Attachment A - Proposed Listing Rule Changes

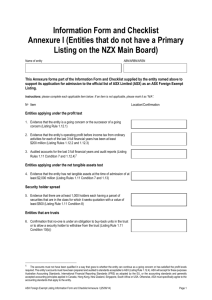

advertisement