The Retire Funds™ Retire 2015 Fd Cl II

advertisement

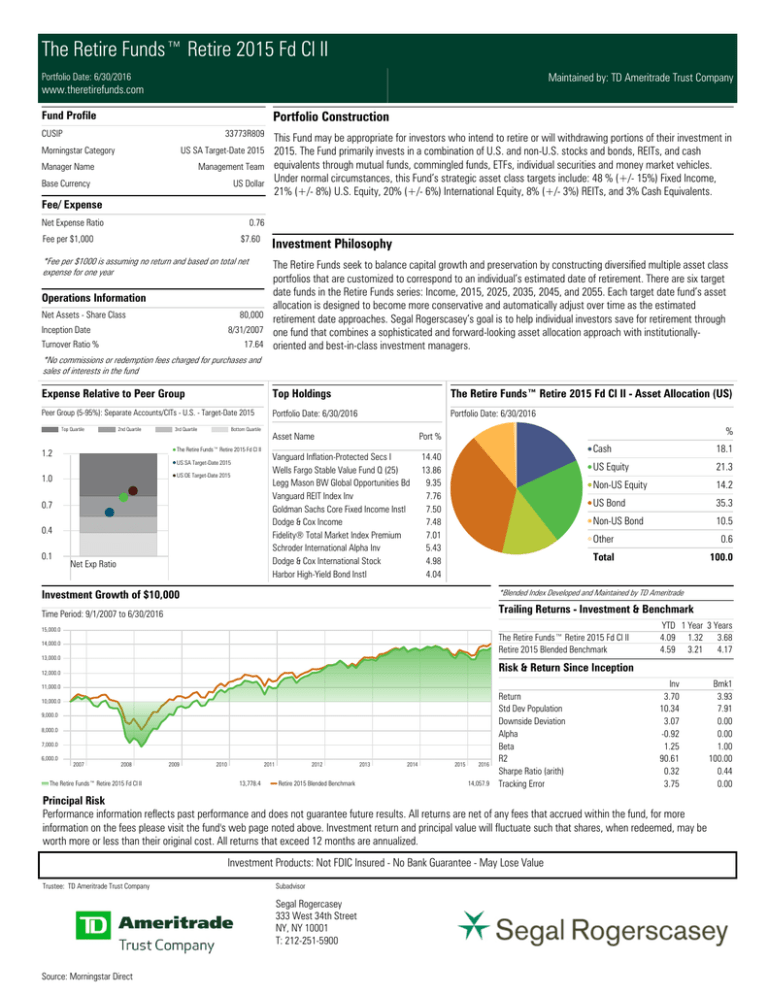

The Retire Funds™ Retire 2015 Fd Cl II Portfolio Date: 6/30/2016 Maintained by: TD Ameritrade Trust Company www.theretirefunds.com Portfolio Construction Fund Profile 33773R809 CUSIP This Fund may be appropriate for investors who intend to retire or will withdrawing portions of their investment in 2015. The Fund primarily invests in a combination of U.S. and non-U.S. stocks and bonds, REITs, and cash Management Team equivalents through mutual funds, commingled funds, ETFs, individual securities and money market vehicles. US Dollar Under normal circumstances, this Fund’s strategic asset class targets include: 48 % (+/- 15%) Fixed Income, 21% (+/- 8%) U.S. Equity, 20% (+/- 6%) International Equity, 8% (+/- 3%) REITs, and 3% Cash Equivalents. US SA Target-Date 2015 Morningstar Category Manager Name Base Currency Fee/ Expense Net Expense Ratio 0.76 Fee per $1,000 $7.60 Investment Philosophy *Fee per $1000 is assuming no return and based on total net expense for one year The Retire Funds seek to balance capital growth and preservation by constructing diversified multiple asset class portfolios that are customized to correspond to an individual’s estimated date of retirement. There are six target date funds in the Retire Funds series: Income, 2015, 2025, 2035, 2045, and 2055. Each target date fund’s asset allocation is designed to become more conservative and automatically adjust over time as the estimated 80,000 retirement date approaches. Segal Rogerscasey’s goal is to help individual investors save for retirement through 8/31/2007 one fund that combines a sophisticated and forward-looking asset allocation approach with institutionally17.64 oriented and best-in-class investment managers. Operations Information Net Assets - Share Class Inception Date Turnover Ratio % *No commissions or redemption fees charged for purchases and sales of interests in the fund Expense Relative to Peer Group Peer Group (5-95%): Separate Accounts/CITs - U.S. - Target-Date 2015 Top Quartile 2nd Quartile 3rd Quartile Bottom Quartile The Retire Funds™ Retire 2015 Fd Cl II 1.2 US SA Target-Date 2015 US OE Target-Date 2015 1.0 0.7 0.4 0.1 Net Exp Ratio Top Holdings The Retire Funds™ Retire 2015 Fd Cl II - Asset Allocation (US) Portfolio Date: 6/30/2016 Portfolio Date: 6/30/2016 Asset Name Port % Vanguard Inflation-Protected Secs I Wells Fargo Stable Value Fund Q (25) Legg Mason BW Global Opportunities Bd IS Vanguard REIT Index Inv Goldman Sachs Core Fixed Income Instl Dodge & Cox Income Fidelity® Total Market Index Premium Schroder International Alpha Inv Dodge & Cox International Stock Harbor High-Yield Bond Instl 14.40 13.86 9.35 7.76 7.50 7.48 7.01 5.43 4.98 4.04 % Cash 18.1 US Equity 21.3 Non-US Equity 14.2 US Bond 35.3 Non-US Bond 10.5 Other 0.6 Total 100.0 Investment Growth of $10,000 *Blended Index Developed and Maintained by TD Ameritrade Time Period: 9/1/2007 to 6/30/2016 Trailing Returns - Investment & Benchmark 15,000.0 The Retire Funds™ Retire 2015 Fd Cl II Retire 2015 Blended Benchmark 14,000.0 13,000.0 Risk & Return Since Inception 12,000.0 11,000.0 10,000.0 9,000.0 8,000.0 7,000.0 6,000.0 YTD 1 Year 3 Years 4.09 1.32 3.68 4.59 3.21 4.17 2007 2008 The Retire Funds™ Retire 2015 Fd Cl II 2009 2010 2011 13,778.4 2012 Retire 2015 Blended Benchmark 2013 2014 2015 2016 14,057.9 Return Std Dev Population Downside Deviation Alpha Beta R2 Sharpe Ratio (arith) Tracking Error Inv 3.70 10.34 3.07 -0.92 1.25 90.61 0.32 3.75 Principal Risk Performance information reflects past performance and does not guarantee future results. All returns are net of any fees that accrued within the fund, for more information on the fees please visit the fund's web page noted above. Investment return and principal value will fluctuate such that shares, when redeemed, may be worth more or less than their original cost. All returns that exceed 12 months are annualized. Investment Products: Not FDIC Insured - No Bank Guarantee - May Lose Value Trustee: TD Ameritrade Trust Company Subadvisor Segal Rogercasey 333 West 34th Street NY, NY 10001 T: 212-251-5900 Source: Morningstar Direct Bmk1 3.93 7.91 0.00 0.00 1.00 100.00 0.44 0.00