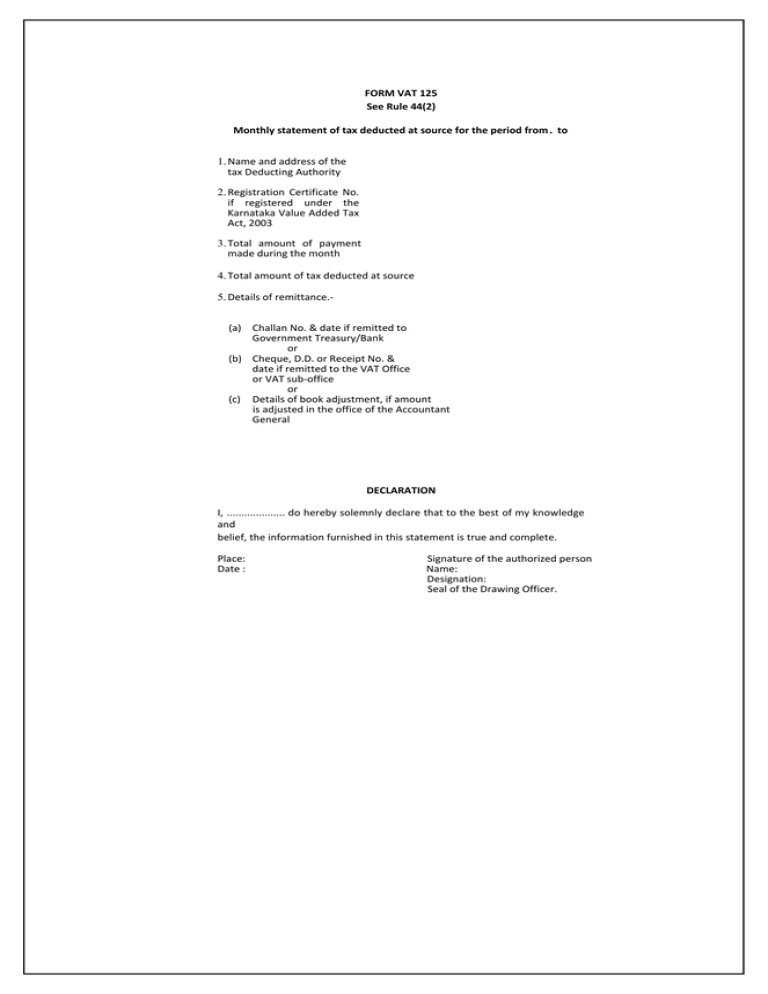

FORM VAT 125 See Rule 44(2)

advertisement

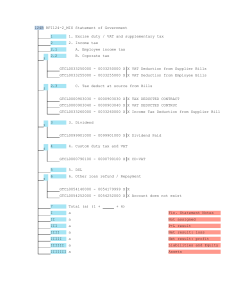

FORM VAT 125 See Rule 44(2) Monthly statement of tax deducted at source for the period from . to 1. Name and address of the tax Deducting Authority 2. Registration Certificate No. if registered under the Karnataka Value Added Tax Act, 2003 3. Total amount of payment made during the month 4. Total amount of tax deducted at source 5. Details of remittance.(a) Challan No. & date if remitted to Government Treasury/Bank or (b) Cheque, D.D. or Receipt No. & date if remitted to the VAT Office or VAT sub-office or (c) Details of book adjustment, if amount is adjusted in the office of the Accountant General DECLARATION I, .................... do hereby solemnly declare that to the best of my knowledge and belief, the information furnished in this statement is true and complete. Place: Date : Signature of the authorized person Name: Designation: Seal of the Drawing Officer.

![FORM VAT 126 canteens) for the month of [See Rule 44 (2)(a)]](http://s2.studylib.net/store/data/016946992_1-03402c6060a7141d9dddd900f81fb970-300x300.png)