VIX® Trading During Periods of Low Volatility

August 2014

VIX

®

Trading During Periods of Low Volatility

by Robert MCGlinchey,

EQDerivatives director and co-founder

Since February 2014, the CBOE Volatility Index ® (VIX ®

Index) has fallen from 21.44 to close at 10.32 on July 3 and has remained in the 12-14 range most of the year.

Despite the low VIX readings, trading volumes in VIX options and futures have not only remained robust, there have been several record-breaking days reported by the Chicago Board Options Exchange (CBOE) during the period (see data at the end of this article).

The “Shoulda Woulda Coulda” Trade

Investors looking at the VIX as a tail hedge are presented with an optimum opportunity to participate in the low level of volatility. Paul Britton, CEO of Capstone

Investment Advisors, says they now have mandates from several large pension funds looking to employ such tail hedges.

Even at these subdued levels, volatility sellers have remained active in the market, while volatility buyers have continued to seek ways to maintain their protective positions, at the same time positioning for a potential move lower in VIX. Regardless of the level of volatility, using VIX options and futures as a tail hedge, being long volatility as a diversification tool, and using the instruments as part of an overlay strategy, has grown in popularity among a larger and more diverse group of market participants.

William Speth, CBOE’s vice president of research and product development, notes that growth in volume or open interest in VIX products is not dependent on high volatility. “The idea is that when VIX is low, the question in the minds of investors is, how much lower can it go?

Because of the mean-reverting nature of the Index, if you’re at historically low levels, in some sense, your belief is that the next move will likely be up rather than down.”

From an institutional fund manager perspective, the primary purpose of using VIX options and futures is to lower the volatility of a portfolio. With the current level of the index hovering around 14, most argue that now is a prime time to use the product as an insurance tool.

“Looking at VIX at 11 lets you be more aggressive in an equity portfolio because of inexpensive insurance. There’s never been a better time to own volatility to let you sleep well at night,” notes one large portfolio manager.

“I was out with a friend who runs alternatives and he put it very eloquently. He calls it the tail hedge conundrum, the ‘shoulda woulda coulda’ trade. I think that’s a brilliant way to describe it,” says Britton. “Don’t let this be a situation where you end up saying ‘I should have bought

VIX at 11 or 12 to protect my positions,’ and now you’re buying it at 25.”

With pension funds and other institutional investors typically long equities, the historical reaction during a volatility spike or, conversely, anticipation of a market swoon, would be to shift to cash. Yet, by buying the VIX now, participants can stay invested. In the past, however, due to many such investors being benchmark driven, they have not generally taken advantage of VIX during periods of low volatility.

The risk of not participating in the current low volatility environment means investors could miss out on deploying effective hedges before the VIX spikes higher, notes Britton. “That message comes from a very large fund manager having serious conversations right now with customers to be able to objectively look at this and analyze how they should be playing it right now to get protection.”

Not Everyone Is a Buyer

On the flip side, many volatility traders and fund managers now recognize that regardless of the level of VIX, there are consistent opportunities to make money trading VIX options and futures from the short side. “We never say volatility is too low,” says Dennis Davitt, managing principal and chief investment officer of Harvest Volatility Advisors.

“We really believe that the absolute level of volatility is not

www.cboe.com

VIX

®

TRADING DURING PERIODS OF LOW VOLATILITY

the only driver of the profitability of a strategy.” Because

VIX tends to be mean reverting, the further out contract months tend to trade higher than the current, front month contract in periods of low volatility. This condition, called “contango,” provides savvy volatility traders the opportunity to profit from the roll down the curve. This is one reason that not everyone is a volatility buyer – even at low levels.

for example, the SPX is at 1900 and you protect with a

1900 put. If the market then goes up to 2000 and you want the same at-the-money protection, you have to sell at a loss and buy the 2000 put,” says Speth. “A VIX trade can potentially give you the same protection at 2000 as at 1900. Volatility may drop a bit, but not enough to rebalance the position. The volatility trade continues to give you coverage irrespective of the price of the portfolio you’re trying to protect.”

| 2

Russell Rhoads, CFA, senior instructor and content developer with The Options Institute SM at CBOE explains that “VIX is a measure of what the marketplace thinks volatility will be in 30 days. Even when VIX is at 11 or

12, if realized volatility ends up being 6, then VIX was actually high and volatility selling strategies would continue to work.”

Calendar Spreads in Vogue

One of the most popular strategies to trade amid the current low volatility environment is the calendar spread.

“When you have contango like this, you also see a lot of calendar spreads. The difference between contract months can be extreme. As you get in farther back-dated contracts, they get closer to the historic mean of the VIX

Index,” says CBOE’s Speth. “So people sell the more expensive, longer-dated contracts (and buy the near-term contract). If the VIX cash index goes up, they can gain more from the near-dated contract moving up than they lose from the farther dated. The spread in the two may narrow or even flip.”

Russell Rhoads continues, “We’re seeing a lot of option spread trades – for example, possibly paying $34 for a

$316 payoff. Volatility moves around an average or mean – so just to get back to the average level, you need a period of high volatility. So if you think there will be a big move up in volatility, the spread trade counters the excruciating wait until it happens. The cost of holding a long position is a valid argument, but the spread counters that.”

Liquidity and Lower Fees

One reason that participation in VIX products has continued to grow despite the significant drop in market volatility over the last year is due to constant liquidity in the options and futures, which is significant when compared with some other markets. “For the kind of VIX positions that we may take, under our risk constraints, liquidity is not really an issue for us. This would not be the case with some of the more OTC equity volatility products,” says Zoltan Eisler, a portfolio manager in directional strategies at Capital

Fund Management, a Paris-based fund manager active in volatility trading, including VIX futures.

For Capital Fund Management, Eisler says the firm complements its index option trading strategies by using the VIX as an additional tool to react to market moves.

“The liquidity of VIX allows us to be very reactive. If one has a diversified options portfolio across different strikes, some of them may become illiquid, and one will find it difficult to close down those positions. For closing a VIX position, one only needs to send in an order – for even a few thousand lots – and within a short period of time this is done,” says Eisler. “It’s very easy and very flexible. You can go from short to long without worrying about legacy positions left behind.”

Fund managers also point out that transaction costs are fairly low relative to trading over-the-counter options. Fees on VIX products are small, while margins are not excessive.

“The product is very easy to trade and it is the easiest way to get volatility exposure,” adds Eisler.

Complementing Strategies

For Speth, those investors who are ahead of the game are using VIX calls as an alternative to SPX puts or as a complement to SPX protective puts. When using just

SPX calls he notes that the cost of such strategies can outweigh the benefits over time since you constantly have to adjust your position.

“With a VIX trade, since volatility is not tied to the absolute level of a stock or index, it can move independently of the price (of the stock or index) which means you don’t have to keep readjusting your position. Let’s say,

Other Volatility Tools and Their Properties

Speth also points out that there are additional volatility products that investors can uniquely take advantage of in times of low volatility, such as the CBOE Short-Term

Volatility Index SM , (VXST SM ), CBOE NASDAQ-100 Volatility

Index (VXN SM ), and the CBOE Russell 2000 Volatility Index

(RVX SM ) – all of which tend to measure at higher levels than VIX. For VXST in particular, investors can access a market estimate of short-term implied volatility that is

www.cboe.com/

with at least one day left to expiration and then weights

C2

www.cboe.com

VIX

®

TRADING DURING PERIODS OF LOW VOLATILITY

those prices to yield a constant, nine-day measure of expected volatility. Because of its shorter time frame,

VXST can be more reactive to news events or market reports.

“Investors shouldn’t think of volatility as just one product,” Speth says. “There are unique products with unique properties in the risk horizon. If an investor can understand the nuances, they have some really powerful tools, depending on their view of risk in the market.”

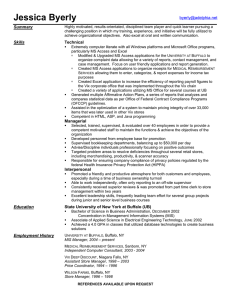

Long-Term Stats: Daily Closing Values of VIX

(Jan. 1990 – Aug. 15, 2014)

18.28

– Median daily closing value of VIX

20.03

– Average daily closing value of VIX

80.86

– Highest daily closing value of VIX

(on Nov. 20, 2008)

9.31

– Lowest daily closing value of VIX

(on Dec. 22, 1993)

A Look at VIX by the Numbers

2014

13.6

– Average daily closing value for VIX in 2014

(year-to-date)

10.4

– Average historic volatility for S&P 500

(SPX) Index in 2014 (year-to-date)

21.44

– Highest daily closing value of VIX

(on February 3, 2014)

10.32

– Lowest daily closing value of VIX

(on July 3, 2014)

2014 Volume

667,168 – Average daily volume for VIX options year-to-date through July 2014

185,799 – Average daily volume for VIX futures year-to-date through July 2014

292,683 – Average daily volume for VIX futures August

1-15, 2014 (on pace to be a record-breaking month)

| 3

To learn more, visit www.cboe.com/VIX .

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized

Options. Copies are available from your broker, by calling 1-888-OPTIONS or from The Options Clearing Corporation at www.theocc.com. Futures trading is not suitable for all investors, and involves risk of loss. The information in this paper is provided for general education and information purposes only. No statement within this paper should be construed as a recommendation to buy or sell a security or futures contract or to provide investment advice. It is not possible to invest directly in an index.

Supporting documentation for any claims, comparisons, statistics or other technical data in this paper is available from CBOE upon request. The CBOE Volatility Index ®

(VIX ® index) and all other information provided by Chicago Board Options Exchange, Incorporated (CBOE) and its affiliates and their respective directors, officers, employees, agents, representatives and third party providers of information (the “Parties”) in connection with the VIX ®

Data or action taken in reliance upon the Data.

Index (collectively “Data”) are presented “as is” and without representations or warranties of any kind. The Parties shall not be liable for loss or damage, direct, indirect or consequential, arising from any use of the

The VIX ® index methodology is the property of CBOE. CBOE ® , Chicago Board Options Exchange ® , Execute Success ® , CBOE Volatility Index ® and VIX ® are registered trademarks and CBOE Short-Term Volatility Index SM , RVX SM , SPX SM , VXN SM and VXST SM are service marks of CBOE. Standard & Poor’s ® , S&P ® and S&P 500 ® are registered trademarks of Standard & Poor’s Financial Services, LLC and have been licensed for use by CBOE and CBOE Futures Exchange, LLC. Financial products based on S&P indices are not sponsored, endorsed, sold or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in such products. Redistribution, reproduction and/or photocopying in whole or in part are prohibited without the written permission of CBOE.

Copyright © 2014 CBOE. All rights reserved.

CBOE | 400 South LaSalle Street | Chicago, IL 60605