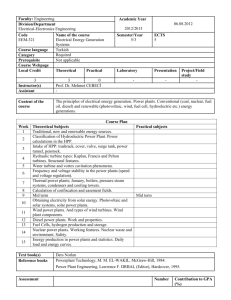

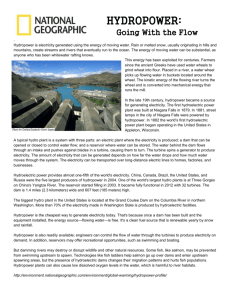

Hydroelectric Power

advertisement