13th Annual INSEAD Private Equity Conference

advertisement

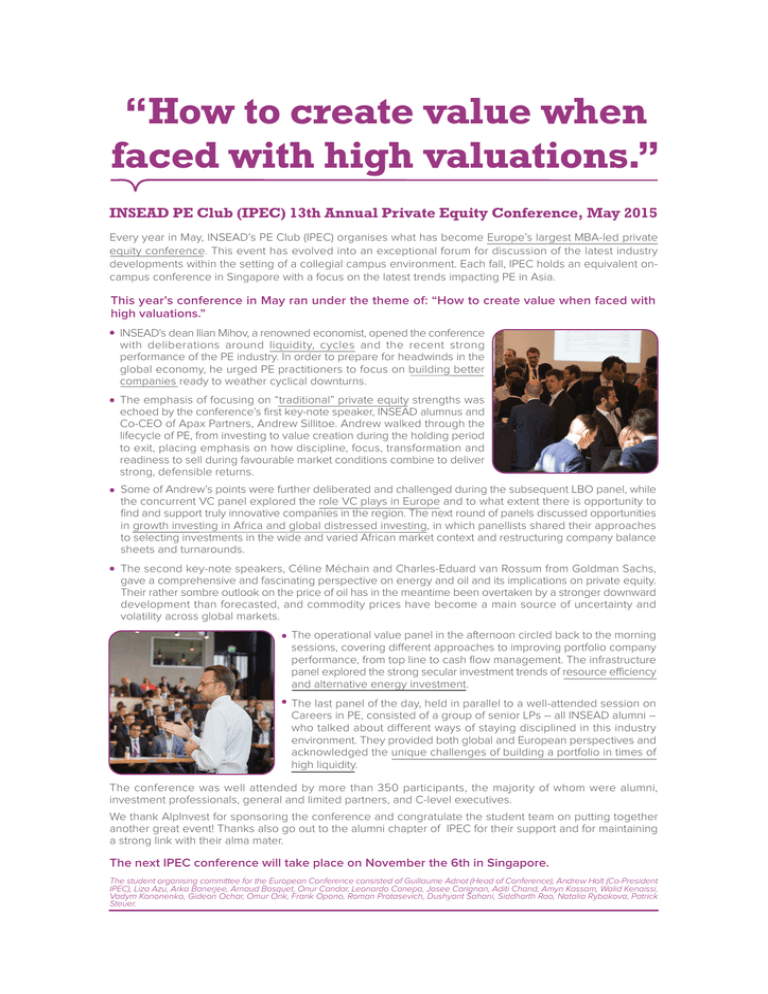

How to create value when faced with high valuations. INSEAD PE Club (IPEC) 13th Annual Private Equity Conference, May 2015 Every year in May, INSEADs PE Club (IPEC) organises what has become Europes largest MBA-led private equity conference. This event has evolved into an exceptional forum for discussion of the latest industry developments within the setting of a collegial campus environment. Each fall, IPEC holds an equivalent oncampus conference in Singapore with a focus on the latest trends impacting PE in Asia. This years conference in May ran under the theme of: How to create value when faced with high valuations. INSEADs dean Ilian Mihov, a renowned economist, opened the conference with deliberations around liquidity, cycles and the recent strong performance of the PE industry. In order to prepare for headwinds in the global economy, he urged PE practitioners to focus on building better companies ready to weather cyclical downturns. The emphasis of focusing on traditional private equity strengths was echoed by the conferences first key-note speaker, INSEAD alumnus and Co-CEO of Apax Partners, Andrew Sillitoe. Andrew walked through the lifecycle of PE, from investing to value creation during the holding period to exit, placing emphasis on how discipline, focus, transformation and readiness to sell during favourable market conditions combine to deliver strong, defensible returns. Some of Andrews points were further deliberated and challenged during the subsequent LBO panel, while the concurrent VC panel explored the role VC plays in Europe and to what extent there is opportunity to find and support truly innovative companies in the region. The next round of panels discussed opportunities in growth investing in Africa and global distressed investing, in which panellists shared their approaches to selecting investments in the wide and varied African market context and restructuring company balance sheets and turnarounds. The second key-note speakers, Céline Méchain and Charles-Eduard van Rossum from Goldman Sachs, gave a comprehensive and fascinating perspective on energy and oil and its implications on private equity. Their rather sombre outlook on the price of oil has in the meantime been overtaken by a stronger downward development than forecasted, and commodity prices have become a main source of uncertainty and volatility across global markets. The operational value panel in the afternoon circled back to the morning sessions, covering different approaches to improving portfolio company performance, from top line to cash flow management. The infrastructure panel explored the strong secular investment trends of resource efficiency and alternative energy investment. The last panel of the day, held in parallel to a well-attended session on Careers in PE, consisted of a group of senior LPs all INSEAD alumni who talked about different ways of staying disciplined in this industry environment. They provided both global and European perspectives and acknowledged the unique challenges of building a portfolio in times of high liquidity. The conference was well attended by more than 350 participants, the majority of whom were alumni, investment professionals, general and limited partners, and C-level executives. We thank AlpInvest for sponsoring the conference and congratulate the student team on putting together another great event! Thanks also go out to the alumni chapter of IPEC for their support and for maintaining a strong link with their alma mater. The next IPEC conference will take place on November the 6th in Singapore. The student organising committee for the European Conference consisted of Guillaume Adnot (Head of Conference), Andrew Holt (Co-President IPEC), Liza Azu, Arka Banerjee, Arnaud Bosquet, Onur Candar, Leonardo Canepa, Josee Carignan, Aditi Chand, Amyn Kassam, Walid Kenaissi, Vadym Kononenko, Gideon Ochar, Omur Onk, Frank Opono, Roman Protasevich, Dushyant Sahani, Siddharth Rao, Natalia Rybakova, Patrick Steuer.