Turid Åvitsland and Jørgen Aasness Combining CGE and

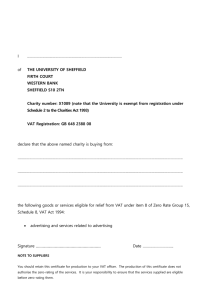

advertisement

Discussion Papers No. 392, October 2004

Statistics Norway, Research Department

Turid Åvitsland and Jørgen Aasness

Combining CGE and

microsimulation models: Effects

on equality of VAT reforms

Abstract:

The effects on the degree of equality of reforms in indirect taxation are analysed by using a

microsimulation model of the Norwegian economy subsequent to a CGE model. The two main

reforms studied are substitution of a uniform VAT rate on all goods and services and substitution of

the non-uniform Norwegian VAT reform of 2001 for the previous, differentiated system. A main

characteristic of the non-uniform reform is the halving of the VAT rate on food. All reforms are made

public revenue neutral by changes in the VAT rate. Producer prices, pre-tax nominal incomes, wealth

and transfers are all exogenous in the microsimulation model. In this paper we feed percentage

changes in corresponding variables from the CGE model into the microsimulation model in order to

enrich the microsimulation analyses. The non-uniform VAT reform leads to a clear increase in

equality while the change in equality concerning the uniform reform is close to 0. With the uniform

VAT reform, as opposed to the non-uniform, decompositions show that taking CGE effects into

account has a large impact on the degree of equality. Changed producer prices and changed pre-tax

nominal incomes, wealth and transfers both contribute to this.

Keywords: CGE and microsimulation models, "Macro-micro" links, Indirect taxation, VAT reforms,

Equality.

JEL classification: D3, D58, D61, D63, H2

Acknowledgement: The authors would like to thank Kirsten Hansen, Mohamed F. Hussein and

Bård Lian for assistance with applying the microsimulation model. We would also like to thank Brita

Bye for initiating the project and for reading and commenting on an earlier draft, Ådne Cappelen for

comments and the Norwegian Research Council for financial support (grant no. 143631/510).

Address: Jørgen Aasness, Statistics Norway, Research Department.

E-mail: jorgen.aasness@ssb.no

Turid Åvitsland, Statistics Norway, Research Department. E-mail: turid.avitsland@ssb.no

Discussion Papers

comprise research papers intended for international journals or books. A preprint of a

Discussion Paper may be longer and more elaborate than a standard journal article, as it

may include intermediate calculations and background material etc.

Abstracts with downloadable Discussion Papers

in PDF are available on the Internet:

http://www.ssb.no

http://ideas.repec.org/s/ssb/dispap.html

For printed Discussion Papers contact:

Statistics Norway

Sales- and subscription service

NO-2225 Kongsvinger

Telephone: +47 62 88 55 00

Telefax:

+47 62 88 55 95

E-mail:

Salg-abonnement@ssb.no

1. Introduction

When evaluating tax reforms, effects on efficiency and equality are of prime interest. The standard

tool for applied, efficiency analyses of tax reforms in specific economies is computable general

equilibrium (CGE) models. Often these include only one representative consumer, making it

impossible to study effects on equality between different households. CGE models with more than one

consumer do exist but are likely to have only a small number of representative household groups. This

fact may imply that the equality part of the analysis will tend to be too crude. Microsimulation models

are therefore apt to be the preferred instrument when applied, equality analyses of tax reforms in

specific economies are undertaken. However, these models often assume unchanged producer prices,

pre-tax nominal incomes, wealth and transfers and may therefore miss valuable information because of

their partial nature.

Efficiency effects in the Norwegian economy of three indirect taxation reforms, made public revenue

neutral by changes in the VAT rate, have earlier been analysed by Bye, Strøm and Åvitsland (2004).

They employed a CGE model with one representative consumer, disregarding equality effects. In this

paper we analyse effects on equality of the same three indirect taxation reforms. For this purpose, a

microsimulation model of the Norwegian economy is used subsequent to the mentioned CGE model.

Producer prices, pre-tax nominal incomes, wealth and transfers are all exogenous in this

microsimulation model and percentage changes in such variables from the CGE anlyses are fed into

the microsimulation model. By combining CGE and microsimulation models in such a way, the

equality analyses are enriched by taking into account potentially important information from the

general equilibrium analyses.

Davies (2003) offers a critical survey concerning research on complementing microsimulation with

CGE or macroeconomic models. He distinguishes between cases where the different model types have

been merged and cases where the models have been treated in a sequential manner. Our procedure

belongs to the latter. Davies (2003) stresses the paper by Bourguignon, Robilliard and Robinson

(2003) as an example of the sequential approach. Bourguignon et al. (2003) employ a simple CGE

model and a microsimulation model where individual incomes are endogenous and consumer prices

are exogenous. The CGE model is calibrated so that aggregate individual incomes are equal to

corresponding values in the microsimulation model in the baseline scenario. CGE changes in incomes

are then fed into the microsimulation model by adjustment of previously estimated intercepts. The

3

CGE model's prices are also implemented in the microsimulation model. Their method relies on a set

of assumptions that yield a degree of separability between the macro, or CGE, part of the model and

the micro-econometric modeling of income generation at the household level. We employ a more

advanced CGE model. Our microsimulation model is more detailed than the one used in Bourguignon

et al. (2003) and both pre-tax incomes and consumer prices are exogenous in our microsimulation

model. Our procedure for combining the two models includes features that ensure a certain degree of

consistency, but there is not complete consistency. In particular, the change in total private

consumption expenditure is not identical in the CGE and microsimulation models. However,

sensitivity analysis indicates that this last inconsistency is unimportant for our results on equality

effects of policy reforms.1

Distributional effects of taxes may be analysed at a specific moment in time or over the life cycle.

Davies, St-Hilaire and Whalley (1984) find that variations in consumption's share of income is smaller

in life cycle than annual data. This reduces the regressivity of taxes assumed to be born by

consumption, like sales and excise taxes. In this paper we analyse distributional effects using a static

microsimulation model to compare different steady state solutions of a dynamic CGE model.

The three reforms analysed in this paper are evaluated against a baseline scenario which describes the

Norwegian, non-uniform, system of indirect taxation in 1995. The first reform analysed is the general

VAT reform, where all goods and services are subject to the same VAT rate. The second reform

analysed is abolition of the investment tax, where the investment tax is set equal to zero. This reform is

both analysed separately and as part of the general VAT reform. The third reform analysed is the

political VAT reform. This reform introduces another non-uniform VAT system, of which a main

characteristic is the halving of the VAT rate on food and non-alcoholic beverages. This VAT system

was actually implemented in Norway in 2001. All the three reforms are in the CGE analysis made

public revenue neutral by changes in the VAT rate.

Ballard, Scholz and Shoven (1987) analyse welfare effects of adopting different VAT systems for the

US. There is no VAT in their baseline scenario. They employ a CGE model with 12 consumer groups,

differentiated by income class. The analysed reforms include a uniform VAT and a differentiated VAT

system. The reforms are made revenue neutral by lowering the personal income tax, both in an

additive and a multiplicative way. They find that rate differentiation produces a less regressive

1

The mentioned CGE model has also been integrated with a detailed microeconometric model of labour supply, see Aaberge

et al. (2004).

4

distribution of welfare gains and losses than those of a uniform VAT. However, for three of their four

VAT simulations, the VAT is a regressive tax-policy change.

We find that the degree of equality, measured by 1 minus the Gini-coefficient, is clearly increased

with the political VAT reform. For the general VAT reform the change in equality is close to 0.

Decompositions show that for both the political and general VAT reform the change in consumer

prices contributes to increase the degree of equality. This fact is most distinct with the political VAT

reform and may be explained by the halving of the VAT rate on food and non-alcoholic beverages.

The change in after-tax disposable income implies a reduction in the degree of equality with the

general VAT reform but is of no importance concerning the political VAT reform.

Other decompositions show that including CGE effects has a large impact on the degree of equality

concerning the general VAT reform. More specifically, both changed producer prices and changed

pre-tax nominal incomes, wealth and transfers contribute to reduce the increase in equality. For the

political reform, including CGE effects is not important.

The paper is organised as follows; section 2 gives a short description of the CGE model and

microsimulation model employed in the analyses. Section 3 describes the policy experiments in more

detail. Section 4 deals with how the CGE and microsimulation models are combined and evaluates our

linking procedure. The numerical equality results are given in section 5, including some

decompositions. Section 6 concludes.

2. Basic features of the models

2.1 The CGE model

The model employed in Bye et al. (2004) is a numerical intertemporal general equilibrium model for

the Norwegian economy.2 The model gives a detailed description of taxes, production and

consumption structures in the Norwegian economy. The model has 41 private and 8 governmental

production activities and 24 commodity groups. The next sections briefly outline some of the

important features of the model. A more detailed description of the model is found in Bye (2000) and

Fæhn and Holmøy (2000).

2

The model has been developed by Statistics Norway. Previous versions of the model have been used routinely by the

Norwegian Ministry of Finance for long-term forecasting and policy analyses.

5

Producer behavior and technology

The structure of the production technology is represented by a nested tree-structure of CESaggregates. All factors are completely mobile and malleable3. The model of producer behavior is

described in detail by Holmøy and Hægeland (1997). The model incorporates both the small open

economy assumption of given world market prices, and avoids complete specialization through

decreasing returns to scale. Producer behavior is generally specified at the firm level. All producers

are considered as price takers in the world market, but have market power in the home market.

Empirical analyses of Norwegian producer behavior support the existence of some domestic market

power, see Klette (1994) and Bowitz and Cappelen (2001).

Consumer behavior

Total consumption, labor supply and savings result from the decisions of an infinitely lived

representative consumer, maximizing intertemporal utility with perfect foresight. The consumer

chooses a path of full consumption subject to an intertemporal budget constraint, which ensures that

the present value of material consumption in all future periods does not exceed total wealth (current

non-human wealth plus the present value of after tax labor income and net transfers). The distribution

of full consumption on material consumption and leisure is determined by a translated CES utility

function, cf. Bye (2003). Total material consumption is allocated across 24 different commodity

groups according to a complete demand system based on a five level nested utility tree. Each subutility

function is a translated CES where the "minimum" consumptions are linear functions of the number of

children and the number of adults in the household. Fixed costs are included and economies of scale in

household production are thus taken into account. The aggregate demand functions are derived by

exact aggregation across all households in the population, where the number of households, adults and

children in Norway are the only demographic variables that enter the aggregate demand. The same

aggregate demand function can also be derived from a representative, utility maximizing consumer,

where the demographic variables then can be interpreted as exogenous preference variables for the

representative agent. See Aasness, Bye and Mysen (1996) for a theoretical outline, Aasness and

Holtsmark (1993) for specification and calibration of an earlier version of the model, and Wold (1998)

for a detailed description of the current model.

Government and intertemporal equilibrium

The government collects taxes, distributes transfers, and purchases goods and services from the

industries and abroad. Overall government expenditure is exogenous and increases at a constant rate

3

Except in the production of electricity, see Holmøy, Nordén and Strøm (1994).

6

equal to the steady state growth rate of the model. The model incorporates a detailed account of the

government’s revenues and expenditures. In the policy experiments it is required that the nominal

deficit and real government spending follow the same path as in the baseline scenario, implying

revenue neutrality in each period.

2.2 The microsimulation model

We have used the model LOTTE-Konsum, developed at Statistics Norway, cf. Aasness (1995) for the

basic outline of the microsimulation model and Aasness, Benedictow and Hussein (2002) for a recent

application. LOTTE-Konsum calculates savings, total consumption expenditure, consumption

expenditure for 24 commodity groups, the number of consumption units and price indexes for each

household, taking into consideration that different households have different consumption patterns.

LOTTE-Konsum also calculates different measures of distributional effects for the model population,

which represents the entire Norwegian population. We have developed a specific version of the model

for our particular application, in order to achieve approximate consistency with the CGE analysis.

LOTTE-Konsum is based on consumer theory and econometric analysis of consumer behaviour and

standard of living, and welfare theory for aggregation of standard of living over households and

individuals in a population. A model for direct taxes, LOTTE, is used as a pre-model for LOTTEKonsum. Personal pre-tax incomes, wealth and transfers are exogenous in this model, while personal

tax payments are endogenous. The resulting disposable after-tax income from LOTTE is used as

exogenous input into LOTTE-Konsum, cf. Aasness et al. (1995). LOTTE uses a model population of

approximately 15 000 households with about 40 000 individuals, weighted to be representative for the

Norwegian population. Consumer prices are exogenous in the microsimulation model.

As a measure of the standard of living for each individual in a household, we use total consumption

per consumption unit in the household.4 This implies that all persons belonging to the same household

4

The standard of living for household k, and all its members, in situation t is wkt = ckt/ek = ykt/(Pktek), where total

consumption of the household (ckt) is defined as ckt = ykt/Pkt, i.e. total consumption expenditure (ykt) divided by a household

specific price index (Pkt), and ek is the number of equivalent adults in the household in base year prices. Aasness (1995)

shows that this can be interpreted as a money metric utility.

The household demand system is used to derive a system of Engel functions in base year prices and predicting non-negative

budget shares for 24 commodities, adding to one, for each of the 15 000 households in the model. These budget shares are

used in Laspeyres price indexes (Pkt) for each household k and local tax reform t. Such price indexes are approximately equal

to any utility based price index for local reforms. It is the distribution of these price indexes, and the underlying distribution

of budget shares, that determine the distributional effects of indirect taxes in our model. The household demand system used

to generate the budget shares is the same as the one used in the CGE model, except for a modification in order to take into

account corner solutions for some of the households. The microsimulation model is calibrated so that the macro budget

shares for the 24 commodities are the same in the micro model and the CGE model in the base year.

7

has the same standard of living, a relevant assumption in the absence of information about the internal

distributions within the households.5 The households are considered as producers of standard of living

for its members. We allow for the existence of economies of scale in the households, which means that

the number of consumption units in a household is smaller than the number of persons in the

household. For instance, a household consisting of two adults will need less than twice the income of a

single adult to achieve the same standard of living. Furthermore, we assume that children need less

consumption than adults to achieve the same standard of living. This is reflected in the model by a

larger increase in the number of consumption units when a household is extended with an adult than

with a child. This implies that large households, and families with children in particular, are relatively

efficient as producers of standard of living.

An equivalence scale is used to calculate the number of consumption units in the households.6 There

exists no generally accepted foundation for empirical determination of equivalence scales. Therefore,

the choice of equivalence scale is a controversial subject, see e.g. Buhman, Rainwater, Schmaus and

Smeeding (1988), Atkinson (1992) and Nelson (1993). In this paper we employ the so-called OECDscale, which implies that if the cost of living for a one-person household is normalised to 1, the cost of

keeping the standard of living constant when the household is expanded with an adult is 0.7, and with

a child 0.5. Several empirical studies of Norwegian consumer expenditure surveys find support for the

hypothesis that the OECD-scale provides a suitable approximation, see Bojer (1977), Herigstad (1979)

and Røed Larsen and Aasness (1996). We also perform sensitivity analyses of policy results with

respect to the choice of equivalence scale within a wide class of scales, cf. footnote 6 and 16 for

details and Aasness (1997) for discussions of sensitivity analysis within this type of continuous class

of scales.

3. Baseline scenario and policy alternatives

The VAT is a tax formally paid by the purchaser of a good or service. All the different stages in the

production process are participating in the calculation and collection of the VAT. A company may

either be a) subject to the VAT, meaning there is a VAT on its sales7 but VAT paid on the company's

5

This can be rationalized by a household maximin welfare function of the individual utilities, cf. Blackorby and Donaldson

(1993). Like them we use household demand functions and aggregate individual well-being across the population.

6

The number of consumption units in household k, in base year prices, is defined as ek = (1-f(e)) + ez1k + f(e)z2k, where z1k

and z2k are the number of children and adults respectively, e is the cost of living for a child relative to a single adult, and f(e)

is the cost of living for an additional adult relative to a single adult. The parameter e is assumed to lie in the interval [0,1], see

Aasness (1997) or Aasness, Benedictow and Hussein (2002) for details.

7

A special case is a VAT rate set equal to 0 (zero-rating).

8

purchases of material inputs and investment goods are refunded or b) not subject to the VAT, meaning

there is no VAT on its sales but the VAT paid on the company's purchases of material inputs and

investment goods is not refunded. The destination principle also applies, meaning that exports subject

to the VAT have a rate set equal to zero, while imports subject to the VAT have the Norwegian rate

attached to it.

The system of indirect taxation in 1995 (the benchmark year in both the CGE and microsimulation

models) was characterized by a general liability to pay VAT on goods. There were few exemptions.

There was no general liability to pay VAT on services but some were explicitly mentioned in the law

and were to have a positive VAT rate. Many services were not subject to the VAT, however.

Generally, the VAT rate was equal to 23 per cent. Paying of the investment tax was connected with

paying of the VAT: If the company was subject to a VAT on its sales, and thereby did not pay any

VAT on its material inputs or investment goods, an investment tax had to be paid. However, in

addition several exemptions were specified in the investment tax Act.

The described system of indirect taxation in 1995, in addition to other taxes in the Norwegian

economy, is implemented in the baseline scenario both in the CGE and microsimulation model.

The first policy alternative, called the general VAT reform, consists of a general VAT rate equal to 23

per cent on all goods and services8. In addition, there is VAT on the purchase of new investments in

dwellings and cars, but there is no VAT on services from these consumer durables. The investment tax

is simultaneously set equal to zero. The second policy alternative, called abolition of the investment

tax9, only sets the investment tax equal to zero.

The third policy alternative, called the political VAT reform, analyses the following characteristics of

the actual, Norwegian VAT reform of 2001: Some more services are subject to the VAT, the general

VAT rate is increased from 23 to 24 per cent and the VAT rate on food and non-alcoholic beverages is

set equal to 12 per cent. In principle, the somewhat extended scope of the VAT should have led more

companies to pay the investment tax. Since the investment tax was to be abolished later on,

exemptions were introduced for the affected companies. The investment tax in the political VAT

reform is therefore equal to the investment tax in the baseline scenario.

8

The only exceptions from this are the banks' interest rate differential and non-profit institutions serving households where

the VAT rate equals zero.

9

All policy alternatives are made public revenue neutral in the CGE simulations by changes in the VAT

rate. The increase in the general VAT rate necessary to ensure public revenue neutrality is 1.05, 2.09

and 1.54 percentage points with the general VAT reform, abolition of the investment tax and the

political VAT reform, respectively. For more details about the system of indirect taxation in the

baseline scenario and the three policy alternatives, see Bye et al. (2004).

4. Combining the CGE and microsimulation model

In this paper we combine the CGE and microsimulation models by multiplying consumer prices,

nominal pre-tax incomes, wealth and transfers in the microsimulation model by percentage changes in

corresponding variables in the CGE model. The microsimulation model calculates personal taxes,

after-tax household disposable income, total household consumption expenditure, household specific

price indexes and standard of living of each person.

The two models have the following features in common: Both describe the Norwegian economy, the

demand system for material consumption is almost identical in the two models, with the same 24

commodity groups, both are characterized by the VAT rates present in 1995 and both are calibrated to

the benchmark year 1995. The latter fact, in addition to the fact that Bye et al. (2004) simulate the

baseline scenario by keeping all exogenous variables constant at their benchmark values10, imply that

both models are characterized by 1995-prices. Two important differences between the CGE and

microsimulation models are that the former has an endogenous leisure variable and is intertemporal,

while the latter does not include any leisure variable and describes the situation in a particular year.

As already mentioned, we multiply microsimulation variables by percentage changes in corresponding

CGE variables. These changes refer to changes from baseline scenario to policy alternative j in the

CGE model's steady state.

(1) MSV

j ,t

=

CGEV

j ,t *

CGEV base,t

*

*

MSV

base ,t

MSV j ,t

CGEV j ,t

⇔

=

.

*

MSV base,t CGEV base,t

9

The investment tax was actually abolished in Norway in 2002.

An exception is parts of the tax system, which are substituted by the tax code of 2000. There are not any major differences

between the tax code in 1995 and the tax code implemented in the CGE model, though.

10

10

MSV

j ,t

and MSV base,t are the microsimulation variable in year t in policy alternative j and the

baseline scenario, respectively. CGEV

j ,t *

*

and CGEV base,t are the CGE variable in year t* in policy

alternative j and the baseline scenario, respectively. In our case, t is equal to the base year (1995) in

the microsimulation (and CGE) model. t* is equal to the CGE analysis' steady state. Since Bye et al.

(2004) simulate the baseline scenario by keeping all exogenous variables constant at their benchmark

values the CGE model's steady state may be interpreted as representing the Norwegian economy in

1995 after it has "calmed down". The assumption we make is therefore that the ratio between a

microsimulation variable in policy alternative j and baseline scenario in 1995 is equal to the

corresponding ratio in the CGE model's "1995", that is the 1995-economy after it has "calmed down".

4.1 Consumer prices

There is perfect correspondence between the classification of goods and services in the CGE and

microsimulation models. Linking consumer prices in the two models is therefore unproblematic. The

numerical changes in consumer prices from the CGE analyses that are used as input in the

microsimulation model, are presented in appendix A.

4.2 Income and wealth

As opposed to the CGE model, the microsimulation model contains a very detailed description of the

tax system for personal taxpayers. This implies that the model also contains incomes and wealth at a

very detailed level. In addition, the two models are based on data from different sources and there are

differences in the definition of incomes in these two datasets, see Epland and Frøiland (2002).

Accordingly, there is no simple one-to-one correspondence between incomes and wealth in the

microsimulation and CGE models.

We have chosen to use national incomes and wealth from the CGE model. We therefore implicitly

assume that households receive constant shares of the different income and wealth components in both

baseline and policy alternatives such that we can employ percentage changes in the mentioned

variables as exogenous input into the microsimulation model11. Broadly speaking, we have linked

incomes in the microsimulation and CGE models as shown in table 1. The numerical changes from the

CGE analyses are shown in appendix A.

11

In our CGE simulations, public sector's net savings and net wealth are unchanged from baseline scenario to policy

alternative. This implies that changes in net national savings and net wealth are equal to the private sector's change in these

variables.

11

Table 1. Linking incomes in the microsimulation and CGE models

Microsimulation model

Wage income

Self-employed taxable income

Dividends

Interest income from foreign debtors and interest on

loans to foreign creditors

CGE model

Total wage and salary payments net of social taxes for

employees

Self-employed's risk-adjusted1), net2), pre-tax3) return

on real capital + calculated wage income for selfemployed

Limited liability companies' risk-adjusted1), net2), pretax3) return on real capital

Interest rate multiplied by net national debt

1) See Bye and Åvitsland (2003) and Bye et al. (2004) for an explanation of risk-adjustment in the CGE model.

2) That is after depreciation.

3) But after paying of VAT and/or investment tax on material inputs and investment goods.

We have linked wealth in the microsimulation and CGE models as shown in table 2. The numerical

changes from the CGE model are reported in appendix A.

Table 2. Linking wealth in the microsimulation and CGE models

Microsimulation model

Bank deposits abroad and debt abroad

Shares

Value of dwellings for taxation purposes, private cars,

self-employed's cars and machinery, self-employed's

fishing boats

CGE model

Net national debt

Value of the real capital stock in limited liability companies

Value of dwellings, private cars, self-employed's cars

and machinery, self-employed's fishing boats

In addition, expenses and some components of income and wealth in the microsimulation model are

absent in the CGE model. We have chosen to keep these variables constant, including interest income

from Norwegian debtors, interest on loans to Norwegian creditors12, domestic bank deposits and

domestic debt.

A detailed description of assumptions and the linking of income and wealth in the two models are

given in appendix B.1 and B.2.

4.3 Transfers

In the CGE model, the different transfers, that is pensions, sickness benefits, unemployment benefits,

child benefits, other transfers from Central Government and other transfers from Local Government,

12

The pre-tax income concept used in the microsimulation model includes interest income but excludes interest on debt.

Stipulated capital income stemming from housing is also excluded. Dwelling services are part of private consumption

expenditure.

12

automatically change as a result of changes in the wage rate, total wage payments or the price index of

aggregate private consumption. The detailed linking of transfers in the two models is reported in

appendix B.3. The numerical changes in transfers from the CGE analyses are reported in appendix A.

4.4 Leisure and savings

Leisure

Leisure is part of the utility function in the CGE model, but not in the microsimulation model. Higher

(lower) incomes due to increased (lower) labour supply are fed into the microsimulation model but the

corresponding decrease (increase) in leisure is not taken into account. Therefore, only the positive

(negative) aspects of increased (decreased) labour supply are included in the microsimulation model.

Savings

There is a somewhat analogous problem concerning savings: In steady state, net savings in real capital

are zero, but real capital wealth may have increased (decreased) from baseline scenario to a policy

alternative due to positive (negative) savings in real capital earlier in the path. We employ changes in

income and wealth from the CGE model's steady state when linking the microsimulation and CGE

model. This means that only the gains (losses) from increased (decreased) savings in real capital are

taken into account when we link the two models. A similar argument applies to financial savings.

4.5 Evaluation of the linking procedure

In order to evaluate our sequential linking procedure, we compare aggregate private consumption

expenditure in current prices in the two models. Both the level in the baseline scenario and the change

and percentage change from baseline scenario to the three policy alternatives are compared, see table

3.

Table 3. Aggregate private consumption expenditure. Current purchaser prices. Microsimulation results versus CGE results. Billion NOK and percentage change

General VAT reform

Microsim.

VCB in baseline scenario 452.75

Change in VCB from

13.14

baseline scenario

Percentage change in VCB 2.90

from baseline scenario

Political VAT reform

CGE

428.22

15.25

Abolition of investment

tax

Microsim.

CGE

452.75

428.22

3.54

3.84

Microsim.

452.75

0.03

CGE

428.22

0.07

3.56

0.78

0.01

0.02

0.90

VCB: Aggregate private consumption expenditure measured in purchaser prices.

13

Numbers from the baseline scenario apply to the year 1995 in the microsimulation model, while these

numbers apply to the steady state in the CGE model. The steady state numbers may, as mentioned

earlier, be interpreted as representing the economy in 1995 after it has "calmed down".

Concerning evaluation of our linking procedure, the impression is that it gives quite reasonable results.

There is not complete consistency, visualized by the fact that the change in aggregate private

consumption expenditure is not identical in the two models. The differences between the results from

the CGE and microsimulation models are not significant, however, cf. footnote 17.

5. Results

The distribution of the standard of living over a population can be summarised in several ways. In this

paper, we focus on the simple aggregated measure equality (E), defined as (1 - G), where G is the

Gini-coefficient13. The equality measure varies between 0 and 1, and the value increases when the

distribution of the standard of living becomes more equal.

It is difficult to grasp whether a change in the degree of equality is large or not. We therefore

"translate" a change in the degree of equality into a change in the standard of living per person, while

simultaneously keeping Sen welfare constant. Sen welfare is defined as: S = WE, where S is Sen

welfare, W is average standard of living per person and E is the degree of equality, cf. Sen (1974) for

an axiomatic basis. The average standard of living per person, W, is in this paper measured by the real

consumption expenditure per equivalent adult, taken from the microsimulation model in 1995 and E is

defined as above. When Sen welfare is to be unchanged from baseline scenario to the three policy

alternatives, a reforms' increase (decrease) in equality must be compensated by a decrease (increase) in

the standard of living per person. Appendix C may be consulted for details.

Table 4 shows the absolute change in the degree of equality from baseline scenario to the three policy

alternatives for our main simulations, 1), and for different decompositions, 2) - 8). It also shows the

change in the degree of equality "translated" into a change in the standard of living per person for

given Sen welfare.

13

The Gini-coefficient is the most common measure of inequality in the economic literature, see Aaberge (2001) for an

axiomatic foundation of the Gini-coefficient.

14

Table 4. Absolute change in the degree of equality from baseline scenario. Translation of this

into an absolute change in NOK (Euro14) in the standard of living per person (W15)

for given Sen welfare

General VAT reform

Reform in microsimulation model

1) a+b+c+d+e

2) a

Equality

0.00012

0.00118

Abolition of investPolitical VAT reform

ment tax

Translated Equality Translated Equality Translated

into W,

into W,

into W,

NOK

NOK

NOK

(Euro)

(Euro)

(Euro)

-69

(-8)

-0.00040

-677

-0.00038

(-80)

3) a+c+d+e

0.00057

-326

0.00073

-418

-0.00064

-0.00061

347

-0.00014

-0.00231

1306

-0.00026

-0.00089

506

-0.00064

0.00248

-1432

0.00162

80

148

364

-0.00026

148

0.00170

0.00063

-361

-978

(-116)

0.00005

-29

(-3)

0.00001

-6

(-1)

-0.00002

(18)

(-170)

-932

(-111)

(43)

(60)

8) e

364

-903

(-107)

(18)

(155)

7) d

0.00157

(9)

(41)

6) c

217

-1013

(-120)

(43)

(-50)

5) c+d+e

0.00176

(26)

(-39)

4) a+b

228

(27)

11

(1)

0.00005

(-43)

-29

(-3)

a: changed VAT rates on consumer goods and services

b: changed producer prices from the CGE simulations

c: changed pre-tax incomes, excl. of dividends, and changed pre-tax wealth from the CGE simulations

d: changed pre-tax dividends from the CGE simulations

e: changed pre-tax transfers from the CGE simulations

Our main simulations, that is the case where all CGE effects are taken into account, (cf. 1) in table 4)

show that equality is clearly increased with the political VAT reform. With the general VAT reform

and abolition of the investment tax the changes in equality are close to 016,17.

14

The exchange rate used in the calculations is equal to 8.42 NOK per Euro.

W is equal to 130491 NOK (15498 Euro) in 1995.

16

All of these conclusions hold when we perform sensitivity analyses with respect to the choice of equivalence scale (cf.

footnote 6).

17

Since our linking procedure does not ensure complete consistency, visualized by the fact that the change in aggregate

private consumption expenditure is not identical in the two models, we have undertaken the following exercise: The main

simulation of the general VAT reform (cf. 1) in table 4) is undertaken while simultaneously changing proportionally all

incomes, wealth and transfers so that the resulting percentage change in aggregate private consumption expenditure in the

microsimulation model is identical with the percentage change in the CGE model. The result shows that the change in

equality is still close to 0 (-0.00005).

15

15

Decompositions show that for both the general and political VAT reform the change in consumer

prices (cf. 4) in table 4) contributes to increase the degree of equality. This effect is largest for the

political VAT reform, but is also distinct for the general VAT reform. The political VAT reform is

characterized by a reduction in the VAT rate on food from 23 to 12 per cent. Generally, persons with a

low standard of living have a larger budget share of food than persons with a high standard of living.

This implies that the reduced VAT rate on food contributes to increase the degree of equality. Both the

political and the general VAT reform introduce VAT on more services (the former only introduces

VAT on some more services, while the latter introduces VAT on all services not subject to the VAT in

the baseline scenario). Generally, persons with a low standard of living have a smaller budget share of

services than persons with a high standard of living. These facts contribute to increase the degree of

equality in the political and general VAT reform.

The partial effect on the degree of equality of changed after-tax disposable income (cf. 5) in table 4) is

clearly negative with the general VAT reform and of no importance with the political VAT reform.

Concerning the general VAT reform, increased transfers imply a large increase in the degree of

equality (cf. 8) in table 4). Generally, transfers constitute a larger share of income for persons with a

low standard of living than for persons with a high standard of living. This together with the fact that

the increase in transfers is large due to a large increase in wages (in the CGE model many transfers

depend upon wages), explain why the degree of equality is much increased. On the other hand, other

components of after-tax disposable income have the opposite effect on the degree of equality: The

increase in dividends has a clear negative effect on the degree of equality (cf. 7) in table 4) since

dividends generally constitute a smaller share of income for persons with a low standard of living than

for persons with a high standard of living. The increase in incomes, exclusive of dividends, and the

change in wealth lead to a distinct reduction in the degree of equality (cf. 6) in table 4). This may be

explained by the fact that wage income generally constitutes a smaller share of income for persons

with a low standard of living than for persons with a high standard of living. The all in all negative

effect on equality of changed after-tax disposable income is approximately cancelled out by the

positive effect on equality of changed consumer prices concerning the general VAT reform.

With abolition of the investment tax, both changed consumer prices and changed after-tax disposable

income lead to changes in equality which are close to 0.

Concerning the general VAT reform, there is a clear effect on the degree of equality from including

CGE effects as compared with the case where such effects are absent (cf. 1) and 2), respectively, in

16

table 4). More specifically, the degree of equality is close to zero when CGE effects are taken into

account while the degree of equality is increased by 0.001 when CGE effects are not included. As

compared with the case where CGE effects are absent (cf. 2) in table 4), including changes in producer

prices (cf. 4) in table 4) and changes in pre-tax incomes, wealth and transfers (cf. 3) in table 4) both

contribute to reduce the increase in the degree of equality.

With the political VAT reform, and especially with abolition of the investment tax, the effect on the

degree of equality of including CGE effects, as compared with the case where such effects are absent,

is of no importance. Concerning abolition of the investment tax, the partial effect of including changes

in producer prices (cf. 4) in table 4) implies a smaller reduction in equality as compared with the case

where CGE effects are absent (cf. 2) in table 4). On the other hand, only changing pre-tax incomes,

wealth and transfers (cf. 3) in table 4) leads to a larger reduction in equality as compared with the case

where CGE effects are absent (cf. 2) in table 4). Taken together, the first effect on equality is cancelled

out by the second such that the degree of equality is the same in the two cases where CGE effects are

included and excluded.

6. Concluding remarks

In this paper we have used a microsimulation model of the Norwegian economy subsequent to a CGE

model to analyse effects on the degree of equality of three indirect taxation reforms. Efficiency effects

of these three reforms have earlier been analysed by Bye et al. (2004) by employing a CGE model

with one representative consumer.

The three reforms analysed in this paper are evaluated against a baseline scenario which describes the

Norwegian, non-uniform, system of indirect taxation in 1995. The first reform analysed is the general

VAT reform, where all goods and services are subject to the same VAT rate. The second reform

analysed is abolition of the investment tax, where the investment tax is set equal to zero. This reform is

both analysed separately and as part of the general VAT reform. The third reform analysed is the

political VAT reform. This reform introduces another non-uniform VAT system, of which a main

characteristic is the halving of the VAT rate on food and non-alcoholic beverages. This VAT system

was actually implemented in Norway in 2001. All the three reforms are in the CGE analysis made

public revenue neutral by changes in the VAT rate18.

18

Bye et al. (2004) find that welfare is increased with the general VAT reform, while it is reduced with the other two

reforms; the political VAT reform experiencing the largest reduction.

17

Consumer prices, pre-tax nominal incomes, wealth and transfers are all exogenous in the

microsimulation model and percentage changes in such variables from the CGE anlyses are fed into

the microsimulation model. By combining CGE and microsimulation models in such a way, the

equality analyses are enriched by taking into account potentially important information from the

efficiency analyses.

We find that equality is clearly increased with the political VAT reform. Concerning the general VAT

reform and abolition of the investment tax the changes in equality are close to 0. Decompositions

show that for both the political and general VAT reforms the change in consumer prices contributes to

increase the degree of equality. This fact is most distinct with the political VAT reform. The change in

after-tax disposable income implies a reduction in the degree of equality with the general VAT reform

but is of no importance concerning the political VAT reform. With abolition of the investment tax,

both the change in consumer prices and the change in after-tax disposable income contribute to a

change in the degree of equality which is close to zero.

Other decompositions show that including CGE effects, as compared with the case where CGE effects

are not taken into account, has a large impact on the degree of equality concerning the general VAT

reform. Both changed producer prices and changed pre-tax nominal incomes, wealth and transfers

contribute to reduce the increase in equality. With the other two reforms, including CGE effects is not

important.

18

References

Aaberge, R. (2001): Axiomatic characterization of the Gini coefficient and Lorenz curve orderings,

Journal of Economic Theory 101, 115-132.

Aaberge, R., U. Colombino, E. Holmøy, B. Strøm and T. Wennemo (2004): Population ageing and

fiscal sustainability: An integrated micro-macro analysis of required tax changes, Discussion Paper

367, Statistics Norway.

Aasness, J. (1995): A microsimulation model of consumer behavior for tax analyses, Paper presented at

the Nordic seminar on microsimulation models, Oslo, May 1995.

Aasness, J. (1997): "Effects on poverty, inequality and welfare of child benefit and food subsidies» in N.

Keilman, J. Lyngstad, H. Bojer, and I. Thomsen (eds): Poverty and economic inequality in industrialized

western countries, Oslo: Scandinavian University Press, 123-140.

Aasness, J., A. Benedictow and M. F. Hussein (2002): Distributional efficiency of direct and indirect

taxes, Rapport 69, Economic Research Programme on Taxation, Oslo: Norges Forskningsråd.

Aasness, J, T. Bye, and H. T. Mysen (1996): Welfare effects of emission taxes in Norway, Energy

Economics 18, 335-346.

Aasness, J., E. Fjærli, H. A. Gravningsmyhr, A. M. K. Holmøy and Bård Lian (1995): The Norwegian

microsimulation model LOTTE: Applications to personal and corporate taxes and social security

benefits, DAE Working Papers no 9533, Microsimulation Unit, Department of Applied Economics,

University of Cambridge.

Aasness, J. and B. Holtsmark (1993): Consumer demand in a general equilibrium model for

environmental analysis, Discussion Paper 105, Statistics Norway.

Atkinson, A.B. (1992): Measuring poverty and differences in family composition, Economica 59, 116.

19

Ballard, C. L., J. K. Scholz and J. B. Shoven (1987): "The value-added tax: A general equilibrium look

at its efficiency and incidence", in M. Feldstein (eds.) The effects of taxation on capital accumulation,

University of Chicago Press, Chicago and London, 445-474.

Blackorby, C. and D. Donaldson (1993): Adult-equivalence scales and the economic implementation

of interpersonal comparisons of well-being, Social Choice and Welfare 10, 335-61.

Bojer, H. (1977): The effects on consumption of household size and composition, European Economic

Review 9, 169-193.

Bourguignon, F., A.-S. Robilliard and S. Robinson (2003): Representative versus real households in

the macro-economic modeling of inequality, Working Paper, Département et laboratoire d'économie

théorique et appliquée, Paris.

Bowitz, E. and Å. Cappelen (2001): Modeling income policies: some Norwegian experiences 19731993, Economic Modelling 18, 349-379.

Buhman, B., L. Rainwater, G. Schmaus, and T.M. Smeeding (1988), Equivalence scales, well-being,

inequality, and poverty: sensitivity estimates across ten countries using the Luxembourg Income Study

(LIS) database, Review of Income and Wealth 34, 115-142.

Bye, B. (2000): Environmental tax reform and producer foresight: An intertemporal computable

general equilibrium analysis, Journal of Policy Modeling 22 (6), 719-752.

Bye, B. (2003): Consumer behaviour in the MSG-6 model - a revised version, Manuscript, Statistics

Norway.

Bye, B., and E. Holmøy (1997): Household behaviour in the MSG-6 model, Documents 97/13, Oslo:

Statistics Norway.

Bye, B., B. Strøm and T. Åvitsland (2004): Welfare effects of VAT reforms: A general equilibrium

analysis, Manuscript, Revised version of Discussion Paper 343, Oslo: Statistics Norway.

20

Bye, B. and T. Åvitsland (2003): The welfare effects of housing taxation in a distorted economy: A

general equilibrium analysis, Economic Modelling 20(5), 895-921.

Davies, J. (2003): Microsimulation, CGE and Macro Modelling for Transition and Developing

Countries, Paper prepared for the UNU/WIDER conference on Inequality, Poverty and Human Wellbeing 30-31 May 2003, Helsinki, Finland.

Davies, J., F. St-Hilaire and J. Whalley (1984): Some Calculations of Lifetime Tax Incidence,

American Economic Review, 74 (4), 633-649.

Epland, J. and G. Frøiland (2002): Husholdningenes inntekter: En sammenlikning av

nasjonalregnskapet og inntektsundersøkelsens inntektsbegreper, Notater 2002/76, Statistisk

sentralbyrå.

Fæhn, T. and E. Holmøy (2000): "Welfare effect of trade liberalisation in distorted economies: A

dynamic general equilibrium assessment for Norway". In Harrison, G. W. et al. (eds): Using dynamic

general equilibrium models for policy analysis, North-Holland, Amsterdam.

Herigstad, H. (1979): Forbrukseiningar, Rapporter 79/16, Statistisk sentralbyrå.

Holmøy, E., and T. Hægeland (1997): Aggregate Productivity Effects and Technology Shocks in a

Model of Heterogeneous Firms: The Importance of Equilibrium Adjustments, Discussion Paper 198,

Oslo: Statistics Norway.

Holmøy, E., B. M. Larsen and H. Vennemo (1993): Historiske brukerpriser på realkapital, Rapporter

93/9, Statistics Norway.

Holmøy, E., G. Nordén, and B. Strøm (1994): MSG-5, A complete description of the system of

equations, Rapporter 94/19, Oslo: Statistics Norway.

Klette, T. J. (1994): Estimating price-cost margins and scale economies from a panel of micro data,

Discussion Papers 130, Oslo: Statistics Norway.

21

Nelson, J. (1993): Household equivalence scales: theory versus policy? Journal of Labor Economics

11, 471-493.

Røed Larsen, E. and J. Aasness (1996): Kostnader ved barn og ekvivalensskalaer basert på Engels

metode og forbruksundersøkelsen 1989-91, Offentlige overføringer til barnefamilier, NOU 1996:13,

Oslo: Akademika, 305-317.

Sen, A. (1974): Informational bases of alternative welfare approaches: aggregation and income

distribution, Journal of Public Economics 4, 387-403.

Wold, I. S. (1998): Modellering av husholdningenes transportkonsum for en analyse av grønne skatter:

Muligheter og problemer innenfor rammen av en nyttetremodell, Notater 98/98, Statistisk sentralbyrå.

22

Appendix A

Simulated changes in consumer prices, income, wealth and

transfers

Table A.1. Consumer prices when producer prices are endogenous. Percentage changes from

baseline scenario. Long run effects

General VAT

reform

1.289

Abolition of

investment tax

1.373

Political VAT

reform

-7.015

Beverages and tobacco

0.790

1.434

-0.789

Electricity

2.441

0.055

1.777

Fuels

2.253

1.302

1.922

Petrol and Car Maintenance

2.602

1.304

2.764

Clothing and Footwear

0.576

1.296

2.113

Goods for Recreation Activities

0.725

1.377

2.070

Furniture and Durable Consumer Goods

1.722

1.261

1.923

Electrical Household Equipment

0.757

1.395

2.076

20.322

0.172

-0.134

Medicines and Medical Goods

0.640

1.229

1.879

Gross Rents

0.343

0.546

1.547

User Cost of Cars etc.

0.634

1.321

1.954

Road Transport etc., Local

18.905

-0.107

0.615

Road Transport etc., Long-distance

18.329

-0.062

0.669

Air Transport etc.

16.315

0.644

-0.186

Railway and Tramway Transport, Local

15.315

0.486

0.897

Railway Transport, Long-distance

15.488

0.481

0.871

Water Transport, Local

23.780

0.089

0.231

Water Transport, Long-distance

23.916

0.045

0.115

Postal and Telecommunication Services

1.496

0.470

2.029

Other Goods

6.300

0.917

1.612

Other Services

9.796

0.990

1.641

0.00

0.00

0.000

Food

Health Services

Direct Purchases Abroad by Resident Households

23

Table A.2. Consumer prices when producer prices are constant. Percentage changes from baseline scenario. Long run effects

General VAT

reform

1.363

Abolition of investment tax

1.652

Political VAT

reform

-7.082

Beverages and tobacco

0.847

1.676

-0.816

Electricity

3.611

1.494

1.823

Fuels

2.464

1.623

1.979

Petrol and Car Maintenance

3.952

1.498

2.665

Clothing and Footwear

0.872

1.724

2.104

Goods for Recreation Activities

0.898

1.698

2.072

Furniture and Durable Consumer Goods

2.081

1.603

1.956

Electrical Household Equipment

0.904

1.704

2.078

24.050

0.000

0.000

Medicines and Medical Goods

0.937

1.692

1.871

Gross Rents

0.752

0.104

0.127

User Cost of Cars etc.

0.807

1.596

1.947

Road Transport etc., Local

24.050

0.000

0.000

Road Transport etc., Long-distance

23.444

0.044

0.054

Air Transport etc.

24.050

0.000

0.000

Railway and Tramway Transport, Local

24.050

0.000

0.000

Railway Transport, Long-distance

23.675

0.027

0.033

Water Transport, Local

24.050

0.000

0.000

Water Transport, Long-distance

24.050

0.000

0.000

Postal and Telecommunication Services

2.271

1.592

3.217

Other Goods

6.458

1.268

1.636

13.369

0.781

1.521

0.000

0.000

0.000

Food

Health Services

Other Services

Direct Purchases Abroad by Resident Households

24

Table A.3. Nominal incomes. Percentage changes from baseline scenario. Long run effects

General VAT Abolition of Political VAT

reform

reform investment tax

Total wage and salary payments net of social taxes for

employees

3.674

1.014

0.000

A: Wage and salary payments net of social taxes for selfemployed1) in agriculture

3.796

0.921

0.054

B: Wage and salary payments net of social taxes for selfemployed1) in forestry

3.754

0.925

0.048

C: Wage and salary payments net of social taxes for selfemployed1) in fishing

3.203

0.750

0.039

D: Wage and salary payments net of social taxes for selfemployed1) in the rest of the industries2)

3.979

1.110

-0.146

2.719

0.580

0.038

1.555

0.214

0.019

Return on real capital for self-employed in fishing; pre-tax ,

risk-adjusted4), net of depreciation + C

2.968

0.694

0.034

Return on real capital for self-employed in the rest of the

industries2); pre-tax3), risk-adjusted4), net of depreciation+D

4.352

1.221

-0.095

Return on real capital in limited liability companies; pre-tax3),

risk-adjusted4), net of depreciation

5.281

1.543

0.112

43.111

11.158

-4.008

Return on real capital for self-employed in agriculture; pretax3), risk-adjusted4), net of depreciation + A

3)

Return on real capital for self-employed in forestry; pre-tax ,

risk-adjusted4), net of depreciation + B

3)

Interest rate multiplied by net national debt

1) We assume that the wage rate received by self-employed is equal to the wage rate received by employees.

2) That is all private production sectors, with the exception of agriculture, forestry, fishing, dwelling services, production of electricity, oil

and gas exploration and drilling, production and pipeline transport of oil and gas, ocean transport and imputed service charges from financial

institutions.

3) But after paying of VAT and/or investment tax.

4) See Bye and Åvitsland (2003) and Bye et al. (2004) for an explanation of risk-adjustment in the CGE model.

25

Table A.4. Nominal wealth. Percentage changes from baseline scenario. Long run effects

General VAT Abolition of Political VAT

reform

reform investment tax

43.111

11.158

-4.008

Net national debt

Value1) of real capital stock2) in limited liability companies

5.112

1.571

0.115

3)

1.719

0.672

0.717

3)

5.386

0.772

0.280

-4.094

-2.346

-0.105

1.379

0.595

0.009

Market value of dwelling capital

Market value of cars

Market value3) of cars and machinery2) for self-employed

3)

Market value of fishing boats for self-employed

1) Measured in purchaser price indexes, exclusive of VAT and/or the investment tax.

2) Comprising all private production sectors, with the exception of dwelling services, production of electricity, oil and gas exploration and

drilling, production and pipeline transport of oil and gas, ocean transport and imputed service charges from financial institutions.

3) Measured in purchaser price indexes, inclusive of VAT and/or the investment tax.

Table A.5. Transfers. Percentage changes from baseline scenario. Long run effects

General VAT Abolition of Political VAT

reform

reform investment tax

3.821

0.943

0.067

Pension

Sickness benefits etc.

3.674

1.014

0.000

Unemployment benefits

3.674

1.014

0.000

Child benefits

3.821

0.943

0.067

Other transfers, Central Government

3.821

0.943

0.067

Other transfers, Local Government

3.142

0.915

0.266

26

Appendix B

The symbol and name of the microsimulation variables (MSV) are first mentioned. Next, the symbol

and name of the corresponding CGE variables (CGEV) are written down. This means that all

microsimulation variables under the heading 1) MSV are exogenously changed by the percentage

change in the variable under the heading 1) CGEV, and so forth. Assumptions made are then clarified,

together with other comments. B.1 deals with income variables, B.2 with wealth variables and B.3

with transfer variables.

B.1 Combining income variables in the CGE and microsimulation

models

1) MSV

K2101, wage income and unemployment benefits for employees

K21013, of this: wage income only into the basis for calculation of member's premium to the National

Insurance Scheme

K2102, income entitled to the seaman's deduction

K2103, income stemming from child care in one's own home

K2104, profit from payments in kind

K2105, other income stemming from labour

K2401, children's wage income (children under 13 years of age)

K1607, calculated personal income limited liability company, liberal occupation

K1608, calculated personal income limited liability company, other industry

K3212, contribution to private/public Norwegian pension scheme in connection with the employment

XEKSTRA, adjustment of personal income

XELF, own wages in an enterprise

XGLF, basis for deduction of wages

XKAG, basis for return to capital

XKN, corrected self-employed, taxable income

XLAKT, wage costs concerning active owners

27

1) CGEV

yww , total wage and salary payments net of social taxes

2) MSV

K1601, calculated personal income one-man enterprise, primary industry

K1604, calculated personal income partner-assessed company, primary industry

K1612, part of wage income/pension stemming from enterprise from which the person in question

receives calculated personal income, primary industry

K1701, remuneration for work to partner in partner-assessed company where personal income is not

calculated, primary industry

2) CGEV

ww11ls11 + ww12 ls12 + ww13 ls13

wwj is wage per hour to wage earners in production sector j in current prices and net of social taxes, lsj

is number of hours worked by self-employed in production sector j, j = 11 (agriculture), 12 (forestry)

and 13 (fishing).

3) MSV

K1602, calculated personal income one-man enterprise, liberal occupation

K1605, calculated personal income partner-assessed company, liberal occupation

K1613, part of wage income/pension stemming from enterprise from which the person in question

receives calculated personal income, liberal occupation

3) CGEV

ww85 ls85

85 is the industry other private services.

4) MSV

K1603, calculated personal income one-man enterprise, other industry

K1606, calculated personal income partner-assessed company, other industry

K1614, part of wage income/pension stemming from enterprise from which the person in question

receives calculated personal income, other industry

K1702, remuneration for work to partner in partner-assessed company where personal income is not

calculated, other industry

28

4) CGEV

∑

ww j ls j

j∈PP \{PW ,11,12,13,85}

PP is all private production sectors and PW is the private production sectors 71 (Production of

electricity), 68 (Oil and gas exploration and drilling), 64 (Production and pipeline transport of oil and

gas), 60 (Ocean transport), 83 (Dwelling services) and 89 (Imputed service charges from financial

institutions).

5) MSV

K2701, self-employed, taxable income, agriculture

5) CGEV

sse11

∑ (bp

i ,11

− δˆi ,11 − risk ) pjbi k i ,11 + ww11ls11

i =10 , 40 ,50

sse11 is the share of self-employed in agriculture, i = 10, 40 and 50 are respectively buildings, cars and

machinery, bpi,11 is the user cost of capital type i per NOK invested in agriculture, δˆi ,11 is the

depreciation rate of capital type i in agriculture, risk is the risk premium, pjbi is the purchaser price

index, exclusive of VAT and the investment tax, for new investment, capital type i and ki,11 is the

capital stock of type i in agriculture in constant prices.

6) MSV

K2702, self-employed, taxable income, forestry

6) CGEV

sse12

∑ (bp

i ,12

− δˆi ,12 − risk ) pjbi k i ,12 +ww12 ls12

i =10 , 40, 50

7) MSV

K2703, self-employed, taxable income, fishing

7) CGEV

sse13

∑ (bp

i ,13

− δˆi ,13 − risk ) pjbi k i ,13 +ww13 ls13

i =30, 50

30 is the capital type ships and fishing boats.

29

8) MSV

K2704, other self-employed, taxable income (inclusive of liberal occupation)

K27041, self-employed, taxable income, partnership company

8) CGEV

∑

{

j∈PP \ PW ,11,12,13}

sse j

∑ (bp

i, j

i =10, 40 ,50 , 30,80

− δˆi , j − risk ) pjbi k i , j +

∑

ww j ls j

j∈PP \{PW ,11,12,13}

80 is the capital type aircraft.

There is a clear coherence between income types 2) to 8) since self-employed, taxable income both

consists of capital income and the self-employed's labour income and calculated personal income is

meant to reflect the self-employed's labour income. The above expressions for the self-employed's

labour income part of self-employed, taxable income and for the calculated personal income are

therefore identical. We assume that the self-employed's wage rate is equal to the wage rate received by

employees.

All private production sectors with the exception of 71 (Production of electricity), 68 (Oil and gas

exploration and drilling), 64 (Production and pipeline transport of oil and gas), 60 (Ocean transport),

83 (Dwelling services) and 89 (Imputed service charges from financial institutions) are included in the

above calculations. 68 (Oil and gas exploration and drilling), 64 (Production and pipeline transport of

oil and gas) and 60 (Ocean transport) are excluded because of a constant real capital stock and no user

costs of real capital attached to them. 89 (Imputed service charges from financial institutions) are not

included since there is no real capital stock there. 83 (Dwelling Services) are excluded since this is an

artificially constructed private production sector directly attached to private consumption. We have

chosen to omit 71 (Production of electricity) since the user cost of capital in this industry differs

conceptually from the other user costs and since real capital is "almost exogenous".

Concerning item 5) to 8), we use the net return on real capital for self-employed as an approximation

to the self-employed's capital income part of self-employed, taxable income. The net return in these

expressions is generally before paying of taxes. An exception is paying of the VAT and the investment

tax since we employ the purchaser price index of new investments exclusive of VAT and the

investment tax. We then think of the difference between the net return on real capital employing

respectively the purchaser price index inclusive and exclusive of the VAT and the investment tax as

representing the paying of these two taxes. Since the microsimulation model only deals with personal

taxes the VAT and the investment tax on inputs are not part of this model.

30

Gross production in agriculture, forestry and fishing is exogenous in the CGE model. Therefore

changes in employment and real capital may only take place through substitution effects, and not

through scale effects.

In the microsimulation model, the calculated personal income is either exogenous, as in item 2) to 4),

or computed by means of individual variables, as in item 1) (the variables starting with the letter X).

The former constitutes the largest part. For practical reasons, we assume that all the "X-variables" in

1), even though they are divided into the two categories primary industry and other industry, are

changed by the change in employees' wage income. The self-employed's endogenous calculated

personal income will then change by roughly the same percentage.

9) MSV

K3104, dividends from shares giving the right to refundment

K31041, of this: dividends from funds of shares

9) CGEV

∑{

j∈PP \ PW }

sllc j

∑ (bp

i, j

i =10, 40, 50, 30,80

− δˆi , j − risk ) pjbi k i , j

sllcj is the share of limited liability companies in production sector j.

Concerning item 9), we use the percentage change in net return on real capital for limited liability

companies as an approximation to the percentage change in dividends. As was the case for items 5) to

8), we employ the purchaser price index of new investments exclusive of VAT and the investment tax.

In addition, we assume that other taxes than the VAT and the investment tax paid by the limited

liability company constitute a constant share of the net return on real capital. We may then think of the

percentage change in the expression above as representing the percentage change in the after-tax net

return on real capital in limited liability companies. As stated earlier, the microsimulation model only

applies to personal taxes.

10) MSV

K3106, income from abroad

K3302, interest on debt to foreign creditors

31

10) CGEV

renu × ngu

renu is the nominal annual interest rate on positive financial investment in the international capital

market and ngu is net national debt.

We only have numbers for net national debt. We assume that the individual components, debt and

claims, change by the same percentage as the net variable.

11) MSV

K3101, interest on deposits in domestic banks

K3102, other interest: outstanding claims, bonds etc.

K3301, interest on debt to Norwegian creditors

We have chosen to keep these variables constant in the microsimulation model since we do not know

the percentage change in debt to Norwegian creditors and claims on Norwegian debtors.

12) MSV

K3107, dividend from abroad

This variable is kept unchanged since the corresponding CGE variable is exogenous.

13) MSV

K2805, taxable gain by selling real property

K3105, taxable gain by selling Norwegian and foreign shares

K3117, gain, gain and loss account

K3118, gain, empty/void negative balance, group A-D

K3306, deductible loss by selling real property

K3308, deductible loss by selling shares

K3317, loss, gain and loss account

K3318, loss, empty positive balance group A-D

All these variables are kept unchanged since the capital gains in the CGE model are equal to 0 in

steady state.

32

14) MSV

K3217, deficit in primary industry

K3218, deficit in other industries

K3219, deficit in partnership companies

K3220, deficit by hiring out real property

K3221, nonlocal deficit

K3309, self-employed's deficit from a previous year that is possible to carry forward

All these variables are kept unchanged since no companies in the CGE model have deficits in

equilibrium (companies with deficits have left the industry).

15) MSV

K2804, net income by hiring out real property, not in connection with self-employment

This variable is kept unchanged since all dwellings are owner-occupied and sites are not included in

the CGE model.

16) MSV

K1505, unused refund deduction from 1994

K2601, received own contributions, annuities, provisions made for a retiring farmer on handing over

the farm to his heir or successor etc.

K2602, received contributions etc. to children under 17 years of age

K2603, other contributions, annuities, provisions made for a retiring farmer on handing over the farm

to his heir or successor etc.

K2803, part owner's share of income in housing company (not percentage income)

K3103, return on the savings part of life insurance

K3108, other income

K31081, nonlocal income (not assessed on a percentage basis)

K3202, actual expenses in order to acquire income

K3207, extra expenses for board and lodging incurred when working away from home

K3208, travels to/from working place

K3209, travel expenses when visiting home

K3210, parents' deduction

K3211, trade union dues

33

K3213, seaman's deduction

K3214, special deduction associated with income from fishing

K3215, self-employed's premium to voluntary extra national insurance for sickness benefits in the

National Insurance Scheme

K3303, alimony and accommodation and support provided by the new owner of landed property for its

former owner inherent in real property with the exception of land/forest

K3304, share of deductible expenses in housing company

K3305, deductible premium for private pension scheme

K3307, other deductions

K12, loan from "Statens Lånekasse" assigned this year

K13, total paid to "Statens Lånekasse" this year

K14, of this interest paid to "Statens Lånekasse" this year

K16, interest balance in "Statens Lånekasse" at the end of the year

K45, tax-free payments

Concerning item 16), none of the variables exist in the CGE model. We have chosen to keep them all

unchanged.

B.2 Combining wealth variables in the CGE and microsimulation

models

17) MSV

K4601, taxable assets abroad

K4803, debt to foreign creditors

17) CGEV

ngu

Concerning item 17), the same comments and assumptions as for item 10) apply. In addition, we

assume that taxable assets abroad mainly consists of bank deposits and not shares.

18) MSV

K4101, bank deposits

K4104, bonds registered in "Verdipapirsentralen"

K4105, other bonds

K4106, outstanding claims

34

K4801, debt to Norwegian creditors

Since we have chosen to keep the variables in 11) unchanged, we also keep the variables in 18)

constant.

19) MSV

K4107, value for taxation purposes of shares in Norwegian companies registered in

"Verdipapirsentralen"

K41071, of this: unit in unit trust

K4108, value for taxation purposes of other shares in Norwegian companies

K4109, other securities

19) CGEV

∑

j∈PP \ {PW }

sllc j

∑

pjbi k i , j

i =10, 40, 50, 30,80

Concerning item 19), we use the percentage change in the value of real capital in limited liability

companies as an approximation to the percentage change in the mentioned share values. The value is

measured exclusive of VAT and the investment tax. This is so since we think of the market value of

shares as a sum of discounted dividends and these dividends are in item 9) measured exclusive of

VAT and the investment tax.

20) MSV

IKB, gross value for taxation purposes, own dwelling property (inclusive of flats in housing cooperatives organized for one particular project only)

IKH, gross value for taxation purposes, cottages

K4301, share of housing company's value for taxation purposes

K4302, value for taxation purposes, own dwelling

K4303, value for taxation purposes, cottage

20) CGEV

pj10,83 k10,83

where pj10,83 is the purchaser price index, inclusive of VAT, for new investments in dwellings and

cottages in the production sector Dwelling services and k10,83 is dwellings and cottages in the same

production sector. We assume that the value for taxation purposes concerning housing constitutes a

constant share of the market value of housing from baseline scenario to the different policy

35

alternatives. IKB and IKH are used as basis for calculation of capital income stemming from housing.

This capital income is not part of the pre-tax income concept in the microsimulation model but is used

as basis for calculation of income taxes. K4301, K4302 and K4303 are used as basis for calculation of

wealth taxes in the microsimulation model.

21) MSV

K4204, private cars, motor cycles

21) CGEV

pc30 hc31

where pc30 is the purchaser price index for cars inclusive of VAT and hc31 is households' stock of cars

in constant prices.

22) MSV

K4401, occupational cars, machinery and fixtures