Systemic risk diagnostics: coincident indicators and early warning

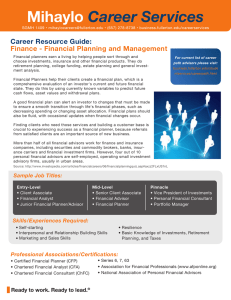

advertisement