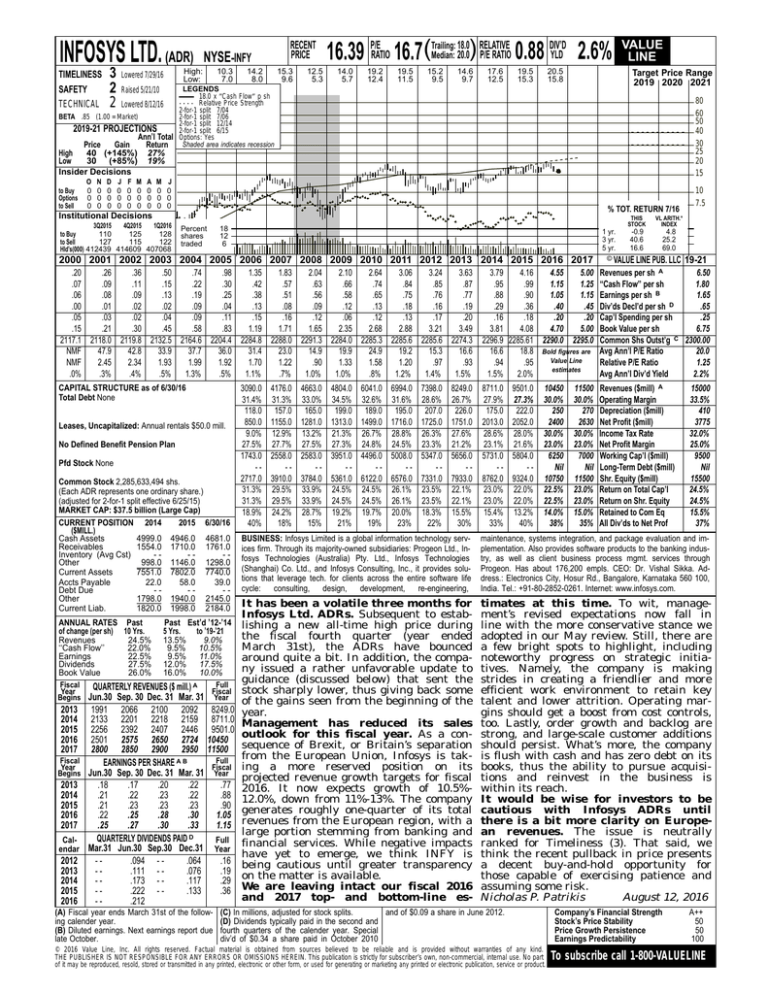

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

.20

.26

.36

.50

.74

.98

1.35

1.83

2.04

2.10

2.64

3.06

3.24

3.63

.07

.09

.11

.15

.22

.30

.42

.57

.63

.66

.74

.84

.85

.87

.06

.08

.09

.13

.19

.25

.38

.51

.56

.58

.65

.75

.76

.77

.00

.01

.02

.02

.09

.04

.13

.08

.09

.12

.13

.18

.16

.19

.05

.03

.02

.04

.09

.11

.15

.16

.12

.06

.12

.13

.17

.20

.15

.21

.30

.45

.58

.83

1.19

1.71

1.65

2.35

2.68

2.88

3.21

3.49

2117.1 2118.0 2119.8 2132.5 2164.6 2204.4 2284.8 2288.0 2291.3 2284.0 2285.3 2285.6 2285.6 2274.3

NMF

47.9

42.8

33.9

37.7

36.0

31.4

23.0

14.9

19.9

24.9

19.2

15.3

16.6

NMF

2.45

2.34

1.93

1.99

1.92

1.70

1.22

.90

1.33

1.58

1.20

.97

.93

.0%

.3%

.4%

.5%

1.3%

.5%

1.1%

.7%

1.0%

1.0%

.8%

1.2%

1.4%

1.5%

CAPITAL STRUCTURE as of 6/30/16

Total Debt None

Leases, Uncapitalized: Annual rentals $50.0 mill.

No Defined Benefit Pension Plan

Pfd Stock None

Common Stock 2,285,633,494 shs.

(Each ADR represents one ordinary share.)

(adjusted for 2-for-1 split effective 6/25/15)

MARKET CAP: $37.5 billion (Large Cap)

CURRENT POSITION 2014

2015 6/30/16

($MILL.)

Cash Assets

4999.0 4946.0 4681.0

Receivables

1554.0 1710.0 1761.0

Inventory (Avg Cst)

---Other

998.0 1146.0 1298.0

Current Assets

7551.0 7802.0 7740.0

Accts Payable

22.0

58.0

39.0

Debt Due

---Other

1798.0 1940.0 2145.0

Current Liab.

1820.0 1998.0 2184.0

ANNUAL RATES Past

of change (per sh) 10 Yrs.

Revenues

24.5%

‘‘Cash Flow’’

22.0%

Earnings

22.5%

Dividends

27.5%

Book Value

26.0%

Fiscal

Year

Begins

VALUE

LINE

Past Est’d ’12-’14

5 Yrs.

to ’19-’21

13.5%

9.0%

9.5% 10.5%

9.5% 11.0%

12.0% 17.5%

16.0% 10.0%

QUARTERLY REVENUES ($ mill.) A

Jun.30 Sep. 30 Dec. 31 Mar. 31

2013 1991 2066 2100 2092

2014 2133 2201 2218 2159

2015 2256 2392 2407 2446

2016 2501 2575 2650 2724

2017 2800 2850 2900 2950

Fiscal

EARNINGS PER SHARE A B

Year

Begins Jun.30 Sep. 30 Dec. 31 Mar. 31

2013

.18

.17

.20

.22

2014

.21

.22

.23

.22

2015

.21

.23

.23

.23

2016

.22

.25

.28

.30

2017

.25

.27

.30

.33

QUARTERLY DIVIDENDS PAID D

Calendar Mar.31 Jun.30 Sep.30 Dec.31

2012

-.094 - .064

2013

-.111 - .076

2014

-.173 - .117

2015

-.222 - .133

2016

-.212

Full

Fiscal

Year

8249.0

8711.0

9501.0

10450

11500

Full

Fiscal

Year

(A) Fiscal year ends March 31st of the following calender year.

(B) Diluted earnings. Next earnings report due

late October.

.77

.88

.90

1.05

1.15

Full

Year

.16

.19

.29

.36

3090.0

31.4%

118.0

850.0

9.0%

27.5%

1743.0

-2717.0

31.3%

31.3%

18.9%

40%

4176.0

31.3%

157.0

1155.0

12.9%

27.7%

2558.0

-3910.0

29.5%

29.5%

24.2%

18%

4663.0

33.0%

165.0

1281.0

13.2%

27.5%

2583.0

-3784.0

33.9%

33.9%

28.7%

15%

4804.0

34.5%

199.0

1313.0

21.3%

27.3%

3951.0

-5361.0

24.5%

24.5%

19.2%

21%

6041.0

32.6%

189.0

1499.0

26.7%

24.8%

4496.0

-6122.0

24.5%

24.5%

19.7%

19%

6994.0

31.6%

195.0

1716.0

28.8%

24.5%

5008.0

-6576.0

26.1%

26.1%

20.0%

23%

7398.0

28.6%

207.0

1725.0

26.3%

23.3%

5347.0

-7331.0

23.5%

23.5%

18.3%

22%

8249.0

26.7%

226.0

1751.0

27.6%

21.2%

5656.0

-7933.0

22.1%

22.1%

15.5%

30%

THIS

STOCK

VL ARITH.*

INDEX

-0.9

40.6

16.6

4.8

25.2

69.0

© VALUE LINE PUB. LLC

10

7.5

19-21

3.79

4.16

4.55

5.00

.95

.99

1.15

1.25

.88

.90

1.05

1.15

.29

.36

.40

.45

.16

.18

.20

.20

3.81

4.08

4.70

5.00

2296.9 2285.61 2290.0 2295.0

16.6

18.8 Bold figures are

Value Line

.94

.95

estimates

1.5%

2.0%

Revenues per sh A

6.50

‘‘Cash Flow’’ per sh

1.80

B

Earnings per sh

1.65

Div’ds Decl’d per sh D

.65

Cap’l Spending per sh

.25

Book Value per sh

6.75

Common Shs Outst’g C 2300.00

Avg Ann’l P/E Ratio

20.0

Relative P/E Ratio

1.25

Avg Ann’l Div’d Yield

2.2%

8711.0

27.9%

175.0

2013.0

28.6%

23.1%

5731.0

-8762.0

23.0%

23.0%

15.4%

33%

Revenues ($mill) A

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

9501.0

27.3%

222.0

2052.0

28.0%

21.6%

5804.0

-9324.0

22.0%

22.0%

13.2%

40%

10450

30.0%

250

2400

30.0%

23.0%

6250

Nil

10750

22.5%

22.5%

14.0%

38%

11500

30.0%

270

2630

30.0%

23.0%

7000

Nil

11500

23.0%

23.0%

15.0%

35%

15000

33.5%

410

3775

32.0%

25.0%

9500

Nil

15500

24.5%

24.5%

15.5%

37%

BUSINESS: Infosys Limited is a global information technology services firm. Through its majority-owned subsidiaries: Progeon Ltd., Infosys Technologies (Australia) Pty. Ltd., Infosys Technologies

(Shanghai) Co. Ltd., and Infosys Consulting, Inc., it provides solutions that leverage tech. for clients across the entire software life

cycle: consulting, design, development, re-engineering,

maintenance, systems integration, and package evaluation and implementation. Also provides software products to the banking industry, as well as client business process mgmt. services through

Progeon. Has about 176,200 empls. CEO: Dr. Vishal Sikka. Address.: Electronics City, Hosur Rd., Bangalore, Karnataka 560 100,

India. Tel.: +91-80-2852-0261. Internet: www.infosys.com.

It has been a volatile three months for

Infosys Ltd. ADRs. Subsequent to establishing a new all-time high price during

the fiscal fourth quarter (year ended

March 31st), the ADRs have bounced

around quite a bit. In addition, the company issued a rather unfavorable update to

guidance (discussed below) that sent the

stock sharply lower, thus giving back some

of the gains seen from the beginning of the

year.

Management has reduced its sales

outlook for this fiscal year. As a consequence of Brexit, or Britain’s separation

from the European Union, Infosys is taking a more reserved position on its

projected revenue growth targets for fiscal

2016. It now expects growth of 10.5%12.0%, down from 11%-13%. The company

generates roughly one-quarter of its total

revenues from the European region, with a

large portion stemming from banking and

financial services. While negative impacts

have yet to emerge, we think INFY is

being cautious until greater transparency

on the matter is available.

We are leaving intact our fiscal 2016

and 2017 top- and bottom-line es-

timates at this time. To wit, management’s revised expectations now fall in

line with the more conservative stance we

adopted in our May review. Still, there are

a few bright spots to highlight, including

noteworthy progress on strategic initiatives. Namely, the company is making

strides in creating a friendlier and more

efficient work environment to retain key

talent and lower attrition. Operating margins should get a boost from cost controls,

too. Lastly, order growth and backlog are

strong, and large-scale customer additions

should persist. What’s more, the company

is flush with cash and has zero debt on its

books, thus the ability to pursue acquisitions and reinvest in the business is

within its reach.

It would be wise for investors to be

cautious with Infosys ADRs until

there is a bit more clarity on European revenues. The issue is neutrally

ranked for Timeliness (3). That said, we

think the recent pullback in price presents

a decent buy-and-hold opportunity for

those capable of exercising patience and

assuming some risk.

Nicholas P. Patrikis

August 12, 2016

(C) In millions, adjusted for stock splits.

and of $0.09 a share in June 2012.

(D) Dividends typically paid in the second and

fourth quarters of the calender year. Special

div’d of $0.34 a share paid in October 2010

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

A++

50

50

100

To subscribe call 1-800-VALUELINE