Optional Group Term Life Insurance Program

For Employees of the State of Tennessee

Insuring your

future

What’s inside:

Why do I need life insurance?

How much is enough?

How do I enroll?

What do I need to know?

The State of Tennessee is proud to partner with Minnesota

Life Insurance Company to provide optional group term life

insurance benefits. This program offers you an affordable

way to provide protection for your family.

Before enrolling, there are two very important questions you

need to answer: Why do I need life insurance? and How much

do I need? This booklet provides information to help you answer

those questions and the instructions to enroll in coverage.

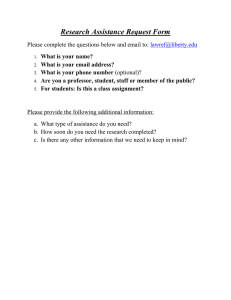

Who is eligible for coverage?

An employee is eligible for coverage if he or she is employed by

the State and scheduled to work no less than 30 hours a week.

In addition, seasonal or part-time employees with 24 months of

service, who are certified by an appointing authority to work at

least 1,450 hours per fiscal year are also eligible. Please see the

policy certificate on www.LifeBenefits.com/StateofTN for more

details on eligibility for employees and their dependents.

Enroll in four simple steps

Step 1 - Determine your needs

p. 5-6

Step 2 - Review your coverage options p. 7

Step 3 - Calculate your costs

p. 8–9

Step 4 - Enroll

p. 10

Questions?

Call Minnesota Life Customer Service

at 1-866-881-0631 from 7 a.m.–6 p.m. CT.

For assistance, go to www.LifeBenefits.com/StateofTN or call 1-866-881-0631.

3

What is Group Term Life insurance?

Group Term Life insurance provides a base level of protection that can be

enhanced by personal savings, individual life insurance and Social Security

benefits. It provides survivors with an “emergency fund,” allowing them to

use individual life insurance and other funds for longer-term needs.

• Basic Group Term Life – The State of Tennessee provides all full-time

employees under age 65 with at least $20,000 in basic group term life

insurance. For many people, this is enough coverage to provide for final

arrangements and their loved ones. However, the State recognizes that

the kind of life insurance you need can change over time. That’s why the

State offers additional Optional Group Term Life coverage for you to

purchase if you so desire.

•O

ptional Group Term Life – This is voluntary coverage paid for by the

employee, allowing the employee to choose the amount of insurance that

fits his or her personal and financial situation. As of January 1, 2013, the

State of Tennessee allows an eligible employee to choose Optional Group

Term Life insurance in $5,000 increments to a maximum of seven times

the employee’s annual base salary or $500,000, whichever is less.

How much life insurance do I need?

Everyone’s needs are unique and it helps to evaluate your family’s

financial situation before choosing the exact amount. Visit

LifeBenefits.com/insuranceneeds for an online calculator that can help you

estimate how much coverage you may need to meet your future goals.

Why do I need life insurance?

Think about it. If you died what would happen to the people who depend

on you for financial support? Studies* show that the premature death of

a household’s breadwinner can have a significant impact on a family’s

financial security. Even if the deceased has some life insurance, the amount

is often inadequate.

*LIMRA, 2011.

4

Underwritten by Minnesota Life

Step1

Determine your needs

To estimate the amount of life insurance you need, you’ll want to periodically

determine what you must protect in the event of your death. This worksheet

will help you determine your needs.

Assets and income

What would be available to your family now, if you weren’t here to provide

for them?

Spouse’s annual income

x number of years to age 65

$

Cash, savings bonds, stocks,

securities (current value)

$

Company savings plan (401(k), 403(b), other)

$

Cash value of life insurance

$

Other assets* or income (other than your own)

$

*Equity in your home, if you plan to sell or borrow against it for cash.

A=$

Basic necessities

What basic needs do you and your family have? (multiply the items

below by the number of years required, if applicable)

Home – remaining mortgage or rent

(120 months is a basic rule of thumb)

$

Annual household operating expenses

(utilities, food, clothing, insurance,

repairs, property taxes, etc.)

$

Childcare

$

Health – health insurance premiums

or medical/hospital expenses not

covered by insurance

$

Debt – balances on credit cards, car loans, etc

$

B=$

(Continued on next page)

For assistance, go to www.LifeBenefits.com/StateofTN or call 1-866-881-0631.

5

Comfort zone

What kind of special or one-time expenses may come along?

Tuition

$

Wedding

$

New residence

$

Elder care x number of years

$

Estate taxes, probate fees, attorney fees

$

Emergency fund

$

Funeral expenses (average is $5,000 - $10,000)

$

Golden years (money put aside

for survivor’s retirement)

$

C=$

Complete the equation

Complete the equation that most closely reflects your particular needs:

Basic necessities

B-A=$

(Compare to current Life Insurance amount)

Comfort zone

(B + C) - A = $

(Compare to current Life Insurance amount)

Remember, your calculation is based on today’s costs and doesn’t account

for inflation or changes in annual earnings. Review your needs periodically –

even annually – to ensure that your needs will be met now and in the future.

6

Underwritten by Minnesota Life

Step2

Coverage options at a glance

Below are the options available to you under the Optional

Group Term Life insurance plan available through the State

of Tennessee.

As a newly eligible employee of the State of Tennessee, you have the

opportunity to choose coverage for yourself and your children on a

guaranteed basis without providing proof of good health. You must enroll

in coverage within 30 days of your initial eligibility. You may apply for

spouse coverage; however health related questions(s) will be asked to

determine if coverage will be issued

Coverage type

Coverage options

Additional information

Optional Term

Life Insurance

$5,000 increments

• Maximum coverage is the lesser of 7x

annual base salary or $500,000

• Up to 5x annual base salary is guaranteed

if elected within 30 days of initial

eligibility; Elections above 5x annual base

salary will require proof of good health (Please see pg 14 for details)

Optional Spouse

Term Life

Insurance

• Spouse is not eligible if he or she is also

eligible for employee coverage

• A spouse may apply for coverage within

30 days after the marriage date

Spouse under

age 55

$5,000, $10,000,

$15,000, $20,000,

$25,000 or $30,000

• Maximum coverage is $30,000

Spouse age

55 or older

$5,000, $10,000 or

$15,000

• Maximum coverage is $15,000

Optional Child

Term Life Rider

$5,000 or $10,000

• Children are eligible from 24 hours to 26

years of age

• A child may also be added to the policy

within 30 days of the birth or adoption

date

• A child may only be covered by

one parent

• All child coverage is guaranteed

• Employee or Spouse must have Optional

Term Life coverage for the Optional Child

Term Life Rider to be elected

For assistance, go to www.LifeBenefits.com/StateofTN or call 1-866-881-0631.

7

Step3

Calculate your costs

Use these examples as your guide to calculating the life insurance costs for

you and your spouse.

Example:

Employee age 38, chooses $150,000 in coverage

$150,000 ÷

$1,000

=

150

Coverage

amount

x $.058

+ $0.30

Monthly rate

Administrative

cost

= $9.00

Monthly cost

Spouse age 34, chooses $20,000 in coverage

$20,000

÷

$1,000

=

20

Coverage

amount

x $.047

+ $0.30

Monthly rate

Administrative

cost

= $1.24

Monthly cost

Now just fill in the blanks!

$

Coverage

amount

8

÷ $1,000

=

x $

Monthly rate

+ $0.30

Administrative

cost

= $

Monthly cost

Underwritten by Minnesota Life

Optional Employee and Spouse Term Life insurance

monthly rates

Rates per $1,000 per month

Age

Rate

Under 25

$0.044

25 - 29

$0.044

30 – 34

$0.047

35 – 39

$0.058

40 – 44

$0.088

45 – 49

$0.150

50 – 54

$0.252

55 – 59

$0.393

60 – 64

$0.612

65 – 69

$1.016

70 – 74

$1.417

75 – 79

$2.177

80 and over

$3.934

Rates are subject to change and increase with age.

Optional Child Term Life rider rates

One monthly premium covers all eligible children.

$5,000 - $0.50 per month

$10,000 - $1.00 per month

For assistance, go to www.LifeBenefits.com/StateofTN or call 1-866-881-0631.

9

Step 4

Change your information

Enroll

You may only enroll during your initial eligibility period

as a newly hired employee or each year during your fall

annual enrollment period.

To begin:

• Review all the information in this booklet.

• Determine the level of coverage you want.

•G

ather the personal information you will need to enroll, such

as Social Security numbers and medical information if you

are choosing coverage that requires proof of good health.

Computer enrollment

It’s easy to enroll in coverage and designate your beneficiary online!

Log on

Log on to www.LifeBenefits.com/StateofTN with the ID and password

information provided below.

You will be prompted to change your password the first time you log on.

Your ID:

TN + your EdisonID number*

Your password:Your password is your eight-digit date of birth

(MMDDYYYY) followed by the last four digits of

your Social Security number

* Your EdisonID number can be obtained from your Human Resources Department.

If you do not have access to a computer or the Internet, forms have been

included with this booklet. Please complete the forms and return directly to

Minnesota Life at the address provided on the top of the form. If you would

like assistance with your enrollment, please contact Minnesota Life directly

at 1-866-881-0631 from 7 a.m. - 6 p.m. CT.

10

Underwritten by Minnesota Life

Enter your information

Follow the instructions on the site to enroll in insurance coverage for you

and your spouse and children if desired, and to designate your beneficiary.

After submitting your information, please print a copy of your application

for your records.

Clean up

Don’t forget to clear your personal information before leaving the computer.

When will my coverage be effective?

New hire coverage will be effective on the first day of the month following

three full months of employment. Coverage applied for that is subject to

proof of good health will be effective upon approval of the coverage. All

elections or increases are subject to the actively at work requirement of

the policy. Please see the policy certificate on www.LifeBenefits.com/

StateofTN for more details on coverage effective dates and exemptions.

For assistance, go to www.LifeBenefits.com/StateofTN or call 1-866-881-0631.

11

What features does my plan have?

Beyond paying a benefit in the event of your death, your Optional Group

Term Life insurance plan has other important features.

Portability – If you are no longer eligible for coverage as an active

employee, you may port (continue) your Optional Group Term Life

Insurance on a direct bill basis (portable coverage ends December 31 of

the year you turn age 70).

Conversion – If your coverage is terminated, you may convert your group

term life coverage to an individual life insurance policy. Premiums may be

higher than those paid by active employees.

Waiver of Premium – If you become totally disabled before age 60 and

remain disabled for nine (9) consecutive months, your life insurance

premiums may be waived.

Accelerated Death Benefit – If an insured person becomes terminally

ill with a life expectancy of 12 months or less, he/she may request early

payment of up to 100 percent of the life insurance amount.

Customized website – You can use www.LifeBenefits.com/StateofTN to

manage your Optional Group Term Life insurance coverage for you and

your family. For example, you can provide evidence of insurability

(if required), designate your beneficiary, calculate your premium

payment, and determine how much life insurance you need at this site.

12

Underwritten by Minnesota Life

What is a beneficiary?

Choosing a beneficiary

Naming a beneficiary is an important right of life insurance ownership. Your

beneficiary designation determines who will receive your life insurance

benefit. Under current tax law, life insurance benefits paid to a beneficiary

are generally not taxable income.

Some common beneficiary choices are:

• Primary beneficiary – The person or persons named will receive the benefit.

•C

ontingent beneficiary – If the primary beneficiary is no longer living,

the benefit is paid to this person.

•D

efault beneficiary – If you do not name a beneficiary, policy benefits

will be paid in the following order: to your spouse, if living; if not, to your

children in equal shares, if living; if not, to your parents in equal shares, if

living, if not; to your estate.

For Spouse Optional Term Life insurance, you may designate a

beneficiary. If no beneficiary is designated, the employee will be the

default beneficiary for this coverage. If the employee is no longer living,

the benefits will be paid to the estate of the Spouse.

For the Optional Child Term Life rider, the employee is automatically the

beneficiary. If the employee is no longer living, the benefits will be paid

to the estate of the Child.

Check your beneficiary(ies) regularly

Over time, events such as marriage, divorce, birth/adoption of children,

or the death of a loved one may dramatically change the intent of how

you want your life insurance benefit paid.

To designate or update your beneficiary, please log in to

www.LifeBenefits.com/StateofTN using your ID and password provided

on p. 10. You may also contact Minnesota Life directly at 1-866-881-0631

to obtain a paper form.

This information is a general discussion of the relevant federal tax laws. It is not intended

for, nor can it be used by any taxpayer for the purpose of avoiding federal tax penalties.

This information is provided to support the promotion or marketing of ideas that may

benefit a taxpayer. Taxpayers should seek the advice of their own tax and legal advisors

regarding any tax and legal issues applicable to their specific circumstances.

13

Underwritten by Minnesota Life

What is proof of good health?

What is proof of good health?

If an applicant chooses coverage that is not guaranteed, Minnesota

Life will request completion of an Evidence of Insurability (EOI) form

to determine if the applicant is insurable (a good risk). When providing

EOI, the applicant will answer a few simple health questions and provide

information on physical condition, height, weight, gender, and tobacco

status (if applicable). Once submitted, a medical underwriter reviews the

application to determine if the person meets our acceptance standards for

the insurance requested. Evidence of Insurability can be completed online

at www.LifeBenefits.com/StateofTN or via paper form. Paper forms are

also available online or by calling Minnesota Life at 1-866-881-0631.

Is additional medical information required?

Many applications can be processed using only the health information

provided on the EOI form. To complete the application process, a physical

exam may be required. Exams are free of charge and can be done at the

applicant’s home. The basic physical examination includes height, weight,

pulse, blood pressure and a medical history questionnaire. The examination

may include special testing such as a blood test, urinalysis and an EKG.

The medical records are kept confidential, and information from the exam

is not released to anyone else without the applicant’s consent. Once all

information is received, it is promptly reviewed and the applicant is notified

of the underwriting decision.

To apply for new coverage or increase your current coverage

when authorized, visit www.LifeBenefits.com/StateofTN.

You can find out in 60 seconds or less if you’re approved.

If you need an exam you can schedule it right on line!

14

Underwritten by Minnesota Life

About Minnesota Life

Minnesota Life is one of the

country’s largest group life insurers.*

We understand the important role

we play in the financial well-being

of the nearly six million employees

we insure nationwide.

We are considered among the

highest rated group life insurance

companies by the independent

rating agencies that analyze the

financial soundness and claimspaying ability of insurance

companies. For more information

about the rating agencies and to see

where our ratings rank compared

to other ratings, please visit

www.securian.com/ratings.

*L

eading writers of group life insurance based on

2011 insurance in force, as reported by A.M. Best

in July 2012.

For assistance, go to www.LifeBenefits.com/StateofTN or call 866-881-0631.

15

F77989 Rev 7-2013DOFU 12-2012

A04258-1112

©2012 Securian Financial Group, Inc. All rights reserved.

This is a summary of plan provisions related to the insurance

policy issued by Minnesota Life to State of Tennessee. In t

he event of a conflict between this summary and the policy

and/or certificate, the policy and/or certificate shall dictate the

insurance provisions, exclusions, all limitations and terms of

coverage. All elections or increases are subject to the actively

at work requirement of the policy. Products are offered under

policy form MHC-96-13180.41.

Underwritten by Minnesota Life Insurance Company

400 Robert Street North

St. Paul, MN 55101

State of Tennessee

Important Benefits

Information

Enclosed

![MODEL LETTER TO APPLICANT WHO WITHDREW [Date]](http://s2.studylib.net/store/data/018002600_1-d07f93b992db43326f6abf58e0ed4b11-300x300.png)