Solution Solution - Colonial Forge High School

advertisement

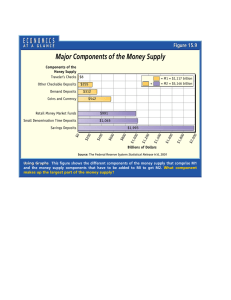

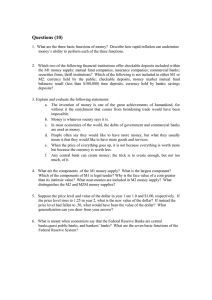

Page 155 Money, Banking, and the Federal Reserve System 1. For each of the following transactions, what is the effect (increase or decrease) on M1? on M2? a. You sell a few shares of stock and put the proceeds into your savings account. b. You sell a few shares of stock and put the proceeds into your checking account. c. You transfer money from your savings account to your checking account. d. You discover $0.25 under the floor mat in your car and deposit it in your checking account. e. You discover $0.25 under the floor mat in your car and deposit it in your savings account. Solution 1. a. Shares of stock are not a component of either M1 or M2, so holding fewer shares does not decrease either M1 or M2. However, depositing the money into your savings account increases M2, since the savings account is part of M2 (but not part of M1). M1 does not change. b. Shares of stock are not a component of either M1 or M2, and so holding fewer shares does not decrease either M1 or M2. However, depositing the money into your checking account increases M1, since checking accounts are part of M1. It also increases M2, since M1 is part of M2. 13 macroeconomics 3:20 PM 30 economics 10/27/05 chapter KrugmanMacro_SM_Ch13.qxp c. Moving money from savings to checking has no effect on M2, since both savings accounts and checking accounts are included in M2. However, since savings accounts are not part of M1, moving money from savings to checking does increase M1. d. Depositing cash into a checking account does not change M1 or M2. You are simply transferring money from one component of M1 (currency in circulation) to another component of M1 (checkable deposits). e. Depositing $0.25 into your savings account has no effect on M2, since both savings accounts and currency in circulation are in M2. However, since savings accounts are not part of M1, depositing the $0.25 into your savings account reduces M1. 2. There are three types of money: commodity money, commodity-backed money, and fiat money. Which type of money is used in each of the following situations? a. Mother-of-pearl seashells were used to pay for goods in ancient China. b. Salt was used in many European countries as a medium of exchange. c. For a brief time, Germany used paper money (the “Rye Mark”) that could be redeemed for a certain amount of grain rye. d. The town of Ithaca, New York, prints its own currency, the Ithaca HOURS, which can be used to purchase local goods and services. Solution 2. a. Mother-of-pearl is commodity money since the shells have other uses (for instance, for shirt buttons). b. Salt is commodity money since it has other uses. 155 156-157_KrugmanMacro_SM_Ch13.qxp 156 11/1/05 8:22 PM Page 156 MACROECONOMICS, CHAPTER 13 ECONOMICS, CHAPTER 30 c. The “Rye Mark” is commodity-backed money since its ultimate value is guaranteed by a promise that it can be converted into valuable goods (grain rye). d. Ithaca HOURS are fiat money because their value derives entirely from their status as a means of payment in Ithaca. 3. The table below shows the components of M1 and M2 in billions of dollars for the month of December in the years 1995 to 2004 as published in the 2005 Economic Report of the President. Complete the table by calculating M1, M2, currency in circulation as a percentage of M1, and currency in circulation as a percentage of M2. What trends or patterns about M1, M2, currency in circulation as a percentage of M1, and currency in circulation as a percentage of M2 do you see? What might account for these trends? Year Currency in circulation Traveler’s checks Checkable deposits Money market funds Time deposits smaller than $100,000 M1 M2 Currency in circulation as a percentage of M1 1995 $372.1 $9.1 $745.9 $448.8 $931.4 $1,134.0 ? ? ? ? 1996 394.1 8.8 676.5 517.4 946.8 1,273.1 ? ? ? ? 1997 424.6 8.5 639.5 592.2 967.9 1,399.1 ? ? ? ? 1998 459.9 8.5 627.7 732.7 951.5 1,603.6 ? ? ? ? 1999 517.7 8.6 597.7 832.5 954.0 1,738.2 ? ? ? ? 2000 531.6 8.3 548.1 924.2 1,044.2 1,876.2 ? ? ? ? 2001 582.0 8.0 589.3 987.2 972.8 2,308.9 ? ? ? ? 2002 627.4 7.8 582.0 915.5 892.1 2,769.5 ? ? ? ? 2003 663.9 7.7 621.8 801.1 809.4 3,158.5 ? ? ? ? 2004 699.3 7.6 656.2 714.7 814.0 3,505.9 ? ? ? ? Savings deposits Currency in circulation as a percentage of M2 3. Solution Here is the completed table: Savings deposits M1 M2 Currency in circulation as a percentage of M1 $931.4 $1,134.0 $1,127.1 $3,641.3 33.0% 10.2% 946.8 1,273.1 1,079.4 3,816.7 36.5% 10.3% 592.2 967.9 1,399.1 1,072.6 4,031.8 39.6% 10.5% 732.7 951.5 1,603.6 1,096.1 4,383.9 42.0% 10.5% 832.5 954.0 1,738.2 1,124.0 4,648.7 46.1% 11.1% 924.2 1,044.2 1,876.2 1,088.0 4,932.6 48.9% 10.8% 589.3 987.2 972.8 2,308.9 1,179.3 5,448.2 49.4% 10.7% 582.0 915.5 892.1 2,769.5 1,217.2 5,794.3 51.5% 10.8% 7.7 621.8 801.1 809.4 3,158.5 1,293.4 6,062.4 51.3% 11.0% 7.6 656.2 714.7 814.0 3,505.9 1,363.1 6,397.7 51.3% 10.9% Year Currency in circulation Traveler’s checks Checkable bank deposits Money market funds Time deposits smaller than $100,000 1995 $372.1 $9.1 $745.9 $448.8 1996 394.1 8.8 676.5 517.4 1997 424.6 8.5 639.5 1998 459.9 8.5 627.7 1999 517.7 8.6 597.7 2000 531.6 8.3 548.1 2001 582.0 8.0 2002 627.4 7.8 2003 663.9 2004 699.3 Currency in circulation as a percentage of M2 156-157_KrugmanMacro_SM_Ch13.qxp 11/1/05 8:22 PM Page 157 M O N E Y, B A N K I N G , A N D T H E F E D E R A L R E S E R V E S Y S T E M M1 consists of currency in circulation, traveler’s checks, and checkable deposits. M2 consists of M1 plus money funds, time deposits, and savings deposits. From 1995 to 2004, there is no obvious trend in M1. M1 grew by $236 billion (or 21% from 1995 to 2004) but was essentially stable from 1995 to 2001; all of this growth occurred between 2002 and 2004. There is, however, a clear upward trend throughout the period for M2, which grew by $2,756.4 billion (or 76% from 1995 to 2004). Currency as a percentage of M1 grew from 33 percent to over 51 percent from 1995 to 2004, but currency as a percentage of M2 remained relatively constant, varying from a low of 10.2% in 1995 to a high of 11.1% in 1999. The increase in currency as a percentage of M1 could reflect increased use of credit cards, causing a reduction in the importance of traveler’s checks and checkable deposits. Yet, since currency as a percentage of M2 did not change, it could also reflect a shift from checkable deposits to money funds, time deposits, and saving deposits. 4. Indicate whether each of the following is part of M1, M2, or neither: a. b. c. d. e. f. $95 on your campus meal card $0.55 in the change cup of your car $1,663 in your savings account $459 in your checking account 100 shares of stock worth $4,000 A $1,000 line of credit on your Sears credit card Solution 4. a. $95 on your campus meal card is similar to a gift certificate. Because it can only be used for one purpose, it is not part of either M1, M2. b. $0.55 in the change cup of your car is part of currency in circulation; it is part of both M1 and M2. c. $1,663 in your savings account isn’t directly usable as a medium of exchange, so it is not part of M1; but because it can readily be converted into cash or checkable deposits, it is part of M2. d. A $459 balance in your checking account is part of M1 and M2; it represents a checkable deposit. e. 100 shares of stock are not part of either M1 or M2. Although an asset, stock is not a highly liquid asset. f. A $1,000 line of credit on your Sears credit card account is not part of either M1 or M2 because it does not represent an asset. 5. Tracy Williams deposits $500 that was in her sock drawer into a checking account at the local bank. a. How does the deposit initially change the T-account of the local bank? How does it change the money supply? b. If the bank maintains a reserve ratio of 10%, how will it respond to the new deposit? c. If every time the bank makes a loan, the loan results in a new checkable bank deposit in a different bank equal to the amount of the loan, by how much could the money supply in the economy expand in total? d. If every time the bank makes a loan, the loan results in a new checkable bank deposit in a different bank equal to the amount of the loan and the bank maintains a reserve ratio of 5%, by how much could the money supply expand in response to an initial cash deposit of $500? 157 KrugmanMacro_SM_Ch13.qxp 158 10/27/05 3:20 PM Page 158 MACROECONOMICS, CHAPTER 13 ECONOMICS, CHAPTER 30 Solution 5. a. Initially, the bank’s reserves rise by $500, as do its checkable deposits. There is no initial change in the money supply; currency in circulation has fallen by $500 but checkable deposits have increased by $500. Assets Reserves +$500 Liabilities Checkable Deposits +$500 b. The bank will hold $50 as reserves against the new deposit and make additional loans equal to $450. c. The money supply can expand by $4,500. Checkable deposits rise by $5,000—the initial $500 deposit of cash plus $4,500 in loans and deposits. Only $4,500 ($500/0.1 − $500) represents additions to the money supply. (Remember that $500 of the increase in deposits came at the expense of a reduction in currency in circulation when Tracy deposited $500 in her bank account.) d. The money supply can expand by $9,500. Checkable deposits rise by $10,000 but because the first $500 was a deposit of cash, only $9,500 ($500/0.05 − $500) represents additions to the money supply. 6. Ryan Cozzens withdraws $400 from his checking account at the local bank and keeps it in his wallet. a. How will the withdrawal change the T-account of the local bank and the money supply? b. If the bank maintains a reserve ratio of 10%, how will the bank respond to the withdrawal? c. If every time the bank decreases its loans, checkable bank deposits fall by the amount of the loan, by how much could the money supply in the economy contract in total? d. If every time the bank decreases its loans, checkable bank deposits fall by the amount of the loan and the bank maintains a reserve ratio of 20%, by how much will the money supply contract in response to a withdrawal of $400? Solution 6. a. Initially, the bank’s reserves fall by $400, as do its checkable deposits. There is no initial change in the money supply; currency in circulation has risen by $400 but checkable deposits have decreased by $400. Assets Reserves −$400 Liabilities Checkable Deposits −$400 b. Assuming that the bank has other checkable deposits, the bank will be holding insufficient reserves. The bank was holding $40 of the $400 withdrawal as required reserves for the $400 deposit; however, the remaining $360 was being held as required reserves for other deposits. The bank will have to reduce its deposits by $3,600 (−$400/0.1 + $400) to reduce its required reserves by $360 (10% of $3,600). It will have to reduce deposits by calling in some of its loans. c. The money supply will contract by $3,600 (−$400/0.1 + $400). Checkable deposits fall by $4,000, but only $3,600 represents a decrease in the money supply. d. The money supply can decrease by $1,600 (−$400/0.2 + $400). Checkable deposits fall by $2,000, but only $1,600 represents a decrease in the money supply. KrugmanMacro_SM_Ch13.qxp 10/27/05 3:20 PM Page 159 M O N E Y, B A N K I N G , A N D T H E F E D E R A L R E S E R V E S Y S T E M 7. The government of Eastlandia uses measures of monetary aggregates similar to those used by the United States, and the central bank of Eastlandia imposes a required reserve ratio of 10%. Given the following information, answer the questions below. Bank deposits at the central bank = $200 million Currency held by public = $150 million Currency in bank vaults = $100 million Checkable bank deposits = $500 million Traveler’s checks = $10 million a. b. c. d. What is M1? What is the monetary base? Are the commercial banks holding excess reserves? Can the commercial banks increase checkable bank deposits? If yes, by how much can checkable bank deposits increase? Solution 7. a. M1 equals the sum of currency held by the public ($150 million), checkable deposits ($500 million), and traveler’s checks ($10 million) or $660. b. The monetary base is the sum of currency held by the public ($150 million) and the reserves of the commercial banks (currency in bank vaults ($100 million) and bank deposits ($200 million) at the central bank). The monetary base is $450 million. c. Required reserves are $50 million (10% of $500 million). Because total reserves are $300 million, the commercial banks are holding $250 million ($300 million − $50 million) in excess reserves. d. Since the commercial banks are holding excess reserves, they can increase deposits. With a required reserve ratio of 10%, reserves of $300 million can support a total of $3,000 million ($300/0.1) in deposits. Commercial banks can increase deposits by an additional $2,500 million. 8. In Westlandia, the public holds 50% of M1 in the form of currency, and the required reserve ratio is 20%. Estimate how much the money supply will increase in response to a new cash deposit of $500 by completing the table below. (Hint: The first row shows that the bank must hold $100 in minimum reserves—20% of the $500 deposit—against this deposit, leaving $400 in excess reserves that can be loaned out. However, since the public wants to hold 50% of the loan in currency, only $400 × 0.5 = $200 of the loan will be deposited in round 2 from the loan granted in round 1.) How does your answer compare to an economy in which the total amount of the loan is deposited in the banking system and the public doesn’t hold any of the loan in currency? What does this imply about the relationship between the public’s desire for currency and the money multiplier? Round Deposits Required reserves Excess reserves Loans Held as currency 1 $500.00 $100.00 $400.00 $400.00 $200.00 2 200.00 ? ? ? ? 3 ? ? ? ? ? 4 ? ? ? ? ? 5 ? ? ? ? ? 6 ? ? ? ? ? 7 ? ? ? ? ? 8 ? ? ? ? ? 9 ? ? ? ? ? 10 ? ? ? ? ? ? ? ? ? ? Total after 10 rounds 159 KrugmanMacro_SM_Ch13.qxp 160 10/27/05 3:20 PM Page 160 MACROECONOMICS, CHAPTER 13 ECONOMICS, CHAPTER 30 Solution 8. Here is the completed table: Round Deposits Required reserves Excess reserves Loans Held as currency 1 $500.00 $100.00 $400.00 $400.00 $200.00 2 200.00 40.00 160.00 160.00 80.00 3 80.00 16.00 64.00 64.00 32.00 4 32.00 6.40 25.60 25.60 12.80 5 12.80 2.56 10.24 10.24 5.12 6 5.12 1.02 4.10 4.10 2.05 7 2.05 0.41 1.64 1.64 0.82 8 0.82 0.16 0.66 0.66 0.33 9 0.33 0.07 0.26 0.26 0.13 10 0.13 0.03 0.10 0.10 0.05 $833.25 $166.65 $666.60 $666.60 $333.30 Total after 10 rounds After 10 rounds, loans can expand by $666.60; this is also the increase in the money supply at this point. (Although deposits increase by $833.25, currency held by the public falls by $166.70—it initially fell by $500 and eventually rose again by $333.30.) If the total amount of each loan is deposited in the banking system (that is, the public does not hold any of the loans in currency), the money supply would increase by $2,000 (500/0.2 − $500); deposits would increase by $2,500. The money multiplier decreases in size as the public holds a greater percentage of loans in currency. 9. What will happen to the money supply under the following circumstances? a. The required reserve ratio is 25%, and a depositor withdraws $700 from his checkable bank deposit. b. The required reserve ratio is 5%, and a depositor withdraws $700 from his checkable bank deposit. c. The required reserve ratio is 20%, and a customer deposits $750 to her checkable bank deposit. d. The required reserve ratio is 10%, and a customer deposits $600 to her checkable bank deposit. Solution 9. a. Deposits contract by $2,800 but $700 is converted into currency held by the public. The money supply contracts by $2,100. b. Deposits contract by $14,000 but $700 is converted into currency held by the public. The money supply contracts by $13,300. c. Deposits expand by $3,750 but currency in circulation falls by $750. The money supply expands by $3,000. d. Deposits expand by $6,000 but currency in circulation falls by $600. The money supply expands by $5,400. KrugmanMacro_SM_Ch13.qxp 11/15/05 3:25 PM Page 161 M O N E Y, B A N K I N G , A N D T H E F E D E R A L R E S E R V E S Y S T E M 10. Although the U.S. Federal Reserve doesn’t use changes in reserve requirements to manage the money supply, the central bank of Albernia does. The commercial banks of Albernia have $100 million in reserves and $1,000 million in checkable deposits; the initial required reserve ratio is 10%. The commercial banks follow a policy of holding no excess reserves. The public holds a fixed amount of currency, so all loans create an equal amount of deposits in the banking system. a. How will the money supply change if the required reserve ratio falls to 5%? b. How will the money supply change if the minimum reserve ratio rises to 25%? Solution 10. a. If the required reserve ratio falls to 5%, the commercial banks of Albernia will be holding $50 million in excess reserves. Since the banks follow a policy of holding no excess reserves, the banks will expand deposits by making loans. The banks’ reserves of $100 million will support $2,000 million in deposits at a reserve ratio of 5%. The bank will expand loans and deposits by $1,000 million; so the money supply expands by $1,000 million. b. If the required reserve ratio rises to 25%, the commercial banks of Albernia will not be holding enough reserves to support $1,000 million in deposits. The banks’ reserves will only support $400 million in deposits. The commercial banks will have to decrease loans and deposits by $600 million; so the money supply will contract by $600 million. 11. Using Figure 13-5, find the Federal Reserve district in which you live. Go to http://www.federalreserve.gov/bios/pres.htm and identify the president of that Federal Reserve Bank. Go to http://www.federalreserve.gov/fomc/and determine if the president of the Fed is currently a voting member of the Federal Open Market Committee (FOMC). Solution 11. Answers will vary depending on where you live and when you look up your answer. If you live in Reedley, California, in July 2005, you were in the San Francisco district of the Federal Reserve system. Janet Yellen was the president of the Federal Reserve Bank of San Francisco and an alternate (nonvoting) member of the FOMC at that time. 12. Show the changes to the T-accounts for the Federal Reserve and for commercial banks when the Federal Reserve buys $50 million in U.S. Treasury bills. If the public holds a fixed amount of currency (so that all loans create an equal amount of deposits in the banking system), the minimum reserve ratio is 10%, and banks hold no excess reserves, by how much will deposits in the commercial banks change? By how much will the money supply change? Show the final changes to the T-account for commercial banks when the money supply changes by this amount. Solution 12. When the Federal Reserve buys $50 million in Treasury bills from commercial banks, its assets increase by $50 million (it now owns $50 million in Treasury bills) but its liabilities also increase by $50 million as it credits the banks’ account at the Federal Reserve, part of the monetary base. From the perspective of commercial banks, their assets fall by $50 million because they sell Treasury bills to the Fed but their assets also rise by $50 million when their deposits at the Fed (reserves) are credited with $50 million. 161 KrugmanMacro_SM_Ch13.qxp 162 10/27/05 3:20 PM Page 162 MACROECONOMICS, CHAPTER 13 ECONOMICS, CHAPTER 30 Initial changes to the T-account of the Federal Reserve immediately after Fed purchase of $50 million in Treasury bills: Assets Treasury bills +$50 million Liabilities Monetary base +$50 million Initial changes to the T-account of commercial banks immediately after Fed purchase of $50 million in Treasury bills: Assets Treasury bills Reserves Liabilities −$50 million +$50 million After the Federal Reserve buys $50 million from commercial banks, the banks are holding $50 million in excess reserves. Since the banks do not want to hold any excess reserves, they will increase loans and deposits by $500 million, the maximum amount that $50 million in reserves can support. Therefore, the money supply will also increase by $500 million. All changes to the T-account of commercial banks after the Fed purchase of $50 million in Treasury bills: Assets Treasury bills −$50 million Reserves +$50 million Loans +$500 million 13. Liabilities Checkable deposits +$500 million Show the changes to the T-accounts for the Federal Reserve and for commercial banks when the Federal Reserve sells $30 million in U.S. Treasury bills. If the public holds a fixed amount of currency (so that all new loans create an equal amount of checkable bank deposits in the banking system) and the minimum reserve ratio is 5%, by how much will checkable bank deposits in the commercial banks change? By how much will the money supply change? Show the final changes to the T-account for the commercial banks when the money supply changes by this amount. Solution 13. When the Federal Reserve sells $30 million in Treasury bills to commercial banks, its assets decrease by $30 million (it now owns $30 million less in Treasury bills) but its liabilities also decrease by $30 million as the banks pay the Federal Reserve for the Treasury bills from their accounts at the Fed (part of the monetary base). From the perspective of commercial banks, their assets rise by $30 million because they buy the Treasury bills from the Fed but their assets also fall by $30 million when they pay for the Treasury bills from their deposits at the Fed (their reserves). Initial changes to the T-account of the Federal Reserve immediately after Fed sale of $30 million in Treasury bills: Assets Treasury bills −$30 million Liabilities Monetary base −$30 million Initial changes to the T-account of commercial banks immediately after Fed sale of $30 million in Treasury bills: Assets Treasury bills Reserves +$30 million −$30 million Liabilities KrugmanMacro_SM_Ch13.qxp 10/27/05 3:20 PM Page 163 M O N E Y, B A N K I N G , A N D T H E F E D E R A L R E S E R V E S Y S T E M After the Federal Reserve sells $30 million in Treasury bills, the banks are no longer holding enough reserves to support their deposits. The banks will need to reduce loans and deposits by $600 million—the amount of deposits that were supported by the $30 million in reserves used to buy the Treasury bills. So the money supply will also decrease by $600 million. All changes to the T-account of commercial banks after Fed sale of $30 million in Treasury bills: Assets Treasury bills +$30 million Reserves −$30 million Loans −$600 million Liabilities Checkable deposits −$600 million 163 KrugmanMacro_SM_Ch13.qxp 10/27/05 3:20 PM Page 164