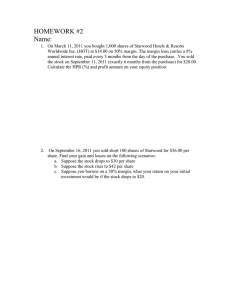

Problem 1 Suppose you want to invest into 100 shares of company

advertisement

Problem 1 Suppose you want to invest into 100 shares of company “Sunny”. The share market price of company “Sunny” is $100. You have only $7000 of your own money, the rest you borrow from the dealer. (1) Draw your balance sheet and calculate you margin? (2) If your maintenance margin is 0.5, at what market price of you shares will you get the margin call? (3) If the price of the share goes up by 30% over the next year. The dividends repaid over the period constitute $23. The rate on margin loan is 8%. What is your rate of return? (4) If the price instead goes down by 30%. The dividends repaid and the rate on margin loan are the same as in the point (1). What is the profit in this case? Problem 2 Suppose you expect the fall in the share price of “Bloomy” company. That is why you ask your broker to sell short 1000 shares of “Bloomy”. The current share price is $100. The maintenance margin is 50%. (1) Draw your balance sheet resulting from the short-selling operation. What value of assets (cash or securities) is required to save as a margin? (2) Suppose the share price falls to $70 per share. What is your profit? (3) Suppose that you have the balance sheet as in point (1), but the maintenance margin is 0.4. At what price will you get the margin call from your broker? (4) What is your loss if the price rises by 20%? How can you limit your losses? Problem 3 Suppose you invest in a fixed-income security in the form of annuity. This security pays $100 each year (assume it pays once per year). The maturity of this security is 3 years and the discount rate is 6% per year (1) What is the price of this security? (2) Now suppose that an hour after you buy the security, the risk-free interest rate rises from 6% to 7% per year. How much can you get for this security? (3) Why do we have this change in the price? (4) What will be the price of this security if the payments of $100 are done twice per year. Assume the same annual interest rate. Problem 4 Suppose that Toyota issues two bonds with identical coupon rates and maturity dates. One bond is callable, however, whereas the other is not. Which bond will sell at a higher price? Why? Problem 5 Consider the following trading strategy. You buy a 30-year bond with 7.5% (annual payment) coupon bond for $980. You hold it 20 years and reinvest the coupons at a rate of 6%. After 20 years you sell it and the forecasted yields to maturity at the selling day is 8%. What will be the value of your portfolio 20 years after you bought this security? Problem 6 A year ago the annual interest rate was 7%. The bond annual coupon with 3 years left in the bond’s life was 6% (coupon is paid annually). Now, the interest rate is 8% per year . What is your total return if you bought this security a year ago & sell it now? Problem 7 Suppose you have 2 bonds. The time to maturity is 3 years for both of them. The one has the coupon rate of 4%, another has the rate of 8%. The interest rate is 6%. (1) Compare capital gains & price movements for both securities? (2) What is the explanation for these price movements? Problem 8 The interest rate at the issue of 30-year government zero is 10%. Suppose, next year the interest rate fall to 9.9% and the investor sells the security. (1) Calculate the amount subject to tax. (Hint: imputed interest is based on a “constant yields method”) (2) What if it were a corporate bond? (3) What if the security is not sold? Problem 9 The yields on the stripped Treasuries are given in the table. Price a 10% coupon bond with 3 years till maturity. Assume annual payments for simplicity. Problem 10 Negative T-Bill rates? How can it happen? Maturity, years 1 2 3 Yields to maturity, % 5 6 7