Hydro One Limited: Annual Report 2015

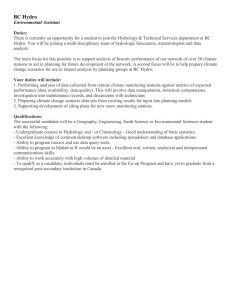

advertisement