the markets the big picture

advertisement

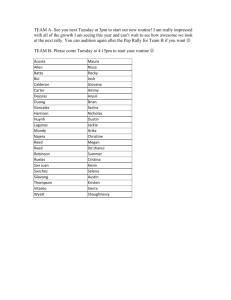

THE MARKETS THE BIG PICTURE: HOW TO DETERMINE THE STOCK MARKET’S DIRECTION By William J. O’Neil William O’Neil’s CAN SLIM strategy has been a long-term superior performer in AAII’s ongoing study of stock screens. But part of his approach— gauging the market’s direction—is not captured in our screens, which focus on individual stocks. In this article, Mr. O’Neil himself describes how investors can determine the stock market’s direction. For a more complete description of the CAN SLIM approach and how it can be used as a screen, see “How to Use the CAN SLIM Approach to Screen for Growth Stocks,” by John Bajkowski, in the April 2003 AAII Journal. A review of all the AAII stock screens, many based on the approaches of well-known investment professionals, appeared in the January 2003 AAII Journal (“Stock Strategy Performance: Winners and Losers in 2002,” by John Bajkowski). Past issues can be found on AAII’s Web site at www.aaii.com. Based on an exhaustive study of the greatest stock market winners dating back to 1953, I developed the CAN SLIM™ research tool. The CAN SLIM approach identifies companies with the same qualities that previous big-winning stocks showed before they began their huge price advances. Here’s a quick rundown of what CAN SLIM stands for: C: Current earnings A: Annual earnings N: New product or service; also, new price highs S: Supply and demand: shares outstanding plus big volume demand L: Leader or laggard I: Institutional sponsorship M: Market direction As the last letter “M” shows, CAN SLIM isn’t just about identifying the right stocks. It also requires that you analyze the general market. You can be right on every individual stock factor, but if you’re wrong about the direction of the general market, three out of four of your stocks will plummet with the market averages and you will certainly lose money big time—as many people did in 2000. Therefore, in your analytical tool kit, you absolutely must have a reliable method to determine what direction the market is headed. The key is to follow, interpret, and understand what the general market averages are doing every day. This is something you must do on your own. Conventional wisdom or consensus thinking is seldom right in the market. I never pay any attention to the parade of experts voicing their personal opinions on the market—it just creates too much confusion and can cost you a great deal of money. The only thing that works is to let the market indexes tell you the time to enter and exit. How do you determine the market’s direction? In this article, I’ll describe the CAN SLIM approach, with a particular focus on identifying market bottoms. WHAT IS THE GENERAL MARKET? The general market is a term that usually refers to the most commonly used market indexes. These indexes tell you the approximate strength or weakness in each day’s overall trading activity and can be one of your earliest indications of emerging trends. These indexes include: • The Standard & Poor’s 500: Consists of 500 of the largest U.S. companies. This index is a broader, more modern representation of market action than the Dow. William J. O’Neil is founder of Investor’s Business Daily, the only national daily newspaper that focuses exclusively on the investment markets using proprietary, databased screens and ratings. He is also founder of William O’Neil & Co., a leading institutional investment research organization based in Los Angeles. Mr. O’Neil is author of “How to Make Money in Stocks,” third edition, 2002, published by McGraw-Hill, and has a September 2003 launch planned for his new book “The Successful Investor.” AAII Journal/June 2003 3 THE MARKETS FIGURE 1. HISTORICAL MARKET CYCLES because they haven’t been proven as effective. Your best bet is to learn to interpret daily price and volume charts of the key general market averages. If you do, you can’t get too far off track, and you won’t need much else. SPOTTING MARKET BOTTOMS Source: Investor’s Business Daily. • The Dow Jones industrial average (DJIA): This index consists of 30 widely traded stocks. It’s a simple but out-ofdate average to study because it is dominated by laggard, old-line companies. • The Nasdaq composite: The more relevant and volatile index in recent years includes the market’s younger, more innovative and fast-growing companies. It includes over 4,000 companies that trade via the Nasdaq network of market makers, and it is more heavily weighted toward the technology sector. everyone who can be run out has thrown in the towel, there isn’t anyone left to take action in the same direction. Then the market will finally turn and begin a whole new trend. Bear markets usually end while business is still in a downtrend. The reason is that stocks are anticipating, or “discounting,” economic events months in advance. Similarly, bull markets usually top out and turn down before a recession sets in. For this reason, use of economic indicators to tell you when to buy or sell stocks is not recommended. The Figure 1 chart of the S&P 500 index shows several past cycles, with the bear markets shaded. STOCK MARKET CYCLES STUDY THE MARKET DAILY The winning investor should understand how a normal business cycle unfolds and over what period of time. Particular attention should be paid to recent cycles. There’s no guarantee that just because cycles lasted three or four years in the past, they’ll last that long in the future. Bull and bear markets don’t end easily. It usually takes two or three pullbacks to fake out or shake out the few remaining speculators. After 4 AAII Journal/June 2003 In bear markets, stocks usually open strong and close weak. In bull markets, they tend to open weak and close strong. The general market averages need to be studied closely every day since reverses in trends can begin on any given day. Relying on these primary indexes is a much more practical and effective method for analyzing the market’s behavior and determining its direction. Don’t rely on other, subsidiary indicators Given current market conditions, many investors who follow the markets have scaled back stock holdings. The big question now is: How long should you remain on the sidelines? If you plunge back into the market too soon, the apparent rally may fade and you’ll lose money; but if you hesitate at the brink of the eventual roaring recovery, opportunities will pass you by. Again, the daily general market averages provide the best answer by far. At some point in every correction—whether mild or severe—the stock market will always attempt to rally. Don’t jump back in right away. Wait for the market itself to confirm the new uptrend. A rally attempt begins when a major market average closes higher after a decline, either from earlier in the day or the previous session. For example, the Dow closes down 2% and then rebounds the next day. The session in which the Dow closes higher is the first day of the attempted rally. Sit tight and be patient. The first few days of improvement can’t tell you if the rally will succeed. Starting on the fourth day of the attempted rally, look for one of the major averages to “follow through,” meaning it shows a booming 2% or greater gain on heavier volume than the day before. This tells you the rally is much more likely to be real. The most powerful follow-throughs THE MARKETS usually occur on the fourth to seventh days of the rally. Followthroughs after the 10th day may indicate a positive but somewhat weaker new uptrend. A follow-through day should give the feeling of an explosive rally that is strong, decisive and conclusive— not begrudging and on the fence, and barely up 1%. The market’s volume for the day should be above its average daily volume in addition to always being higher than the prior day’s trading. Occasionally, a follow-through occurs as early as the third day of the rally. In such a case, the first, second and third days must all be very powerful, with a major average up 2% or more each session on heavy volume. There will be a few cases in which confirmed rallies fail. A few large institutional investors, armed with their immense buying power, can run up the averages on a particular day and create the impression of a follow-through. Unless the smart buyers are back on board, the rally will implode—usually crashing on heavy volume within the next day or two. A follow-through signal doesn’t mean you should rush out and buy with abandon. It gives the go-ahead to begin buying quality stocks as they break out of sound price bases. These leading stocks are a vital second confirmation that the attempted rally is succeeding. Remember, no new bull market has ever started without a strong price and volume follow-through confirmation. It pays to wait and listen to the market. Figure 2 presents a classic example of the stock market bottom that occurred in 1982. How did the market act when stocks began to rally this past March? As usual, they followed historical precedent. The stock market got a jump on the Iraq war rally before the shooting began. Stocks turned higher March 12 and followed through three sessions later when the major indexes surged more than 2% in heavier volume. That was the all-clear sign to start testing the market. Since then, it’s passed with flying colors. The reason? Stocks with solid fundamentals have been breaking out of sound price bases and rallying to new highs. MARKET TURNS: OTHER CUES Certain Psychological Market Indicators Can Help History shows that the market tends to go up just when many market “experts” are most skeptical and uncertain. That’s where psychological market indictors come in. Speculation in put and call options is the get-rich-quick scheme for many investors. You can plot and analyze the ratio of calls to puts for a valuable insight into crowd temperament. Options traders buy calls, which are options to buy common stock, or puts, which are options to sell common stock. A call buyer hopes the price of the option’s underlying stock or index will rise; a buyer of put options wishes prices to fall. The volume of call options is generally higher than put options. However, when the market seems especially weak, put volume will exceed call volume. When this happens, option traders are extremely bearish and think that stock prices can only go lower. The put- FIGURE 2. RALLY AT 1982 MARKET BOTTOM Source: Investor’s Business Daily. AAII Journal/June 2003 5 THE MARKETS call ratio jumps above 1.0, which occurred at or near market bottoms in 1990, 1996 and 1998. The percentage of investment advisers who are bearish is an interesting measure of investor sentiment. When bear markets are near the bottom, the great majority of advisory letters will usually be bearish. Near market tops, most will be bullish. The majority is usually wrong when it’s most important to be right. Typically, the indicator flashes an impending market bottom when bears exceed bulls. This happened just last year in October as the market hit its lowest point since its March 2000 market top. The short-interest ratio is the amount of short selling on the New York Stock Exchange (NYSE), expressed as a percentage of total NYSE volume. This ratio can reflect the degree of bearishness shown by speculators in the market. Along bear market bottoms, you will usually see two or three major peaks showing sharply increased short selling. There’s no rule governing how high the index should go, but studying past market bottoms can give you an idea of what the ratio looked like at key market junctures. An index sometimes used to measure the degree of speculative activity is the Nasdaq volume as a percentage of NYSE volume. This measure provided a helpful tip-off of impending trouble during the summer of 1983, when Nasdaq volume significantly increased relative to the Big Board’s (NYSE). When a trend persists and accelerates, indicating wild, rampant speculation, you’re close to a general market correction. Interpret the Overrated Advance/ Decline Line Some technical analysts religiously follow advance/decline (A/D) data. Technicians take the number of stocks advancing each day versus the number declining and then plot that ratio on a graph. Advance/ decline lines are far from precise, because they frequently prematurely 6 AAII Journal/June 2003 veer down sharply long before a bull market finally tops. In other words, the market keeps advancing toward higher ground, but is being led by fewer but better stocks. The advance/decline line is simply not as accurate as the key general market indexes because analyzing the market’s direction is not a total numbers game. All stocks are not created equal—it’s better to know where the real leadership is and how it’s acting than it is to know how many more mediocre stocks are advancing and declining. An advance/decline line can sometimes be helpful when a clearcut bear market attempts a shortterm rally. If the advance/decline line lags the market averages and can’t rally, it’s giving an internal indication that, despite the rally strength in the Dow or S&P, the broader market remains frail. In such instances, the rally usually fizzles. In other words, it takes more than just a few leaders to make a new bull market. At best, the advance/decline line is a secondary indicator of limited value. Watch Federal Reserve Board Rate Changes Among fundamental general market indicators, changes in the Federal Reserve Board’s discount rate (the interest rate the board charges member banks for loans), the federal funds rate (the interest rate that banks with fund reserves charge for loans to banks without fund reserves), and occasionally stock margin levels are valuable indicators to watch. As a rule, interest rates provide the best confirmation of basic economic conditions, and changes in the discount rate and federal funds rate are by far the most reliable. Three successive significant hikes in the discount rate have generally marked the beginning of bear markets and impending recessions. Bear markets have usually, but not always, ended when the rate was finally lowered. Money market indicators mirror general economic activity. At times, I follow selected government and Federal Reserve Board measurements, including 10 indicators of the supply and demand for money, and indicators of interest-rate levels. History proves that the direction of the general market, as well as of several industry groups, is often affected by changes in interest rates because the level of interest rates is usually tied to a tight or easy Fed monetary policy. For the investor, the simplest and most relevant monetary indicators to follow and understand are the changes in the Federal Reserve Board discount rate and the federal funds rate. Changes in T-bill rates and the erratic, tricky federal funds rate sometimes help predict impending discount rate changes. The monetary base and the velocity of money are other measures sometimes used by professionals. The Fed also watches economic data such as unemployment figures, inflation data, gross domestic product (GDP), and many others. The bear market and the costly protracted recession that began in 1981, for example, were created solely because the Fed increased the discount rate in rapid succession in September, November and December of 1980. Its fourth increase, on May 8, 1981, thrust the discount rate to an all-time high of 14%. That finished off the U.S. economy, our basic industries, and the stock market. Such actions and their result starkly demonstrate how much our federal government—not Wall Street or business—may at times influence our economic future. However, Fed rate changes should not be your primary market indicator because the stock market itself is always your best barometer. My own analysis of market cycles turned up three key market turns that the discount rate did not help predict. THE MARKETS SPOTTING MARKET TOPS Look for distribution After a long advance, the stock market will inevitably turn lower. The correction may be relatively mild, or it may be severe, such as the bear market that started in March 2000. During the 30-month bear market period ending last October, the Nasdaq plunged as much as 78%. Hundreds of stocks, including well-known names like Sun Microsystems, dived more than 90%. As bad as the bear market was, it was fairly easy to spot. Like other market tops, there were repeated days when the major stock indexes fell in heavier volume than the day before. This is called distribution. It’s a sign that institutional investors such as mutual funds, pension funds and other big players are selling stock. Three to five distribution days over a week or two can kill even the strongest bull market. At the same time that you see the major averages selling off on heavier volume, leading stocks will also start breaking down. Together, these two indicators should push you into cash as you sell your market-leading stocks. You’ll be safely on the sidelines when the majority of other investors are still hoping for a rebound. THE BIG PICTURE SUMMARY To summarize this complex but vitally important topic: Learn to interpret the daily price and volume changes of the general market indexes and the actions of individual market leaders. Once you know how to do this correctly, you can stop listening to all the costly, uninformed personal market opinions of amateurs and professionals alike. The key to staying on top of the stock market is not predicting or knowing what the market is going to do, but knowing what the market has actually done recently and what it is currently doing. One of the great values to this system of interpreting the market averages’ price and volume changes is not just the ability to recognize major market tops and bottoms, but also the ability to track each rally attempt when the market is on its way down. By waiting for powerful follow-through days, you can normally prevent yourself from being drawn into the market prematurely when the rally attempts ultimately end in failure. In other words, you have rules that will continue to keep you out of a declining market so that you don’t get sucked into phony rallies. A LONG-TERM VIEW If this sounds a bit daunting, don’t worry. If you want some guidance, you might follow the discussions in Investor Business Daily’s “The Big Picture,” a daily market analysis to help investors spot key turning points in the stock market. What’s my own long-term big picture view? Because the market went through three years of correction, which is almost unprecedented, I feel very strongly that the worst is over—and that it’ll be a slow, steady recovery process. I would expect to see recovery with the aid of the Tax Cut Stimulus Package and with the fight against terrorism having made significant progress. The country is in a rebuilding process that should continue for the next few cycles, and those willing to keep doing their homework and follow proven time-tested investing rules and strategies should do well in the future. ✦ AAII Journal/June 2003 7