beta 1o ta lam bd a fo unda tio n , in c fo r th e perio d en d et) d

advertisement

O FF)CI~L

|ILl ~IM 'Y

BE T A 1O T A L A M BD A FO U N D A T IO N ,IN C

B A T O N R O U G E ,L O U ISIA N A

,q,:cs h (m ~ tlds

(,Ib'a,vl f'lA(;t

tI~CK uilII{)

FIN A N C IA L STA T EM E N T S

FO R T H E PE R IO D E N D E T) D E C E M BE R 31, 1999

Release Date

07_Z2~R)-(

~O

D E SIR E E '~V .H O N O R E '

C erlif

i ed Public A ccountant

A ProfessionalCorporation

BETA IO TA LA M BD A FO U N D A TIO N IN C

BA TO N R O U G E , LO U ISIA N A

FIN AN CIA L STA TEM EN TS

PER IO D EN D ED D ECEM BER 31 1999

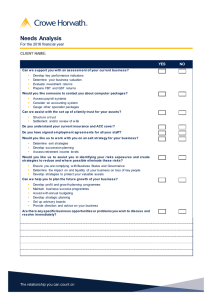

C O N TEN T S

IN D EPEN D EN T A U D 1TO P.'S R EPO RT O N FIN A N CIA L STA TEM EN TS

FIN A N C IA L S'IA T EM EN T S

Statem entofFinancialPosition

2

Statem entofA ctivities and C hanges in N etA ssets

3

Statem entofC ash Flow s

4

Statem entofFunctionalExpenses

5

N O T E S T O FIN A N C IA L STA T EM EN T S

6 -7

REPO R T O N C O M PLIA N C E A N D IN TERN A L C O N TR O L O V ER FIN A N CIA L

R EPO R TIN G BA SED O N A N A U D IT O F FIN A N C IA L STA TEM EN TS PER FO RM ED

IN A C C O R D A N C E W IT It G O V ERN M EN T A U D ITIN G STA N D A R D S

SU M M A R Y O F FIN D IN G S C O N C LU SIO N S CA U SES

A N D R EC O M M EN I)A TIO N S A N D M A N A G EM EN T 'S RE SPO N SF,

9

D esiree'W .H onore'.C PA

433-H Longw ood C ourt

B aton R ouge,Louisiana 70806

Telephone:(225)344-7649

Em ail:DItONORE@ AOL.COM

IN I)EPEN I)EN T A U D ITO R 'S R EPO R T O N FIN A N CIA L STA TEM EN TS

To the Board ofD irectors

Beta Iota Larabda Foundation,Inc

(A N otforProf

itO rganziation

Baton R ouge,l,ouisiana

Ihave anditcd lhc accom panying statem entoff

inancialposition ofBeta lota Lam bda Foundation,

Inc.(a non prof

itorganization)asofD ecember31,1999,and therelated sta|em em sofactivities,

functionalexpenses,and cash f

low s forthe yearthen ended. These f

inancialstatem ents are the

responsibility ofO rganization's m anagem ent. M y responsibility is to express an opinion on these

inancialstalem ents based on m y audit.

f

Iconducted m y auditin accordance w ith generally accepted auditing standardsand the standards

applicable to f

inancialaudits contained in G overnm entA uditing Standards,issued by the

Com ptroller G eneralofthe U nited States. Those standardsrequire thatIplan and perform the

auditto obtain reasonable assurance aboutw hetherthe f

inancialstatem entsare free ofm aterial

m isstatem ent. A n auditincludes exam ining,on a testbasis,evidence suppor

t ing the am ountsand

disclosures in the f

inancialstatem ents. A n auditalso includesassessing the accounting principles

used and signif

icantestim ates m ade by the m anagem ent,as w ellas evaluating the overallf

inancial

statem entpresentation. Ibelieve thatm y auditprovides a reasonable basis for m y opinion.

In m y opinion,the f

inancialstatem entsreferred to above presentfairly,in allm aterialrespects,the

inancialposition ofBeta Iota Lam bda Foundation,Inc.asofD ecem ber31,1999,and the changes

f

in its netassets and its cash f

low s for the eighteen m onth period then ended in conform ity w ith

generally accepted accounting principles.

In accordance w ith G over

n m entA uditing Standards,Ihave also issued m y reported dated A ugust

10,2000,on m y consideration ofBeta Iota Lam bda Foundation,Inc.'sinternalcontrolover

inancialreporting and m y tests ofits com pliance w ith certain provisions oflaw s,regulations,

f

_

contracts,and grants.

A ugust 10,2000

E TA IO TA I,A M BD A FO U N D A T IO N .IN C

A N O N PR O F IT O R G A N IZ A T IO N

BA T O N R O U G E L O U ISIA N A

ST A T EM EN T O F FIN A N C IA L PO SIT IO N

P E R IO D E N D E 1-) D E C E M B E R 31 1999

A SSETS

C U R R EN T A SSET S

C ash and cash equivalents

Prepaid Expenses

Totalcurrentassets

$6,822

2.529

9.351

I'I~.OPERTY AN D EQ U II'M EN T

Building and Im provem ents

Furniture,f

ixtures and equipm ent

A utom obiles

l.ess accum ulated depreciation

Totalproperty and equipm ent

314,950

66,844

26,469

(144,493)

263.769

T otalassets

$273,120

A BII.IT IE S A N D N ET A SSET S

C U I{R EN T LIA BILITIES

A ccounts payable m xd accrued expenses

1.793

1,793

Totalcurrentliabilities

N I'

;T A SSET S -U N RE STR IC TE D

271.327

271.327

Totalliabilities and netassets

$273,120

The accom panying notesare an integralpartofthisstatem ent.

2

BETA IO TA LA M BD A FO IJN D A T IO N .IN ~

(A N O N PR O FIT O R G A N IZ A T IO N

BA T O N R O U G E L O U ISIA N A

STA TEM EN T O F A C T IV IT IES

PE R IO D E N D E D D E C E M B E R 31. 1999

Slit,PO R T A N D R EV I~N U E

G rantfrom G overnor's O ff

ice ofU rban

A fairs and D evelopm ent

G rantfrom l.ouisiana D epartm entofSocial

Services,O f'ice ofC om m unity Services

lnterestIncom e

Private funds

Totalsupportand revenue

50,000

663

43,806

231.719

EX PEN SE S

Program services

A lpha C enter

U rban A fairs

C om m unity Services

TotalE xpenses

53,340

150,285

28,750

232,375

C H A N G E IN N ET A SSETS

N etassets -beginning ofyear

N etassets -end ofyeal

137.250

(656)

271.983

$271,327

The accom panying notesare an integralpartofthisstatem ent.

BETA IO TA LA M BD A FO U N D A T IO N .IN C

A N O N PR f)F1T O R G A N IZ A T IO N

B A T O N R O U G E .L O U ISIA N A

ST A T EM EN T O F C A SH FL O W S

P E R IO D E N D E D D E C E M B E R 31 1999

C A SII FI,O W S FR O M O PER A TIN G A CTIVITIES

C ash received f

l or

a governm entgrants and

private sources

C ash paid to suppliers and em ployees

N etcash provided by operating activities

$231,719

(189,917)

41.802

C A SII FLO W S FR O M IN V ESTIN G A C TIV ITIE S

Purchase ofequipm ent

N etcash provided by operating activities

(30,887)

(30,887)

N ET (I)ECREA SI'

;)IN CICEA SE IN CA SH AN D

CA SH EQ U IVA LEN TS

10,915

CA SH AN D CA StlEQ U IVALEN TS -beginning ofyear

(4,093)

CA SIt AN D CA SItEQ U 1VA LEN TS -end ofyear

$6,822

Schedule reconcilinlgchanges in netassetsto net

cash provided hy operating activities:

C hange in netasset,

';

(656)

Adjustm entsto reconcilenetincom eto net

cash provided by operating activities

D epreciation

40,665

(D ecrease)increase in accountspayable and

accrued expenses

N etcash provided by operating activities

1,793

$41~8o2

The accom panying notesare an integralpartofthisstatem ent

4

ETA IO TA LA M BD A FO U N D A TIO N .IN (

A N O N PR O F IT O R G A N IZA T IO N

BA T O N R O U G E I,O U ISIA N A

ST A T E M E N T O F F U N C T IO N A I,E X PE N SE S

PE R IO D E N D E D D E C E M BE R 31 1999

A lpha

C enter

Salaries and w ages

]>logjam D irectol

EducationalD irector

A dm inistrative A ssistant

Em ployee Benef

its

T herapeutic and training

of

fice supplies

Bookkeeping/professionalservices

A uto Supplies

Insurance

T elephone

D epreciation

M aintenance/R epairs

Travel

U rban

A fairs

37,500

35,000

I9,375

7.078

255

2.750

2,952

2,140

TotalE xpenses

3,809

1.318

3,057

38,018

1.846

2.647

9,126

18,517

9,153

32,114

5.000

$53,340

$150,285

$28,750

The accom panying notesare an integralpartofthisstatem ent

5

Total

Expenses

37,500

35,000

19,375

7.078

721

Tutorial(O ther)A ssistance/Services

U tilities

C om m unity

Services

7,016

4,890

721

4,375

0

40,665

10,971

0

50,631

14,153

$232,375

B E T A IO TA L A M B D A FO U N D A T IO N IN C

(A N ON PROFIT ORG AN IZATION )

BA T O N R O U G E L O U ISIA N A

N O T E S T O FIN A N C IA L ST A T E M EN T S

D E C EM BE R 31 1999

SunLn!~JX ofSigrdf

icantA ccounting Policies

_

a.

O perations

Bc

t a Iota Lam bda Foundation,Inc.(BILF)providestutoriali

n struction in ACT

preparation,LouisianaIligh Schoolexitexam ination,and generalsubjectsto local

youths. BILF also sponsorssportsand recreation activitiesforstudentsthrough its

Sum m erA cadem y. The O rganization also conductsw orkshops on teen pregnancy

com m unity aw areness,and services to elderly citizens ofthe com m unity. The

organization is dedicated to providing educational,tutoring,arts,counseling,and

rclated services to "atrisk" youths.

b.

]~e~ve!u_e

_ __

Be

t a Iota Lam bda Foundation,Inc.receives substantially allofits grantand contract

revenue from the state agencies. R evenue is recognized w hen services are provided.

Expenses are recognized as incr

u sted.

A ny ofthe funding sources m ay,atits disc

r etion,requestreim bur,;em entfor

expenses or return offunds,orboth,as a resultofnon-com pliance hy Beta Iota

Lam bda Foundation,Inc.w ith the term softhe grants/contracts.

c.

C ontributions

Contributions received are recorded as unrestricted,tem porarily restricted,or

perm anently restricted supportdepending on the existence and /ornature ofany

donorrestrictions. BILF hasnotreceived any contributionsw ith donor-im posed

cstrictionsthatw ould resultin tem porarily orperm anently restricted netassets.

d.

]~ropert~ and Equipm en

_

Proper

t y and equipm entare recorded atcost. Expenditures for m aintenance,

repairs,and m inorrenewalsarecharged againstearningsasincurred.M ajor

expenditures forrenew als and betterm ents are capitalized. W hen item s are retired or

otherw ise disposed of,the costofthe assetand the related accum ulated depreciation

are rem oved from the books. A ny result

ing gain orloss iscredited to orcharged

againstincom e.

BETA IO TA LA M BD A FO U N D A TIO N ,{N_C

.

(A N ON PROFIT ORG AN IZATION )

B A T O N R O U G E .L O U ISIA N A

N O T E S T O FIN A N C IA L STA T E M EN T S

D E C E M BE R 31. 1999

Sum r4La!y_ofSignif

icantA ccountingPolicies

~ continued

_

.

t~opertv and Equipm ent_(continued) D epreciation isprovided in am ountssuff

icient

_

to relate the costofdepreciable assetsto operationsovertheirestim ated service lives

(25yearsforbuilding and improvem ents,5-7yearsforfurnit

u rearid equipm ent,and

5yearsforvehicles),using straight-linem ethod.

e.

lncom e Taxes

The O rganization is a nonprof

itorganization thatis exem ptfrom :Federalincom e

taxation underSection 501(c)(7)oftheInter

n alRevenueCode.

C ash and C ash Equivalents

C ash and cash Equivalents consistofitem s having m aturities ofthree m onths orless

from the date ofacquisition.

C oncentrations ofCreditR isk

The O rganization m aintains its cash balances in f

i nancialinstitutions located in

Baton R ouge,Louisiana. The balances are insured by the FederalD epositInsurance

Corporation up to $100,000.

R F.PO I-VI'O N C O M PLIA N C E A N D O N IN TERN A L C O N TR O L O V ER FIN A N CIA L

R EPO R TIN G BA SED O N A N A U D IT O F FIN A N C IA L STA TEM EN TS PERFO RM ED

IN A C C O R D A N C E W ITH G O V E R N M EN T A U D IT IN G STA N D A R D S

To the Board ofD irectors

Beta Iota I,am bda Foundation.lnc

haveaudited lhef

inancialstatem entsofBeta Iota LambdaFoundation,Inc.(anonprof

it

organization)asofand forthe 18 m onth period D ecem ber31,1999 and have issued m y report

thereon dated A ugust 10,2000. I have conducted m y auditin accordance w ith generally accepted

auditing standards and the standards applicable to f

inancialaudits contained in G overnn~ent

A uditing~qt~ glards,issued by the Com ptroller G eneralofthe U nited States.

__

C om pliance

A s partofobtaining reasonable assurance aboutw hetherBeta Iota Lam bda Foundation,Inc.'s

inancialslatem ents are free ofm aterialm isstatem ent,Iperform ed tests oflhe itscom pliance w ith

f

cer

t ain provisionsoflaw s,regulations,contracls,and grants,noncom pliance w ith w hich could have

a directand m aterialef

f ecton the determ ination off

i nancialstatem entam ounts, tlow ever,

providing an opinion on com pliancewith thoseprovisionswasnotan objectiveofm y audit,and

accordingly,1 do notexpress such an opinion. The results ourtests disclosed instances of

noncom pliance thatare required to be repor

t ed under G overnm entA nditil)g Standar'

ds and w hich

are bestdescribed in the accom panying schedule off

indings.

InternalC ontrolO verFinancialR enortin~

In planning and perform ing m y audit,I considered Beta Iota Lam bda Foundation,Inc.'s internal

controloverf

inancialreporting in orderto determ ine m y auditing proccdm es forthe purpose of

expressing nay opinion on the f

inancialstatem ents and notto provide an opinion on the internal

controlover f

i nancialreporting. M y consideration ofthe internalover f

inancialreporting w ould not

necessarily disclose allm atters in the inter

n alcontroloverf

inancialrepor

t ing thatm ightbe m aterial

w eaknesses. A m aterialw eaknessisa condition in w hich the design oroperation ofone orm ore of

the internalcontrolcom ponentsdoesnotreduce to a relatively low levelthe risk thatm isstatem ents

in am ounts thatw ould be m aterialin relation to the f

inancialstatem entsbeing audited m ay occur

and notbe detected w ithin a tim ely period by em ployees in the norm alcourse ofperform ing their

assigned f

im ctions. Inoted no m attersinvolving the internalcontroloverf

inancialrepor

t ing and its

operation that1considerto be m aterialw eaknesses.

This reportis intended solely forthe inform ation and use ofthe Board ofD irectors,M anagem ent,

O ff

ice ofthe:I.egislative A uditor,G overnor's O f

i ce on U rban A fairs,O ff

ice ofC om m unity

Services,and other oversightagencies. H ow ever,this reportis a m atter ofpublic record and its

distribution is notlim ited.

A ugust 10,2000

BETA IO TA LA M BD A FO U N D A TIO N IN C

(A N ON PROFIT O RG AN IZA TION I

BA TO N R O U G E LO U ISIA N A

SU M M A R Y O F FIN D IN G S C O N C LU SIO N S.CA U SES

A N D R EC O M M EN D A TIO N S A N D M A N A G EM EN T 'S RE SPO N SE

D elm l

1

D escription ofException

Form 990 R eturn ofO rganization Exem ptfrom Incom e Tax w as nottim ely

iled forf

f

iscalyearsended 1998 and 1999.

M anagem entintendsto f

ile thisreturn assoon aspossible and getcurrenton

allInternalR evenue Service incom e tax reporting requirem ents.

A uditisbeing subm itted af

terthe statutory and contractrequired date of

June 30,2000. O rganization did nothave allf

inancialtransactionsrecorded

in the generalledgerfor allprogram s.

M anagem enthasm oved to record alltransactionsin generalledger.Softw are

hasbeen purchased and utilized thatism ore in lines w ith tile needsofthe

organization.

N O TE

The above f

indingsand conclusions,asw ellasthe auditreportsand audited

inancialstatem ents,w ere discussed w ith D onald W ade,Executive D irector

f

and D om enic M cClinton,Treasurer,w ho concun'ed w ith nay f

indings,

conclusions,and recom m endations.