Gold/Silver Ratio - justspreads.com.au

advertisement

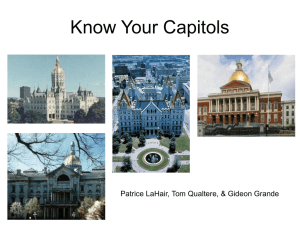

A Tale of Two Precious Metals – Gold/Silver Ratio The investment community purchases gold and silver for different reasons. Typically they act as a hedge or protection from concerns over inflation or times of economic instability and uncertainty. They are valued in terms of the U.S. dollar, so periods of dollar weakness helps to support their value. Recently, the lack of faith in paper and ink has put further pressure on the U.S. dollar and has pushed gold and silver to new record highs. Also, a prudent investor will expose their equity to a range of asset classes including precious metals i.e. gold and silver as part of a diversified and balanced portfolio. Then there is the natural allure of silver and especially gold, to have in one’s possession for comfort and in some cases pleasure. Regardless of why an investor buys, holds or is thinking of purchasing gold or silver their strategy is the same – “buy and hold”. An old Wall Street saying, “Always keep ten percent of your portfolio in precious metals, and hope that you’re wrong.” For the more active investor, the essence of the gold-silver ratio is to switch holdings when the ratio swings to the extreme historical levels. An example would be when an investor holds one ounce of gold, and the ratio widens to say 100:1, the investor would sell their ounce of gold for 100 ounces of silver. Conversely, if the ratio contracted or narrowed to say 32:1, the trader would sell their 100 ounces of silver for at least two ounces of gold. There is no dollar value when making this trade; rather it is the relative value of the metals to each other that is important. The trading community, on the other hand, trades gold and silver for different reasons. Typically, a trader would “take a view” on the price of either metal that it will move up or down in price within a pre-determined and shorter (less than three months) time frame to that of an investor. Simply put they want to profit from the near-term price activity and have no desire to buy and hold. Their basis or reason to go long or short either metal can vary. Both metals have cycles or seasonal patterns which is the tendency for a particular commodity to behave (price wise) during a certain period every year. Gold has a seasonal tendency to peak in late January after the holiday season, as jewellery demand starts to decline. Price increases can last into the first part of February as dealers increase their inventories for Valentine’s Day. Gold tends to post seasonal bottoms in late July or early August. Silver has a tendency to make a major seasonal bottom in September and then has a seasonal peak in April. Silver tracks the price of gold and is commonly referred to as the poor man’s gold. The prices of both metals are subject to spikes in demand from the investment community, which uses them as a hedge or protection. In general, both metals move in the same price direction but sometimes at varying rates of change. Rare Opportunity – Neither Bullish nor Bearish The word “crisis” in Chinese is composed of two characters: the first, the symbol of danger; the second, opportunity This is where a spread trader seeks a trading opportunity, to profit from the price discrepancy or variation in price between the two metals. The spread trader does not necessarily need to be bullish or bearish either metal, rather the “spreader” will take a view on whether their price relationship will widen or narrow. This price relationship is referred to as the ratio between gold to silver. This ratio is a long-standing and classic trading opportunity within trading circles. In late April of 2011, the ratio was around 32:1, that is gold is 32 times the price of silver or how many ounces of silver it takes to purchase on ounce of gold. I have no view or price target for either gold or silver, but I am a firm believer that history repeats itself and for those who do not obey this, are likely to repeat the same mistakes or miss a rare trading opportunity. In 1980, silver screamed up to extraordinary highs of $50.36 and gold had its day in the sun reaching a high of $850.00, resulting in alltime highs for both metals. After the economic recovery in the early 1980s, gold and silver settled to a much lower price for a lengthy period. If all things stabilize on the geopolitical front, as they have in the past, and there is no major financial collapse or on-going crisis, then one should consider employing a trading strategy. There is an appropriate saying that speaks well to this opportunity, “To know where you’re going you need to know where you’ve been” During 1980, the gold/silver ratio was 30:1; in 1983 32:1, then in 1991 it was 100:1. In the last 30 years the ratio for gold/silver has been as narrow (low) as 30 and as wide (high) as 100. The Trading Strategy - Spot or Futures In all cases, spread trading attempts to capture the price difference between two contracts whereby one will outpace the other. As a spread trader we might have the view or speculate that when gold and silver reach a ratio of around 32:1 the spread price is too narrow (historically) and that we anticipate it should widen out to say 38:1. We look to sell silver the “expensive” commodity (as it relates to gold) and buy gold the “cheap” commodity (as it relates to silver). To benefit financially a trader can buy gold and sell silver in equal dollar amounts, so long as the price/ratio widens out. Let’s take a close look at the spread history of long gold and short silver during early May through to the end of June. This spread has been profitable 87% of the time over the last 15 years, when you enter on May 8th and exit the trade on June 30th. At the time of this report gold was $1500/oz and silver was $45/oz (33:1). If you are interested in a rare trading opportunity that features capital preservation, low costs, and prudent risk management using spreads, then consider these approaches. Scenario #1 Spot market By using a cash or spot position you can assign any dollar amount e.g. $30,000 to each leg (one long, the other short) on whether the spread will widen or narrow. In this example, we buy $30,000 USD gold (approximately 20 ounces) and sell $30,000 USD silver (approximately 660 ounces) using a cash or spot metals dealer. There will be a holding cost to “sell” or be short the silver and to “buy” or be long the gold. We anticipate that there is a 7 week holding period (to enter and exit the trade) with holding costs per day at 5% borrowing means you will pay around $5.00 per day (not including commissions). As the individual prices (of gold and silver) move up and down over time, you will notice that one will inevitably outpace the other. The advantage here in this scenario is that you can choose the dollar amount that is within your comfort zone. This is an OTC (over-the-counter) trade that can be customized to your risk appetite and requires less than $5,000 in a trading/margin account. See your cash/spot metals dealer for the precise costs for holding/borrowing and commissions to purchase and exit this position. Scenario #2 Futures market Another approach used to trade this spread is by using futures contracts. In this case, we would buy the full sized contract August Gold futures (100 oz) and sell Sep Silver futures (5,000 oz) at the COMEX futures exchange and hold the spread for the same duration i.e. early May through the end of June. Futures have no holding charges, but even with a discounted spread margin of 50 – 70%, these futures contracts will require a margin of $15,000 or more. If you are more comfortable with less than there are mini futures contracts traded at the NYSE Liffe. The mini gold contract has 33 ounces and mini silver is 1,000. The margin here will be at least half (under $10,000) to that of the full size contracts. In either scenario, you will look for the price of gold to outpace the price of silver regardless of the overall market direction. Consult with your futures dealer for a precise quote and the correct contract ratio of silver to gold. After a while you note that the ratio (gold to silver price) has moved from 33:1 to 37:1; both markets have moved lower in price, for example gold is now $1400/oz and silver is $38/oz. For demonstration purposes let’s assume we assigned $30,000 to each leg (using a spot dealer). The $30,000 of gold bought at $1500/oz (20 oz) is sold at $1400 amounting to a $2,000 loss; the $30,000 of silver sold at $45/oz (667 oz) can be purchased back at $38 amounting to a $4,500 profit. The net difference is (approximately) $4,500 - $2,000 = $2,500 profit. The silver outpaced the gold price. By this example you should be able to determine how much equity to put towards this trade opportunity. History Tends to Repeat Seasonality suggests that a change in direction (gold/silver) to the upside (widens) occurs in late April or early May. The two charts below represent the last 30 years for the gold/silver spread. The monthly spread charts below tells us that the price of silver has outpaced the price of gold regardless of the outright direction of either metal during this time frame. We have seen that history itself offers an edge (with seasonal statistics) and can by itself be the sole basis for your trading decision. As long as you determine your risk before you take on the trade. You will need to establish your plan of action before undertaking this spread. You’ll need to have your profit and your loss levels determined before you apply either (spot or futures) trading approach. You will need to determine your risk to reward so that you remain within your comfort zone. The monthly charts below range from 1980 till April 2011. Close examination will show the seasonal tendencies for this spread to widen during the suggested time frame of early May through the end of June. The seasonal strategy calendar indicates that silver drops in value during mid-May through to mid-June around 64% of time over the last 15 years. Perhaps this is further indication that silver might outpace gold. Conclusion As a trader of futures, we have to accept that any market can be erratic and unpredictable. The outright gold and silver prices have been volatile with price spikes and over-extended price ranges. By using a spread we greatly reduce much of this volatility and do not need a profound view on the outright direction of either metal. In fact, we have created an entirely new trading entity by spreading gold against silver and it has a life (trading opportunity) of only 7 weeks in every year. Conversely, you might view the spread level 32:1 as a benchmark or pivotal point. That is, if the spread moves below 32:1 then it will continue to narrow. This idea is not advice or a recommendation. Rather it is awareness as to the relationship of these two metals and a rare opportunity to profit. Here we offer an opportunity to calculate, organize, review and present historical data that may inspire further thought, analysis and create a tradeable viewpoint using a sound basis.