An Independent Parliamentary Entitlements System Review

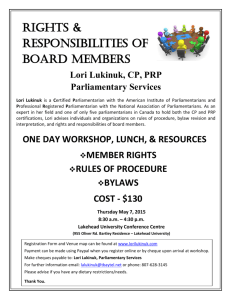

advertisement