QUESTIONS 1. Explain how exchange rate and inflation affect the

advertisement

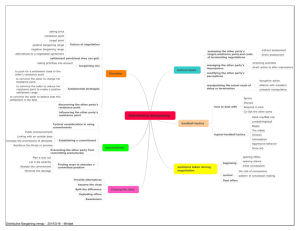

QUESTIONS 1. Explain how exchange rate and inflation affect the way you price your product. The exchange rate has a great deal of impact in international marketing. When a seller's currency is strong and revalued, its price which may remain unchanged domestically loses competitiveness overseas. Its agent/customer abroad has to spend more money just to buy the same volume, forcing the agent to subsequently increase prices in order to pass along cost increases to consumers. Inflation affects pricing by increasing production costs which must be passed along to middlemen and subsequently consumers. A marketer thus must compensate for inflation by adjusting prices periodically. Any installment plan based on a fixed price is probably not wise. If the marketer is unable to adjust prices frequently, it may have to initially overprice its product. In addition, it should insulate itself against the declining value of a depreciating local currency by posting its prices in terms of an appreciating hard currency. 2. What is dumping? When does it become illegal? What can a seller do to circumvent antidumping regulations? Dumping is the practice of charging different prices for the same product in similar markets. Usually, imported goods are sold at prices so low as to be detrimental to local producers of the same kind of merchandise. Depending on local laws, dumping becomes illegal when the price charged drops below a specified level--at less than fair value or below its home-market price or production cost. To circumvent antidumping regulations, a seller should differentiate the exported item from the item being sold in the home market so that price comparison is not possible or valid. This may involve product modification or multiple brands. Another method is to make competitive adjustments in nonprice items (e.g., terms of payment) when negotiating with affiliates and distributors. 3. What methods can be used to compute a transfer price (for transactions between affiliated companies)? There are four basic methods used to determine transfer prices. The first method involves transfers at direct manufacturing costs. The second technique involves a transfer at direct manufacturing cost plus a predetermined markup to cover additional expenses. The third course of action involves the use of a market-based transfer price. Finally, the fourth process employs an arm's length price. DISCUSSION ASSIGNMENTS AND MINICASES 1. How should farmers price their products? In general, U.S. farmers do not have a pricing problem due to the fact that they usually have no control over how the products should be priced. Because they offer commodities, the prices are determined by the demand and supply. The farmers are thus forced to accept market prices. They can be above the market prices only if their offerings are somewhat differentiated or have a higher quality than those offered by foreign farmers. 1 2. To protect itself, how should a marketer price its product in a country with high inflation? In a country with high inflation, a marketer needs to adjust price on a continuous basis, sometimes sharply. It is risky to offer a long-term contract without any allowance for price adjustment. A product may have to be overpriced to begin with. Accounts receivable must be quickly collected. Unbundling may be necessary so that an affordable price can be achieved. 3. Price haggling is an art. Discuss how you can haggle effectively. There are several rules of thumb of haggling. First, after being quoted a price which the seller claims to be very cheap, you should say that it is still too expensive, forcing the seller to be the first to lower the price. Then it is time to make a counteroffer, usually at half the original offer. After that, you should expect the offer and counteroffer to move by 10-percent increments. In the process of bargaining, point out the flaws of the product (e.g., style, size, quality, quantity, defect, etc.). Bargaining is easier with a friend's support. Persistence and patience are necessary, although aggressiveness may be unsuitable in some places. You may also ask for the best offer immediately, claiming to be in a hurry. Keep in mind that many merchants are superstitious and that they do not want to lose a sale to begin the day. If nothing seems to work, the tactic is to show disinterest by walking away. Usually, the merchant will call you back for further bargaining. If he does not and you are really interested in his merchandise which is not available elsewhere, your return trip will weaken your position and pride. To soften the blow, you may want to walk by while asking whether the seller is willing to lower the offer. If the seller is receptive or friendly or if you are desperate, you then can go in to make a purchase. As suggested by Christiane Bird of the New York Daily News (August 18, 1985), "think of bargaining as a game. You and the merchant are actors, and the more confident and the more decisive you act, the better chance you'll have." Still in the end, the best way to protect yourself is to do your homework. The knowledge is essential to determine a product's fair value. It is thus desirable to talk to the locals--a friend, hotel personnel, etc. in order to learn when, where, and how to haggle. 4. Explain why U.S. automakers prefer to use the "unbundling" approach in pricing their cars while their foreign competitors tend to use the "bundling" pricing approach. U.S. automakers prefer to use the unbundling approach because of several reasons. First, unbundling gives the appearance of affordable and lower prices. Second, there is extra profit to be made for each option added. Third, Detroit can claim that cars can be custom-made to fit buyers' specifications. For the Japanese, bundling greatly simplifies production, especially when their cars for the U.S. market have to come from overseas factories. Bundling also offers a better value without the proportionate increase in price. It simplifies consumers' decision making as well. Overall, production and marketing activities are simplified. 2